Foreign Exchange Reserves

The usable foreign exchange reserves increased by 1.20% to USD 7,404 million (3.80 months of import cover). This was below the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover and EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar, but depreciated against the Sterling Pound and the Euro to exchange at KES 129.05, KES 169.20 and KES 143.61 respectively. The observed appreciation against the Dollar is attributed to increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.80% | -0.07% |

| Sterling Pound | -15.34% | 1.73% |

| Euro | -17.30% | 1.24% |

Liquidity

Liquidity in the money markets tightened, with the average inter-bank rate increasing from 12.87% to 12.92%, as tax remittances more than offset government payments. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.87% | 12.92% |

| Interbank volume (billion) | 25.92 | 14.60 |

| Commercial banks’ excess reserves (billion) | 10.80 | 26.70 |

Fixed Income

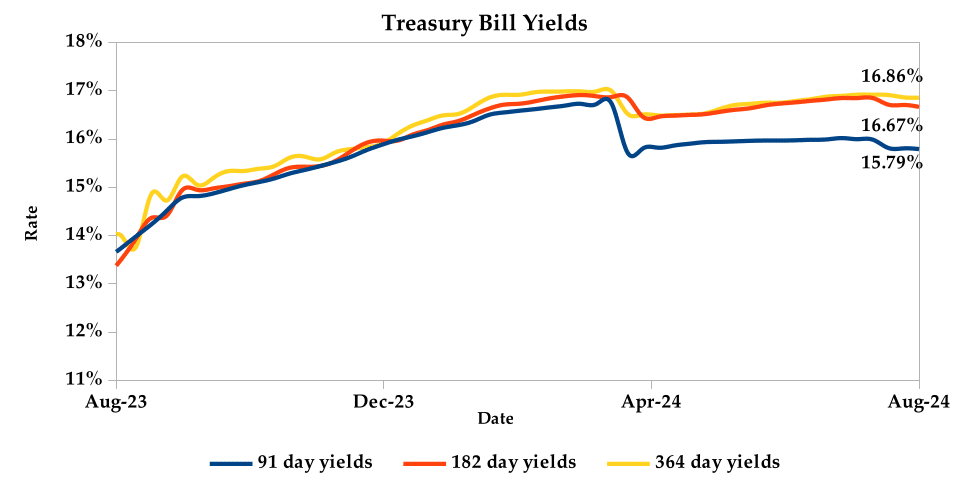

T-Bills

T-Bills were under-subscribed during the week, with the overall subscription rate decreasing to 79.87%, down from 107.25% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 197.79%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 57.60% and 54.98% respectively. The acceptance rate decreased by 10.27% to close the week at 89.30%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 553.14%, from KES 6.93 billion in the previous week to KES 45.29 billion. Total bond deals increased by 176.83% from 315 in the previous week to 872.

In the primary bond market, CBK re-opened IFB1/2023/017 through tap sale, which sought to raise KES 15.0 billion. The sale runs from 20/08/2024 to 29/08/2024 and the coupon rate is 14.40%.

Eurobonds

In the international market, yields on Kenya’s Eurobonds decreased by an average of 0.30% compared to the previous week, by 0.33% month-to-date and increased by 0.50% year-to-date. The yield on the 10- year Eurobond for Angola declined while for Zambia increased . Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | 0.40% | -0.27% | -0.40% |

| 2018 30-Year Issue | 0.61% | -0.20% | -0.17% |

| 2019 7-Year Issue | -0.13% | -0.40% | -0.39% |

| 2019 12-Year Issue | 0.62% | -0.39% | -0.31% |

| 2021 13-Year Issue | 0.94% | -0.35% | -0.23% |

| 2024 6-Year Issue | 0.53% | -0.34% | -0.32% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 2.40%, 3.38%, 3.10% and 1.33% higher compared to the previous week, bringing the year-to-date performance to 14.09%, 12.62%, 18.35% and 18.16% respectively. Market capitalization also gained 2.26% from the previous week to close at KES 1.64 trillion, recording a year-to-date increase of 13.93%. The performance was driven by gains recorded by large-cap stocks such as Standard Chartered, NCBA, KCB and Stanbic of 10.42%, 7.69%, 7.04% and 5.57% respectively. This was however weighed down by the loss recorded by EABL of 5.13%.

The Banking sector had shares worth KES 616M transacted which accounted for 51.00% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 98M transacted which represented 8.00% and Safaricom, with shares worth KES 436M transacted, represented 36.00% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| I&M Holdings | 59.31% | 34.95% |

| Transcentury | -28.85% | 15.63% |

| Longhorn | 2.90% | 14.81% |

| StanChart | 30.58% | 10.42% |

| KPLC | 51.43% | 10.42% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Williamson Tea | -8.77% | -11.02% |

| BOC Kenya | 2.74% | -9.89% |

| Flame Tree | -8.77% | -8.77% |

| BK Group | -7.61% | -7.61% |

| Jubilee | -17.30% | -6.71% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 2.77 | 1.99 | -28.33% |

| Derivatives Contracts | 5.00 | 11.00 | 120.00% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 18.80% | 1.45% |

| Dow Jones Industrial Average (DJI) | 9.17% | 1.27% |

| FTSE 100 (FTSE) | 7.85% | 0.20% |

| STOXX Europe 600 | 8.28% | 1.31% |

| Shanghai Composite (SSEC) | -3.64% | -0.87% |

| MSCI Emerging Markets Index | 7.42% | 0.64% |

| MSCI World Index | 15.16% | 1.82% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 384.63% | 0.94% |

| JSE All Share | 11.01% | 1.67% |

| NSE All Share (NGSE) | 26.30% | -1.16% |

| DSEI (Tanzania) | 17.94% | -0.02% |

| ALSIUG (Uganda) | 18.03% | 0.74% |

Global and Continental Markets

The US stock market closed the week on a positive note as the Federal Reserve Chair, Jerome Powell, signaled the possibility of imminent interest rate cuts. His comments at the Jackson Hole symposium boosted market confidence, leading to gains across major indices.

European stocks closed the week on an upward trajectory, as investors welcomed Fed Chair’s suggestion of possible interest rate cuts. This positive outlook aligned with the overall market optimism.

Asian stock markets closed the week in the red zone, as investors grappled with concerns about China’s economic outlook and ongoing geopolitical tensions.

Week’s Highlights

- The S&P Global Ratings downgraded Kenya’s credit rating to ‘B-‘ from ‘B’, citing the withdrawal of the controversial Finance Bill 2024 following deadly protests. This decision may interfere with the country’s fiscal consolidation efforts. The downgrade follows similar actions by Moody’s and Fitch, who also cited the withdrawal of the Finance Bill as a key factor. S&P projects debt-servicing costs to surpass 30% of government revenue between 2024 and 2027, placing Kenya among the highest-rated sovereigns in terms of debt burden. Despite easing immediate external liquidity risks, Kenya’s structurally high external debt and significant financing needs remain a concern. The abandoned tax hikes proposed in the Finance Bill 2024 were previously supported by the IMF as part of efforts to restructure Kenya’s debt obligations.

- The NCBA Group’s half-year profit rose 5% to KES 9.8 billion, driven by a 5.9% increase in the loan book and a 2.4% growth in customer deposits. Operating income grew 1.1%, but operating expenses rose faster, leading to a slight margin compression.The lender’s total assets increased by 4.3% and loan loss provisions declined by 38.3% due to a 4% decrease in gross non-performing loans. NCBA Group continued to promote financial inclusion, disbursing KES 478 billion in Digital Loans, a 4% year-on-year increase.

- The Central Bank of Kenya (CBK) will discontinue paying commissions to licensed securities dealers, stock brokers and custodian banks starting September. This decision comes just a year after the launch of the DhowCSD platform, an electronic system designed to streamline the bidding process. While the DhowCSD platform has modernized the securities trading process, the halt in commissions will negatively impact the revenues of stock brokers and custodian banks. The CBK has been paying agents a 0.15% commission of the value of securities sold on their behalf, net of a 5% withholding tax. The DhowCSD platform was introduced on 31st July 2023, replacing the previous manual system that required physical placement and payment of bids at the CBK. As stated in a recent prospectus for the 17-year infrastructure bond tap sale, “Licensed placing agents will not be paid commission from 2nd September, 2024.”

- 5 The People’s Bank of China (PBOC) held its key lending rates steady at the August fixing, aligning with market expectations. The one-year loan prime rate (LPR), the benchmark for most corporate and household loans, remained at 3.45%. The five-year rate, a reference for property mortgages, was also unchanged at 3.85%. Both rates remain at record lows following surprise cuts in July. This decision reflected the PBOC’s balancing act, with Governor Pan Gongsheng recently stating that authorities would avoid “drastic” measures for the economy. He mentioned the central bank’s plans to accelerate the implementation of existing financial policies, explore new steps and support proactive fiscal measures. Bloomberg News reported that policymakers are likely to gradually shift their focus away from quantitative targets, such as credit and money supply expansion goals and place more emphasis on price-based tools like interest rates.

- The annual inflation rate in the Eurozone rose to 2.6% in July 2024 from 2.5% in June, matching the preliminary estimate and exceeding initial market forecasts of a slowdown to 2.4%. Energy costs surged and non-energy industrial goods inflation remained high. Food, alcohol and tobacco inflation eased slightly due to lower unprocessed food prices, though processed food inflation remained steady. The core inflation rate held steady at 2.9%, surpassing initial market expectations of 2.8%.

- The HCOB Eurozone Composite PMI rose to 51.2 in August 2024 from 50.2 in July, exceeding market expectations of 50.1 and marking the sixth consecutive month of expansion in the Eurozone’s private sector activity. Services growth reached a four-month high, offsetting the manufacturing sector’s two-year decline. New orders diverged, with services expanding softly and manufacturing declining sharply, leading to an overall decrease in new business for the third month. Employment growth eased slightly, ending a seven-month streak of expansion. Input costs rose sharply, but inflation slowed. Firms passed on costs to clients at a faster pace, increasing output charge inflation.

Get future reports

Please provide your details below to get future reports: