Foreign Exchange Reserves

The usable foreign exchange reserves increased by 1.98% to USD 8,186 million (4.2 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover but below EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 129.18, KES 169.66 and KES 142.47 respectively. The observed appreciation the Dollar is attributed to increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.70% | 0.01% |

| Sterling Pound | -15.11% | -2.21% |

| Euro | -17.95% | -1.39% |

Liquidity

Liquidity in the money markets tightened, with the average inter-bank rate increasing marginally from 12.74% to 12.76%, as tax remittances more than offset government payments. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.74% | 12.76% |

| Interbank volume (billion) | 18.12 | 17.94 |

| Commercial banks’ excess reserves (billion) | 12.40 | 21.00 |

Fixed Income

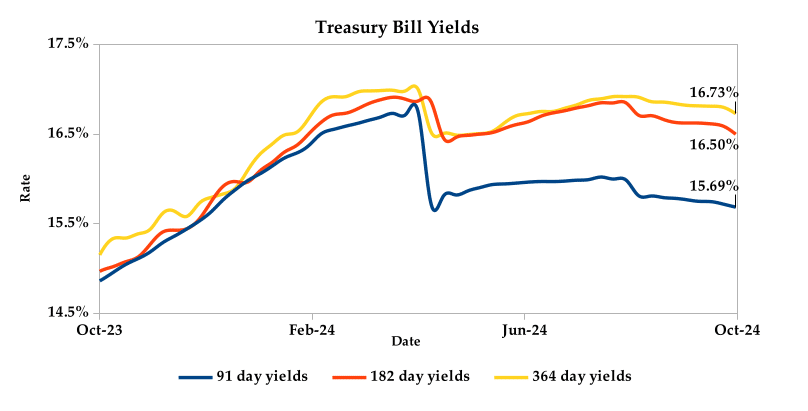

T-Bills

T-Bills were over-subscribed during the week, with the overall subscription rate increasing to 224.83% from 87.18% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 433.83%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 202.11% and 163.95% respectively. The acceptance rate decreased by 9.05% to close the week at 54.18%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 0.14%, from KES 28.93 billion in the previous week to KES 28.88 billion. Total bond deals increased by 0.70% from 572 in the previous week to 576.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.39% compared to the previous week, 0.34% month-to-date and decreased 0.53% year-to-date. The yields on the 10-year Eurobonds for Angola and Zambia also increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -1.04% | 0.41% | 0.45% |

| 2018 30-Year Issue | -0.11% | 0.23% | 0.27% |

| 2019 7-Year Issue | -1.60% | 0.44% | 0.45% |

| 2019 12-Year Issue | -0.17% | 0.31% | 0.39% |

| 2021 13-Year Issue | 0.05% | 0.27% | 0.32% |

| 2024 6-Year Issue | -0.31% | 0.37% | 0.46% |

Equities

NASI, NSE 25 and NSE 10 settled 1.07%, 1.54% and 2.10% higher compared to the previous week while NSE 20 settled 0.27 lower, bringing the year-to-date performance to 17.77%, 23.48% 26.00% and 17.51% respectively. Market capitalization also gained 1.07% from the previous week to close at KES 1.70 trillion, recording a year-to-date increase of 17.99%. The performance was driven by gains recorded by large-cap stocks such as EABL, NCBA, Co-operative Bank and Standard Chartered of 5.29%, 3.64%, 3.40% and 2.42% respectively.

The Banking sector had shares worth KES 343M transacted which accounted for 33.90% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 33M transacted which represented 3.00% and Safaricom, with shares worth KES 556M transacted, represented 55.00% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| E.A Portland | 478.13% | 60.59% |

| Orchards | 70.00% | 58.61% |

| Tp Serena | -7.69% | 16.73% |

| NBV | -10.98% | 13.47% |

| Kakuzi | 14.22% | 9.80% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Car General | -16.00% | -16.00% |

| Kenya Power | 115.00% | -14.00% |

| Eveready | 11.86% | -11.11% |

| Trans-Century | -21.15% | -10.87% |

| Nation Media | -27.94% | -8.98% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 4.46 | 2.79 | -37.30% |

| Derivatives Contracts | 17.00 | 14.00 | -17.65% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 21.26% | 0.22% |

| Dow Jones Industrial Average (DJI) | 12.30% | 0.09% |

| FTSE 100 (FTSE) | 7.24% | -0.48% |

| STOXX Europe 600 | 8.37% | -1.80% |

| Shanghai Composite (SSEC) | 12.63% | 8.06% |

| MSCI Emerging Markets Index | 15.09% | 0.41% |

| MSCI World Index | 16.70% | -0.76% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 2.10% | -0.40% |

| JSE All Share | 12.90% | -1.54% |

| NSE All Share (NGSE) | 28.33% | -0.95% |

| DSEI (Tanzania) | 21.22% | 0.44% |

| ALSIUG (Uganda) | 26.62% | 0.69% |

Global and Continental Markets

The US stock market closed the week on an upward trajectory, buoyed by a stronger-than- expected jobs report that reinforced the resilience of the US economy and eased recessionary concerns.

European stock markets closed the week in the red zone, as investors shifted away from riskier assets amid growing concerns over Iran’s potential attack on Israel.

Asian stock markets closed the week on a positive note, as investors scrambled to join a searing rally fueled by Beijing’s latest round of stimulus measures.

Week’s Highlights

- Kenya’s GDP fell to a 2-year low, growing 4.6% year-on-year in the second quarter of 2024, from a 5% expansion in the previous quarter. Protests against proposed tax increases disrupted various activities, impacting the economy. The agricultural sector, a key driver, grew at a slower pace despite increased production of certain crops. Other sectors also experienced slower growth, while construction and mining contracted. Overall, the economy faced headwinds during the quarter, with disruptions from protests, global economic factors and rising costs impacting various sectors.

- The Stanbic Bank Kenya PMI declined to 49.7 in September 2024 from 50.6 in August, indicating a contraction in the Kenyan private sector. Economic drawbacks faced by both businesses and households led to reduced sales, output and new orders. Despite lower demand, businesses increased purchasing activity to build stock. While firms maintained their workforce, hiring remained subdued. Input prices rose at the slowest pace in four months, resulting in only a slight increase in output prices. Business sentiment reached its lowest level in a decade, reflecting concerns about the ongoing economic challenges.

- Kenya has launched a Digital Nomad Work Permit and a Transit & Long Connection Travellers Electronic Travel Authorization (ETA), making it more convenient for digital professionals and long-haul travelers to experience the country. These permits aim to enhance the visitor experience and boost tourism revenue. The Digital Nomad Work Permit allows remote workers to live and work in Kenya, while the ETA enables transit passengers to explore the country during layovers. Kenya’s tourism earnings reached a record high of KES 352.54 billion in 2023.

- 5 Ndovu Wealth Limited has launched its Money Market Fund, Ndovu Fund, following approval from the Capital Markets Authority. Having previously partnered with Zimele Assets Management, Ndovu now offers investment products independently. The Ndovu Fund allows investors to start with as little as KES 500 and aims to provide flexibility and competitive returns. In June 2024, money market funds accounted for 67.4% of all funds under management in Kenya, totaling KES 171.2 billion. Ndovu now joins the 51 approved unit trust schemes.

- Eurozone inflation eased to 1.8% in September 2024 from 2.2% in August, the lowest since April 2021. This is below the European Central Bank’s (ECB) target of 2%. Energy prices fell sharply, while services inflation slowed and food prices rose slightly. Core inflation also decreased. Among major economies, Germany, France, Italy and Spain all saw inflation decline. The ECB expects inflation to rise again later in 2024 due to base effects, and is expected to decline towards 2% in 2025.

- UK’s annual inflation remained steady at 2.2% in August 2024, matching the previous month’s rate and aligning with market expectations. While rising airfares and recreational costs contributed to inflationary pressures, declining fuel prices and slower increases in restaurant and hotel costs helped offset these impacts. Overall, the Consumer Price Index (CPI) rose by 0.3% compared to the previous month, aligning with market expectations.

- The S&P Global US Composite PMI declined to 54 in September 2024, from 54.4 in August. While the service sector remained resilient, manufacturing activity contracted further. Additionally, inflationary pressures intensified, with input and output prices rising at their fastest rates in months.

- The HCOB Eurozone Composite PMI fell to 49.6 in September 2024, from 51 in August. This signaled a contraction in the Eurozone private sector for the first time since February. Services activity slowed and the manufacturing contraction deepened. Demand for goods and services fell at the fastest pace in eight months, leading to job cuts and reduced backlogs. Business confidence weakened and all three major economies in the Eurozone also recorded contractions.

Get future reports

Please provide your details below to get future reports: