Foreign Exchange Reserves

The usable foreign exchange reserves decreased by 5.37% to USD 8,652 million (4.4 months of import cover). This remains above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover but falls below the EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar, but depreciated against the Sterling Pound and the Euro to exchange at KES 129.26, KES 159.21 and KES 134.39 respectively. The observed appreciation against the Dollar is attributed to increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -0.03% | -0.24% |

| Sterling Pound | -1.84% | 0.56% |

| Euro | -0.24% | 0.79% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 11.31% to 11.30%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 11.31% | 11.30% |

| Interbank volume (billion) | 29.92 | 23.14 |

| Commercial banks’ excess reserves (billion) | 15.10 | 21.60 |

Fixed Income

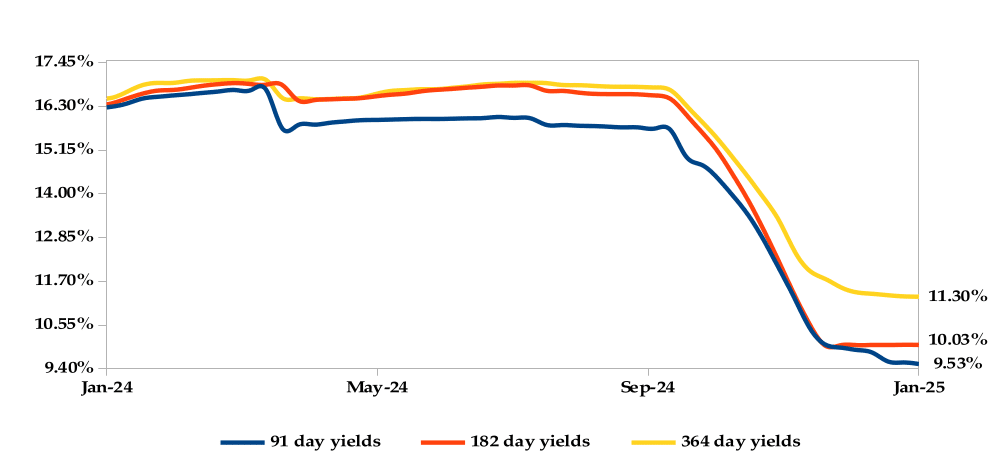

T-Bills

T-Bills were over-subscribed during the week, with the overall subscription rate increasing to 136.73% from 78.59% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 419.77%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 38.22% and 122.03% respectively. The acceptance rate increased by 4.06% to close the week at 99.98%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 4.97% from KES 47.01 billion in the previous week to KES 49.34 billion. Total bond deals increased by 27.27% from 616 in the previous week to 784.

In the primary bond market, CBK re-opened IFB1/2022/14 and IFB1/2023/17 infrastructure bonds in an effort to raise KES 70 billion. The coupon rates are 13.94% and 14.40% while their tenors are 11.8 years and 15.1 years respectively. The sale runs from 23/01/2025 to 12/02/2025.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.16% compared to the previous week, but decreased by 0.10% month-to-date and year-to-date. The yield on the 10- year Eurobond for Angola increased while that of Ivory Coast decreased.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -0.06% | -0.06% | 0.21% |

| 2018 30-Year Issue | -0.05% | -0.05% | 0.13% |

| 2019 7-Year Issue | -0.15% | -0.15% | 0.12% |

| 2019 12-Year Issue | -0.10% | -0.10% | 0.18% |

| 2021 13-Year Issue | -0.10% | -0.10% | 0.16% |

| 2024 6-Year Issue | -0.13% | -0.13% | 0.16% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 1.29%, 1.82%, 2.86% and 3.05% higher respectively compared to the previous week, bringing the year-to-date performance to 5.70%, 6.18%, 3.23% and 3.32% respectively. Market capitalization also gained 1.30% from the previous week to close at KES 2.08 trillion, recording a year-to-date increase of 5.70%. The performance was driven by gains recorded by large-cap stocks such as EABL, KCB and ABSA of 7.21%, 6.64% and 4.37% respectively.

The Banking sector had shares worth KES 1B transacted which accounted for 47.00% of the week’s traded value. Manufacturing & Allied sector had shares worth KES 176.8M transacted which represented 7.00% and Safaricom, with shares worth KES 878M transacted, represented 36.00% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Trans- Century | 132.50% | 86.00% |

| E.A Cables | 50.00% | 41.96% |

| Flame Tree Group | 31.25% | 31.25% |

| Uchumi | 50.00% | 26.32% |

| Sanlam | 42.22% | 15.41% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Kenya Airways | 39.95% | -36.94% |

| EA Portland Cement | -14.29% | -10.75% |

| HF Group | 76.52% | -9.58% |

| KPLC | 22.78% | -8.88% |

| Car & General | -12.00% | -8.71% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 0.00 | 3.58 | 309.17% |

| Derivatives Contracts | 10.00 | 9.00 | -10.00% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 0.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 3.97% | 1.74% |

| Dow Jones Industrial Average (DJI) | 4.79% | 2.15% |

| FTSE 100 (FTSE) | 2.93% | -0.03% |

| STOXX Europe 600 | 3.80% | 1.23% |

| Shanghai Composite (SSEC) | -0.30% | 0.33% |

| MSCI Emerging Markets Index | 1.25% | 1.86% |

| MSCI World Index | 4.02% | 2.09% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 4.35% | 1.42% |

| JSE All Share | -0.21% | -0.78% |

| NSE All Share (NGSE) | 0.41% | 1.22% |

| DSEI (Tanzania) | 4.63% | 2.90% |

| ALSIUG (Uganda) | 7.38% | 1.15% |

Global and Continental Markets

The US stock market closed the week on an upward trajectory, as gains in the technology, consumer services and industrials sectors led shares higher.

European stock markets closed the week in the green zone, buoyed by gains in the healthcare and luxury sectors. The uptick was however tempered by lingering uncertainties over U.S. President Donald Trump’s proposed tariff measures following his inauguration.

Asian stock markets closed the week higher, with technology shares in the lead after OpenAI announced a massive partnership to build more artificial intelligence infrastructure in the US.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 3.53% and 2.83% lower at $74.66 and $78.50 respectively. Gold futures prices settled 1.10% higher at $2,778.90.

Week’s Highlights

- The Treasury proposed taking over the Central Bank of Kenya’s (CBK) responsibility for selling government bonds and treasury bills as part of reforms aimed at streamlining debt management and separating fiscal and monetary roles. Upon approval, the Public Debt Management Office (PDMO) would take charge of government securities, including setting the borrowing schedule and determining debt pricing. Although this initiative aligns with the Treasury’s goal of reducing interest rates on government securities to below the current 11%, it is expected to face opposition from the CBK.

- Safaricom announced the official launch of its new money market fund (MMF), Ziidi, which raised KES 2.85 billion during its pilot phase since December 2024. Developed in partnership with Standard Investment Bank (SIB) and ALA Capital, Ziidi enables M-Pesa users to invest as little as KES 100, offering daily interest and seamless, free transactions between Ziidi accounts and M-Pesa wallets. With over 450,000 users already on board, the fund aims to enhance financial inclusion for Kenyans. Ziidi follows Safaricom’s earlier attempt with the Mali MMF, piloted in 2019 in collaboration with Genghis Capital. Mali raised KES 2.3 billion by March 2024 but faced delays transitioning beyond the pilot phase due to management disputes. It currently operates as a closed fund, no longer accepting new investors.

- The Cabinet approved a significant reform plan to enhance operational efficiency and reduce the government’s wage bill. The reforms include merging 42 state corporations with overlapping or related mandates into 20 entities to eliminate redundancy. Additionally, nine state corporations will be dissolved, with their functions transferred to relevant ministries or other state entities. Sixteen corporations with outdated functions that can be provided by the private sector will also be dissolved or divested. Furthermore, six state corporations will undergo restructuring to better align their mandates and enhance performance.

- 5 Actuarial Services E.A. Limited 1113 Kayahwe Rd, Off Galana Rd, Kilimani, P. O. Box 10472 – 00100 NAIROBI, KENYA Tel. +254 202 710 028 / Cell: +254 111 037 100 / +254 708 710 028 / +254 785 710 028 Office Email: info@actserv-africa.com Website: www.actserv.co.ke Additionally, the reform plan states that all professional organizations currently classified as state corporations will be reclassified and will cease to receive government budgetary allocations. This decision comes amid growing fiscal pressures and recommendations from the International Monetary Fund (IMF) and the World Bank for Kenya to reform inefficient state-owned enterprises. As of 31st March 2024, many state corporations had accumulated pending bills amounting to KES 94.40 billion, highlighting the need for these reforms.

- The S&P Global UK Composite PMI dropped to 50.4 in December 2024 from 50.5 in November, falling short of the preliminary estimate of 50.5. This marked the fourth straight month of slower growth. New orders saw a slight decline, ending a year-long streak of expansion, as weak demand and rising costs impacted business activity. Private sector employment saw its steepest decline since January 2021, driven by reduced demand and higher payroll costs. At the same time, cost pressures hit their highest level since April, prompting companies to significantly increase prices to cope with rising expenses.

- The People’s Bank of China (PBoC) kept the one-year loan prime rate (LPR) at 3.10% and the five-year LPR at 3.60% in January, marking the third consecutive month of unchanged rates, in line with market expectations. These rates, which are at record lows following reductions in October and July 2024, serve as benchmarks for most corporate loans and property mortgages. The decision was influenced by renewed pressure on the Yuan, which constrained the central bank’s ability to ease monetary policy further, as well as growing concerns over potential US policy changes under the incoming Trump administration.

- The HCOB Eurozone Composite PMI increased slightly to 49.6 in December, up from 48.3 in November and a preliminary reading of 49.5, but it remained in contraction territory. The modest growth in the services sector was overshadowed by a sharp decline in manufacturing activity. Activity in Germany, France and Italy continued to shrink, while Spain and Ireland stood out, with Spain recording its strongest private-sector growth since March 2023. New orders fell for the seventh month in a row, reflecting weak domestic and export demand. Employment saw its steepest decline in four years, driven by job losses in manufacturing. Input costs rose at their fastest pace since July, particularly in services, pushing inflation higher overall.

Get future reports

Please provide your details below to get future reports: