Foreign Exchange Reserves

The usable foreign exchange reserves stood at USD 6,605 million (3.69 months of import cover). This falls short of CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover as well as EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 127.54, KES 152.57 and KES 135.39 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency, which has caused a market shortage.

| YTD Change | W-o-W Change | |

|---|---|---|

| Dollar | 3.34% | 0.88% |

| Sterling Pound | 2.58% | 0.30% |

| Euro | 2.83% | 1.05% |

Liquidity

Liquidity in the money markets tightened with the average interbank rate rising from 6.56% to 6.88%, as tax remittances more than offset government payments. Open market operations remained active.

| Week (previous) | Week (ending) | |

|---|---|---|

| Interbank rate | 6.56% | 6.88% |

| Interbank volume (billion) | 24.06 | 11.61 |

| Commercial banks’ excess reserves (billion) | 15.40 | 14.70 |

Fixed Income

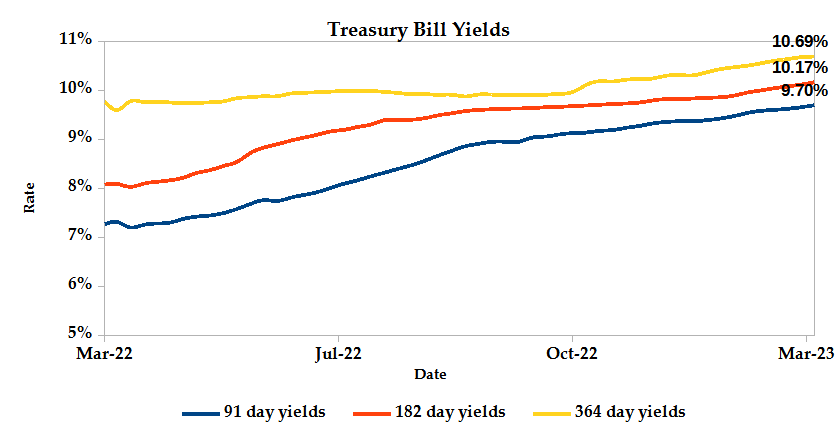

T-Bills

T-Bills were over-subscribed during the week, with the overall subscription rate recorded at 136.25%, up from a subdued 80.98% performance recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 555.73% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 60.16% and 44.55% respectively. The acceptance rate decreased by 24.99% to close the week at 72.74%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover declined by 23.17% from KES 12.31 billion in the previous week to KES 9.46 billion. Total bond deals increased by 29.72% from 508 in the previous week to 659.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average 0.28% compared to the previous week, 0.77% month to date and 0.23% year to date. The yields on the 10-Year Eurobonds for Ghana and Angola also increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | -0.49% | 1.18% | 0.54% |

| 2018 10-Year Issue | 0.53% | 0.84% | 0.30% |

| 2018 30-Year Issue | 0.25% | 0.51% | 0.15% |

| 2019 7-Year Issue | 0.39% | 0.86% | 0.44% |

| 2019 12-Year Issue | 0.20% | 0.66% | 0.14% |

| 2021 13-Year Issue | 0.51% | 0.59% | 0.13% |

Equities

NASI, NSE 20 and NSE 25 settled 0.24%, 1.27% and 0.54% lower compared to the previous week bringing the year to date performance to -0.92%, -2.47% and -0.16% respectively. Market capitalization lost 0.24% from the previous week to close at KES 1.96 trillion recording a year to date decline of 0.92%. The performance was driven by losses recorded by large-cap stocks such as Equity, ABSA, EABL and Standard Chartered of 1.74%, 1.20%, 0.28% and 0.15% respectively. These were however mitigated by the gains recorded by Co-operative, Safaricom and KCB of 1.59%, 0.43% and 0.13% respectively.

The Banking sector had shares worth KES 462.8M transacted which accounted for 46.12% of the week’s traded value, Manufacturing & Allied sector had shares worth KES 84M transacted which represented 8.39% and Safaricom, with shares worth KES 420M transacted represented 41.88% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| TPSE | 5.77% | 10.00% |

| EA Portland | 2.94% | 6.71% |

| Eveready | -8.33% | 6.45% |

| NBV | -10.66% | 5.07% |

| Kakuzi | 3.96% | 4.64% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Stanbic | 1.96% | -8.26% |

| HF Group | 4.44% | -7.58% |

| Olympia | -10.47% | -6.36% |

| Kenya Power | -8.02% | -5.70% |

| BAT | -1.36% | -5.42% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 0.90 | 0.94 | 4.48% |

| Derivatives Contracts | 11 | 17 | 54.55% |

| I-REIT Turnover (million) | 0.36 | 0.55 | 51.60% |

| I-REIT deals | 63 | 44 | -30.16% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 5.79% | 1.90% |

| Dow Jones Industrial Average (DJI) | 0.77% | 1.75% |

| FTSE 100 (FTSE) | 5.20% | 0.87% |

| STOXX Europe 600 | 6.93% | 1.43% |

| Shanghai Composite (SSEC) | 6.80% | 1.87% |

| MSCI Emerging Markets Index | 2.65% | 1.66% |

| MSCI World Index | 6.04% | 1.89% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -0.32% | -0.33% |

| JSE All Share | 5.79% | 2.02% |

| NSE All Share (NGSE) | 7.62% | 1.06% |

| DSEI(Tanzania) | 1.66% | -0.65% |

| ALSIUG (Uganda) | -0.74% | -0.48% |

US indices had a positive week with the S&P 500 gaining 1.5%, the Dow Jones Industrial Average up by 1.04%, and the Nasdaq Composite rising 1.9%. Despite hitting its highest level since 2010, the 10-year Treasury yield retreated below the key 4% level. This week’s data showed a return to growth in US services activity for the first time in eight months, indicating that the economy is resilient enough to withstand further rate hikes.

European stock markets had a positive week with the DAX index in Germany up 0.9%, the CAC 40 in France rising 0.6%, and the FTSE 100 in the UK climbing 0.4%. The STOXX 600 also rose by 0.9%, with tech stocks up by 1.8% and mining stocks rising 2.2%. The positive sentiment was driven by gains in Asia, where data showed that China’s services sector had expanded at the fastest pace in six months, indicating a robust recovery in this important export market for European companies. Investors also awaited the final reading of Eurozone services activity data, contributing to the overall positive sentiment.

Asian indices had a positive week, with most stocks inching higher. The Nikkei 225 index in Japan was the best performer, rising by 1.5%, following a soft inflation reading from Tokyo. The inflation in Japan’s capital eased substantially from an over 40-year high in January. Other Asian stocks were mildly positive, with optimism over a Chinese economic recovery somewhat offsetting growing fears of a more hawkish Federal Reserve. Overall, markets in Asia digested more signals on U.S. monetary policy and positive Chinese economic data, contributing to the positive performance of the Asian indices.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 4.20% and 3.21% higher at $79.68 and $85.83 respectively. Gold futures prices settled 2.06% higher at $1,854.60.

Week’s Highlights

- The private sector activity in Kenya contracted for the first time since August 2022, according to the Stanbic Bank Kenya PMI, which declined to 46.6 in February 2023. This was due to a drop in output and new orders, with international sales falling at the fastest rate on record. Employment fell to its lowest level since April 2021, and input purchasing declined for the first time since August 2022. Input cost inflation accelerated to a five-month high and was among the quickest on record, primarily due to increased taxes and import costs, and a depreciation of the shilling against the Dollar. Output cost inflation remained largely unchanged. Despite the contraction, business sentiment improved significantly and was at its highest level in almost three years.

- Kenya has signed a government-to-government deal with the United Arab Emirates to import 30% of its monthly fuel requirements on credit for up to one year. The move aims to ease pressure on Dollar demand and alleviate uncertainty over local pump prices, as oil shipments make up 28% of Kenya’s monthly imports. The State-owned National Oil Corporation will facilitate the imports.

- The Energy and Petroleum Regulatory Authority (EPRA) has objected to Kenya Power’s proposal to bill some customers in Dollars due to concerns that the utility company may be compensated twice for exchange rate losses. According to EPRA, Kenya Power is already fully compensated for foreign exchange losses through the foreign exchange surcharge included in current bills, which reimburses the company for fluctuations of hard currencies for expenditures denominated in Dollars and Euros. EPRA’s opposition highlights the potential impact of exchange rate fluctuations on utility companies and the need for effective compensation mechanisms to mitigate these risks.

- Kenyan banks are struggling to meet the high demand for Dollars, leading to a widening spread between the Shilling’s official printed exchange rate against the Dollar and the price at which buyers can access the hard currency in banks. The Central Bank of Kenya has directed commercial banks to ration Dollars due to a shortage of the currency and the need to protect reserves. Manufacturers and importers are having difficulties meeting their obligations due to a lack of access to the US currency. The spread between buying and selling prices for the Dollar in banking halls has widened, with some banks running out of Dollars on some days. The shortage has put a strain on supplier relations and the ability to negotiate favorable prices in spot markets.

- The Government has announced plans to provide subsidies for gas cylinders to promote the adoption of clean energy. The subsidy will include the elimination of all taxes on cooking gas, including the 8% value added tax and provide subsidies for the 6kg gas cylinder. This is expected to result in a projected reduction in the price of at least 80%. The subsidy will be implemented from the upcoming fiscal year.

- Nigeria’s crude oil production increased by 100,000 barrels per day in February, bringing it closer to the goal of producing 1.6 million barrels per day in Q1 2023. This growth occurred despite OPEC+ agreeing to cut production to support the market.

- China’s government has set a 2023 growth target of around 5% year-on-year, lower than the previous year’s target of around 5.5%. The move comes as the country emerges from three years of COVID-19 restrictions. The Chinese economy grew 3% in 2022, missing the previous year’s target and recording one of the slowest rates of growth in almost 50 years. The government has also set a 2023 budget deficit target of 3% of GDP, up from 2.8% last year, and a 2023 inflation target of around 3%, unchanged from 2022.

Get future reports

Please provide your details below to get future reports: