Foreign Exchange Reserves

The usable foreign exchange reserves stood at USD 6,550 million (3.66 months of import cover). This falls short of CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover as well as EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 131.27, KES 161.73 and KES 142.89 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency, which has caused a market shortage.

| YTD Change | W-o-W Change | |

|---|---|---|

| Dollar | 6.36% | 1.07% |

| Sterling Pound | 8.74% | 3.34% |

| Euro | 8.53% | 3.72% |

Liquidity

Liquidity in the money markets tightened with the average interbank rate increasing from 6.97% to 7.41%, as tax remittances more than offset government payments. Open market operations remained active.

| Week (previous) | Week (ending) | |

|---|---|---|

| Interbank rate | 6.97% | 7.41% |

| Interbank volume (billion) | 29.07 | 14.35 |

| Commercial banks’ excess reserves (billion) | 2.70 | 14.60 |

Fixed Income

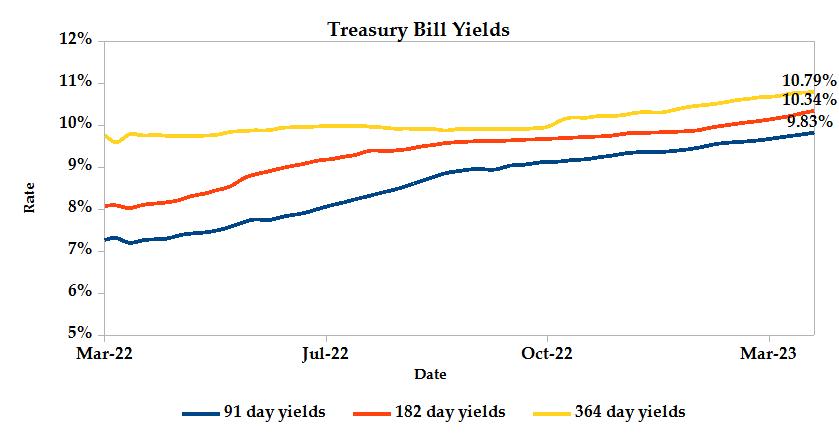

T-Bills

T-Bills were under-subscribed during the week, with the overall subscription rate recorded as 49.16%, down from 121.63% performance recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 179.44% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 36.92% and 9.30% respectively. The acceptance rate decreased by 1.13% to close the week at 97.50%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 5.21% from KES 18.45 billion in the previous week to KES 19.42 billion. Total bond deals deceased by 0.21% from 938 in the previous week to 936.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average 0.04% compared to the previous week, 1.85% month to date and 1.83% year to date. The yields on the 10-Year Eurobonds for Ghana increased while for Angola declined. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 1.30% | 2.16% | 0.23% |

| 2018 10-Year Issue | 2.34% | 2.10% | -0.02% |

| 2018 30-Year Issue | 1.13% | 1.01% | -0.26% |

| 2019 7-Year Issue | 2.83% | 2.80% | 0.32% |

| 2019 12-Year Issue | 1.57% | 1.56% | -0.14% |

| 2021 13-Year Issue | 1.82% | 1.47% | 0.09% |

Equities

NASI, NSE 20 and NSE 25 settled 7.27%, 2.22% and 4.54% higher compared to the previous week bringing the year to date performance to -12.89%, -6.64% and -9.85% respectively. Market capitalization gained 7.29% from the previous week to close at KES 1.73 trillion recording a year to date decline of 12.92%. The performance was driven by gains recorded by large-cap stocks such as Safaricom, KCB, Co-operative bank and Equity of 15.60%, 14.52%, 2.44%, and 1.31% respectively. These were however weighed down by the losses recorded by NCBA, Stanbic and ABSA of 3.82%, 1.36%, and 0.83% respectively.

The Banking sector had shares worth KES 819M transacted which accounted for 3.19% of the week’s traded value, Manufacturing & Allied sector had shares worth KES 22.9B transacted which represented 89.49% and Safaricom, with shares worth KES 1.8B transacted represented 7.04% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Safaricom | -21.41% | 15.60% |

| Express | 12.31% | 15.56% |

| KCB | -7.43% | 14.52% |

| Kenya-Re | -2.67% | 14.47% |

| Total | -14.26% | 11.75% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Kakuzi | -37.66% | -37.54% |

| B.O.C | -1.06% | -9.09% |

| TP Serena | 0.00% | -4.76% |

| Unga | -50.16% | -3.92% |

| Car & General | -36.84% | -3.88% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 9.01 | 0.13 | -98.52% |

| Derivatives Contracts | 45 | 4 | -91.11% |

| I-REIT Turnover (million) | 0.35 | 5.41 | 1,432.01% |

| I-REIT deals | 50 | 49 | -2.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 3.84% | 1.39% |

| Dow Jones Industrial Average (DJI) | -2.71% | 1.19% |

| FTSE 100 (FTSE) | -1.97% | 0.95% |

| STOXX Europe 600 | 1.37% | 0.87% |

| Shanghai Composite (SSEC) | 4.79% | 0.46% |

| MSCI Emerging Markets Index | 1.00% | 2.17% |

| MSCI World Index | 3.52% | 1.37% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -3.15% | 1.75% |

| JSE All Share | 1.20% | 3.25% |

| NSE All Share (NGSE) | 6.39% | -0.08 |

| DSEI(Tanzania) | 0.19% | 2.15% |

| ALSIUG (Uganda) | -8.99% | -4.06% |

US stocks edged higher this week, with big tech companies like Meta Platforms and Microsoft Corporation leading the charge and triggering a wider market recovery. Additionally, bank stocks saw an improvement as Morgan Stanley, State Street Corp, and Citigroup Inc managed to reduce their losses. The Federal Reserve officials played their part in this positive trend by easing investors’ concerns regarding a possible liquidity crisis in the banking industry.

European indices ended the week on a positive note, with the banking sector regaining confidence after UBS Group rescued the struggling lender, Credit Suisse. Furthermore, crude benchmarks made a recovery from their largest weekly decline, recording gains for the week.

Asian Pacific indices recorded a marginal weekly increase, as measures taken by regulators to stabilize the banking sector provided some comfort to investors. Despite this, investors remain apprehensive about the possibility of a banking crisis, and concerns regarding a deceleration in economic growth are gradually impacting market sentiment.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 3.69% and 2.22% higher at $69.20 and $74.59 respectively. Gold futures prices settled 0.52% higher at $1,983.80.

Week’s Highlights

- The Central Bank of Kenya (CBK) issued the Kenya Foreign Exchange Code (The FX Code) to commercial banks. The FX Code sets out standards for commercial banks, and aims to strengthen and promote the integrity and effective functioning of the wholesale foreign exchange (FX) market in Kenya. It will facilitate better functioning of the market, reinforcing Kenya’s flexible exchange rate regime for greater resilience of the economy. Market participants will be required to submit quarterly reports to CBK on the level of compliance to the FX Code within 14 days after the end of the period.

- Kenya’s Cabinet has approved the Privatization Bill 2023 as part of its efforts to enhance economic productivity. The bill aims to encourage private sector participation, improve infrastructure and public service delivery, reduce government spending, and generate revenue through compensation for privatizations. It also seeks to improve regulation, broaden ownership of state-owned entities and enhance efficiency and responsiveness to stakeholders. The Privatization Bill 2023 is part of a wider reform process targeting public enterprises and aims to revitalize Kenya’s capital markets by reviewing the framework for state divestiture in non-strategic sectors.

- Kenya’s balance of payment and current account deficit for the 12 months ending January 2023, as per the provisional data, indicates an improvement in the current account deficit from 5.6% in a similar period in 2022 to 4.9% of GDP. The narrower deficit is indicative of sluggish growth of imports, boosted by strong exports of goods and services as well as resilient remittance inflows.

- Diageo Kenya Limited has successfully completed its tender offer to acquire up to 118,394,897 ordinary shares of East African Breweries PLC (EABL), representing a maximum of 14.97% of the issued share capital of EABL. The offer was made to all other shareholders of EABL on a willing buyer, willing seller basis at a price per Ordinary Share of KES 192.00. Diageo Kenya received valid tenders from 1,697 shareholders, totaling 143,515,078 Ordinary Shares. Following the completion of the tender offer, Diageo Kenya now holds 514,003,331 Ordinary Shares representing 65.0% of the issued ordinary shares of EABL.

- UK’s year on year inflation rate unexpectedly rose to 10.4% in February 2023, from 10.1% in January 2023, surpassing the forecast of 9.9%. The primary reason for this was the rise in the cost of food and non-alcoholic beverages, particularly vegetables, as a result of shortages caused by adverse weather in Southern Europe and Africa. Higher electricity prices also contributed to the increase. Moreover, the Consumer Price Index (CPI) surged 1.1% compared to January, representing the highest increase in four months.

- The Bank of England raised its interest rate by 0.25% to 4.25% during the March 2023 meeting to combat rising inflation which edged higher to 10.4% in February. While inflation is expected to fall sharply over the rest of the year, policymakers warned that further tightening may be necessary if there are persistent pressures. Despite recent banking crises, the UK banking system remains robust and resilient, with strong capital and liquidity positions. Policymakers will closely monitor the impact of households’ and businesses’ credit conditions and its effects on the macroeconomic and inflation outlook.

- The S&P Global/CIPS UK Composite PMI fell slightly to 52.2 in March 2023 from 53.1 in the previous month, but still pointed to sustained growth in the private sector, with the service economy performing strongly while manufacturing struggled with subdued order books. Input price inflation fell to a two-year low due to lower commodity prices and falling freight rates, and confidence rose to the highest level in a year.

- The S&P Global US Composite PMI jumped to 53.3 in March 2023 from 50.1 in the previous month, driven by growth in both the services and manufacturing sectors, with the greatest improvement in delivery times on record. New orders increased, leading to a rise in backlogs of work and hiring activity, while input inflation softened but remained elevated. Business confidence was affected by uncertainty in financial markets.

- The US Federal Reserve raised the target range for the federal funds rate by 0.25% to 5% to support its goals of maximum employment and inflation at a target 2% rate in the long run. While recent indicators suggest modest growth in spending and production, inflation remains elevated and the Committee is attentive to inflation risks. Tighter credit conditions for households and businesses are expected to impact economic activity, hiring, and inflation, and additional policy firming may be appropriate to tame inflation. The Committee is committed to this objective and will closely monitor incoming information to assess the implications of monetary policy direction.

Get future reports

Please provide your details below to get future reports: