Foreign Exchange Reserves

The usable foreign exchange reserves stood at USD 6,479 million (3.60 months of import cover). This falls short of CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover as well as EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar but strengthened against the Sterling Pound and the Euro to exchange at KES 138.25, KES 170.55 and KES 148.13 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency, which has caused a market shortage.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | 12.02% | 0.55% |

| Sterling Pound | 14.67% | -0.18% |

| Euro | 12.51% | -0.26% |

Liquidity

Liquidity in the money markets slightly increased, with the average interbank rate marginally decreasing by 0.01% to 9.24%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 9.25% | 9.24% |

| Interbank volume (billion) | 29.00 | 20.41 |

| Commercial banks’ excess reserves (billion) | 36.40 | 26.10 |

Fixed Income

T-Bills

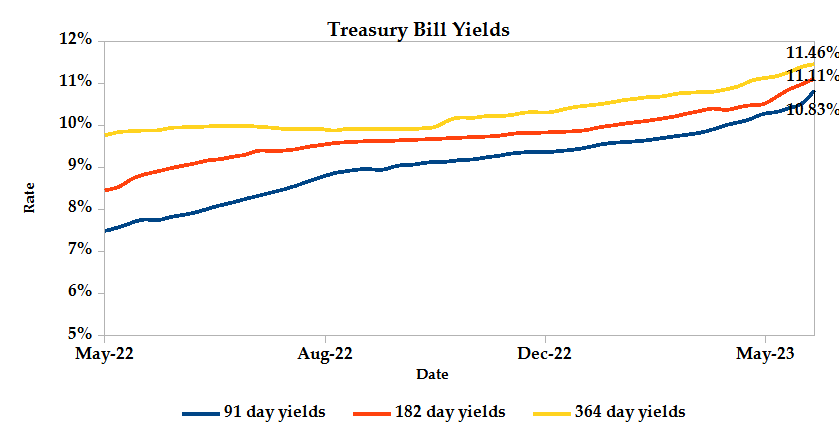

T-Bills were under-subscribed during the week, with the overall subscription rate recorded as 91.87%, down from 150.09% performance recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 356.06% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 40.42% and 37.64% respectively. The acceptance rate decreased by 4.50% to close the week at 95.36%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 22.71% from KES 19.35 billion in the previous week to KES 14.96 billion. Total bond deals increased by 7.52% from 452 in the previous week to 486.

In the primary bond market, CBK reopened the 3-year fixed bond; FXD1/2023/003, through a tap sale which sought to raise KES 20 billion. The issue was over-subscribed receiving bids worth KES 27.21 billion, representing a performance of 136.03%. KES 27.20 billion worth of bids were accepted at a weighted average rate of 14.23%.

Eurobonds

In the international market, yields on Kenya’s Eurobonds decreased by an average 0.37% compared to the previous week, 2.07% month to date and increased 1.70% year to date. The yields on the 10-Year Eurobonds for Angola declined while that of Ghana increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 2.77% | -4.89% | 0.32% |

| 2018 10-Year Issue | 1.65% | -1.96% | -0.46% |

| 2018 30-Year Issue | 0.78% | -1.05% | -0.31% |

| 2019 7-Year Issue | 2.37% | -2.18% | -0.97% |

| 2019 12-Year Issue | 1.29% | -1.11% | -0.34% |

| 2021 13-Year Issue | 1.34% | -1.22% | -0.48% |

Equities

NASI and NSE 25 settled 0.60% and 1.23% lower while NSE 20 settled 1.38% higher compared to the previous week bringing the year to date performance to -23.10%, -11.18% and -19.06% respectively. Market capitalization lost 0.60% from the previous week to close at KES 1.52 trillion recording a year to date decline of 23.16%. The performance was driven by gains recorded by large-cap stocks such as NCBA, Standard Chartered and ABSA of 6.13%, 4.11% and 3.85% respectively. These were however weighed down by losses recorded by Stanbic, Co-operative and Equity of 10.68%, 6.94% and 3.91% respectively.

The Banking sector had shares worth KES 520.6M transacted which accounted for 37.00% of the week’s traded value, Manufacturing & Allied sector had shares worth KES 96.5M transacted which represented 6.86% and Safaricom, with shares worth KES 735.6M transacted represented 52.29% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Eveready | 116.67% | 44.44% |

| Nation Media | 15.51% | 17.74% |

| CIC Insurance | -1.57% | 11.24% |

| Home Afrika | -8.82% | 10.71% |

| B.O.C | 8.83% | 10.00% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Stanbic | -3.68% | -10.68% |

| TPS | -6.15% | -9.63% |

| Longhorn | -21.33% | -9.23% |

| NBV | -32.49% | -9.22% |

| Sasini | 16.48% | -9.04% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 1.70 | 1.31 | -22.99% |

| Derivatives Contracts | 20.00 | 10.00 | -50.00% |

| I-REIT Turnover (million) | 0.41 | 0.13 | -67.74% |

| I-REIT deals | 50 | 34 | -32.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 9.97% | 0.32% |

| Dow Jones Industrial Average (DJI) | -0.12% | -1.00% |

| FTSE 100 (FTSE) | 0.97% | -1.67% |

| STOXX Europe 600 | 6.27% | -1.59% |

| Shanghai Composite (SSEC) | 3.24% | -2.02% |

| MSCI Emerging Markets Index | 1.07% | -0.45% |

| MSCI World Index | 8.73% | -0.52% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -0.08% | -0.35% |

| JSE All Share | 4.45% | -2.17% |

| NSE All Share (NGSE) | 2.67% | 1.51% |

| DSEI (Tanzania) | -3.72% | 0.12% |

| ALSIUG (Uganda) | -16.11% | -2.11% |

US indices recorded mixed performance in the past week as investors resisted from making large investment choices as the US debt ceiling talks progressed but remained optimistic about the debt ceiling being raised. The increased likelihood of a deal in debt-ceiling discussions boosted investor confidence in stocks. On the other hand, stronger consumer expenditure and inflation data, pushed the scales in favor of a further rate hike in June. Fitch Ratings has also put the US on credit watch for a possible downgrade.

European indices edged lower because of fears that the Bank of England may tighten monetary policy further. Consequently, the FTSE 100 and STOXX 600 plummeted to their lowest levels in eight and three weeks respectively. Lower oil prices weighed on energy companies after the Russian government downplayed the probability of additional OPEC output cutbacks. Precious metal miners fell mirroring the slump in gold prices. Cindeworld’s stock also fell despite the company’s declaration that it intended to emerge from bankruptcy protection. Investors are still focused on the debt ceiling negotiations.

Asia Pacific indices traded lower as fears of a US debt default remained, despite little movement in lifting the debt ceiling. Investors remain wary amid growing fears of a US default, which could spark a recession and have disastrous economic implications. Furthermore, mounting COVID-19 cases and weak economic development made investors fearful of China with a new outbreak expected to peak by late June.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 2.01% and 2.38% higher at $73.11 and $77.39 respectively. Gold futures prices settled 0.78% lower at $1964.45.

Week’s Highlights

- The International Monetary Fund (IMF) recently reached an agreement with the Kenyan government on economic policies and reforms that would provide the country with critical financial assistance. The current Extended Credit Facility (ECF) and Extended Fund Facility (EFF) arrangements, as well as a new arrangement under the Resilience and Sustainability Facility (RSF), were all reviewed. Kenya received a USD 544.3 million increase in access under the ECF and EFF, which was extended by 10 months to April 2025 to allow the government to accomplish the IMF program objectives. The new 20-month RSF will operate concurrently with the ECF/EFF and will provide up to USD 544.3 million in funding for long-term structural climate resilience and adaptation. The third accord, which is still subject to IMF board approval in July, will see Kenya immediately receive USD 410 million, bringing the total IMF financial support disbursed under the ECF and EFF arrangements to USD 2,017 million. The IMF’s entire commitment under these arrangements stands at USD 3.52 billion.

- The Central Bank of Kenya has reported an ease on the country’s Eurobond yields despite the downgrade from Moody’s Investors Services to a B3 rating from the previous B2 rating. The declining trend in yields means that if the government rebounds to the international financial markets, it can potentially access external financing at more favorable terms. Kenya’s Eurobond in the foreign market fell by 0.83%, indicating a long-term improvement in investor sentiment. The International Monetary Fund (IMF) recently reaffirmed the country’s financial and monetary status, relieving investor concerns and causing the yield to fall.

- The Central Bank of Kenya (CBK) released the 2022 Bank Supervision Annual Report. According to the report, despite challenging business and operating conditions, the banking industry has proven to be resilient, posting a good 2022 performance with an overall sectoral profit before tax of KES 240.40 billion, a 22% increase, attributed to higher increase in total income compared to total expenses. Furthermore, due to increases in loans and advances, the banking sector’s asset base increased by 10% to approximately KES 6.6 trillion in 2022.

- South Africa’s annual inflation rate fell to 6.8% in April, down from 7.1% in March 2023, surpassing expectations of 7.0% but still above the SARB’s target range of 3%–6%. The observed improvement in inflation was due to a slower rise in transportation, restaurant and hotel prices as well as household content and service prices. Core inflation, excluding food, non-alcoholic beverages, fuel and energy rose to 5.3% in April, up from 5.2% in March, in line with market expectations. Consumer prices rose by 0.4% in April, down from 1.0% in March and barely shy of the 0.5% increase predicted. The South African Reserve Bank (SARB) raised interest rates by 0.5% to 8.25%, exceeding market expectations of 0.25%. Borrowing costs have risen to their highest level since May 2009. The main reasons for the upward adjustment were the Rand’s depreciation and inflationary pressures.

- The People’s Bank of China held its medium-term policy rate at 2.75%, prompting key lending rates to be held steady for the ninth month running and meeting analysts’ expectations. The one-year Loan Prime Rate (LPR), which is the medium-term lending facility used for corporate and household loans, was kept at 3.65%, while the five-year rate, a reference for mortgages, was unchanged at 4.30%. In April, factory output, retail sales and fixed asset investment all grew at a slower pace, falling below economists’ estimates.

- The US economy grew more than expected in the first quarter of 2023. Gross Domestic Product (GDP) increased at an annual rate of 1.3% in Q1 2023, slightly higher than the 1.1% recorded in the advance estimate and exceeding experts’ projections of 1.1%. Despite high inflation, the increase in real GDP represented growth in consumer spending, exports, federal government spending and non-residential fixed investment. Private inventory investment and residential fixed investment, on the other hand, fell. As exports outpaced imports, net external demand contributed positively to GDP. Despite an upward revision, the GDP in Q1 2023 remained the lowest since Q2 2022.

- In the United Kingdom (UK), the Consumer Price Index (CPI) fell to 8.7% in April 2023, down from 10.1% in March 2023, falling short of the Bank of England’s aim of 2% but above market estimates of 8.2%. The reported decrease is due to a substantial reduction in electricity and gas costs, which increased by 24.3% compared to 85.6% in March. Housing and utility inflation fell to 12.3% in April from 26.1% in March. Food and alcoholic beverage inflation was 19.0%, up from 19.1% in the previous month, while transportation prices increased 1.5% up from 0.8%. Core inflation, excluding food and energy increased to 6.8% the highest rate since March 1992 and higher than analysts’ expectations of 6.2%. UK policymakers will more than likely continue to hike interest rates to curb inflationary pressures.

- The S&P Global/CIPS UK composite PMI dropped to 53.9 in May 2023, down from 54.9 in April and falling short of market expectations of 54.6. Private sector output increased significantly, while manufacturing sector output fell for the third consecutive month due to weak orders and client destocking. Corporate clients’ budget constraints, increased economic uncertainty and higher borrowing prices were identified as impediments to growth. The HCOB Flash Euro-area composite PMI slipped to 53.3 in May 2023, down from 54.1 in April, falling short of expectations of 53.7. Despite uneven economic development, private sector activity increased for the fifth month in a row. The services sector increased from 55.9 to 56.2, while industrial production decreased from 45.8 to 44.6. As demand growth nearly stalled, output growth outpaced new orders to the highest level since February 2009. Optimism in the UK and Eurozone fell to its lowest level since February 2023 as concerns about decreasing client demand and rising interest rates grew.

Get future reports

Please provide your details below to get future reports: