Foreign Exchange Reserves

The usable foreign exchange reserves stood at USD 7,005 million (3.92 months of import cover). This falls short of CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover as well as EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 124.35, KES 154.21 and KES 135.60 respectively. The observed depreciation against the Dollar is attributed to increased demand from importers as well as investors hedging their exposure using safe haven USD deposits.

| YTD Change | W-o-W Change | |

|---|---|---|

| Dollar | 0.75% | 0.21% |

| Euro | 2.99% | 1.04% |

| Sterling Pound | 3.69% | 0.65% |

Liquidity

Liquidity in the money markets tightened with the average interbank rate rising to 6.39% from 6.12%, as tax remittances offset government payments. Open market operations remained active.

| Week (previous) | Week (ending) | |

|---|---|---|

| Interbank rate | 6.12% | 6.39% |

| Interbank volume (billion) | 12.40 | 14.52 |

| Commercial banks’ excess reserves (billion) | 3.10 | 2.90 |

Fixed Income

T-Bills

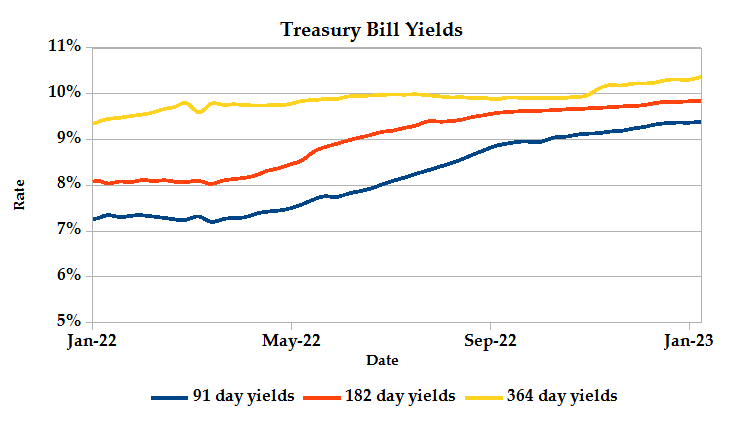

T-Bills remained over-subscribed during the week, with the overall subscription rate coming in at 142.91%, up from 122.74% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 458.94% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 102.65% and 56.76% respectively. The acceptance rate declined by 6.21% to close the week at 93.57%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 21.18% from KES 11.64 billion in the previous week to KES 14.10 billion. Total bond deals increased by 6.48% from 586 in the previous week to 624.

Eurobonds

In the international market, yields on Kenya’s Eurobonds declined by an average 0.16% compared to the previous week and 1.03% year to date. The yields on the 10-year Eurobonds for Ghana and Angola increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | -2.51% | -2.51% | -0.46% |

| 2018 10-Year Issue | -0.75% | -0.75% | -0.16% |

| 2018 30-Year Issue | -0.54% | -0.54% | -0.03% |

| 2019 7-Year Issue | -1.15% | -1.15% | -0.18% |

| 2019 12-Year Issue | -0.74% | -0.74% | -0.05% |

| 2021 13-Year Issue | -0.50% | -0.50% | -0.08% |

Equities

NASI and NSE 25 gained 1.45% and 0.70% while NSE 20 settled 0.55% lower compared to the previous week bringing the year to date performance to -1.00%, -0.04% and -0.07% respectively. Market capitalization picked up 1.45% from the previous week to close at KES 1.96 trillion recording a year to date decline of 1.00%. The performance was driven by gains recorded by large-cap stocks such as Safaricom, EABL and Co-operative of 3.10%, 2.08% and 1.61% respectively. These were however weighed down by losses recorded by Equity of 1.30%

The Banking sector had shares worth KES 359M transacted which accounted for 33.90% of the week’s traded value, Manufacturing & Allied sector had shares worth KES 72M transacted which represented 6.80% and Safaricom, with shares worth KES 587M transacted represented 55.38% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Olympia | -3.72% | 13.10% |

| Kenya Orchards | 31.73% | 9.60% |

| ABSA Gold ETF | 8.55% | 8.55% |

| BOC Kenya | -1.06% | 6.87% |

| Home Afrika | -5.88% | 6.67% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| Car & General | -24.49% | -17.78% |

| NBV | -10.66% | -12.00% |

| EA Portland | -6.18% | -8.07% |

| Express | -1.73% | -7.33% |

| Nation Media | -4.43% | -6.79% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 1.46 | 2.57 | 76.61% |

| Derivatives Contracts | 21 | 35 | 66.67% |

| I-REIT Turnover | 0.27 | 0.83 | 205.48% |

| I-REIT Deals | 30 | 52 | 73.33% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 6.44% | 2.47% |

| Dow Jones Industrial Average (DJI) | 2.54% | 1.81% |

| FTSE 100 (FTSE) | 2.79% | -0.07% |

| STOXX Europe 600 | 4.83% | 0.67% |

| Shanghai Composite (SSEC) | 4.76% | 0.00% |

| MSCI Emerging Markets | 9.21% | 1.44% |

| MSCI World Index | 7.11% | 2.22% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -1.64% | 0.70% |

| JSE All Share | 9.37% | 2.15% |

| NSE All Share (NGSE) | 2.06% | 0.12% |

| DSEI (Tanzania) | -0.01% | 0.64% |

| ALSIUG (Uganda) | -0.26% | -0.23% |

US indices ended the week green following a week of better than expected economic updates and strong quarter four earnings results by Tesla. Among the S&P sectors, consumer discretionary led the gains while energy recorded the highest loss. Tech stocks continued their rally, with Alphabet, Meta, Amazon leading the upside.

European stocks posted mixed performance with major STOXX 600 sectors such as energy and consumer discretionary providing a boost to weakness in consumer staple stocks.

Asia Pacific indices traded higher over the week, with MCSI’s Asia Pacific Index up by 2.13%, while Nikkei 225 added 3.12%, tracking US gains. Japanese stocks lagged due to higher than expected January inflation data and murky Bank of Japan monetary stance. Vietnam’s market was up 0.9% driven by the telecommunication and energy sectors.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 2.73% and 1.11% lower at $79.41 and $86.66 respectively. Gold futures prices settled 0.02% higher at $1,928.60.

Week’s Highlights

- KPLC submitted a tariff review proposal to the Energy and Petroleum Regulatory Authority (EPRA) seeking to raise energy charges beginning 1st April 2023. The proposed charges are KES 14 per kilowatt-hour tariff for customers with consumption needs of less than 30 units of power per month and KES 21.68 per kilowatt-hour for those exceeding 30 units. These have been adjusted from KES 10 per kilowatt-hour for usage below 100 units per month and KES 15.8 per unit above 100 units. The review, the company noted, has been occasioned by rising financial needs while income from the sale of electricity stagnated.

- The African Development Bank has projected that the estimated average GDP growth for African economies will stabilize at 4% over 2023-2024, from 3.8% in 2022. This outlook reflects continuing policy support in the region as well as global efforts to tame the impact of external shocks and uncertainty. Africa is expected to benefit from the downstream impact of China’s reopening and Asia’s positive growth outlook, seeing as Asia accounts for about 40% of Africa’s total merchandise exports.

- Diageo has received the requisite regulatory approval to acquire an additional 14.97% stake (118,394,897 ordinary shares) in EABL. The move expands and solidifies Diageo’s presence in the East African market and capitalize on EABL’s strong performance. The tender offer opens on 6th February 2023, while transfer and settlement of shares commences on 11th April 2023.

- East African Portland Cement announced plans to expand into Rwanda and DRC as part of a new strategic business cycle dubbed New Dawn targeting growth in its volumes and brand portfolio. The company intends to reclaim its market share and support the government’s affordable housing agenda and infrastructure growth, expected to hit KES 3 trillion in the next five years.

- The South African Rand experienced a 0.55% depreciation against the US Dollar during the week, as investors anticipated the central bank’s policy direction. The South African Reserve Bank raised its repo rate by 25 basis points to 7.25%, less than major sentiments of a 50 bps hike after three 75 bps hikes. The Rand’s performance remains overshadowed by the negative impact of scheduled power cuts which have been detrimental to business activity and investor confidence.

- US economy’s growth decelerated to 2.9% in the fourth quarter of 2022, from 3.2% in the third quarter, beating market expectations of a 2.8% growth. The slowdown reflected a downturn in exports, non residential fixed investment, state and local government spending and consumer spending. Consumer spending dropped 0.2%, falling for the second consecutive month, standing in the way of the economy’s growth path for 2023.

- S&P Global’s Composite US PMI registered at 46.6 in January 2023, up from 44.7 in December. The reading signaled a contraction in business activity for the seventh straight month and a fall in both manufacturing and services sectors. High inflation continued to pose a challenge to consumer spending as companies reported soft demand. Input prices for both service sector firms and producers rose partly due to wage pressures.

Get future reports

Please provide your details below to get future reports: