Foreign Exchange Reserves

The usable foreign exchange reserves stood at USD 7,885 million (4.31 months of import cover). The notable surge was driven by the disbursement of USD 415.4 million under the IMF’s Extended Fund Facility and the Extended Credit Facility (EFF/ECF) arrangements. This meets CBK’s statutory requirement to endeavour to maintain at least 4.0 months of import cover but still falls short of the EAC region’s convergence criteria of 4.5 months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar and the Euro but strengthened against the Sterling Pound to exchange at KES 141.77, KES 158.63 and KES 182.51 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency, which has caused a market shortage.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | 14.87% | 0.28% |

| Sterling Pound | 22.71% | -1.38% |

| Euro | 20.48% | 0.34% |

Liquidity

Liquidity in the money markets tightened, with the average interbank rate increasing from 8.60% to 10.40%, as tax remittances more than offset government payments. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 8.60% | 10.40% |

| Interbank volume (billion) | 28.70 | 15.60 |

| Commercial banks’ excess reserves (billion) | 28.30 | 18.20 |

Fixed Income

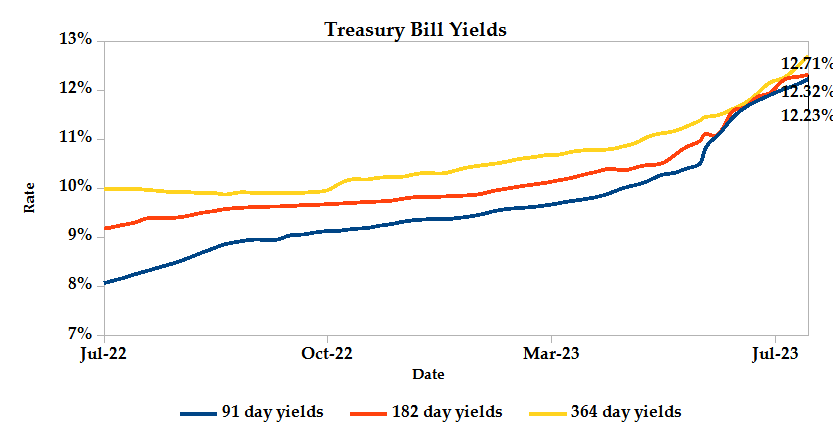

T-Bills

T-Bills remained over-subscribed during the week, with the overall subscription rate recorded as 164.50%, up from 151.85% performance recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 711.59% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 86.38% and 23.77% respectively. The acceptance rate decreased by 7.00% to close the week at 92.85%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 14.32% from KES 12.83 billion in the previous week to KES 14.67 billion. Total bond deals decreased by 13.64% from 638 in the previous week to 551.

In the primary bond market, CBK released tap sale auction results for the FXD1/2023/5 and FXD1/2016/10 treasury bonds, which sought to raise KES 20.0 billion. The issues received bids worth KES 44.43 billion, representing a subscription rate of 222.14%. Of these, KES 43.44 billion worth of bids were accepted at a weighted average rate of 16.84% and 16.33% respectively.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average 0.04% compared to the previous week, 0.46% month to date and 0.65% year to date. The yields on the 10- Year Eurobonds for Angola and Ghana also increased Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | -0.11% | 0.29% | 0.27% |

| 2018 10-Year Issue | 0.95% | 0.46% | -0.06% |

| 2018 30-Year Issue | 0.45% | 0.29% | -0.06% |

| 2019 7-Year Issue | 1.11% | 0.82% | 0.09% |

| 2019 12-Year Issue | 0.57% | 0.37% | -0.05% |

| 2021 13-Year Issue | 0.95% | 0.54% | 0.06% |

Equities

NASI, NSE 25 and NSE 20 settled 2.88%, 0.72% and 1.32% lower compared to the previous week bringing the year-to-date performance to -13.11%, -3.72% and -8.72% respectively. Market capitalization lost 2.89% from the previous week to close at KES 1.72 trillion recording a year-to-date decline of 13.15%. The performance was driven by losses recorded by large-cap stocks such as Safaricom, NCBA and KCB of 6.25%, 3.26% and 1.99% respectively. These were however mitigated by gains recorded by Equity and ABSA of 3.25% and 1.23% respectively.

The Banking sector had shares worth KES 61.2M transacted which accounted for 60.38% of the week’s traded value, Manufacturing & Allied sector had shares worth KES 17.6M transacted which represented 2.20% and Safaricom, with shares worth KES 205.5M transacted represented 25.61% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| CIC Insurance | 15.18% | 10.55% |

| Express | -13.61% | 8.40% |

| Eaagads | 33.33% | 7.69% |

| Centum | 15.85% | 5.79% |

| HF | 51.43% | 5.53% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Trans-Century | -40.40% | -16.90% |

| TP Serena | -10.00% | -14.29% |

| Umeme | 60.43% | -14.29% |

| Eveready | 109.72% | -8.48% |

| E.A Portland | -4.12% | -7.12% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 0.86 | 1.88 | 119.11% |

| Derivatives Contracts | 9 | 26 | 188.89% |

| I-REIT Turnover (million) | 0.53 | 0.17 | -67.37% |

| I-REIT deals | 60 | 43 | -28.33% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 18.62% | 0.69% |

| Dow Jones Industrial Average (DJI) | 6.32% | 2.08% |

| FTSE 100 (FTSE) | 1.45% | 3.08% |

| STOXX Europe 600 | 7.19% | 0.99% |

| Shanghai Composite (SSEC) | 1.64% | -2.16% |

| MSCI Emerging Markets Index | 4.06% | -2.61% |

| MSCI World Index | 16.45% | 0.36% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -3.32% | 1.73% |

| JSE All Share | 4.71% | -1.24% |

| NSE All Share (NGSE) | 25.99% | 3.89% |

| DSEI (Tanzania) | -4.02% | -1.23% |

| ALSIUG (Uganda) | -13.56% | 1.15% |

US indices traded higher over the week, achieving their 10th consecutive week of gains and extending their most prolonged winning streak since 2017. The notable surge was driven by increased activity in defensive market segments, particularly utilities, as investors adopted a cautious stance in anticipation of the upcoming quarterly earnings reports from major tech companies scheduled for next week.

European stocks closed the week on a positive trajectory, driven by strong performances in the mining, banking and healthcare sectors. The market sentiment was buoyed by favorable corporate earnings reports and promising signs of a significant deceleration in British consumer inflation. Moreover, the better-than-expected UK retail sales data added to the growing optimism that global price pressures might be alleviating.

Asia Pacific indices concluded the week in the red zone, as investors evaluated the potential impact of additional Chinese stimulus measures amidst concerns surrounding technology stocks. Technology stocks faced headwinds, primarily driven by Taiwan Semiconductor Manufacturing Co (TSMC), Asia’s most valuable company, reporting a significant 23% drop in its second-quarter profit. Moreover, the warning issued by TSMC, indicating further anticipated declines in sales and profits for the rest of the year, added to the concerns surrounding the tech sector’s performance.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 2.19% and 1.50% higher at $77.07 and $81.07 respectively. Gold futures prices settled 0.11% higher at $1,966.60.

Week’s Highlights

- Fitch Ratings revised Kenya’s long-term foreign-currency Issuer Default Rating (IDR) outlook to Negative from Stable while affirming the IDR at ‘B’. The revision is attributed to increased external financing constraints due to high funding requirements, including a significant Eurobond maturity in 2024, coupled with weakening international reserves and rising financing costs. Additionally, uncertainty surrounding the fiscal trajectory and social unrest exacerbated by potential execution risks of announced tax hikes, contributed to the negative outlook. However, the rating affirmation acknowledges Kenya’s commitment to fiscal consolidation supported by the IMF program and its strong medium-term growth prospects, even though it faces challenges related to relatively high government debt, external indebtedness and a narrow revenue base.

- IMF completed its fifth reviews under the Extended Fund Facility and Extended Credit Facility Arrangements (EFF/ECF) for Kenya, resulting in an immediate disbursement of $415.4 million, including $110.3 million from augmentation of access. The Board also approved an extension of the EFF/ECF arrangement form the current 38 months to 48 months. Additionally, the Executive Board has approved a 20-month arrangement under the Resilience and Sustainability Facility (RSF) worth $551.4 million. This support aims to aid Kenya’s ambitious initiatives in building resilience to climate change and encouraging private climate financing. Key policy priorities include reducing debt vulnerabilities through multi-year fiscal consolidation efforts, achieved by increasing tax revenues and rationalizing spending while safeguarding essential social and developmental expenses. The program also emphasizes a proactive monetary policy stance to complement these measures and foster a prudent and mutually reinforcing policy framework.

- The Kenya Pension Funds Investment Consortium (KEPFIC) received a wide array of infrastructure and alternative investment opportunities, amounting to KES 770 billion of which KES 359.40 billion were shortlisted. These proposals were submitted by various project sponsors and fund managers, seeking capital from local retirement benefits schemes. The initiative reflects the growing interest of pension schemes in Kenya to diversify their investment portfolios into new sectors, aiming to potentially achieve higher returns on their investments.

- South Africa’s annual inflation rate continued its downward trajectory, reaching a 19-month low of 5.4% in June 2023, below market expectations of 5.6%. The decrease brought it back within the central bank’s target range of 3%-6%. Notably, food inflation dropped to an eleven-month low of 11%, and prices also softened in various sectors, including household contents & services, clothing, transport and restaurants & hotels. However, inflation accelerated for housing & utilities, recreation & culture and alcoholic beverages & tobacco. The annual core inflation, which excludes volatile items, also slowed to 5% in June, aligning with market estimates. On a monthly basis, consumer price inflation remained unchanged at 0.2%.

- The Eurozone inflation rate in June 2023 was confirmed at 5.5%, the lowest since January 2022, driven by declining energy prices. However, the core rate, which excludes food and energy, rose to 5.5%, supporting the view that European Central Bank (ECB) policymakers may continue raising rates in the upcoming months. Energy prices declined sharply by 5.6%, while food, alcohol & tobacco and non-energy industrial goods saw softer price increases. Services inflation picked up to 5.4%. On a monthly basis, consumer prices advanced 0.3% in June.

- The People’s Bank of China (PBoC) maintained lending rates in its July fixing, despite indications of a stalling economic recovery that may necessitate additional stimulus. The one-year loan prime rate (LPR) for corporate and household loans remains steady at 3.55%, while the five-year rate for mortgages is unchanged at 4.2%, aligning with market expectations. This decision follows a surprising 10bps rate cut in June, which was prompted by a faster-than-expected GDP growth in Q2. The economy expanded by 5.5% in the first half of the year, surpassing the government’s target of around 5.0% for 2023.

Get future reports

Please provide your details below to get future reports: