Foreign Exchange Reserves

The usable foreign exchange reserves decreased by 0.42% to USD 8,969 million (4.6 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5- months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 129.30, KES 164.74 and KES 136.53 respectively. The observed appreciation the Dollar is attributed to increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.64% | -0.29% |

| Sterling Pound | -17.57% | -0.05% |

| Euro | -21.38% | -0.41% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 11.91% to 11.80%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 11.91% | 11.80% |

| Interbank volume (billion) | 22.83 | 43.16 |

| Commercial banks’ excess reserves (billion) | 44.80 | 24.00 |

Fixed Income

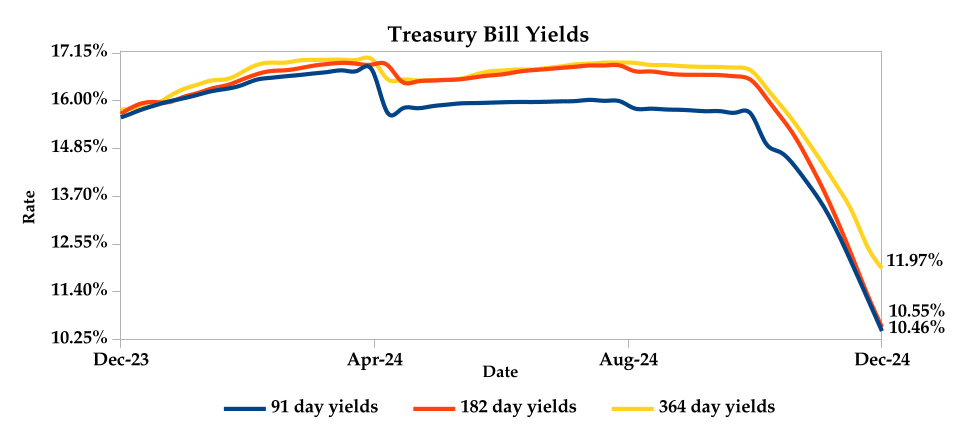

T-Bills

T-Bills remained over-subscribed during the week, with the overall subscription rate decreasing to 176.31% from 211.07% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 473.20%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 67.64% and 166.22% respectively. The acceptance rate increased by 45.83% to close the week at 99.77%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 37.73% from KES 27.92 billion in the previous week to KES 38.46 billion. Total bond deals decreased by 2.91% from 688 in the previous week to 668.

In the primary bond market, CBK released auction results for the re-opened FXD1/2023/010 and FXD1/2018/020 treasury bonds which sought to raise KES 25.0 billion. The issues received bids worth KES 71.32 billion, representing a subscription rate of 285.27%. Of these, KES 53.41 billion worth of bids were accepted at weighted average rates of 14.69% and 15.11% respectively.

Eurobonds

In the international market, yields on Kenya’s Eurobonds decreased by an average of 0.27% compared to the previous week, 0.20% month-to-date and 1.14% year-to-date. The yield on the 10- year Eurobond for Angola increased .

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -1.60% | -0.22% | -0.27% |

| 2018 30-Year Issue | -1.65% | -0.01% | -0.02% |

| 2019 7-Year Issue | -2.65% | -0.28% | -0.47% |

| 2019 12-Year Issue | -0.53% | -0.21% | -0.31% |

| 2021 13-Year Issue | 0.28% | -0.18% | -0.19% |

| 2024 6-Year Issue | -0.72% | -0.28% | -0.38% |

Equities

NASI, NSE 25 and NSE 10 settled 3.30%, 2.47% and 2.96% higher compared to the previous week while NSE 20 settled 1.63% lower, bringing the year-to-date performance to 25.27%, 31.49% 32.20% and 21.35% respectively. Market capitalization also gained 3.30% from the previous week to close at KES 1.80 trillion, recording a year-to-date increase of 25.51%. The performance was driven by gains recorded by large-cap stocks such as Safaricom, EABL and NCBA of 8.33%, 3.77% and 3.36% respectively.

The Banking sector had shares worth KES 902M transacted which accounted for 47.00% of the week’s traded value. Manufacturing & Allied sector had shares worth KES 381M transacted which represented 19.00% and Safaricom, with shares worth KES 489M transacted, represented 25.00% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Olympia | 3.98% | 16.04% |

| Diamond Trust | 34.64% | 12.62% |

| Scangroup | 0.92% | 8.91% |

| NBV | -7.72% | 8.61% |

| Safaricom | 18.18% | 8.33% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Kenya Power | 152.86% | -21.85% |

| Sanlam | -33.33% | -11.50% |

| Bamburi | 56.94% | -10.67% |

| BK Group | -11.97% | -7.68% |

| Kenya-Re | -42.70% | -7.02% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 3.07 | 0.44 | -85.83% |

| Derivatives Contracts | 24.00 | 6.00 | -75.00% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 0.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 28.41% | 0.96% |

| Dow Jones Industrial Average (DJI) | 18.37% | -0.60% |

| FTSE 100 (FTSE) | 7.60% | 0.26% |

| STOXX Europe 600 | 8.77% | 2.00% |

| Shanghai Composite (SSEC) | 10.29% | -1.91% |

| MSCI Emerging Markets Index | 232.21% | 2.33% |

| MSCI World Index | 21.64% | 1.18% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 3.97% | 1.46% |

| JSE All Share | 13.02% | 3.04% |

| NSE All Share (NGSE) | 29.24% | 0.72% |

| DSEI (Tanzania) | 21.86% | -0.79% |

| ALSIUG (Uganda) | 30.04% | -0.64% |

Global and Continental Markets

The US stock market posted mixed perfomance during the week, boosted by gains in the consumer services, consumer goods and technology sectors. However, the market was weighed down by losses in the oil & gas, utilities and basic materials sectors.

European stock markets closed the week on an upward trajectory, driven by gains in bank stocks and optimism surrounding the potential passage of a new French budget.

Asian stock markets closed lower this week, as escalating tensions between Russia and Ukraine weighed down investor sentiment.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 1.18% and 2.50% lower at $67.20 and $71.12 respectively. Gold futures prices also settled 0.80% lower at $2659.60.

Week’s Highlights

- The Monetary Policy Committee (MPC) lowered the benchmark lending rate by 75 basis points to 11.25% from 12.00% at its 5th December meeting, citing the success of previous measures in reducing inflation below the mid-point of the target range of 5%, stabilising the exchange rate and anchoring inflation expectations. The MPC observed a moderation in non- food non-fuel inflation and noted that global central banks are easing rates amid declining inflationary pressures. The decision allows for a gradual easing of monetary policy while maintaining exchange rate stability, which is expected to lower borrowing costs, boost economic activity and reduce government debt servicing costs.

- The Stanbic Bank Kenya PMI increased to 50.9 in November 2024 from 50.4 in October, signaling sustained private sector expansion for the second consecutive month and reaching its highest level since May. This was primarily driven by improved output and new orders, with new orders recording the fastest growth in six months and output exceeding the series average. Purchasing activity grew at its quickest pace since September 2022, while employment rose for the second straight month, albeit at a slower rate than in October. Supplier delivery times improved slightly due to strong vendor competition. However, input cost inflation hit a three-month high, driven by higher taxes, leading to a nine-month high in output cost inflation amid strong customer demand. Notably, business sentiment weakened slightly during the month.

- 5 The National Assembly’s Finance and Planning Committee has proposed extending the deadline for commercial banks to increase their core capital from KES 1 billion to KES 10 billion from three years to eight years. This decision follows a request from the Kenya Bankers Association (KBA), which highlighted that the initial three-year period set by the Business Laws (Amendment) Bill 2024, was insufficient for most banks to comply without operational disruptions. The KES 1 billion core capital threshold, established in 2012, has remained unchanged despite significant growth in banking assets, liabilities and clientele. The committee noted that the current minimum capital level is inadequate to support the sector’s growth trajectory, increasing its vulnerability to potential adverse events. This extension aims to ensure a smooth transition for the banking sector and maintain financial stability.

- NCBA Group reported a 3% increase in net profit to KES 15.1 billion in the first nine months of 2024. While non-interest income grew, increased interest expenses impacted net interest income. The bank’s strong credit management led to lower impairment charges and improved asset quality. Customer deposits grew and digital loan uptake remained robust. The Kenyan banking business continued to be the primary driver of the Group’s profitability, with contributions from subsidiaries in Uganda, Tanzania and Rwanda. Looking ahead, NCBA expects the government and markets to play a crucial role in sustaining economic growth and enabling businesses and households to build resilience against future shocks.

- The Caixin China General Manufacturing PMI increased to 51.5 in November 2024 from 50.3 in October, surpassing market expectations of 50.5 and marking the second consecutive month of growth. The uptick was primarily driven by a surge in foreign orders and a rebound in exports.This led to increased output, higher purchasing activity and a buildup of inventory. While employment continued to contract, the pace of decline slowed. Input costs rose sharply due to higher raw material prices, leading to increased selling prices. Business confidence reached an eight-month high, fueled by optimism about the economic outlook and supportive government policies.

- The HCOB Eurozone Composite PMI was revised slightly higher to 48.3 in November 2024, from a preliminary reading of 48.1, but still down from 50 in October. This indicates a contraction in private sector activity, marking the fastest decline since January. Both the services and manufacturing sectors contracted, driven by weak demand, particularly from foreign markets. Employment also declined and business confidence hit a 12-month low. Despite the overall economic slowdown, inflationary pressures persisted, with input and output prices rising.

- The Eurozone GDP grew by 0.9% year-on-year in Q3 2024, marking its strongest performance since Q1 2023. This uptick follows a revised 0.5% growth in the second quarter. Historically, the Eurozone has averaged annual GDP growth of 1.61% since 1995, with a peak of 15.3% in the second quarter of 2021 and a trough of -14.0% in the second quarter of 2020.

Get future reports

Please provide your details below to get future reports: