Foreign Exchange Reserves

The usable foreign exchange reserves increased by 2.10% to USD 7,503 million (3.90 months of import cover). This was below the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover and EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 129.19, KES 170.23 and KES 143.61 respectively. The observed depreciation against the Dollar is attributed to high demand for the currency.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.71% | 0.01% |

| Sterling Pound | -14.82% | 0.18% |

| Euro | -17.30% | 0.40% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 12.88% to 12.64%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.88% | 12.64% |

| Interbank volume (billion) | 14.65 | 28.66 |

| Commercial banks’ excess reserves (billion) | 20.30 | 16.40 |

Fixed Income

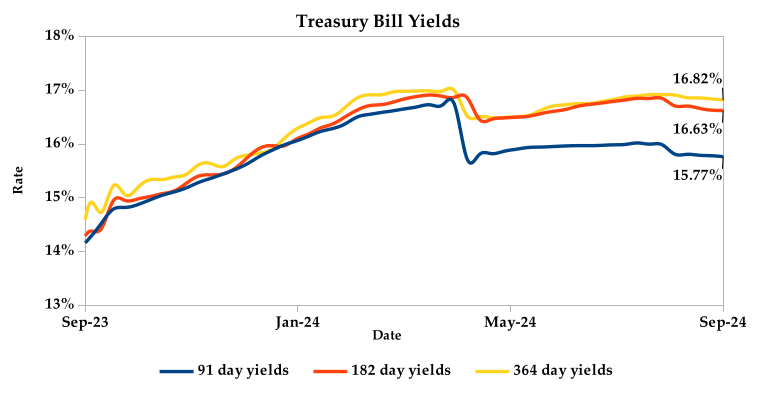

T-Bills

T-Bills remained over-subscribed during the week, with the overall subscription rate increasing to 162.25%, from 100.84% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 580.16%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 101.66% and 55.68% respectively. The acceptance rate decreased by 2.99% to close the week at 94.78%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 60.91%, from KES 19.50 billion in the previous week to KES 31.37 billion. Total bond deals decreased by 28.42% from 862 in the previous week to 617.

In the primary bond market, CBK re-opened FXD1/2024/010 and FXD1/2016/020 bonds with coupon rates of 16.00% and 14.00% respectively, targeting to raise KES 30 billion. The sale runs from 04/09/2024 to 18/09/2024.

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.07% compared to the previous week, by 0.11% month-to-date and declined by 0.38% year-to-date. The yields on the 10-year Eurobonds for Angola and Zambia also increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | 0.29% | 0.10% | 0.06% |

| 2018 30-Year Issue | 0.50% | 0.04% | 0.02% |

| 2019 7-Year Issue | -0.23% | 0.20% | 0.12% |

| 2019 12-Year Issue | 0.52% | 0.12% | 0.09% |

| 2021 13-Year Issue | 0.77% | 0.08% | 0.03% |

| 2024 6-Year Issue | 0.44% | 0.13% | 0.10% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 1.84%, 1.74%, 1.73% and 1.67% higher, compared to the previous week, bringing the year-to-date performance to 14.80%, 13.16%, 19.85% and 21.41% respectively. Market capitalization also gained 2.04% from the previous week to close at KES 1.65 trillion, recording a year-to-date increase of 15.02%. The performance was driven by gains recorded by large-cap stocks such as KCB, Equity, Standard Chartered and Safaricom of 6.14%, 5.12%, 3.83% and 2.07% respectively. This was however weighed down by the loss recorded by Co-operative Bank of 3.32%.

The Banking sector had shares worth KES 278M transacted which accounted for 21.00% of the week’s traded value. Construction and Allied sector had shares worth KES 185M transacted which represented 14.00% and Safaricom, with shares worth KES 741M transacted, represented 57.00% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Carbacid | 60.33% | 41.47% |

| Kenya Power | 85.00% | 27.59% |

| E.A Portland | 16.75% | 19.44% |

| Eveready | 0.00% | 15.69% |

| NBV | -6.91% | 15.08% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Home Afrika | -23.08% | -14.29% |

| Crown Paints | -16.13% | -6.56% |

| HF Group | 8.99% | -6.23% |

| Sanlam | 1.67% | -6.15% |

| KenGen | 21.00% | 5.10% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 0.76 | 1.68 | 121.51% |

| Derivatives Contracts | 9.00 | 14.00 | 55.56% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 14.03% | -4.25% |

| Dow Jones Industrial Average (DJI) | 6.97% | -2.93% |

| FTSE 100 (FTSE) | 5.96% | -2.33% |

| STOXX Europe 600 | 5.86% | -3.52% |

| Shanghai Composite (SSEC) | -6.63% | -2.69% |

| MSCI Emerging Markets Index | 4.90% | -2.28% |

| MSCI World Index | 11.02% | -3.90% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 243.20% | -28.89% |

| JSE All Share | 6.54% | -3.17% |

| NSE All Share (NGSE) | 26.90% | -0.15% |

| DSEI (Tanzania) | 20.07% | 0.75% |

| ALSIUG (Uganda) | 21.49% | 2.30% |

Global and Continental Markets

US stock market closed the week in a downward trajectory, reaching its lowest point in nearly a month, as investors assessed the latest US jobs report, which signaled a weakening labour market.

European stock markets closed the week lower, primarily driven by declines in personal goods and automobile shares. Additionally, investors closely analysed the latest U.S. jobs report data to gauge the potential for interest rate cuts by the Federal Reserve.

Asian stock markets closed the week in the red zone, as investors digested China’s latest inflation data. Consumer inflation rose less than expected in August and producer deflation persisted for the 23rd consecutive month.

Week’s Highlights

- The Stanbic Bank Kenya Purchasing Managers’ Index (PMI) increased to 50.6 in August 2024 from 43.1 July, indicating a significant recovery in private sector activity after disruptions caused by the anti-Finance Bill 2024 protests. Kenya’s manufacturing PMI averaged 50.93 points from 2014 until 2024, with a record high of 59.10 points in October 2020 and a record low of 34.40 points in October 2017.

- Kenya has officially become a full member of the Asian Infrastructure Investment Bank (AIIB), a multilateral development institution with 109 members and USD 100 billion in capital. As a fully paid member, Kenya will now have access to concessional funding for infrastructure projects, climate change initiatives, connectivity programs, regional cooperation endeavors and technology-driven initiatives.

- Stanbic Bank Kenya has expanded into the asset management sector with the launch of a new Insurance and Asset Management Unit, following approval from the Capital Markets Authority (CMA). The bank introduced two funds: the Stanbic Money Market Fund (KES) and the Stanbic Fixed Income Fund (USD), managed by its subsidiary, SBG Securities Limited. Notably, Stanbic Bank plans to introduce additional investment products in the future.

- Actuarial Services E.A. Limited 1113 Kayahwe Rd, Off Galana Rd, Kilimani, P. O. Box 10472 – 00100 NAIROBI, KENYA Tel. +254 202 710 028 / Cell: +254 111 037 100 / +254 708 710 028 / +254 785 710 028 Office Email: info@actserv-africa.com Website: www.actserv.co.ke 5 The Competition Authority of Kenya (CAK) has approved Kenya Electrical and Electronics Company (KEDA) Ceramics Company’s acquisition of certain assets from Ramoda Ceramics. This merger will increase KEDA’s market share to 31%. Ramoda, facing liquidity challenges, had ceased operations due to constraints in its business, strategic and operational divisions. The acquired assets include properties, plants and machinery used for ceramic tile manufacturing, distribution, and sales.

- The Caixin China General Manufacturing Purchasing Managers’ Index (PMI) rose to 50.4 in August from 49.8 in July, signaling a return to growth in the manufacturing sector. This was primarily driven by a surge in new orders fueled by stronger domestic demand. While domestic demand improved, foreign orders declined slightly for the first time this year, reflecting deteriorating external conditions. Despite this, employment stabilised after a prolonged decline and backlogs of work continued to accumulate. Inflationary pressures eased as input prices fell for the first time in five months and output prices declined due to discounts offered by firms.

- The HCOB Eurozone Composite Purchasing Managers’ Index (PMI) increased to 51.0 in August 2024 from 50.2 in July. This marked the sixth consecutive month of expansion, the longest streak in over two years. Despite this positive trend, underlying data revealed economic fragility within the Eurozone. New orders, employment and business confidence all declined during the month. The overall expansion was primarily driven by a stronger upturn in the service sector, which offset the continued weakness in the manufacturing sector. While cost pressures eased significantly, output charges surged to their highest level since April. France and Spain were key contributors to the accelerated growth, while Germany saw a second consecutive decline in private sector activity.

- The S&P Global US Composite Purchasing Managers’ Index (PMI) was revised upwards to 54.6 in August 2024, from the preliminary estimate of 54.1 and a slight increase from 54.3 in July. This marks the 19th consecutive month of expansion in the US private sector. The service sector led the growth, reaching its fastest pace of activity since March 2022 with a PMI of 55.7. In contrast, the manufacturing sector contracted for the second consecutive month, with a PMI of 47.9. New orders growth in the service sector offset the decline in manufacturing, contributing to the overall expansion. However, staffing levels decreased for the first time in three months, with both sectors reporting declines.

- The Eurozone economy expanded by 0.30% in the second quarter of 2024 compared to the previous quarter. This marks a continuation of the region’s economic recovery. Since 1995, the average GDP growth rate in the Eurozone has been 0.38%. The highest growth rate recorded was 11.70% in the third quarter of 2020, while the lowest was -11.10% in the second quarter of 2020.

Get future reports

Please provide your details below to get future reports: