Foreign Exchange Reserves

The usable foreign exchange reserves remained adequate at USD 7,382 million (4.13 months of import cover). This meets CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover. However, it does not meet EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 124.09, KES 153.21 and KES 134.21 respectively. The observed depreciation against the Dollar is attributable to increased demand from energy and commodity importers.

| YTD Change | W-o-W Change | |

|---|---|---|

| Dollar | 0.54% | 0.21% |

| Euro | 3.01% | 1.73% |

| Sterling Pound | 1.94% | 0.67% |

Liquidity

Liquidity in the money markets tightened with the average interbank rate rising to 6.12% from 5.21%, as tax remittances offset government payments. Open market operations remained active.

| Week (previous) | Week (ending) | |

|---|---|---|

| Interbank rate | 5.21% | 6.12% |

| Interbank volume (billion) | 26.29 | 12.40 |

| Commercial banks’ excess reserves (billion) | 12.20 | 3.10 |

Fixed Income

T-Bills

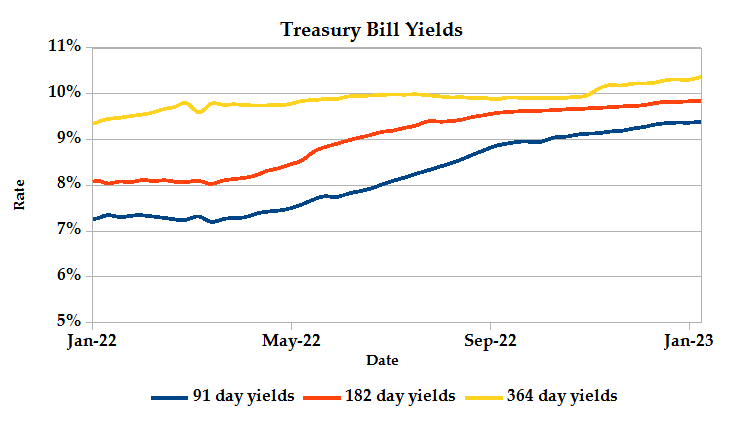

T-Bills remained over-subscribed during the week, with the overall subscription rate coming in at 122.74% from 108.88% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 354.29% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 130.96% and 21.89% respectively. The acceptance rate declined by 0.17% to close the week at 99.77%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover dropped 1.47% from KES 11.81 billion in the previous week to KES 11.64 billion. Total bond deals increased by 27.67% from 459 in the previous week to 586.

In the primary bond market, CBK reopened FXD1/2020/005 and FXD1/2022/015 through a tap sale seeking KES 10.0 billion. The bonds were over-subscribed, receiving bids worth KES 18.02 billion, out of which KES 17.63 billion was accepted.

Further, Central Bank has reopened FXD1/2017/010 with an effective tenor of 4.5 years and a coupon of 12.97% as well as issued a new FXD1/2023/010 bond, whose coupon is set to be market determined. Both papers seek to raise KES 50.0 billion for budgetary support with the period of sale running from 17th January to 7th February 2023.

Eurobonds

In the international market, yields on Kenya’s Eurobonds declined by an average 0.44% compared to the previous week and 0.87% year to date. The yields on the 10-year Eurobonds for Ghana and Angola increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | -2.06% | -2.06% | -1.27% |

| 2018 10-Year Issue | -0.59% | -0.59% | -0.23% |

| 2018 30-Year Issue | -0.50% | -0.50% | -0.27% |

| 2019 7-Year Issue | -0.97% | -0.97% | -0.47% |

| 2019 12-Year Issue | -0.69% | -0.69% | -0.24% |

| 2021 13-Year Issue | -0.41% | -0.41% | -0.15% |

Equities

NASI gained 0.82% while NSE 20 and NSE 25 settled 0.69% and 0.02% lower compared to the previous week bringing the year to date performance to -2.41%, 0.49% and -0.73% respectively. Market capitalization picked up 0.82% from the previous week to close at KES 1.94 trillion recording a year to date decline of 2.42%. The performance was driven by gains recorded by large-cap stocks such as Safaricom and ABSA of 2.50% and 0.41% respectively. These were however weighed down by losses recorded by EABL, Co-operative, Equity and KCB of 2.32%, 1.59%, 1.18% and 0.78% respectively.

The Banking sector had shares worth KES 712M transacted which accounted for 15.54% of the week’s traded value, Manufacturing & Allied sector had shares worth KES 139M transacted which represented 3.04% and Safaricom, with shares worth KES 3.6B transacted represented 80.70% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Trans-Century | 24.24% | 9.82% |

| Kenya Orchards | 20.19% | 9.65% |

| Kakuzi | 8.64% | 8.57% |

| Sameer | 7.08% | 5.09% |

| Umeme | 13.64% | 4.94% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| Olympia | -14.86% | -16.00% |

| Home Afrika | -11.76% | -14.29% |

| Liberty | -4.17% | -12.50% |

| NBV | 1.52% | -11.70% |

| BOC Kenya | -7.42% | -9.03% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 1.74 | 1.46 | -16.32% |

| Derivatives Contracts | 29.00 | 21 | -27.59% |

| I-REIT Turnover | 0.56 | 0.27 | -50.92% |

| I-REIT Deals | 49.00 | 30 | -38.78% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 3.88% | -0.66% |

| Dow Jones Industrial Average (DJI) | 0.72% | -2.71% |

| FTSE 100 (FTSE) | 2.87% | -0.94% |

| STOXX Europe 600 | 4.13% | -0.09% |

| Shanghai Composite (SSEC) | 4.76% | 2.18% |

| MSCI Emerging Markets | 7.65% | 0.62% |

| MSCI World Index | 4.79% | -0.38% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -2.32% | -0.44% |

| JSE All Share | 7.07% | 0.00% |

| NSE All Share (NGSE) | 1.94% | 0.16% |

| DSEI (Tanzania) | -0.65% | -0.91% |

| ALSIUG (Uganda) | -0.03% | -0.68% |

US indices recorded mixed performance, with the Dow and S&P 500 shedding the previous week’s gains while tech-heavy Nasdaq 100 gained 0.67% as investors piled on the tech stocks ahead of earnings reports due to be released in the next two weeks. Communication services index, up 3.96%, was among the highest performers among the S&P sectors. Lower than expected quarterly earnings release by Netflix were offset by increasing subscriber numbers, mitigating the Dow’s position.

European stocks marked weekly losses, weighed down by a fall in UK retail sales in December, as the cost of living crisis crippled discretionary spending. The STOXX 600, despite posting a 0.1% weekly decline, was boosted by travel & leisure and retail stocks. Also aiding the outlook was Germany’s Producer Price Index which was down for the third straight month in December and the lowest yearly reading since November 2021.

Asia Pacific indices edged higher, with markets readying for a major economic boost from the week-long Lunar New Year holiday and traders took advantage of heavily discounted stocks amid prospects of recovery. The Chinese government has also shown signs of support for consumer spending with the hope of igniting growth, maintaining benchmark loan prime rate at 3.65%.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 1.95% and 2.76% higher at $81.64 and $87.63 respectively. Gold futures prices settled 0.34% higher at $1,928.20.

Week’s Highlights

- The National Treasury, in the recently released Draft 2023 Budget Policy Statement, projected an increase in revenue collected in the 2023/24 financial year to KES 2.90 trillion, up from KES 2.51 trillion in FY2022/23. This will be supported by on-going reforms in tax policy and revenue administration measures aimed at expanding the tax base. To stimulate and sustain economic activity, the Government has committed to continue fiscal consolidation plans by containing expenditure and the country’s debt sustainability.

- KRA has submitted a draft of the Excise Duty (Excisable Goods Management System)(Amendment) Regulations, 2023 through the Excise Duty Act, 2015. Among the proposals include that every package of excisable goods manufactured or imported into Kenya listed in the first schedule should be subjected to an excise stamp. Excisable goods provided under the second schedule of the Act be exempted from the requirement of excise stamps. An increase in excise stamp fees effective 1st March 2023 is expected in categories such as manufactured tobacco, bottled or packaged waters and cosmetics and beauty products.

- CMA has extended the approval granted to Nairobi Coffee Exchange (NCE) to continue its operations as a coffee exchange until 30th April 2023, in accordance with the Capital Markets (Coffee Exchange) Regulations, 2020.

- China’s Q4 2022 economic growth slowed to 2.9% from 3.9% in Q3, exceeding market expectations of a 1.8% expansion. The period was characterized by strict Covid restrictions, which were only relaxed towards the end of the year, boosting sentiments of economic revival in 2023. An ailing residential property market and weak global demand for the country’s exports still pose a threat to the 2023 outlook.

- OPEC’s Monthly Oil Market Report projected that total world oil demand is expected to reach 101.8 million barrels a day (mb/d), maintaining the previous month’s 2.2 mb/d demand growth assessment. Minor upward adjustments were made for China’s oil demand, which is expected to grow by 510,000 barrels per day (bpd) in 2023, considering the uptick in performance of the economy. Contrary to OPEC’s plan to cut production by 2 million bpd, the report indicated a 91,000 bpd increase in crude oil output in December 2022, led by a rebound in Nigeria.

Get future reports

Please provide your details below to get future reports: