Foreign Exchange Reserves

The usable foreign exchange reserves decreased by 1.42% to USD 9,144 million (4.7 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5- months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar and the Euro, but appreciated against the Sterling Pound to exchange at KES 129.58, KES 136.49 and KES 163.91 respectively. The observed depreciation against the Dollar is attributed to a surge in demand for USD.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.46% | 0.18% |

| Sterling Pound | -17.98% | -0.02% |

| Euro | -21.40% | 0.10% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 12.00% to 11.87%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.00% | 11.87% |

| Interbank volume (billion) | 21.74 | 28.31 |

| Commercial banks’ excess reserves (billion) | 44.90 | 48.40 |

Fixed Income

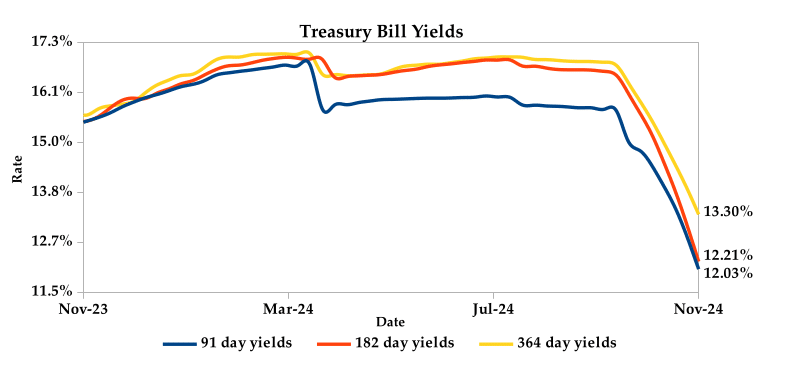

T-Bills

T-Bills remained over-subscribed during the week, with the overall subscription rate decreasing to 321.82% from 398.08% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 623.35%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 171.41% and 351.62% respectively. The acceptance rate increased by 33.39% to close the week at 60.04%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 35.97% from KES 23.42 billion in the previous week to KES 31.85 billion. Total bond deals increased by 34.47% from 557 in the previous week to 749.

In the primary bond market, CBK re-opened FXD1/2023/10 and FXD1/2018/20 treasury bonds in an effort to raise KES 25.0 billion. The coupon rates are 14.15% and 13.20% respectively. The sale runs from 21/11/2024 to 04/12/2024. Additionally, CBK re-issued FXD1/2024/10 bond with a coupon rate of 16.00%, targeting to raise KES 20 billion. The sale runs from 21/11/2024 to 11/12/2024.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.11% compared to the previous week, 0.14% month-to-date and declined by 0.41% year-to-date. The yield on the 10- year Eurobond for Angola also increased .

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -0.93% | 0.03% | 0.06% |

| 2018 30-Year Issue | -0.01% | 0.05% | 0.03% |

| 2019 7-Year Issue | -1.82% | 0.15% | 0.21% |

| 2019 12-Year Issue | 0.06% | 0.13% | 0.12% |

| 2021 13-Year Issue | 0.35% | 0.17% | 0.13% |

| 2024 6-Year Issue | -0.08% | 0.31% | 0.13% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 1.97%, 2.02%, 2.41% and 2.95% lower compared to the previous week, bringing the year-to-date performance to 25.58%, 25.34%, 30.62% and 31.86% respectively. Market capitalization also lost 1.97% from the previous week to close at KES 1.76 trillion, recording a year-to-date increase of 22.82%. The performance was driven by losses recorded by large-cap stocks such as Equity, Stanbic and Co-op Bank of 7.92%, 5.89% and 3.10% respectively. This was however mitigated by the gain recorded by Standard Chartered of 2.11%.

The Banking sector had shares worth KES 585M transacted which accounted for 45.00% of the week’s traded value. Energy & Petroleum sector had shares worth KES 64M transacted which represented 4.90% and Safaricom, with shares worth KES 549.5M transacted, represented 42.66% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Eaagads | 3.52% | 9.96% |

| Eveready | -1.69% | 8.41% |

| Olympia | -8.56% | 6.41% |

| I&M | 71.06% | 6.04% |

| Crown Paints | -8.98% | 4.68% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Sanlam | -16.67% | -16.67% |

| E.A Portland | 357.50% | -14.39% |

| Liberty | 83.42% | -10.38% |

| Nation Media | 36.76% | -9.47% |

| E.A Cables | 2.04% | -9.09% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 2.7 | 30.88 | -67.68% |

| Derivatives Contracts | 10.00 | 5.00 | -50.00% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 0.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 25.86% | 1.68% |

| Dow Jones Industrial Average (DJI) | 17.45% | 1.96% |

| FTSE 100 (FTSE) | 7.00% | 2.46% |

| STOXX Europe 600 | 6.26% | 1.06% |

| Shanghai Composite (SSEC) | 10.29% | -1.91% |

| MSCI Emerging Markets Index | 6.11% | 0.21% |

| MSCI World Index | 18.83% | 1.49% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 2.43% | -1.41% |

| JSE All Share | 11.27% | 1.82% |

| NSE All Share (NGSE) | 28.74% | 0.11% |

| DSEI (Tanzania) | 24.01% | -0.65% |

| ALSIUG (Uganda) | 33.86% | -2.22% |

Global and Continental Markets

The US stock market rallied during the week, driven by gains in consumer goods, financials and industrials sectors. Key contributors included Boeing, Nike and American Express.

European stock markets posted gains over the week, despite a challenging backdrop of weak business activity and heightened geopolitical risks stemming from the Russia-Ukraine conflict. The surge in real estate stocks helped to lift market sentiment.

Asian stock markets closed lower this week, despite Nvidia’s strong quarterly earnings. While the tech giant exceeded expectations, its cautious outlook for the current quarter, fueled by slowing AI demand, dampened investor sentiment. Additionally, heightened geopolitical tensions between Russia and Ukraine further limited risk appetite.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 5.60% and 5.81% higher at $70.77 and $75.17 respectively. Gold futures prices settled 5.53% higher at $2,712.20.

Week’s Highlights

- The Central Bank of Kenya (CBK) has announced changes to some denominations of the Kenyan currency banknotes. The changes affect the KES 50, KES 100, KES 200, KES 500 and KES 1,000 currency banknotes.

- KCB Group reported a 49% increase in net profit to KES 45.8 billion for the nine months ended September 2024. This was driven by a 21.9% rise in operating income to KES 142.95 billion, fueled by significant growth in both funded and non-funded income.

- Stanbic Bank reported a 9% year-on-year increase in profit after tax to KES 10.1 billion for the nine months ended 30th September 2024. The growth was driven by a 12% increase in the loan book and higher asset yields, leading to a 5% rise in net interest income. While non- interest income declined due to fewer non-recurring transactions and lower trading margins, overall profitability was boosted by the bank’s strong performance in lending.

- Actuarial Services E.A. Limited 1113 Kayahwe Rd, Off Galana Rd, Kilimani, P. O. Box 10472 – 00100 NAIROBI, KENYA Tel. +254 202 710 028 / Cell: +254 111 037 100 / +254 708 710 028 / +254 785 710 028 Office Email: info@actserv-africa.com Website: www.actserv.co.ke 5 Absa Bank Kenya reported a 16% increase in revenue to KES 46.8 billion for the nine months ended September 2024. This led to a 20% improvement in profitability, with net profit reaching KES 14.7 billion. The bank’s focus on providing access to finance drove a 18% growth in funded income, while non-funded income increased 13% due to diversified revenue sources and strong performance from new business streams.

- President William Ruto has directed the immediate cancellation of procurement processes for the JKIA expansion and Ketraco transmission lines, citing concerns over the involvement of the Adani Group. The Indian conglomerate, whose founder Gautam Adani was recently indicted in the US, was set to invest $1.85 billion in the JKIA PPP agreement and $736 million in the Ketraco PPP agreement.

- The People’s Bank of China (PBoC) held its key lending rates steady in November, keeping borrowing costs at record lows. The one-year and five-year Loan Prime Rates (LPRs) were maintained at 3.1% and 3.6%, respectively. While the central bank has implemented stimulus measures to revive economic growth, it is closely monitoring their impact and may consider further easing, potentially through a reserve requirement ratio cut.

- UK’s annual inflation rate surged to a six-month high of 2.3% in October 2024 compared to 1.7% in September, driven by higher energy and housing costs. The rise exceeded both the Bank of England’s target and market expectations. While food inflation remained steady, services inflation accelerated, contributing to the overall uptick. Core inflation also edged up to 3.3% from 3.2%.

- The S&P Global US Composite PMI surged to a 21-month high of 55.3 in November from 54.1 in October, signaling robust expansion across the US private sector. While the service sector boomed, manufacturing continued to contract. Strong growth was driven by increased demand, leading to a sharp rise in new orders. However, employment remained under pressure and inflationary pressures eased. Firms’ optimism for the future reached a 21-month high, fueled by hopes of lower interest rates and improved economic conditions.

Get future reports

Please provide your details below to get future reports: