Foreign Exchange Reserves

The usable foreign exchange reserves increased by 8.58% to USD 9,323 million (4.8 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5- months of import cover.

Currency

The Kenyan Shilling remained fairly stable against the Dollar, depreciated against the Sterling Pound and appreciated against the Euro to exchange at KES 129.21, KES 167.56 and KES 139.34 respectively. The observed stability against the Dollar is attributed to increased foreign inflows and purchase of Dollars by the Central Bank.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.70% | 0.00% |

| Sterling Pound | -16.16% | 0.14% |

| Euro | -19.76% | -0.59% |

Liquidity

Liquidity in the money markets tightened, with the average inter-bank rate increasing from 12.00% to 12.08%, as tax remittances more than offset government payments. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.00% | 12.08% |

| Interbank volume (billion) | 31.47 | 55.18 |

| Commercial banks’ excess reserves (billion) | 39.50 | 41.10 |

Fixed Income

T-Bills

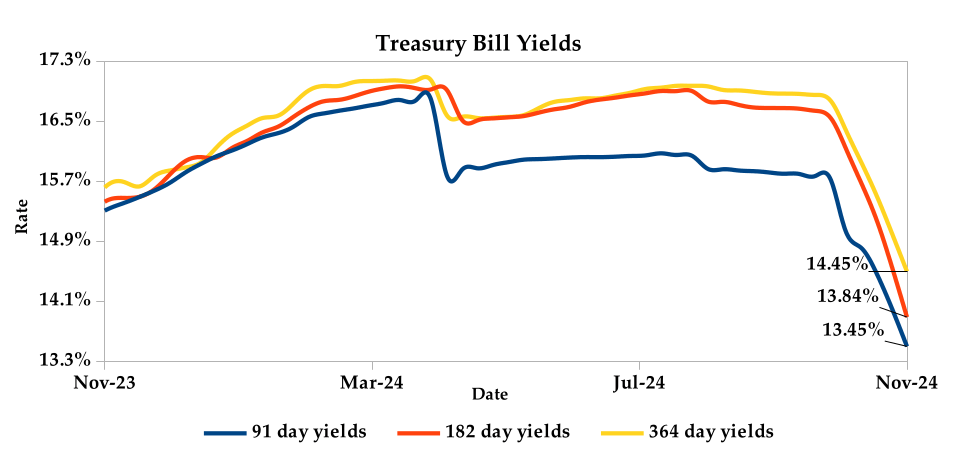

T-Bills remained over-subscribed during the week, with the overall subscription rate increasing to 409.89% from 259.03% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 686.12%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 427.80% and 281.48% respectively. The acceptance rate increased by 20.70% to close the week at 54.63%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 6.27% from KES 27.92 billion in the previous week to KES 26.17 billion. Total bond deals increased by 5.00% from 500 in the previous week to 525.

In the primary bond market, CBK released auction results for the re-opened FXD1/2023/10 and FXD1/2022/15 which sought to raise KES 25.0 billion. The issues received bids worth KES 33.05 billion, representing a subscription rate of 132.19%. Of these, KES 25.68 billion worth of bids were accepted at a weighted average rate of 15.97% and 16.30% respectively.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.05% compared to the previous week but declined 0.04% month-to-date and 0.58% year-to-date. The yield on the 10-year Eurobond for Angola decreased while that of Zambia increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -1.04% | -0.08% | 0.05% |

| 2018 30-Year Issue | -0.10% | -0.03% | 0.03% |

| 2019 7-Year Issue | -2.04% | -0.07% | 0.05% |

| 2019 12-Year Issue | -0.12% | -0.05% | 0.01% |

| 2021 13-Year Issue | 0.13% | -0.04% | 0.05% |

| 2024 6-Year Issue | -0.34% | 0.06% | 0.07% |

Equities

NASI, NSE 25 and NSE 10 settled 1.72%, 0.10% and 0.13% lower, while NSE 20 settled 1.15% higher compared to the previous week, bringing the year-to-date performance to 25.68%, 33.52%, 35.76% and 27.75% respectively. Market capitalization lost 1.71% from the previous week to close at KES 1.81 trillion, recording a year-to-date increase of 25.93%. The performance was driven by losses recorded by large-cap stocks such as Safaricom, NCBA and ABSA of 6.57%, 1.70% and 1.63% respectively. This was however mitigated by gains recorded EABL and Stanbic of 5.33% and 3.88%.

The Banking sector had shares worth KES 287M transacted which accounted for 32.00% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 52M transacted which represented 5.00% and Safaricom, with shares worth KES 466M transacted, represented 52.00% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Unga | 5.04% | 17.22% |

| Trans-Century | -21.15% | 10.81% |

| Uchumi | 16.67% | 10.53% |

| E.A Portland | 340.00% | 10.34% |

| TPS | -14.46% | 9.45% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| HF Group | 11.30% | -12.93% |

| Crown Paints | -14.17% | -11.69% |

| Express | -14.86% | -10.00% |

| Carbacid | 33.33% | -7.83% |

| Williamson Tea | 0.22% | -6.73% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 1.93 | 3.41 | 77.21% |

| Derivatives Contracts | 15.00 | 9.00 | -40.00% |

| I-REIT Turnover (million) | 0.00 | 600.00 | 0.00% |

| I-REIT deals | 0.00 | 1.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 26.41% | 4.66% |

| Dow Jones Industrial Average (DJI) | 16.64% | 4.61% |

| FTSE 100 (FTSE) | 4.54% | -1.28% |

| STOXX Europe 600 | 5.88% | -0.84% |

| Shanghai Composite (SSEC) | 16.54% | 5.51% |

| MSCI Emerging Markets Index | 10.83% | 1.19% |

| MSCI World Index | 19.63% | 3.58% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 4.26% | 0.48% |

| JSE All Share | 11.01% | -1.44% |

| NSE All Share (NGSE) | 27.96% | -0.20% |

| DSEI (Tanzania) | 25.91% | 0.48% |

| ALSIUG (Uganda) | 34.50% | 1.28% |

Global and Continental Markets

The US stock market recorded gains during the week, supported by gains in the utilities, real estate and consumer staples sector. This was fueled by the optimism surrounding Donald Trump’s victory in the recently concluded elections, the latest interest rate cuts by the Federal Reserve by 25 basis points and the Fed chair affirming his confidence in the economy.

European stock markets posted losses over the week, as markets continued to assess the impact that Donald Trump’s economic policies will have in the European corporate sector. Investors also continue to digest the recent earnings reports and the impact of cutting of rates by the Federal Reserve and the Bank of England by 25 basis points.

Asian stock markets posted gains during the week, supported by the latest Chinese inflation data. Inflation stood at 0.3% in October, compared with market estimates of 0.4%, despite Beijing’s stimulus measures in late September to support the slowing economy.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 1.28% and 1.05% higher at $70.38 and $73.87 respectively. Gold futures prices settled 1.98% lower at $2,694.80.

Week’s Highlights

- The Stanbic Bank PMI increased to 50.4 in October from a decline of 49.7 in September, signalling improved business environment. Employment levels increased for the first time since July, fueled by a marginal increase in production levels. Inventories posted the highest gains in 14 months due to increased purchases by firms to counter demands. Greater spending by firms partly reflected improved output expectations at the beginning of this quarter. Despite increased hiring and purchases, firms continued to witness a mild rate of input cost inflation.

- The consumption of petroleum products in the current financial year slightly declined by 2.1% to 5.46 million cubic metres from 5.57 million in 2023, according to a report by the Energy and Petroleum Regulatory Authority (EPRA). The decline in consumption was as a result of decreased domestic demand. While the consumption of kerosene significantly declined, LPG demand increased exponentially due to zero rating taxes by the government in a move to promote use of clean energy.

- Safaricom’s half year profits declined 17.7% to KES 28.1 billion, following depreciation of the Ethiopian Birr by over 100% after adopting a free-floating currency in July, costing the telco KES 17.5 billion. On the flipside, the Kenyan business’ profits surged 14.1% to KES 47.5 billion, boosted by increased service revenues. The company did not declare interim dividends for the period.

- Actuarial Services E.A. Limited 1113 Kayahwe Rd, Off Galana Rd, Kilimani, P. O. Box 10472 – 00100 NAIROBI, KENYA Tel. +254 202 710 028 / Cell: +254 111 037 100 / +254 708 710 028 / +254 785 710 028 Office Email: info@actserv-africa.com Website: www.actserv.co.ke 5 The NSE posted the highest returns in Dollar terms among African securities exchanges, supported by a stronger Shilling and higher blue chip stocks. According to the MSCI Index, Kenya climbed 332 points in the first ten months of the year, rebounding from a 43% loss in 2023. Following closely were Ivory Coast, Mauritius and Senegal by 33.4%, 31.5% and 29.5%. Nigeria and Egypt trailed, declining 72.3% and 28.8% respectively on the back of weaker currencies, despite posting gains in their local currencies.

- The Organisation of Petroleum Exporting Countries (OPEC) estimates global oil demand to reach 120.1 million barrels per day (mbpd) by 2050, compared to 103 mbpd this year. Increasing demand will be fueled by a world economy that is expected to more than double in size to more than $360 trillion by 2050 and the rapidly growing world population. OPEC has revised its outlook downwards in recent times due to the shifting demand patterns in China.

- China’s annual inflation rate declined to 0.3% in October 2024, compared to 0.4% recorded in September. This was below market estimates and was the lowest reading since June, despite Beijing’s stimulus measures in late September to support the slowing economy. Non-food prices further declined to -0.3% from -0.2% in September, largely driven by further drops in the cost of transport and housing. In contrast, prices increased for healthcare and education. On the food side, prices moderated after experiencing their sharpest rise in 20 months in September. Core consumer prices, excluding food and energy, rose 0.2% year-on-year after the smallest gain since February 2021 of 0.1% in September. Monthly, the CPI fell by 0.3%, exceeding the consensus of a 0.1% decline, following a flat reading in September.

- The year-ahead inflation expectations in the United States eased to 2.6% in November 2024, the lowest since December 2020, down from 2.7% in the prior month, according to the preliminary estimate from the University of Michigan Consumer Survey. Analysts had expected it to remain steady at 2.7%. Meanwhile, the five-year outlook ticked up to 3.1% in November, from 3% in October and also slightly above market estimates of 3%.

Get future reports

Please provide your details below to get future reports: