Foreign Exchange Reserves

The usable foreign exchange reserves decreased by 6.17% to USD 7,409 million (3.90 months of import cover). This falls short of CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover as well as EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 130.47, KES 168.81 and KES 142.06 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -16.89% | 0.94% |

| Sterling Pound | -15.53% | 1.15% |

| Euro | -18.19% | 1.11% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 13.15% to 13.14%, as government payments more than offset tax remittances. Remittance inflows totaled $371.60 million in June 2024, an 8.11% decrease from $404.40 million in May 2024 and a 7.43% rise compared to $345.90 million in June 2023. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 13.15% | 13.14% |

| Interbank volume (billion) | 38.43 | 26.94 |

| Commercial banks’ excess reserves (billion) | 18.40 | 41.10 |

Fixed Income

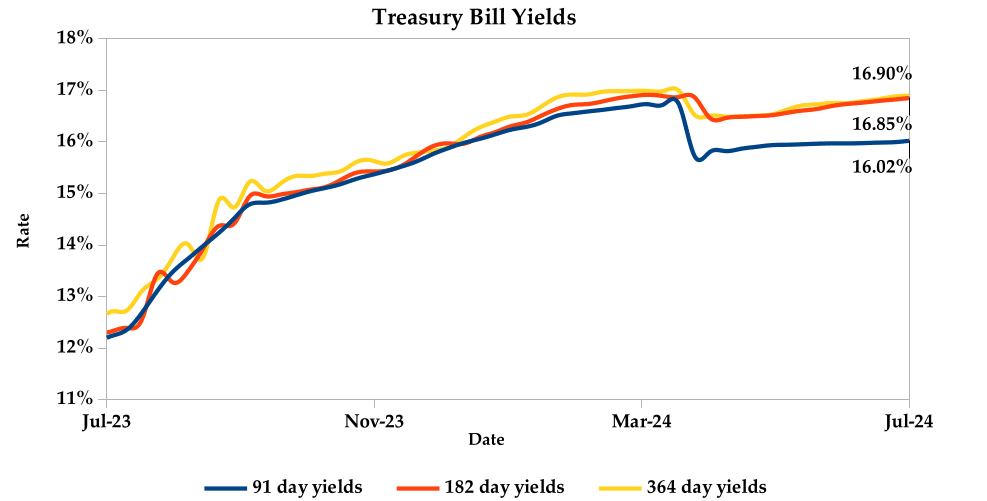

T-Bills

T-Bills were under-subscribed during the week, with the overall subscription rate decreasing to 87.43%, down from 137.29% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 272.06%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 72.65% and 28.37% respectively. The acceptance rate decreased by 2.71% to close the week at 89.31%.

T-Bonds

In the secondary bond market, there was a high demand for the week’s bond offers. Bond turnover increased by 1.26%, from KES 44.32 billion in the previous week to KES 44.88 billion. Total bond deals increased by 1.02% from 686 in the previous week to 693.

In the primary bond market, CBK released auction results for two reopened bonds, FXD1/2024/010 and FXD1/2008/020, which sought to raise KES 30.0 billion. The issues received bids worth KES 14.68 billion, representing a subscription rate of 48.94%. Of these, KES 9.77 billion worth of bids were accepted at a weighted average rate of 16.59% and 18.29% respectively.

Eurobonds

In the international market, yields on Kenya’s Eurobonds decreased by an average of 0.12% compared to the previous week, 0.67% month-to-date and increased by 0.11% year-to-date. The yields on the 10- Year Eurobonds for Angola and Zambia increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | 0.18% | -0.37% | 0.27% |

| 2018 30-Year Issue | 0.21% | -0.59% | -0.22% |

| 2019 7-Year Issue | -1.40% | -1.43% | -0.77% |

| 2019 12-Year Issue | 0.41% | -0.63% | -0.09% |

| 2021 13-Year Issue | 0.85% | -0.51% | 0.00% |

| 2024 6-Year Issue | 0.39% | -0.48% | 0.10% |

Equities

NASI, NSE 25 and NSE 10 settled 1.29%, 0.76%, 0.77% lower while NSE 20 settled 0.35% higher compared to the previous week, bringing the year-to-date performance to 18.09%, 20.93%, 23.67% and 12.78% respectively. Market capitalization also lost 1.29% from the previous week to close at KES 1.70 trillion, recording a year-to-date increase of 18.09%. The performance was driven by losses recorded by large-cap stocks such as Safaricom, Equity and Standard Chartered of 3.81%, 1.62% and 0.90% respectively. This was however mitigated by gains recorded by EABL and Stanbic of 3.33% and 0.87% respectively.

The Banking sector had shares worth KES 295M transacted which accounted for 23.0% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 160M transacted which represented 12.0% and Safaricom, with shares worth KES 248M transacted, represented 19.0% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| EA Portland | -33.00% | 20.18% |

| Home Afrika | -10.26% | 12.90% |

| TP Serena | -12.62% | 12.25% |

| HF Group | 31.88% | 10.98% |

| Car & General | -12.00% | 10.00% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Egaads | -6.25% | -7.69% |

| Liberty | 45.08 | -4.44% |

| Safaricom | 19.27% | -3.81% |

| Jubilee | -8.24% | -3.69% |

| Britam | 7.00% | -3.17% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 1.86 | 3.10 | 66.16% |

| Derivatives Contracts | 7.00 | 15.00 | 114.29% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 16.07% | -1.97% |

| Dow Jones Industrial Average (DJI) | 6.82% | 0.72% |

| FTSE 100 (FTSE) | 5.62% | -1.18% |

| STOXX Europe 600 | 6.59% | -2.68% |

| Shanghai Composite (SSEC) | 0.68% | 0.37% |

| MSCI Emerging Markets Index | 6.34% | -3.02% |

| MSCI World Index | 12.13% | -2.03% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 375.78% | 4.53% |

| JSE All Share | 5.18% | -2.37% |

| NSE All Share (NGSE) | 32.30% | 0.87% |

| DSEI (Tanzania) | 18.21% | 0.56% |

| ALSIUG (Uganda) | 19.75% | -0.42% |

Global and Continental Markets

The US stock market was volatile during the week, despite Netflix’s positive performance, the S&P 500 and NASDAQ ended the week down. This decline reflects a shift towards smaller companies as investors anticipate potential interest rate cuts by the Fed, coupled with concerns about US-China trade tensions and potential protectionist policies under a future Trump administration. The Dow Jones, however, managed a weekly gain of 0.72%.

European stocks ended the week in the red zone, extending their losing streak to a worrying five days – the longest since last October. This slump was fueled by anxieties over potential US trade barriers and the aftershocks of a global tech outage. The STOXX500 and STOXX 600 indexes closed down for the week, with chipmakers and automakers taking the biggest hits.

Asian stock markets closed the week on an upward trajectory, Japan swung to a JPY 224.04 billion trade surplus in June 2024. This marks a significant turnaround from the prior year’s deficit and the second surplus this year. Exports continued their growth streak for the seventh month, driven by strong sales to the US and China. While imports rose, the pace was the slowest in three months, reflecting the weak Yen. Despite this positive performance, Japan still faces a trade deficit of JPY 3.23 trillion for the first half of 2024.

Week’s Highlights

- The National Treasury gazetted the actual revenues and net expenditures for the fiscal year 2023/2024, as at 30th June 2024. Total revenue amounted to KES 2.29 trillion, reflecting a 13.22% increase from the previous month but falling short of the revised estimate II of KES 2.46 trillion by 6.93%. Expenditure totaled KES 3.80 trillion, significantly lower than the estimated KES 4.26 trillion, resulting in a fiscal deficit of 65.74%. This deficit was financed through external and internal borrowing at 47% and 53% respectively. External borrowing significantly decreased by 24.33% and domestic borrowing decreased by 5.6% compared to the revised estimates.

- The Central Bank of Kenya released the annual bank supervision report for the year ending 31 December 2023. Key highlights of the sector’s financial performance include; Capital and reserves increased by 6.8% from KES 917.6 billion to KES 980.2 billion, while net assets grew by 16.7% from KES 6.6 trillion in December 2022 to KES 7.7 trillion in December 2023. Liquidity ratio marginally increased from 50.8 in December 2022 to 51 in December 2023. Gross loans increased by 15.2% from KES 3,630.3 trillion in December 2022, to KES 4,183.4 trillion in 2023. The growth in loans is attributed to increased demand for credit by the various economic sectors. On the downside, net profit after tax declined by 8.8% from KES 240.4 billion in December 2022 to KES 219.2 billion last year. Non-performing loans ratio from 13.9% to 15.6% in December 2023, occasioned by deteriorating asset quality as a result of challenges in the business environment.

- 5 The Tanzanian conglomerate Amsons Group, through its subsidiary Amsons Industries, is eyeing a full takeover of Bamburi Cement. It has launched a buyout offer valuing the company at KES 65 per share, a 44% premium over its June 9th closing price. This offer requires acceptance from at least 75% of shareholders, and Amsons has already secured a commitment from Bamburi’s majority owner. If successful, Amsons intends to delist Bamburi Cement from the Nairobi Stock Exchange (NSE). The news unsurprisingly sent Bamburi’s stock price soaring by 28.3% on Thursday, and it’s likely to continue climbing towards Amsons’ offer price.

- Kenya Electricity Generating Company (KenGen), is making a big push for green energy. They’re building a 42.5-megawatt solar power plant at Seven Forks, aiming for completion in 28 months. Partnering with the French Development Agency(AFD), this project will not only boost Kenya’s renewable energy but also help manage power costs. The solar plant will work alongside their existing hydropower, reducing reliance on water during the day and saving it for drier times. This is a significant step towards Kenya’s ambitious goal of achieving 100% renewable energy by 2030.

- UK’s inflation surprised in June 2024, holding steady at 2% despite predictions of a drop. This continues the trend of the lowest inflation rates since 2021. While restaurant and hotel costs, particularly hotels, rose the most, other sectors offered some relief. Clothing and footwear inflation eased, with garment prices leading the decline. Food prices, Housing and Utilities continued their downward trend. Despite some price increases in transport, like used cars and airfare, overall inflation remained stable for services and recreation.

- China’s economic growth stumbled in Q2 2024, reaching just 4.7% year-over-year. This undershot expectations (5.1%) and marked a significant slowdown from Q1 2024 (5.3%). This marks the weakest performance since early 2023, reflecting a confluence of challenges: a slumping property market, weak domestic demand, a declining Yuan and trade tensions. These figures coincide with the Third Plenum, a key political event where economic reforms and stimulus measures are likely on the table. Despite hitting the annual target with 5.0% growth in the first half, June data painted a concerning picture. Retail sales and industrial output witnessed multi-month lows, indicating a broader slowdown. The unemployment rate held steady at 5.0%, while the trade sector showed a surprising decline in imports despite rising exports.

- The European Central Bank (ECB) kept interest rates on hold in July 2024 as expected, with current data backing their inflation outlook. Though some May inflation readings rose due to temporary factors, most stabilized or fell by June. High wage growth’s inflationary impact has been absorbed by corporate profits, but domestic price pressures and service sector inflation remain high. The ECB projects inflation to stay above their target for much of next year. Committed to bringing inflation back to 2%, it will maintain a restrictive monetary policy, adjusting rates based on incoming data, underlying inflation trends and policy effectiveness.

Get future reports

Please provide your details below to get future reports: