Foreign Exchange Reserves

The usable foreign exchange reserves stood at USD 7,051 million (3.81 months of import cover). This falls short of CBK’s statutory requirement to endeavour to maintain at least 4.0 months of import cover as well as the EAC region’s convergence criteria of 4.5 months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar but appreciated against the Sterling Pound and the Euro to exchange at KES 146.14, KES 182.17 and KES 156.39 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency, which has caused a market shortage.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | 18.40% | 0.43% |

| Sterling Pound | 22.48% | -1.27% |

| Euro | 18.79% | -1.14% |

Liquidity

Liquidity in the money markets marginally increased, with the average interbank rate decreasing from 12.49% to 12.39%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.49% | 12.39% |

| Interbank volume (billion) | 33.15 | 50.01 |

| Commercial banks’ excess reserves (billion) | 4.90 | 10.30 |

Fixed Income

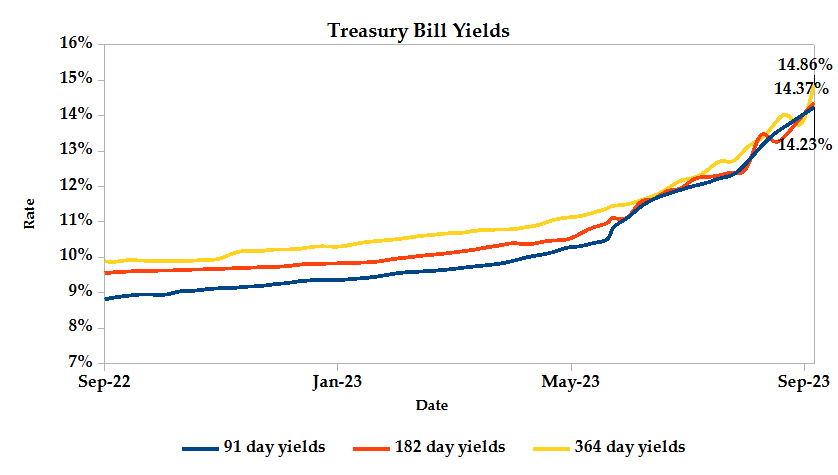

T-Bills

T-Bills were over-subscribed during the week, with the overall subscription rate recorded as 161.83%, up from the 96.56% performance recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 870.79% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 12.27% and 27.81% respectively. The acceptance rate increased by 0.16% to close the week at 99.83%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 47.87% from KES 9.52 billion in the previous week to KES 14.08 billion. Total bond deals decreased by 21.52% from 539 in the previous week to 423.

In the primary bond market, CBK reopened the FXD1/2023/2 and FXD1/2016/10 Treasury bonds through a tap sale in an effort to raise KES 35.0 billion. The respective coupon rates of the bonds are 16.97% and 15.04%, while their effective tenors are 1.9 years and 2.9 years. The sale runs from 01/09/2023 to 13/09/2023.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average 0.21% compared to the previous week, 0.25% month to date and 1.19% year to date. The yields on the 10-Year Eurobonds for Zambia increased while that of Angola declined.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 1.75% | 0.85% | 0.69% |

| 2018 10-Year Issue | 1.38% | 0.13% | 0.09% |

| 2018 30-Year Issue | 0.59% | 0.08% | 0.08% |

| 2019 7-Year Issue | 1.39% | 0.27% | 0.21% |

| 2019 12-Year Issue | 0.78% | 0.09% | 0.09% |

| 2021 13-Year Issue | 1.25% | 0.11% | 0.11% |

Equities

NASI and NSE 20 settled 0.57% and 0.20% higher while NSE 25 settled 0.55% lower compared to the previous week bringing the year to date performance to -22.49%, -7.98% and -18.78% respectively. Market capitalization gained 0.57% from the previous week to close at KES 1.54 trillion, recording a year to date decline of 22.28%. The performance was driven by gains recorded by large-cap stocks such as Safaricom and Standard Chartered of 2.65% and 1.56%. These were however weighed down by losses recorded by EABL and Equity of 3.51% and 3.25% respectively.

The Banking sector had shares worth KES 308M transacted which accounted for 26.76% of the week’s traded value, Manufacturing & Allied sector had shares worth KES 92.5M transacted which represented 8.03% and Safaricom, with shares worth KES 690M transacted represented 59.92% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Uchumi | -4.76% | 11.11% |

| Scangroup | 0.00% | 9.96% |

| Liberty | -20.63% | 9.59% |

| Orchards | 73.08% | 9.42% |

| Olympia | 18.24% | 8.70% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Longhorn | -26.67% | -16.03% |

| Sameer | 22.17% | -7.17% |

| Car General | -24.49% | -6.68% |

| Home Africa | -5.88% | -5.88% |

| Sanlam | -20.67% | -5.00% |

Alternative Investments

| Losers | Week (previous) | Week (ending) | % Change |

|---|---|---|---|

| Derivatives Turnover (million) | 1.08 | 1.41 | 31.01% |

| Derivatives Contracts | 37.00 | 37.00 | 0.00% |

| I-REIT Turnover (million) | 0.21 | 0.59 | -99.73% |

| I-REIT deals | 499 | 49 | -90.18% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 16.56% | -1.29% |

| Dow Jones Industrial Average (DJI) | 4.35% | -0.75% |

| FTSE 100 (FTSE) | -1.00% | 0.18% |

| STOXX Europe 600 | 4.72% | -0.76% |

| Shanghai Composite (SSEC) | 0.01% | -0.53% |

| MSCI Emerging Markets Index | 1.17% | -1.20% |

| MSCI World Index | 13.38% | -1.36% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -2.23% | 0.55% |

| JSE All Share | -0.50% | -1.52% |

| NSE All Share (NGSE) | 32.07% | 0.91% |

| DSEI (Tanzania) | -5.35% | 0.80% |

| ALSIUG (Uganda) | -21.52% | -0.68% |

The US stock market closed the week in the red, as investors worried about rising oil prices and uncertainty about the Federal Reserve’s next move on interest rates. This has led to concerns about inflation, which could weigh on economic growth. The Federal Reserve is expected to keep interest rates unchanged in its next meeting, amidst investors’ concern about about the possibility of a rate hike in the near future. Additionally, there are some concerns that the global economy is slowing down, which could lead to lower corporate profits.

The European stock market was volatile during the week, as investors were heartened by stronger-than-expected industrial production statistics from France and Spain. These figures were encouraging, outweighing fears about the region’s economic growth and the downturn in German industrial production. The STOXX Europe 600 recorded losses following reports that China has increased restrictions on the use of Apple iPhones by government staff as well as a decline in metal prices.

Asia Pacific indices edged lower during the week, as investors weighed the implications of weak Chinese trade data and the possibility of additional U.S. sanctions against China, which could result in further restrictions on tech exports to China and potentially prompt Beijing to take retaliatory action, further destabilizing global trade.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 2.29% and 2.37% higher at $87.51 and $90.65 respectively. Gold futures prices settled 1.24% lower at $1942.70.

Week’s Highlights

- The Central Bank of Kenya (CBK) increased the limits on mobile money transactions and wallet sizes. The daily mobile money wallet size increased from KES 300,000 to KES 500,000 and the transaction limit from KES 150,000 to KES 250,000. The increased transaction cap will apply to all transactions that use the infrastructure and rails for mobile money, including those between PSPs (Payment Service Providers), banks, and other organizations that collaborate with mobile money providers. The respective current tariff for transactions of up to KES 150,000 will apply for transactions of up to KES 250,000. This will make it easier for businesses, individuals, and government agencies to make and receive larger digital payments, which will make mobile money more convenient in Kenya.

- The Nairobi Securities Exchange (NSE) has launched two new market indices: the NSE 10 Share Index (N10) and the NSE Bond Index (NSE-BI). The N10 Index tracks the performance of the top 10 most traded companies on the NSE, while the NSE-BI tracks the performance of the benchmark government bonds listed on the NSE. The N10 Index is based on a market capitalization-float-adjusted methodology. The index is distributed on a daily basis, and its performance is part of the end-of-day reports. The constituent company list of the N10 Index will be reviewed semi-annually. While the NSE-BI is a weekly index that is based on the closing prices of the benchmark government bonds on the NSE, the index is expected to be used as the underlying asset for a fixed-rate futures contract that will be issued on the NSE derivatives market. The contract will be available to the market starting 1st October 2023.

- The Stanbic Bank Kenya’s PMI rose to 50.6 in August 2023, up from 45.5 in the previous month, indicating a recovery in Kenya’s private sector after six months of contraction. Reduced political tension served as the catalyst for the development by boosting demand and activity in the services and industrial sectors. Output also slightly recovered from July’s fastest pace in almost a year. Despite the small increase, new orders were up over the preceding six months. The rate of job creation accelerated as firms tried to increase their workforce to meet higher demand. However, inflationary pressures remained historically high, which weighed on business costs. Looking ahead, the overall level of confidence rose to a five-month high. This is due to expansion plans by businesses, such as opening new branches and widening product and service offerings.

- Sanlam and Allianz have announced the formation of a joint venture, Sanlam Allianz Africa, following regulatory approval. The joint venture will merge the operations of Sanlam and Allianz in 29 African countries, resulting in the largest pan-African non-banking financial services entity on the continent. The recently formed joint venture will act as a focal point for Sanlam and Allianz’s combined operations throughout the nations of Africa where either or both corporations are already present. Through this partnership, both clients and shareholders will get access to a greater range of insurance and financial services. This collaboration intends to take advantage of the strengths, knowledge, and resources of both firms.

- The Euro Area GDP grew by a meager 0.1% in the three months to June 2023, revised down from an initial estimate of 0.3%. This comes after a 0.1% growth in the previous quarter, which was revised up from a flat reading. On the expenditure front, household consumption remained constant, government spending increased by 0.2%, and gross fixed capital formation rose by 0.3%. However, exports decreased by 0.7% and imports increased by 0.1%. Germany, the largest economy in the Eurozone, saw no growth in the second quarter. France grew by 0.5%, Spain grew by 0.4% and Italy contracted by 0.4%. The overall health of the Euro Area’s economy continues to be a source of concern, and there are growing concerns about its capacity to avert a recession, particularly in light of Germany’s dim future prospects.

- China’s trade surplus decreased to $68.36 billion in August 2023, the smallest since May, as exports fell more than imports amid weak demand. Exports declined by 8.8% year-on-year, better than market expectations of a 9.2% drop, while imports fell by 7.3%, in line with market expectations. For the first eight months of the year, China’s trade surplus stood at $553.4 billion, with exports down by 5.6% and imports down by 7.6%. The trade surplus with the United States widened to $33.06 billion in August from $30.3 billion in July. The slowdown in China’s trade is a sign of the challenges facing the world economy.

Get future reports

Please provide your details below to get future reports: