Foreign Exchange reserves

The CBK’s usable foreign exchange reserves remained adequate at USD 8.489 billion(5.11 months of import cover). This meets CBK’s statutory requirement to endeavour to maintain at least 4.0 months of import cover, and the EAC region’s convergence criteria of 4.5 months of import cover.

Currency

The Kenyan Shilling depreciated against major currencies over the week, exchanging against the USD at Kshs 106.97 up from Kshs 106.81 recorded last week. Additionally, it shed off 36 basis points against the Sterling Pound to trade at Kshs 130.80.

Liquidity

The money market remained liquid during the week, underpinned by government payments. The weekly mean of the daily weighted average inter-bank rate settled at 4.20% compared to 4.17% in the previous week. The value transacted declined by 11.2% to stand at Kshs 11.48 billion. Commercial banks’ excess reserves rose to Kshs 38.90 billion up from Kshs 36.50 billion.

Fixed Income

T-Bills

T-bills remained oversubscribed at a rate of 149.27%. The over-subscription is due to high liquidity in the money market and investors’ preference for short-term papers. The subscription rate for the 91-day, 182-day, and 364-day papers increased to 270.95%, 104.90%, and 144.96%, respectively. The yields on the 91-day, 182-day, and 364-day papers all increased marginally by less than 100 basis points to close at 7.32%, 8.23%, and 9.20%, respectively.

T-Bonds

The bonds market registered reduced activity from the previous week with the bonds turnover declining by 10.34% to Kshs 10.73 billion. The total bond deals decreased from 464 to 416. Results of the reopened 5-year T-Bond, issue number FXD1/2020/5, indicate that the bond was under-subscribed at 68.60% as the total bids received amounted to Kshs 20.58 billion against theamount offered of Kshs 30.00 billion. The market weighted average rate of accepted bids came in at 11.74% with the coupon rate standing at 11.67%. The government only accepted Kshs 8.95 billion out of the Kshs 20.58 billion worth of bids received. In the international market, yields on Kenya’s Eurobonds decreased by an average of 151.6 basis points. Similarly, the yields on the 10-year Eurobonds for Angola and Ghana declined.

Equities

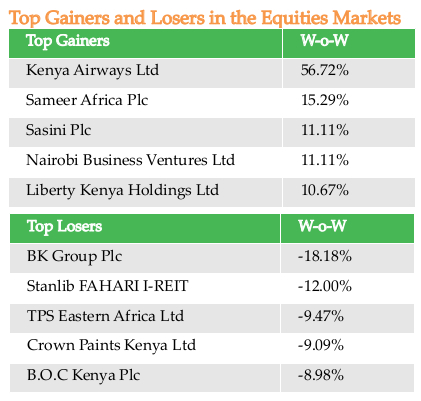

The Equity Market closed the week with 80.9 million shares valued at Kshs 2.4 billion against 145 million shares valued at Kshs 4.9 billion transacted the previous week. The market capitalization edged up by 3.75% to come in at Kshs 2.15 trillion. NASI, NSE 20 and NSE 25 appreciated by 3.74%, 2.00% and 3.13% respectively. The performance of the NASI was driven by gains recorded by large-cap stocks, with Equity, Safaricom and KCB gaining by 7.3%, 6.1% and 1.8%, respectively. The Banking sector had shares worth Kshs 1.3 billion transacted which accounted for 54.95% of the week’s traded value, Manufacturing & Allied sector represented 12.79% and Safaricom with shares worth Kshs 732 million transacted represented 30.36%.

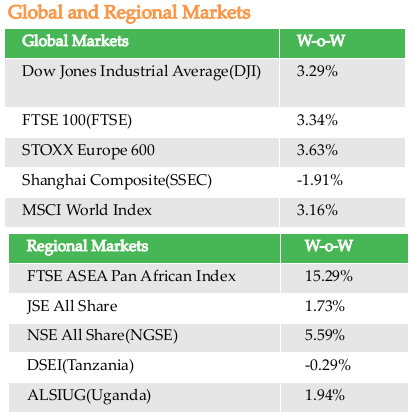

Global stocks rose for the week, with the MSCI World Index soaring by 3.16%. The performance in global equity markets was fostered by hopes of a vaccine in curbing COVID-19. In the USA, DJI and S&P 500 gained 11.11% 3.29% and 3.20% respectively. The pan-European STOXX Europe 600 Index rose 3.63%. Among major European country stock indexes, Germany’s Xetra DAX Index climbed 6.10%, France’s CAC 40 gained 4.34%, and Italy’s FTSE MIB Index added 2.79%. The UK’s FTSE 100 Index advanced 3.45%. However, China’s Crown Paints Kenya Ltd -9.09% SSEC dipped by 1.91%. with the US – China relations deteriorating.

On the regional front, Pan African FTSE ASEA continued to climb up from the previous week, edging higher by 15.29%. South Africa’s JALSH gained 1.73%, Nigeria’s NGSEINDEX grew 5.59%, Tanzania’s DSEI plummeted 0.28% and Uganda’s ALSIUG went up by 1.94%.

Oil futures prices continued to strengthen with the Crude Oil WTI and ICE Brent Crude gaining 12.98% and 8.09% respectively. The gold futures prices went down by a marginal 1.18%.

Alternative Investments

The Derivatives Market closed the week with a total of 16 contracts valued at Kshs 458,200. KCB contract expiring in 17th December 2020 moved 5 contracts valued at Kshs 180,000.The I-REIT market registered increased activity with a turnover of Kshs 3.23 million from 117 unit deals against a turnover of Kshs 915,420 from 56 unit deals in the previous week.The ETF market had 1 contract valued at Kshs 359,000.

Week’s Highlights

During the week, KCB Group, Co-operative Bank, DTBK, and below is a summary of their earnings:

- KCB Group – Profit before tax increased by 5.0% to Kshs 8.9 billion, up from 8.5 billion 10 in Q1’2019. Profit after tax grew by 8.4% to Kshs 6.3 billion in Q1’2020, from Kshs 5.8 billion in Q1’2019. The rise in profitability was driven by increase in interest income and non-funded income by 20.4% and 36.7% respectively to Kshs 20.2 billion and 30.5 billion. This was offset by 36.7% growth in operating expenses to Kshs 14.0 billion. The bank’s balance sheet expanded as total asset climbed up by 30.5% to Kshs 947.1 billion up from Kshs 725.7 billion in Q1’2019. This growth was largely driven by a 52.0% increase in investment in government and other securities to Kshs 202.6 billion, from Kshs 133.3 billion in Q1’2019. The loan book also recorded a 19.3% growth to Kshs 553.9 billion, from Kshs 464.3 billion in Q1’2019. The strong balance sheet growth is also partly attributable to KCB consolidating assets following the acquisition of NBK.

- Co-operative Bank – The bank registered a marginal 0.3% decline in profit after tax to Kshs 3.59 billion in Q1’2020 from Kshs 3.60 billion in Q1’2019. Profit before tax and exceptional items, on the other hand, grew by 3.7% to Kshs 3.7 billion from Kshs 3.6 billion in Q1’2019. The performance was driven by the 20.6% increase in total operating expenses, which grew faster than the 12.5% growth in total operating income in Q1’2020. Interest and non-funded income grew by 4.5% and 19.0% respectively to Kshs 10.5 billion and 5.0 billion. The Cost to Income Ratio (CIR) deteriorated to 58.1%, from 54.2% in Q1’2019, following the faster rise in total operating expenses that outpaced total operating profit. The balance sheet enlarged with the total asset rising by 10.5% to Kshs 470.4 billion from 425.7 billion in Q1’2019. This follows 11.5% growth in government securities to Kshs 115.9 billion in Q1’2020 from Kshs 103.9 billion, coupled with a 9.8% growth in net loans and advances to Kshs 276.2 billion in Q1’2020 from Kshs 251.6 billion in Q1’2019. Deposits placements also rose by 27.0% to Kshs 19.3 billion from Kshs 15.2billion.

- Diamond Trust Bank Kenya – Profit before tax rose by 0.5% to Kshs 3.0 billion, from Kshs 2.9 billion in Q1’2019. Profit after tax grew by 3.7% to Kshs 2.04 billion in Q1’2020, from Kshs 1.97 billion in Q1’2019. The performance was brought about by 2.4% growth in interest income to Kshs 8.0 billion and 3.4% growth in non-funded income to Kshs 1.6 billion, this outweighed 5.2% increase in operating expenses. The Cost to Income Ratio (CIR) deteriorated to 52.9 %, from 51.8% in Q1’2019. The balance sheet improved as total assets increased by 4.0% to Kshs 385.0 billion. This growth was largely driven by a 6.7% increase in net loans to Kshs 201.3 billion from Kshs 188.6 billion in Q1’2019, coupled with a 1.9% increase in government securities to Kshs 128.2 billion from Kshs 125.8 billion in Q1’2019. The growth in assets was however slowed down by a 21.9% decline in placements to Kshs 8.6 billion from Kshs 11.1 billion in Q1’2019.

- NCBA Group – Profit before tax declined by 26.5% to Kshs 2.4 billion from Kshs 3.3 billion in Q1’2019. Profit after tax declined by 26.8% to Kshs 1.6 billion in Q1’2020 from Kshs 2.2 billion in Q1’2019. The performance can be attributed to 23.6% rise in total operating income to Kshs 10.9 billion which was offset 49.8% increase in total operating expenses from Kshs 5.5 billion to Kshs 8.3 billion. Interest and non-funded income went up by 6.8% and 49.7% respectively to Kshs 10.2 billion and Kshs 5.4 billion. The cost to income ratio deteriorated to 76.1% from 62.8%. The balance sheet expanded as total assets rose by 9.2% to Kshs 509.6 billion from Kshs 466.8 billion in Q1’2019. This growth was largely driven by a 21.1% increase in government securities to Kshs 153.5 billion from the Kshs 126.8 billion recorded in Q1’2019. The loan book expanded by 3.9% to Kshs 245.9 billion in Q1’2020 from Kshs 240.6 billion in Q1’2019.