Foreign Exchange Reserves

The usable foreign exchange reserves increased by 1.45% to USD 7,856 million (4.1 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover but below EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar, but depreciated the Sterling Pound and the Euro to exchange at KES 129.18, KES 171.68 and KES 144.20 respectively. The observed appreciation the Dollar is attributed to increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.70% | 0.01% |

| Sterling Pound | -14.10% | 1.07% |

| Euro | -16.96% | 0.70% |

Liquidity

Liquidity in the money markets tightened, with the average inter-bank rate increasing from 12.64% to 12.69%, as tax remittances more than offset government payments. Remittance inflows totaled $427.20 million in August 2024, a 3.12% increase from $414.26 million in July 2024 and a 20.53% rise from $354.43 million in August 2023. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.64% | 12.68% |

| Interbank volume (billion) | 35.12 | 24.82 |

| Commercial banks’ excess reserves (billion) | 13.80 | 11.90 |

Fixed Income

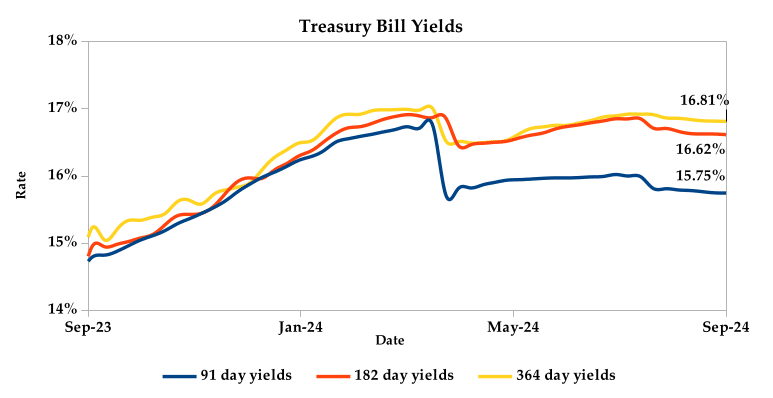

T-Bills

T-Bills were over-subscribed during the week, with the overall subscription rate increasing to 126.43% from 89.10% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 283.87%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 84.05% and 105.84% respectively. The acceptance rate decreased by 9.59% to close the week at 84.31%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 7.87%, from KES 32.64 billion in the previous week to KES 35.21 billion. Total bond deals increased by 3.55% from 648 in the previous week to 671.

In the primary bond market, CBK released auction results for the re-opened FXD1/2024/010 and FXD1/2016/020 which sought to raise KES 30.0 billion. The issues received bids worth KES 22.64 billion, representing a subscription rate of 75.47%. Of these, KES 19.28 billion worth of bids were accepted at a weighted average rate of 16.87% and 17.29% respectively.

Eurobonds

In the international market, yields on Kenya’s Eurobonds decreased by an average of 0.92% compared to the previous week, 0.57% month-to-date and 0.30% year-to-date. The yields on the 10-year Eurobonds for Angola and Zambia also decreased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -0.74% | -0.93% | -1.18% |

| 2018 30-Year Issue | 0.09% | -0.38% | -0.53% |

| 2019 7-Year Issue | -1.21% | -0.78% | -1.45% |

| 2019 12-Year Issue | -0.01% | -0.41% | -0.80% |

| 2021 13-Year Issue | 0.24% | -0.44% | -0.77% |

| 2024 6-Year Issue | -0.15% | -0.47% | -0.79% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 0.12%, 4.45%, 0.36% and 0.25% higher compared to the previous week, bringing the year-to-date performance to 15.73%, 18.68%, 20.07% and 21.49% respectively. Market capitalization also gained 0.12% from the previous week to close at KES 1.67 trillion, recording a year-to-date increase of 15.95%. The performance was driven by gains recorded by large-cap stocks such as KCB, NCBA and EABL of 4.48%, 1.86% and 1.15% respectively. This was however weighed down by the losses recorded by Standard Chartered, Stanbic and Equity of 3.44%, 3.33% and 2.78% respectively.

The Banking sector had shares worth KES 735M transacted which accounted for 52.00% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 115M transacted which represented 8.00% and Safaricom, with shares worth KES 353M transacted, represented 25.00% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| E.A Portland | 129.38% | 50.41% |

| Kenya Power | 169.29% | 41.73% |

| KenGen | 55.50% | 24.90% |

| Kenya Re | -30.27% | 22.86% |

| Scangroup | 9.17% | 19.60% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Sanlam | 1.67% | -7.58% |

| TP Serena | -22.15% | -5.60% |

| Trans-Century | -34.62% | -5.56% |

| Flame Tree | -8.77% | -5.45% |

| Olympia | -15.90% | -4.18% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 4.83 | 7.46 | 54.36% |

| Derivatives Contracts | 37.00 | 13.00 | -64.86% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 20.24% | 1.36% |

| Dow Jones Industrial Average (DJI) | 11.53% | 1.62% |

| FTSE 100 (FTSE) | 6.59% | -0.52% |

| STOXX Europe 600 | 7.47% | -0.33% |

| Shanghai Composite (SSEC) | -7.61% | 1.21% |

| MSCI Emerging Markets Index | 7.98% | 2.23% |

| MSCI World Index | 16.02% | 1.15% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 4.68% | -69.63% |

| JSE All Share | 9.36% | 1.97% |

| NSE All Share (NGSE) | 29.29% | 0.81% |

| DSEI (Tanzania) | 19.30% | 0.37% |

| ALSIUG (Uganda) | 22.79% | 0.60% |

Global and Continental Markets

US stock market closed the week on an upward trajectory, buoyed by investors’ confidence in the Federal Reserve’s ability to achieve a soft landing. Notably, the Fed’s aggressive 50 basis point rate cut, the first in four years and hints of further reductions boosted market sentiment.

European stock markets closed the week in the red zone, weighed down by declines in the fixed line telecommunications, electronic & electrical equipment and mining sectors.

Asian stock markets closed the week on a positive note, buoyed by the People’s Bank of China’s decision to hold its key interest rates steady. The PBoC maintained its one- and five-year loan prime rates at 3.35% and 3.85% respectively, aligning with market consensus.

Week’s Highlights

- The National Treasury gazetted revenue and net expenditures data for the the second month of the FY 2024/25, ending 30th August 2024. Total revenue collected amounted to KES 330.46 billion, representing 11.33% of the original KES 2.92 trillion target. This was 32.03% lower than the projected KES 486.20 billion for the period. Total expenditure reached KES 439.95 billion, accounting for 10.18% of the original estimate. The resulting fiscal deficit of KES 109.48 billion was financed through domestic and external borrowings of 97.20% and 2.80% respectively.

- The International Monetary Fund (IMF) concluded its six-day visit to Kenya, aiming to assess the country’s economic progress and policy measures. Kenya entered a four-year IMF program in 2021, securing approximately USD 3.6 billion in funding, including support for climate change initiatives. The program seeks to manage public debt and create a favorable environment for private sector growth. Notably, despite delays in tax reforms due to recent protests, the IMF remains committed to supporting Kenya’s ongoing program and identifying solutions to address its economic challenges.

- Kenya has introduced the Movable Property Security Rights (Amendment) Bill 2024, a major legislative overhaul aimed at modernising and streamlining the laws governing security rights over movable property. The Bill seeks to unify existing regulations, repeal outdated legislation and clarify hire purchase agreements, ultimately fostering a more efficient business environment.

- 5 Acorn Holdings, a pioneer in green bonds on the African continent, is set to delist from the Nairobi Securities Exchange (NSE). The company’s KES 5.7 billion green bond, issued in 2019 for student accommodation development, will be redeemed early. This bond, held by Acorn Student Accommodation (ASA) Development REIT, has yielded investors an annual interest rate of 12.5%. ASA REIT is a specialized investment vehicle focused on acquiring, developing and managing student housing properties.

- The Federal Reserve made a significant move in September 2024, cutting the federal funds rate by 50 basis points to a range of 4.75% to 5%. This marked the first reduction in borrowing costs since the onset of the COVID-19 pandemic in March 2020. The central bank also revised its economic projections, indicating a slower decline in inflation and a more optimistic outlook for growth. This move signaled a shift towards a more accommodating monetary policy as the central bank sought to support economic growth and mitigate the risks of a recession.

- UK’s annual inflation remained steady at 2.2% in August 2024, matching the previous month’s rate and aligning with market expectations. While rising airfares and recreational costs contributed to inflationary pressures, declining fuel prices and slower increases in restaurant and hotel costs helped offset these impacts. Overall, the Consumer Price Index (CPI) rose by 0.3% compared to the previous month, aligning with market expectations.

- The Bank of England (BoE) held the Bank Rate steady at 5% during its September 2024 meeting, following a 25 basis point cut in August. This decision was in line with market expectations. Annual inflation in August stood at 2.2% and is projected to rise to around 2.5% by the end of the year as the impact of last year’s energy price declines fades from the annual comparison. The Committee expects headline GDP growth to return to its underlying pace of approximately 0.3% per quarter in the second half of the year. In addition, the Committee unanimously agreed to reduce its holdings of UK government bonds by £100 billion over the next 12 months, bringing the total to £558 billion.

- The People’s Bank of China (PBoC) held its key lending rates steady at the September fixing, matching market expectations. The one-year loan prime rate (LPR), the benchmark for most corporate and household loans, remained at 3.35%. The five-year rate, a reference for property mortgages, was also kept unchanged at 3.85%. The central bank delayed the medium-term lending facility (MLF) operation for the second time in two months, signaling a shift towards letting short-term rates play a more prominent role in guiding markets. August economic data in China showed a mixed picture, with an uncertain economic upturn. Industrial output grew at its slowest pace in five months, while retail sales were sluggish and the unemployment rate increased. New yuan loans recovered from July’s 15-year low but fell short of expectations.

Get future reports

Please provide your details below to get future reports: