Foreign Exchange Reserves

The usable foreign exchange reserves increased by 0.91% to USD 7,340 million (3.80 months of import cover). This was below the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover and EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar and the Sterling Pound but depreciated against the Euro to exchange at KES 129.25, KES 164.84 and KES 141.14 respectively. The observed appreciation against the Dollar is attributed to increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.67% | -0.53% |

| Sterling Pound | -17.52% | -0.73% |

| Euro | -18.72% | 0.67% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 13.19% to 13.14%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 13.19% | 13.14% |

| Interbank volume (billion) | 34.00 | 33.69 |

| Commercial banks’ excess reserves (billion) | 19.30 | 14.00 |

Fixed Income

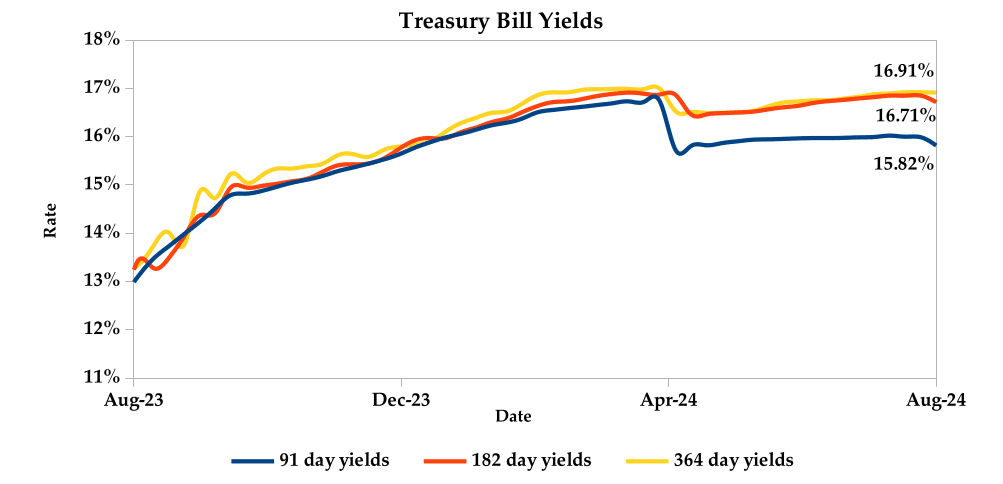

T-Bills

T-Bills remained over-subscribed during the week, with the overall subscription rate increasing to 163.74%, from 101.69% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 313.73%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 193.13% and 74.36% respectively. The acceptance rate decreased by 7.36% to close the week at 87.35%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 51.11%, from KES 21.53 billion in the previous week to KES 10.53 billion. Total bond deals decreased by 1.13% from 441 in the previous week to 436.

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.66% compared to the previous week, by 0.66% month-to-date and declined by 1.49% year-to-date. The yields on the 10-year Eurobonds for Angola and Zambia also increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | 1.49% | 0.82% | 0.82% |

| 2018 30-Year Issue | 1.30% | 0.49% | 0.49% |

| 2019 7-Year Issue | 1.07% | 0.80% | 0.80% |

| 2019 12-Year Issue | 1.62% | 0.61% | 0.61% |

| 2021 13-Year Issue | 1.91% | 0.62% | 0.62% |

| 2024 6-Year Issue | 1.53% | 0.66% | 0.66% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 1.16%, 1.52%, 1.28% and 1.35% lower, compared to the previous week, bringing the year-to-date performance to 10.97%, 8.28%, 14.55% and 16.61% respectively. Market capitalization also lost 1.16% from the previous week to close at KES 1.59 trillion, recording a year-to-date increase of 10.97%. The performance was driven by losses recorded by large-cap stocks such as KCB, EABL, Safaricom and Co-operative Bank of 2.60%, 2.09%, 1.66% and 1.56% respectively. This was however mitigated by the gain recorded by NCBA of 1.02%.

The Banking sector had shares worth KES 1B transacted which accounted for 65.00% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 127M transacted which represented 6.00% and Safaricom, with shares worth KES 447M transacted, represented 23.00% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Eaagads | 9.37% | 18.14% |

| Total | 11.11% | 14.94% |

| BK Group | -5.07% | 11.40% |

| Car General | -11.00% | 9.34% |

| TP Serena | -7.69% | 9.09% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Sanlam | -6.33% | -12.19% |

| Kapchorua Tea | 4.65% | -10.00% |

| Nation Media | -24.26% | -9.65% |

| Standard Group | -30.49% | -9.43% |

| Olympia | -20.18% | -7.45% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 3.48 | 1.39 | -60.09% |

| Derivatives Contracts | 20.00 | 19.00 | -5.00% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 12.68% | -0.04% |

| Dow Jones Industrial Average (DJI) | 4.73% | -0.60% |

| FTSE 100 (FTSE) | 5.78% | -0.08% |

| STOXX Europe 600 | 4.32% | 0.27% |

| Shanghai Composite (SSEC) | -3.38% | -1.49% |

| MSCI Emerging Markets Index | 6.08% | 2.21% |

| MSCI World Index | 8.79% | -0.03% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 374.00% | 0.49% |

| JSE All Share | 6.33% | 0.38% |

| NSE All Share (NGSE) | 29.76% | 0.88% |

| DSEI (Tanzania) | 16.83% | -0.29% |

| ALSIUG (Uganda) | 15.82% | -1.76% |

Global and Continental Markets

US stock market closed the week on a downward trajectory, as investors grappled with economic and monetary policy uncertainties. A decline in Super Micro Computer shares dragged down the semiconductor sector, contributing to the overall market decline.

European stocks recorded a mixed performance, as investors assessed the validity of recession concerns in the US. Positive French employment data, with unemployment falling to 7.3% in the second quarter, boosted the market sentiment.

Asian stock market closed the week in the red zone, pressured by the mixed economic signals from China. Higher-than-expected consumer inflation in July contrasted with persistent deflationary pressures in the producer price index.

Week’s Highlights

- The Monetary Policy Committee (MPC) of the Central Bank of Kenya (CBK) has reversed its tightening stance, cutting the benchmark lending rate by 25 basis points to 12.75%. This marks the first rate cut in four years and aims to lower borrowing costs for consumers and businesses. The move comes after the CBK aggressively raised rates from 10.5% to 13.0% between December 2023 and February 2024 in response to inflationary pressures. The MPC noted that these measures have successfully reduced overall inflation to within the target range, stabilized the exchange rate and anchored inflationary expectations. Additionally, the Committee observed a moderation in non-food, non-fuel inflation, alongside a trend of easing interest rates by central banks in advanced economies in response to diminishing inflationary pressures. With these developments, the MPC determined that there is room for a gradual easing of monetary policy while maintaining exchange rate stability.

- The Stanbic Bank Kenya PMI contracted to 43.1 in July from 47.2 in June. This marked the second consecutive month of contraction and the steepest decline since April 2021. Disruptions caused by protests severely impacted business activity, leading to steep falls in output and new orders across most sectors, particularly agriculture. Supply chain challenges intensified, with longer delivery times and growing backlogs. Employment growth continued, albeit at a slower pace, while inflationary pressures persisted. Despite these challenges, business confidence remained marginally above its record low.

- 5 The Central Bank of Kenya (CBK) has unveiled new designs for all Kenyan banknotes. The KES 1,000, 500, 200, 100 and 50 notes will feature signatures of the CBK governor and National Treasury principal secretary, along with a 2024 print year and enhanced security features including color-changing threads. The CBK cited an impending shortage of banknotes as the primary reason for the redesign.

- Competition Authority of Kenya (CAK) has approved UAE-based B Commodities’ acquisition of a 98.56% stake in Lipton Teas and Infusion, greenlighting one of the region’s most anticipated mergers. The deal will boost B Commodities’ market share to 10.7% from Lipton’s previous 6%, while leaving 89.3% for other players. Key competitors include Kenya Tea Development Agency (KTDA), Eastern Produce Kenya Ltd. and Williamson Tea with 48.8%, 5.6% and 4.3% market share respectively. Kenya’s annual tea production of 450 million kilograms generates KES 163 billion in exports and KES 22 billion domestically, according to the Agriculture and Food Authority.

- Amstel Trading Company Ltd. is set to establish a paper converting facility in Kenya after securing approval from the Competition Authority of Kenya (CAK) for a joint venture with Kingsbourne Assets Limited (KAL). KAL, a British Virgin Islands-registered company with paper manufacturing plants in Indonesia, Amstel’s primary import source, will partner to expand the Kenyan firm’s production capacity. The new facility aims to reduce product delivery times and enhance distribution of photocopy paper within the East African market.

- The final HCOB Eurozone Composite PMI was revised slightly up to 50.2 in July from a preliminary 50.1, but remained below June’s 50.9, signaling a continued slowdown in economic activity. The reading indicated only fractional growth, marking the weakest performance since the upturn began in March. While the service sector expanded, its growth was tempered by a sharp contraction in manufacturing. New orders declined, employment stagnated, and business confidence hit a six-month low. Inflationary pressures persisted, albeit at a moderated pace.

- China’s trade surplus increased to USD 84.65 billion in July, below market expectations. While exports grew 7% year-on-year, this was slower than expected and marked a deceleration from the previous month. Imports rebounded strongly, driven by government stimulus efforts. Despite the widening surplus, the trade gap with the US narrowed. For the first seven months of the year, China recorded a USD 518 billion surplus.

- China’s annual inflation rate increased to 0.5% in July from 0.2% in June, surpassing expectations and marking the highest level since February. This was the sixth consecutive month of price increases, reflecting the government’s stimulus efforts. Food prices stabilized after a prolonged decline, while non-food costs continued to rise, driven primarily by housing, clothing, healthcare, and education expenses. However, transport costs fell due to easing fuel prices. Core inflation, excluding volatile food and energy items, moderated to 0.4%. Month-on-month, consumer prices increased by 0.5%, snapping a three-month decline.

Get future reports

Please provide your details below to get future reports: