Foreign Exchange Reserves

The usable foreign exchange reserves stood at USD 6,492 million (3.61 months of import cover). This falls short of CBK’s statutory requirement to endeavour to maintain at least 4.0 months of import cover as well as the EAC region’s convergence criteria of 4.5 months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 136.40, KES 171.43 and KES 150.40 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency, which has caused a market shortage.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | 10.51% | 0.36% |

| Sterling Pound | 15.26% | 1.22% |

| Euro | 14.24% | 0.45% |

Liquidity

Liquidity in the money markets tightened with the average interbank rate increasing from 9.37% to 9.83%, as tax remittances more than offset government payments. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 9.37% | 9.83% |

| Interbank volume (billion) | 12.87 | 26.58 |

| Commercial banks’ excess reserves (billion) | 22.10 | 17.30 |

Fixed Income

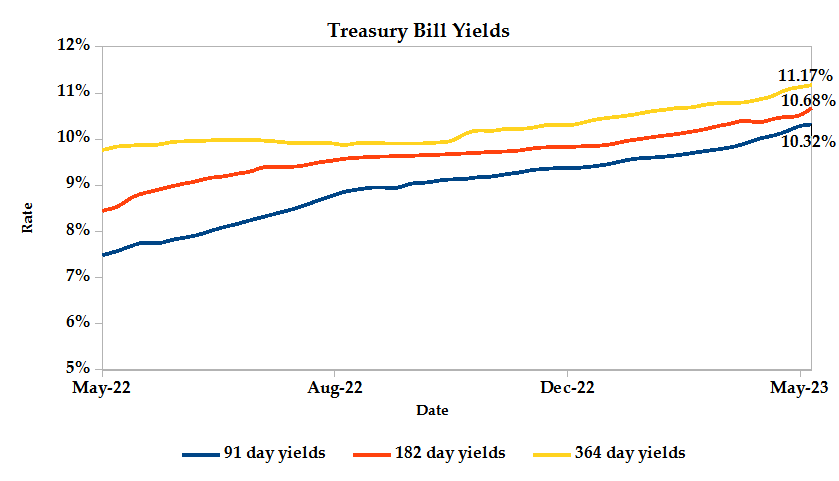

T-Bills

T-Bills were over-subscribed during the week, with the overall subscription rate recorded as 110.72%, up from 37.52% performance recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 508.01% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 53.36% and 9.17% respectively. The acceptance rate increased by 3.35% to close the week at 96.13%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 15.56% from KES 12.93 billion in the previous week to KES 14.94 billion. Total bond deals decreased by 15.61% from 442 in the previous week to 373.

Eurobonds

In the international market, yields on Kenya’s Eurobonds decreased by an average 0.15% compared to the previous week, 0.26% month to date and increased 3.51% year to date. The yields on the 10-Year Eurobonds for Ghana increased while that of Angola declined. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 6.83% | -0.83% | -0.23% |

| 2018 10-Year Issue | 3.24% | -0.37% | -0.37% |

| 2018 30-Year Issue | 1.71% | -0.12% | -0.14% |

| 2019 7-Year Issue | 4.53% | -0.02% | 0.05% |

| 2019 12-Year Issue | 2.25% | -0.15% | -0.15% |

| 2021 13-Year Issue | 2.48% | -0.08% | -0.08% |

Equities

NASI, NSE 20 and NSE 25 settled 4.26%, 2.81% and 4.68% lower compared to the previous week bringing the year to date performance to -19.07%, -8.41% and -13.28% respectively. Market capitalization lost 4.27% from the previous week to close at KES 1.60 trillion recording a year to date decline of 19.13%. The performance was driven by losses recorded by large-cap stocks such as ABSA, NCBA and EABL of 16.87%, 15.32%, and 6.14% respectively.

The Banking sector had shares worth KES 172M transacted which accounted for 19.21% of the week’s traded value, Manufacturing & Allied sector had shares worth KES 118M transacted which represented 13.20% and Safaricom, with shares worth KES 587.6M transacted represented 65.61% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Olympia | -1.69% | 15.94% |

| Eveready | 20.83% | 10.13% |

| Flame Tree | 24.55% | 7.87% |

| B.O.C | 14.13% | 7.67% |

| CIC Insurance | -3.14% | 6.94% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| ABSA | -17.21% | -16.87% |

| NCBA | -14.12% | -15.32% |

| E.A Portland | -7.35% | -10.00% |

| TPS | 3.08% | -9.76% |

| BK Group | 6.67% | -7.25% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 0.58 | 0.04 | -93.97% |

| Derivatives Contracts | 11.00 | 1.00 | -90.91% |

| I-REIT Turnover (million) | 0.28 | 0.10 | -64.96% |

| I-REIT Deals | 40 | 30 | -25.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 8.16% | -0.80% |

| Dow Jones Industrial Average (DJI) | 1.63% | -1.25% |

| FTSE 100 (FTSE) | 2.97% | -1.17% |

| STOXX Europe 600 | 7.17% | -0.29% |

| Shanghai Composite (SSEC) | 6.99% | 0.34% |

| MSCI Emerging Markets Index | 1.98% | 0.47% |

| MSCI World Index | 8.50% | -0.49% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -0.41% | -0.05% |

| JSE All Share | 6.07% | -0.10% |

| NSE All Share (NGSE) | 1.69% | 0.12% |

| DSEI (Tanzania) | -3.33% | -2.19% |

| ALSIUG (Uganda) | -8.75% | -0.68% |

US indices ended the week lower, after major benchmark averages capped a mixed week amid ongoing banking turmoil. A trio of regional banks including Western Alliance Bancorporation, First Horizon National Corporation and PacWest Bancorp all nursed heavy losses days after First Republic collapsed, sparking new concerns about troubles in the banking sector. PacWest signaled troubles with concerns that it may also be on the brink of collapse. Bank concerns and the tight lending conditions spilled over to the transport sector causing a decline in the market.

European indices in the past week recorded a marginal decrease. The European Central Bank raised its interest rates by 0.25% to 3.25% indicating that more tightening would be employed to tame inflation. Energy shares fell as investors prepare for another interest rate hike and market experts continue to look for ways to avoid debt defaults. Car stocks including BMW and Volkswagen fell citing high operation costs and rising competition leading to a drop in profit.

Asia Pacific indices ended the week on a positive note following a series of strong earnings and a slight drop in inflation. Tech-heavy markets were supported by a series of stronger than expected earnings from major tech firms. Shanghai Shenzhen CSI 300 and Shanghai Composite indices traded higher as they continue to recover from previous lows. Strong travel and consumer spending from the Golden Week holiday contributed to economic growth in the week. Investors continue to gauge the state of economic recovery in the region.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 7.11% and 5.24% lower at $71.32 and $75.37 respectively. Gold futures prices settled 1.28% higher at $2024.60.

Week’s Highlights

- Kenya’s Gross Domestic Product (GDP) for Q4 2022 stood at 3.8% compared to 8.6% in Q4 of 2021. The annual GDP increased by 4.8% in 2022, a slower rate than the 7.6% reported in 2021 and below analysts’ estimate of 5.5%. The most prominent sector was service-oriented activities, which accounted for 61.1% of total GDP. Agriculture accounted for 21.2% of total GDP, while industry-related activities represented for 17.7%. Private final consumption expenditure, rose from KES 8,970.8 billion in 2021 to KES 10,107.2 billion in 2022. The government’s final consumption spending also increased by 12.3% in 2022. The Gross National Income increased from KES 11,823.5 billion in 2021 to KES 13,163.2 billion in 2022. Gross National Disposable Income increased by 11.5% to stand at KES 13,932.0 billion in 2022.

- The National Treasury released the Finance Bill, 2023. Upon approval, salaried individuals earning above KES 500,000 on a monthly basis, will be required to part with 35% PAYE from the current 30%. Additionally, the Treasury, removed sections of the law that provided for halving of VAT on petroleum products from 16% to 8%. This means that the cost of petroleum products will rise, causing a ripple effect on inflation. Furthermore, the increased monthly NSSF and NHIF contributions will significantly cause a shrink in employees’ take home pay. The National Treasury also proposed to increase the excise charge on money transfer services provided by telcos from 12% to 15%, while bank costs are expected to decline as a result of the proposed reduction in excise duty from 20% to 15%.

- The National Treasury has proposed a 3% deduction from employees’ base pay, with the employer matching another 3%, towards the National Housing Development Fund as part of the Finance Bill, 2023. The maximum amount that can be deducted to the housing fund is to be capped at KES 5,000. Employees who qualify for affordable housing will use their accrued contributions to finance the purchase of a home under the affordable housing scheme. Employees who do not meet the criteria for affordable housing may access their contributions after 7 years or upon retirement (whichever occurs earlier). At that point, contributors then have the option of transferring their accrued benefits to a pension scheme registered with the Retirement Benefits Authority, a person registered and qualified for affordable housing, their spouse or dependent children, or they can withdraw their contributions and be subject to the prevailing tax rates.

- The Stanbic Bank Kenya PMI dropped from 49.2 in March to 47.2 in April 2023. The most recent data pointed to a strong and faster drop in the private sector economy as rising inflation and political turmoil caused a sharp decline in consumer demand. Output and new orders both fell significantly. Manufacturing and services led the most recent output decline, in contrast to growth in agriculture, construction and wholesale & retail industries. While backlogs continued to grow, employment increased at its quickest rate since the year began. Overall, the cost inflation remained quite high due to rising import prices brought on by a weaker currency.

- The Central Bank of Kenya (CBK) announced the issuance and implementation of the Kenya Quick Response Code Standard 2023 (KE-QR Code Standard 2023; or the Standard).The Standard was created through collaboration between CBK, Payment Service Providers, banks and card schemes. The Quick Response Code Standard will be implemented in phases as the parties align their operations with the set out standards as they raise customer awareness. The Standard will lay out the procedures for issuing Quick Response (QR) Codes to customers and companies that accept digital payments from Payment Service Providers and institutions governed by the CBK. The Standard will help promote inclusivity by enabling organizations of diverse sizes and client focus to enhance use of digital payments. Long-term, the usage of standard QR Codes will facilitate the introduction of new products and extend the benefits currently enjoyed by clients making payments across various institutions and mobile money networks.

- The US Federal Reserve raised the lending rate by 0.25% to a tactical range of 5%-5.25% in May. The decision was in line with market analysts’ expectations. As they pursue their goal of returning inflation to 2%, the Committee will regularly monitor incoming data and consider the monetary policy implications. Furthermore, policymakers will consider the cumulative tightening of monetary policy in calculating the amount to which additional policy firming may be necessary to accomplish the intended goal. Officials also stated that, while the US banking system is strong and robust, tighter credit conditions for families and businesses are likely to have an impact on economic activity, hiring and inflation, the extent to which is unknown.

- The S&P Global/CIPS UK Composite PMI rose to 54.9 in April from 52.2 in March exceeding analysts estimates of 53.9. Growth was mainly driven by service providers, which increased to 55.9 in April from 52.9 in March. The stronger sales pipeline for services encouraged enterprises to create more jobs whereas manufacturers eliminated jobs. On the price front, lower transportation and raw material costs offset rising service provider salaries, keeping inflation at historically high levels.

Get future reports

Please provide your details below to get future reports: