Foreign Exchange Reserves

The usable foreign exchange reserves decreased by 1.32% to USD 7,311 million (3.80 months of import cover). This falls short of CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover as well as EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 132.47, KES 170.54 and KES 143.94 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -15.56% | 1.61% |

| Sterling Pound | -14.67% | 1.02% |

| Euro | -17.11% | 1.33% |

Liquidity

Liquidity in the money markets decreased, with the average inter-bank rate marginally increasing from 13.14% to 13.15%, as tax remittances more than offset government payments. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 13.14% | 13.15% |

| Interbank volume (billion) | 26.94 | 24.28 |

| Commercial banks’ excess reserves (billion) | 41.10 | 26.80 |

Fixed Income

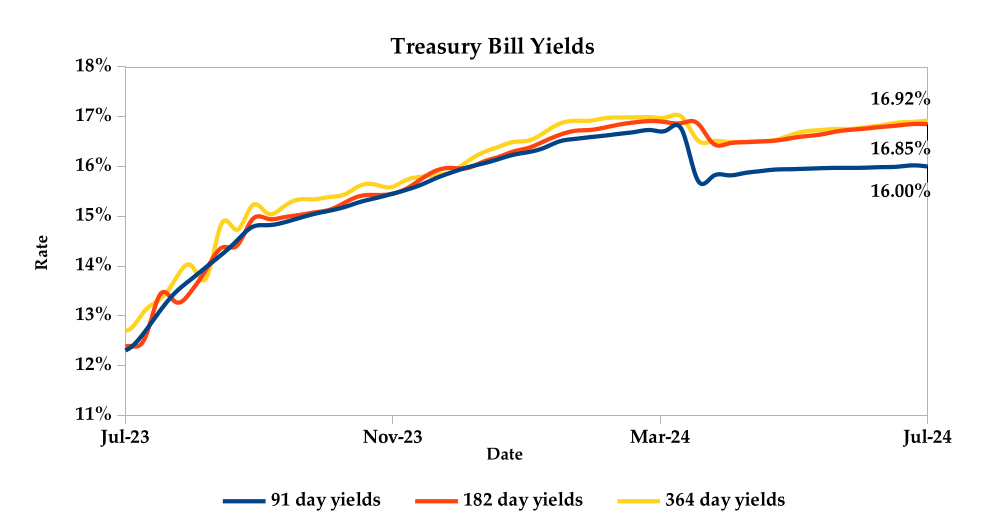

T-Bills

T-Bills were over-subscribed during the week, with the overall subscription rate increasing to 131.86%, up from 87.43% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 645.26%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 41.47% and 16.88% respectively. The acceptance rate decreased by 18.83% to close the week at 72.50%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 40.30%, from KES 44.88 billion in the previous week to KES 26.79 billion. Total bond deals decreased by 12.70% from 693 in the previous week to 605.

In the primary bond market, CBK reopened two infrastructure bonds, IFB1/2023/6.5 and IFB1/2023/17, with coupon rates of 17.9% and 14.4% respectively, seeking to raise KES 50 billion. The sale runs from 25/07/2024 to 14/08/2024.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.53% compared to the previous week, decreased by 0.14% month-to-date and increased by 0.63% year-to-date. The yields on the 10- Year Eurobonds for Angola and Zambia increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | 0.52% | -0.03% | 0.34% |

| 2018 30-Year Issue | 0.55% | -0.24% | 0.35% |

| 2019 7-Year Issue | 0.07% | 0.04% | 1.47% |

| 2019 12-Year Issue | 0.83% | -0.21% | 0.42% |

| 2021 13-Year Issue | 1.15% | -0.21% | 0.30% |

| 2024 6-Year Issue | 0.68% | -0.19% | 0.29% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 4.04%, 1.62%, 3.06% and 3.40% lower compared to the previous week, bringing the year-to-date performance to 13.32%, 10.95%, 17.23% and 19.46% respectively. Market capitalization also lost 4.04% from the previous week to close at KES 1.63 trillion, recording a year-to-date increase of 13.32%. The performance was driven by losses recorded by large-cap stocks such as Safaricom, KCB, Equity and EABL of 7.93%, 6.47%, 3.05% and 1.45% respectively.

The Banking sector had shares worth 345M transacted which accounted for 21% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 170M transacted which represented 10% of the week’s traded value and Safaricom, with shares worth KES 1B transacted, represented 62% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| EA Portland | -8.75% | 36.19% |

| Express | -2.70% | 20.00% |

| Eaagads | 2.73% | 9.58% |

| Longhorn | 3.32% | 5.51% |

| Williamson Tea | 15.35% | 5.20% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Home Afrika | -17.95% | -8.57% |

| Safaricom | 9.82% | -7.93% |

| EA Cables | -8.16% | -7.22% |

| KCB Group | 44.87% | -6.47% |

| Total | 12.22% | -6.05% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 3.10 | 4.29 | 38.60% |

| Derivatives Contracts | 15.00 | 22.00 | 46.67% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 15.10% | -0.83% |

| Dow Jones Industrial Average (DJI) | 7.62% | 0.75% |

| FTSE 100 (FTSE) | 7.31% | 1.59% |

| STOXX Europe 600 | 7.17% | 0.55% |

| Shanghai Composite (SSEC) | -2.41% | -3.07% |

| MSCI Emerging Markets Index | 4.65% | -1.59% |

| MSCI World Index | 11.20% | -0.84% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 374.55% | -0.26% |

| JSE All Share | 6.78% | 1.52% |

| NSE All Share (NGSE) | 29.23% | -2.33% |

| DSEI (Tanzania) | 16.40% | -1.53% |

| ALSIUG (Uganda) | 17.23% | -2.10% |

Global and Continental Markets

The US stock market was volatile during the week, led by the Dow Jones, as easing inflation fueled rate cut hopes. The PCE inflation data supported this view, though the core rate was slightly higher than expected. All sectors gained, with 3M leading the charge. However, the broader market remains cautious, with the S&P 500 and NASDAQ posting weekly losses. Investors now look ahead to earnings from tech giants next week.

European stocks ended the week in the green zone, boosted by positive earnings reports. The STOXX 500 and STOXX 600 indexes closed higher. While the US PCE data had little impact on rate cut expectations, strong performances from companies like Hermes, Saint-Gobain and EssilorLuxottica lifted market sentiment. However, declines in Mercedes-Benz and ThyssenKrupp led to a drop in the overall gains. For the week, European stock indices remained relatively unchanged.

Asian stock markets closed the week in the red zone, driven by disappointing US tech earnings and ongoing concerns about China’s economy. This extended a period of weakness for the tech sector, as investors rotated into more cyclical stocks.

Week’s Highlights

- The government will maintain the National Health Insurance Fund (NHIF) services following a court-ordered suspension of the Social Health Insurance Fund (SHIF). The High Court’s initial ruling declaring SHIF unconstitutional has been temporarily halted pending an appeal by the Attorney General. This decision provides a 45-day window for legal proceedings.

- The Central Bank of Kenya has introduced a new requirement for all domestic Real-Time Gross Settlement (RTGS) payments effective 3rd August. The “Purpose of Payment” field will now be mandatory for all online and mobile banking transactions.

- Cameroon became the fifth Sub-Saharan African nation to issue a Eurobond in 2024, raising USD 550 million on July 23rd. The seven-year bond carried a 9.5% coupon and a 10.75% yield. Despite being undersubscribed by 1.1%, the bond was successfully placed through a private offering. Proceeds will fund development projects outlined in the 2024 Finance Law.Cameroon joins Ivory Coast, Benin, Kenya, and Senegal in tapping international capital markets this year. However, the country’s Caa1, CCC+, and B ratings from Moody’s, S&P Global, and Fitch respectively, highlight its high credit risk profile.

- Actuarial Services E.A. Limited 1113 Kayahwe Rd, Off Galana Rd, Kilimani, P. O. Box 10472 – 00100 NAIROBI, KENYA Tel. +254 202 710 028 / Cell: +254 111 037 100 / +254 708 710 028 / +254 785 710 028 Office Email: info@actserv-africa.com Website: www.actserv.co.ke 5 US economic growth accelerated in the second quarter, expanding at an annualized rate of 2.8% compared to 1.4% in the first quarter, surpassing expectations. Consumer spending rebounded, driven by goods purchases, but services growth slowed. Business investment strengthened, particularly in equipment, while residential investment contracted. Government spending increased, offset by a decline in net exports due to faster import growth. Inventory buildup also contributed positively to overall growth.

- Eurozone economic growth slowed sharply in July. The Flash Composite PMI fell to 50.1, signaling near-stagnation. Manufacturing contracted while the service sector growth rate decelerated. New orders declined, business confidence weakened, and job creation halted. Input costs rose, but selling price increases moderated. Germany and France, the region’s largest economies, also experienced economic contractions.

- The S&P Global US Composite PMI strengthened in July, signaling continued economic expansion. While the service sector thrived, manufacturing contracted. New orders moderated but remained robust in services. Employment growth slowed, and business confidence waned amidst rising political uncertainty. Despite cost pressures, price increases remained subdued.

- The People’s bank of China has significantly lowered key interest rates to support economic growth. Both the one-year and five-year loan prime rates were reduced to 3.35% and 3.85% respectively, impacting borrowing costs for businesses and households. Additionally, the short-term interest rate was cut. These moves follow weak econ

- he National Treasury gazetted the actual revenues and net expenditures for the fiscal year 2023/2024, as at 30th June 2024. Total revenue amounted to KES 2.29 trillion, reflecting a 13.22% increase from the previous month but falling short of the revised estimate II of KES 2.46 trillion by 6.93%. Expenditure totaled KES 3.80 trillion, significantly lower than the estimated KES 4.26 trillion, resulting in a fiscal deficit of 65.74%. This deficit was financed through external and internal borrowing at 47% and 53% respectively. External borrowing significantly decreased by 24.33% and domestic borrowing decreased by 5.6% compared to the revised estimates.

- The Central Bank of Kenya released the annual bank supervision report for the year ending 31 December 2023. Key highlights of the sector’s financial performance include; Capital and reserves increased by 6.8% from KES 917.6 billion to KES 980.2 billion, while net assets grew by 16.7% from KES 6.6 trillion in December 2022 to KES 7.7 trillion in December 2023. Liquidity ratio marginally increased from 50.8 in December 2022 to 51 in December 2023. Gross loans increased by 15.2% from KES 3,630.3 trillion in December 2022, to KES 4,183.4 trillion in 2023. The growth in loans is attributed to increased demand for credit by the various economic sectors. On the downside, net profit after tax declined by 8.8% from KES 240.4 billion in December 2022 to KES 219.2 billion last year. Non-performing loans ratio from 13.9% to 15.6% in December 2023, occasioned by deteriorating asset quality as a result of challenges in the business environment.

- 5 The Tanzanian conglomerate Amsons Group, through its subsidiary Amsons Industries, is eyeing a full takeover of Bamburi Cement. It has launched a buyout offer valuing the company at KES 65 per share, a 44% premium over its June 9th closing price. This offer requires acceptance from at least 75% of shareholders, and Amsons has already secured a commitment from Bamburi’s majority owner. If successful, Amsons intends to delist Bamburi Cement from the Nairobi Stock Exchange (NSE). The news unsurprisingly sent Bamburi’s stock price soaring by 28.3% on Thursday, and it’s likely to continue climbing towards Amsons’ offer price.

- Kenya Electricity Generating Company (KenGen), is making a big push for green energy. They’re building a 42.5-megawatt solar power plant at Seven Forks, aiming for completion in 28 months. Partnering with the French Development Agency(AFD), this project will not only boost Kenya’s renewable energy but also help manage power costs. The solar plant will work alongside their existing hydropower, reducing reliance on water during the day and saving it for drier times. This is a significant step towards Kenya’s ambitious goal of achieving 100% renewable energy by 2030.

- UK’s inflation surprised in June 2024, holding steady at 2% despite predictions of a drop. This continues the trend of the lowest inflation rates since 2021. While restaurant and hotel costs, particularly hotels, rose the most, other sectors offered some relief. Clothing and footwear inflation eased, with garment prices leading the decline. Food prices, Housing and Utilities continued their downward trend. Despite some price increases in transport, like used cars and airfare, overall inflation remained stable for services and recreation.

- China’s economic growth stumbled in Q2 2024, reaching just 4.7% year-over-year. This undershot expectations (5.1%) and marked a significant slowdown from Q1 2024 (5.3%). This marks the weakest performance since early 2023, reflecting a confluence of challenges: a slumping property market, weak domestic demand, a declining Yuan and trade tensions. These figures coincide with the Third Plenum, a key political event where economic reforms and stimulus measures are likely on the table. Despite hitting the annual target with 5.0% growth in the first half, June data painted a concerning picture. Retail sales and industrial output witnessed multi-month lows, indicating a broader slowdown. The unemployment rate held steady at 5.0%, while the trade sector showed a surprising decline in imports despite rising exports.

- The European Central Bank (ECB) kept interest rates on hold in July 2024 as expected, with current data backing their inflation outlook. Though some May inflation readings rose due to temporary factors, most stabilized or fell by June. High wage growth’s inflationary impact has been absorbed by corporate profits, but domestic price pressures and service sector inflation remain high. The ECB projects inflation to stay above their target for much of next year. Committed to bringing inflation back to 2%, it will maintain a restrictive monetary policy, adjusting rates based on incoming data, underlying inflation trends and policy e

- omic data and aim to stimulate the economy.

Get future reports

Please provide your details below to get future reports: