Foreign Exchange Reserves

The usable foreign exchange reserves stood at USD 6,814 million (3.70 months of import cover). This falls short of CBK’s statutory requirement to endeavour to maintain at least 4.0 months of import cover as well as the EAC region’s convergence criteria of 4.5 months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 151.06, KES 184.30 and KES 160.90 respectively. The observed depreciation against the Dollar is attributed to a high demand from energy and commodity importers.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | 22.39% | 0.46% |

| Sterling Pound | 23.91% | 1.24% |

| Euro | 22.21% | 1.44% |

Liquidity

Liquidity in the money markets slightly increased, with the average inter-bank rate decreasing from 12.36% to 12.32%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.36% | 12.32% |

| Interbank volume (billion) | 12.28 | 16.33 |

| Commercial banks’ excess reserves (billion) | 19.80 | 17.80 |

Fixed Income

T-Bills

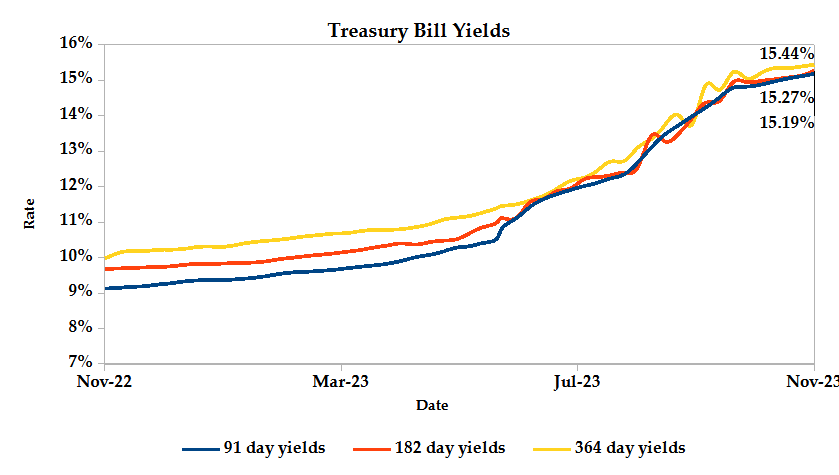

T-Bills were over-subscribed during the week, with the overall subscription rate recorded as 102.82%, up from the 75.63% performance recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 562.00% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 12.82% and 9.14% respectively. The acceptance rate increased by 11.41% to close the week at 96.09%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 23.77% from KES 12.01 billion in the previous week to KES 9.16 billion. Total bond deals decreased by 11.81% from 415 in the previous week to 366.

Eurobonds

In the international market, yields on Kenya’s Eurobonds decreased by an average 0.89% compared to the previous week, 0.37% month-to-date loss and a 1.59% year-to-date gain. The yields on the 10-year Eurobonds for Zambia and Angola also declined. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 1.17% | -0.56% | -1.11% |

| 2018 10-Year Issue | 2.33% | -0.25% | -0.82% |

| 2018 30-Year Issue | 0.88% | -0.27% | -0.67% |

| 2019 7-Year Issue | 2.23% | -0.38% | -0.96% |

| 2019 12-Year Issue | 1.34% | -0.36% | -0.79% |

| 2021 13-Year Issue | 1.60% | -0.39% | -0.99% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 4.12%, 1.27%, 3.90% and 4.47% lower compared to the previous week, bringing the year-to-date performance to -32.67%, -13.85%, -26.46% and -10.91% respectively. Market capitalization also lost 4.11% from the previous week to close at KES 1.34 trillion, recording a year-to-date decline of -32.48%. The performance was driven by losses recorded by large-cap stocks such as KCB, Safaricom, NCBA and Co-operative of 13.26%, 6.80%, 4.74% and 3.81% respectively.

The Banking sector had shares worth KES 257.9M transacted which accounted for 41.42% of the week’s traded value, Manufacturing and Allied sector had shares worth KES 24M transacted which represented 3.86% and Safaricom, with shares worth KES 301M transacted represented 48.48% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| CIC Insurance | 2.19% | 17.11% |

| Longhorn | -21.00% | 9.72% |

| Sameer | 9.43% | 9.43% |

| Flame Tree | 17.27% | 9.32% |

| Carbacid | 43.51% | 7.19% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Sasini | -8.91% | -14.79% |

| KCB | -57.37% | -13.26% |

| Olympia | -2.03% | -11.85% |

| Standard Group | -34.16% | -10.65% |

| Williamson Tea | 31.25% | -8.00% |

Alternative Investments

| Losers | Week (previous) | Week (ending) | % Change |

|---|---|---|---|

| Derivatives Turnover (million) | 0.96 | 1.28 | 32.58% |

| Derivatives Contracts | 33.00 | 35.00 | 6.06% |

| I-REIT Turnover (million) | 630.00 | 1,882,122.00 | 298649.52% |

| I-REIT deals | 1.00 | 37.00 | 360.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 13.97% | 5.85% |

| Dow Jones Industrial Average (DJI) | 2.80% | 5.07% |

| FTSE 100 (FTSE) | -1.81% | 1.73% |

| STOXX Europe 600 | 2.32% | 3.41% |

| Shanghai Composite (SSEC) | -2.75% | 0.43% |

| MSCI Emerging Markets Index | -1.49% | 3.10% |

| MSCI World Index | 10.88% | 5.56% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -0.96% | -0.29% |

| JSE All Share | -2.11% | 4.91% |

| NSE All Share (NGSE) | 36.05% | 4.56% |

| DSEI (Tanzania) | -7.06% | -0.76% |

| ALSIUG (Uganda) | -24.86% | -1.83% |

The US stock market closed the week in the green, as investors bet that the Federal Reserve is close to ending its aggressive interest rate hikes. Bond yields tumbled after data showed that US jobs’ growth slowed and unemployment rose slightly, reinforcing hopes that the Fed is done raising rates. Real estate, financials and materials led the market gains.

European stock market closed the week on an upward trajectory, primarily driven by gains in rate-sensitive real estate and technology stocks, as investors grew more optimistic that central banks are close to finishing their interest rate hikes.

Asian stock markets closed the week in the green zone as well, boosted by a rebound in China’s services sector, offsetting the decline in manufacturing.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 5.88% and 6.18% lower at $80.51 and $84.89 respectively. Gold futures prices settled 0.51% higher at $1999.20.

Week’s Highlights

- The Stanbic Bank Kenya PMI fell to 46.2 in October 2023, its second-fastest decline since August 2022, amid rising costs. The decline was driven by contractions in output and new orders across all sectors, with new orders falling the fastest in construction, wholesale and retail. Employment also decreased at its fastest pace since June 2020, and purchasing activity fell slightly. Lead time increased due to concerns about vendor cash flow. Input inflation accelerated to a record pace on higher fuel prices and currency weakness, while output cost inflation rose above its previous high in mid-2022 due to rising demand and business activity. Sentiment remained muted, but optimism was still stronger than the record low in April amid expected rise in demand.

- Kenya’s external debt servicing cost has been revised up by an additional KES 216.7 billion, representing a 24% hike. The increase is attributed to the continued weakening of the shilling and rising interest rates on commercial loans. The rise in debt servicing costs puts pressure on public finances and could have negative consequences for the Kenyan economy.

- The Central Bank of Kenya (CBK) approved the acquisition of a 51% stake in SMEB Microfinance Bank by Hope Advancement Inc. (HOPE), a US-based charitable organization. This acquisition is expected to strengthen SMEB MFB by providing additional capital for business expansion, upgrading information technology infrastructure and reconstituting the board to improve governance.

- Kenya and Japan launched an Industrial Policy Dialogue (IPD) to improve their trade balance. The Industrial Policy Dialogue will identify and develop areas of industrial collaboration to strengthen economic relations between Kenya and Japan. It will also provide a forum for discussing potential areas of cooperation in the future. Currently, the trade balance between Kenya and Japan is in favour of Japan, with Kenya importing more goods from Japan than it exports. The IPD is a positive development for both Kenya and Japan, as it will provide an opportunity to boost trade and investment, create jobs and grow their economies.

- Kenya Railways announced an increase in fares for all its train services by upto 50%, effective January 1, 2024, primarily due to rising cost of fuel which has significantly impacted the company’s operating costs. Advance ticket purchases for the Madaraka Express Passenger Service will be subject to the new fares as of November 1, 2023. The fare increase is likely to have a negative impact on railway users, especially those who rely on trains for their daily commute or for long-distance travel, amidst the already rising cost of living.

- BURN Manufacturing, the world’s largest maker of clean cookstoves, has issued the first-ever green bond in Sub-Saharan Africa specifically for clean cooking. The $10 million bond will allow BURN to expand its manufacturing capacity in Kenya and launch a new manufacturing facility in Lagos, Nigeria. This is expected to increase production from 400,000 to 600,000 units per month, including a range of life-saving biomass, electric and LPG stoves.

- The US Federal Reserve maintained its target range for the lending rate at a 22-year high of 5.25%-5.5% in November, for the second consecutive time, reflecting the Fed’s dual focus of bringing inflation back to its 2% target while avoiding a recession. The Fed Chair Jerome Powell signaled that the September dot plot, which showed most policymakers forecasting one more rate hike this year, may no longer be accurate. Powell also stated that the Fed has not discussed any rate cuts yet, as its primary focus remains on whether it will need to raise rates further.

- The Bank of England kept its base interest rate at 5.25%, a 15-year high, at its November meeting, for the second consecutive time. Policymakers are closely monitoring the UK economy, which is showing signs of slowing down, while also trying to deal with the ongoing problem of high inflation. The Monetary Policy Committee (MPC) voted 6-3 to keep rates unchanged, with three members voting for a 0.25% increase. The central bank stressed that monetary policy will likely remain tight for some time in order to bring inflation back to its 2% target, and the MPC is ready to tighten policy further if needed.

- The Eurozone economy contracted by 0.1% quarter-on-quarter in the third quarter of 2023, marking its first decline since 2020. The contraction was primarily driven by the German economy, which contracted by 0.1% in the quarter, while other major economies such as France and Spain grew modestly. The European Central Bank (ECB) downgraded its growth forecast for the Eurozone economy in 2023 to 0.7%, from its previous forecast of 2.8%. The ECB attributed the slowdown to tighter financing conditions and high prices that dampened domestic demand, weak foreign demand and a shrinking industrial sector.

- Eurozone inflation fell to 2.9% year-on-year in October 2023, its lowest level since July 2021, slightly below the market consensus of 3.1%. The core rate, which excludes volatile food and energy prices, also decreased to 4.2% in October, its lowest level since July 2022. However, both rates remained above the European Central Bank’s target of 2%, driven by a drop in energy prices, which fell by 11.1% in October. Food prices also eased, while prices for non-energy industrial goods and services remained relatively stable. On a monthly basis, consumer prices rose slightly by 0.1% in October, following a slightly stronger increase of 0.3% in September.

- The Caixin China General Manufacturing PMI contracted to 49.5 in October 2023, marking the first contraction in the manufacturing sector since July. This was due to a slowdown in new order growth and a renewed fall in output. New orders in October grew slightly, as foreign sales fell for the fourth consecutive month. Manufacturing employment fell to its lowest level since May, even as backlogs of work continued to grow. Input costs rose sharply to a nine-month high in October, while selling prices increased more moderately. Additionally, Chinese manufacturers’ sentiment fell to its lowest level since September 2022.

Get future reports

Please provide your details below to get future reports: