Foreign Exchange Reserves

The usable foreign exchange reserves increased by 0.09% to USD 6,981 million (3.60 months of import cover). This falls short of CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover as well as EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar, but depreciated against the Sterling Pound and the Euro to exchange at KES 130.04, KES 166.16 and KES 141.46 respectively. The observed appreciation against the Dollar is attributed to the increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.16% | -0.15% |

| Sterling Pound | -16.86% | 0.29% |

| Euro | -18.54% | 0.41% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 13.47% to 13.18%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 13.47% | 13.18% |

| Interbank volume (billion) | 17.44 | 30.13 |

| Commercial banks’ excess reserves (billion) | 15.70 | 12.60 |

Fixed Income

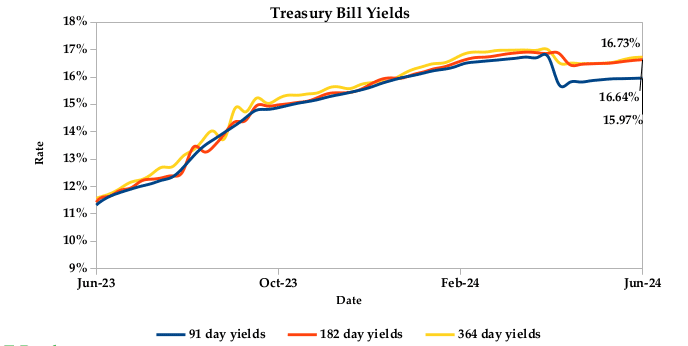

T-Bills

T-Bills remained over subscribed during the week, with the overall subscription rate increasing to 150.98%, up from 139.63% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 626.53%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 59.73% and 52.00% respectively. The acceptance rate decreased by 3.66% to close the week at 94.27%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 27.09%, from KES 28.26 billion in the previous week to KES 20.060 billion. Total bond deals increased by 0.57% from 702 in the previous week to 706.

In the primary bond market, CBK released auction results for the re-opened 2-year FXD1/2023/002 and 3-year FXD1/2024/003 which sought to raise KES 30.0 billion. The issues received bids worth KES 32.84 billion, representing a subscription rate of 109.46%. Of these, KES 30.88 billion worth of bids were accepted at a weighted average rate of 17.12% and 17.59% respectively.

In the international market, yields on Kenya’s Eurobonds decreased by an average of 0.23% compared to the previous week, by 0.08% month-to-date and 0.56% year-to-date. The yields on the 10-year Eurobonds for Angola declined while that for Zambia increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -0.96% | -0.16% | -0.33% |

| 2018 30-Year Issue | -0.16% | 0.05% | -0.07% |

| 2019 7-Year Issue | 1.43% | -0.14% | -0.36% |

| 2019 12-Year Issue | -0.37% | -0.08% | -0.22% |

| 2021 13-Year Issue | 0.14% | -0.04% | -0.17% |

| 2024 6-Year Issue | -0.58% | -0.11% | -0.23% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 1.43%, 2.34%, 0.77% and 0.03% higher, compared to the previous week, bringing the year-to-date performance to 24.61%, 16.83%, 25.00% and 28.51% respectively. Market capitalization also gained 1.43% from the previous week to close at KES 1.79 trillion, recording a year-to-date increase of 24.60%. The performance was driven by gains recorded by large-cap stocks such as Stanbic, KCB and Safaricom of 7.94%, 2.53% and 2.51% respectively. This was however weighed down by the loss recorded by EABL of 7.44%.

The Banking sector had shares worth KES 1Bn transacted which accounted for 66.0% of the week’s traded value. Energy and Petroleum sector had shares worth KES 42.70M transacted which represented 2.38% and Safaricom, with shares worth KES 430.0M transacted, represented 23.9% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| BK Group | 1.69% | 13.88% |

| Kenya-Re | 41.08% | 9.21% |

| NBV | -2.44% | -2.44% |

| Stanbic | 12.26% | 7.94% |

| Kenya Power | 27.86% | 7.83% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Transcentury | 13.46% | -13.46% |

| Flame Tree | -1.75% | -11.81% |

| Kapchorua Tea | 7.44% | -7.60% |

| EA Breweries | 25.81% | -7.44% |

| Sanlam | 2.67% | -6.71% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 2.86 | 0.61 | -78.81% |

| Derivatives Contracts | 30.00 | 12.00 | -60.00% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 12.74% | 1.32% |

| Dow Jones Industrial Average (DJI) | 2.87% | 0.29% |

| FTSE 100 (FTSE) | 6.78% | -0.36% |

| STOXX Europe 600 | 9.41% | 1.04% |

| Shanghai Composite (SSEC) | 3.00% | -1.15% |

| MSCI Emerging Markets Index | 4.73% | 2.31% |

| MSCI World Index | 9.76% | 0.97% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 276.27% | 4.67% |

| JSE All Share | 1.72% | 0.11% |

| NSE All Share (NGSE) | 30.57% | -0.08% |

| DSEI (Tanzania) | 15.80% | -1.14% |

| ALSIUG (Uganda) | 22.90% | -1.46% |

Global and Continental Markets

The US stock market posted gains during the week, as investors awaited the Federal Reserve’s decision on interest rates and inflation data. While the Fed is expected to hold rates steady, investors are looking forward to future rate cuts and the Fed’s updated economic outlook. Notably, gains in the Utilities, Oil and Gas, and Consumer Services sectors led the charge.

European stocks were volatile during the week, fueled by rate-sensitive sectors like Real Estate and Utilities, after a stronger-than-anticipated U.S. jobs report increased jitters that the Federal Reserve would not cut interest rates anytime soon.

Asian stocks plunged this week, as investors remained cautious ahead of key central bank decisions and inflation data. The holiday weekend offered no relief, with strong US jobs data raising concerns about the Fed tightening monetary policy.

Week’s Highlights

- The Monetary Policy Committee (MPC) retained the benchmark rate at 13% during its 5th June 2024 meeting, noting that its previous measures have lowered overall inflation to the central bank’s mid-point target range of 5%, stabilised the exchange rate and anchored inflationary expectations. Additionally, CBK narrowed the interest rate corridor and adjusted the discount window rate, indicating a potential path for future rate cuts.

- The Stanbic Bank Kenya PMI increased to 51.8 in May 2024 from 50.1 in April, indicating a positive trend in the private sector. This upswing was fueled by an increase in output and new orders, both expanding at their fastest pace since early 2023. Lower fuel prices and a stronger Kenyan Shilling led to a further decline in input costs, allowing businesses to boost output without raising prices substantially. Job creation increased for the fifth month in a row, driven by increased workloads and expectations of rising business activity. While business confidence dipped slightly from its 13-month high in April, firms remain optimistic and plan for future growth through expansion and marketing investments.

- The government obtained a $1.2 billion loan from the World Bank, which will be partly used to pay off the Eurobond that will be maturing this month. This follows the government’s buyback of over $1.4 billion of the bond in February through a new debt issuance. The World Bank expects Kenya to leverage the remaining Development Policy Operatios(DPO) funds for long- term initiatives, including fostering competition in its markets, strengthening labor inclusivity and promoting climate action. Central Bank noted that using part of the loan for the Eurobond repayment won’t negatively impact the Kenyan Shilling, which has shown significant appreciation against major currencies.

- 5 The Organisation of Petroleum Exporting Countries (OPEC+) met during the week and agreed to extend output cuts into 2025. It also allowed phasing out of voluntary cuts of 2.2 million barrels per day (mbpd) from October 2024. Notably, the UAE secured a production increase of 0.3 mbpd in 2025, while the group agreed to extend the existing voluntary cuts of 1.65 million barrels per day until the end of December 2025.

- The HCOB Eurozone Composite PMI dipped slightly to 52.2 in May. This still marks the strongest expansion since May 2023 and sits near the long-term average, buoyed by stronger demand, businesses ramped up output and hiring, with confidence improving for the seventh consecutive month. Inflationary pressures eased slightly for both input costs and output charges but remained above pre-pandemic levels.

- The S&P Global US Composite PMI surged to 54.5 in May 2024, exceeding initial expectations of 54.4 and marking the strongest business activity expansion since April 2022. This broad- based growth was fueled by accelerations in both manufacturing and services of 51.3 and 54.3, respectively. Companies ramped up production to meet a renewed rise in new orders following a brief April dip, with even export activity showing a slight increase. Employment remained stable overall, with manufacturing job gains offsetting service sector reductions. While input costs and selling prices continued to rise, business confidence remained positive, with companies anticipating further output growth.

- The European Central Bank (ECB) decreased interest rates by 25 basis points in June, as expected, following a nine-month period of holding rates steady. This shift comes after inflation significantly eased, falling by over 2.5 percentage points since September 2023. However, domestic price pressures remain a concern, prompting the ECB to maintain a cautious approach. The ECB will continue to monitor the data and keep policy rates restrictive enough to combat inflation. Revised staff projections indicate higher-than- expected inflation for 2024 and 2025, with economic growth expected to pick up gradually over the next three years.

Get future reports

Please provide your details below to get future reports: