Foreign Exchange Reserves

The usable foreign exchange reserves increased by 18.67% to USD 8,321 million (4.30 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover but fell short of EAC region’s convergence criteria of 4.5- months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 128.55, KES 163.10 and KES 137.94 respectively. The observed appreciation against the Dollar is attributed to the increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -18.11% | -0.08% |

| Sterling Pound | -18.39% | -0.62% |

| Euro | -20.56% | -0.40% |

Liquidity

Liquidity in the money markets decreased, with the average inter-bank rate increasing from

13.04% to 13.07%, as tax remittances more than offset government payments. Open market

operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 13.04% | 13.07% |

| Interbank volume (billion) | 19.62 | 26.73 |

| Commercial banks’ excess reserves (billion) | 8.16 | 11.30 |

Fixed Income

T-Bills

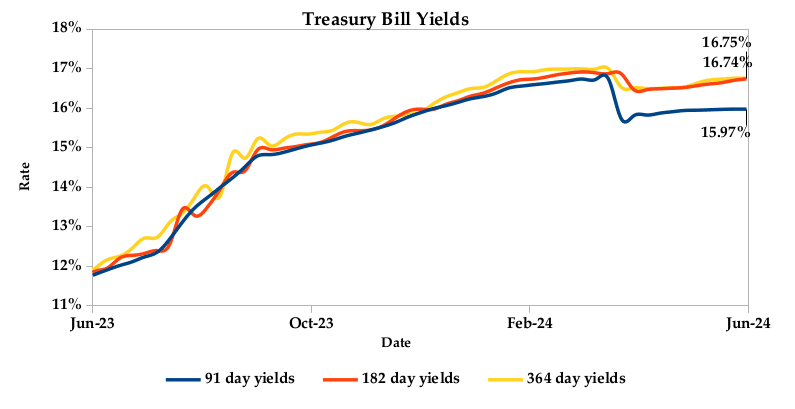

T-Bills remained under-subscribed during the week, with the overall subscription rate decreasing to 60.02% from 94.66% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 147.96%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 39.33% and 45.53% respectively. The acceptance rate decreased by 0.51% to close the week at 92.95%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 8.24%, from KES 20.86 billion in the previous week to KES 22.58 billion. Total bond deals decreased by 19.79% from 672 in the previous week to 539.

In the primary bond market, CBK released auction results for the re-opened FXD1/2023/002, FXD1/2024/003, FXD1/2023/005 and FXD1/2023/010 through a tap sale which sought to raise KES 20.0 billion. The issues received bids worth KES 25.13 billion, representing a subscription rate of 125.67%. Of these, KES 23.86 billion worth of bids were accepted at a weighted average rate of 17.12%, 17.59%, 18.16% and 16.39% respectively.

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.47% compared to the previous week, by 0.74% month-to-date and declined by 0.26% year-to-date. The yields on the 10-year Eurobonds for Angola and Zambia also increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | 0.05% | 0.85% | 0.62% |

| 2018 30-Year Issue | 0.49% | 0.70% | 0.35% |

| 2019 7-Year Issue | -0.71% | 0.58% | 0.33% |

| 2019 12-Year Issue | 0.55% | 0.84% | 0.54% |

| 2021 13-Year Issue | 0.88% | 0.70% | 0.44% |

| 2024 6-Year Issue | 0.32% | 0.79% | 0.55% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 0.80%, 0.81%, 0.79% and 0.90% lower, compared to the previous week, bringing the year-to-date performance to 22.59%, 14.68%, 22.52% and 25.87% respectively. Market capitalization also lost 0.81% from the previous week to close at KES 1.76 trillion, recording a year-to-date increase of 22.59%. The performance was driven by losses recorded by large-cap stocks such as KCB, Co-operative Bank, Stanbic and Standard Chartered of 3.67%, 2.99%, 2.99% and 2.02% respectively.

The Banking sector had shares worth KES 730M transacted which accounted for 60.0% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 77M transacted which represented 6.50% and Safaricom, with shares worth KES 275M transacted, represented 23.0% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Kapchorua Tea | 25.12% | 6.11% |

| Unga | -18.99% | 4.20% |

| I&M Holdings | 22.92% | 4.13% |

| Flame Tree | 2.63% | 3.54% |

| Carbacid | 19.33% | 2.29% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Trans-Century | -26.92% | -22.45% |

| Longhorn | -12.86% | -14.63% |

| Car General | -20.00% | -12.47% |

| EA Portland | -28.25% | -10.87% |

| NBV | -10.98% | -8.37% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 3.01 | 9.86 | 227.57% |

| Derivatives Contracts | 13.00 | 9.00 | -30.77% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 15.22% | 0.61% |

| Dow Jones Industrial Average (DJI) | 3.81% | 1.45% |

| FTSE 100 (FTSE) | 6.69% | 1.12% |

| STOXX Europe 600 | 7.65% | 0.79% |

| Shanghai Composite (SSEC) | 1.21% | -1.14% |

| MSCI Emerging Markets Index | 6.08% | 0.93% |

| MSCI World Index | 10.68% | 0.45% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 299.71% | 3.94% |

| JSE All Share | 5.08% | 3.32% |

| NSE All Share (NGSE) | 31.26% | -0.18% |

| DSEI (Tanzania) | 14.94% | -0.28% |

| ALSIUG (Uganda) | 20.99% | -0.60% |

Global and Continental Markets

The U.S. stock market closed the week on a positive note, as investors digested higher-than- expected S&P Global PMIs for the U.S. This data revealed faster private sector business activity amid easing price pressures.

European markets closed the week on an upward trajectory, buoyed by investor expectations of future interest rate cuts by the Bank of England. The central bank opted to hold the bank rate steady at 5.25%, as anticipated. However, the fact that two members voted to lower rates fueled market optimism for a potential decrease in the coming months.

Asian stock Market closed the week in the red zone, weighed down by concerns about China’s uneven economic recovery and the lack of strong policy support from the People’s Bank of China (PBOC). The PBOC held key interest rates steady, despite market expectations for further easing.

Week’s Highlights

- The National Assembly passed the Finance Bill 2024 during its Second Reading on June 20, 2024, despite the ongoing protests. The bill now moves to the Committee of the Whole House next Tuesday, June 25th, for detailed scrutiny. This committee, comprised of all MPs, will examine the bill clause-by-clause, offering opportunities for amendments and votes on proposed changes. Notably, the Parliament’s Committee on Finance, responding to public concerns, tabled amendments on June 18th. These amendments proposed easing the bill’s impact by potentially removing VAT on bread, scrapping motor vehicle tax and exempting small businesses with a turnover below KES 1 million from e-TIMS registration. However, the Treasury warns of a significant budget shortfall if MPs do not endorse the revenue- raising measures currently contained in the Finance Bill 2024.

- The Treasury, has presented a plan to raise the minimum core capital requirement for banks to KES 10 billion from the current KES 1 billion. The proposal, which aims to create a more robust banking sector, would require banks to hold significantly more capital. This increase, according to the Treasury, would allow banks to better finance large-scale projects while also strengthening their overall resilience.

- Africa Mega Agriculture Center (AMAC), a company offering equipment leasing, processing, storage and farm support services, has proposed acquiring a controlling stake of 84.42% in Kenya Orchards Limited (KOL). KOL is a publicly traded company on the Nairobi Securities Exchange (NSE) known for its bottled and canned fruit and vegetable products. The deal, which includes 10,863,537 shares, would be conducted privately with KOL’s existing major shareholders. Notably, AMAC emphasizes it has no intention of delisting KOL from the Nairobi Securities Exchange (NSE), ensuring continued investor access. This move aims at revitalising KOL. As a strategic investor, AMAC seeks to diversify KOL’s operations, leveraging its established brand recognition while addressing its recent financial decline.

- The Bank of England (BoE) kept interest rates unchanged at 5.25% in its June meeting, as most anticipated. However, the decision hinted at a possible shift, with some policymakers favoring a cut. This comes as inflation dips back to the 2% target, fueled by lower energy prices compared to last year. While GDP growth surpassed forecasts, underlying surveys hint at a potential slowdown. The Monetary Policy Committee (MPC) emphasized its commitment to a restrictive monetary policy until inflation risks are demonstrably under control. It remains cautious of lingering inflationary pressures and will adjust policy as needed based on future economic data and forecasts.

- The People’s Bank of China (PBoC) kept key interest rates unchanged at their June fixing, as anticipated by markets. The one-year Loan Prime Rate (LPR), a crucial benchmark for loans, remained at 3.45%. The five-year LPR, used for mortgages, also held steady at 3.95% after a record cut in February. These rates are at historic lows, reflecting China’s fragile economic recovery and fueling calls for additional stimulus from Beijing. Notably, the PBoC maintained a medium-term lending rate of 2.5% for the 10th month in a row while draining a net CNY 55 billion from the banking system to avoid excessive liquidity.

- Euro Area inflation rose to 2.6% in May 2024 from 2.4% in April, aligning with preliminary estimates. This was primarily driven by a rebound in energy prices of 0.3% from -0.6% and a faster rise in service sector costs of 4.1% from 3.7%. However, price growth slowed for food, alcohol and tobacco by 2.6%, and non-energy industrial goods to by 0.7%. Notably, the services sector had the strongest upward influence on overall inflation. Among major economies, inflation accelerated in Germany, France and Spain by 2.8%, 2.6% and 3.8% respectively, while Italy saw a slight decrease of 0.8%. The core inflation rate, excluding volatile items like food and energy, also increased to 2.9% from 2.7%.

- 5 The S&P Global US Composite PMI surged to 54.6 in June, marking its highest level since April 2022. This positive data suggests a robust US economy, with both the service sector and manufacturing contributing to growth with PMIs of 55.1 and 51.7 respectively. On the flip side, the HCOB Eurozone composite PMI fell to 50.8 in June, below market expectations of 52.5 but still indicating a fourth consecutive month of private sector expansion. This modest growth relied solely on the services sector, which remained steady at 52.6. Manufacturing activity contracted further to 45.6, hitting a six-month low. New orders declined for the first time in four months, primarily due to weak export demand.

Get future reports

Please provide your details below to get future reports: