Foreign Exchange Reserves

The usable foreign exchange reserves stood at USD 7,226 million (3.80 months of import cover). This falls short of CBK’s statutory requirement to endeavour to maintain at least 4.0 months of import cover as well as the EAC region’s convergence criteria of 4.5 months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, but appreciated the Sterling Pound and the Euro to exchange at KES 131.44, KES 163.20 and KES 139.74 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -16.28% | 0.83% |

| Sterling Pound | -18.34% | -0.41% |

| Euro | -19.53% | -0.24% |

Liquidity

Liquidity in the money markets tightened, with the average inter-bank rate increasing from 13.37% to 13.71%, as tax remittances more than offset government payments. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 13.37% | 13.71% |

| Interbank volume (billion) | 24.58 | 21.13 |

| Commercial banks’ excess reserves (billion) | 20.10 | 30.4 |

Fixed Income

T-Bills

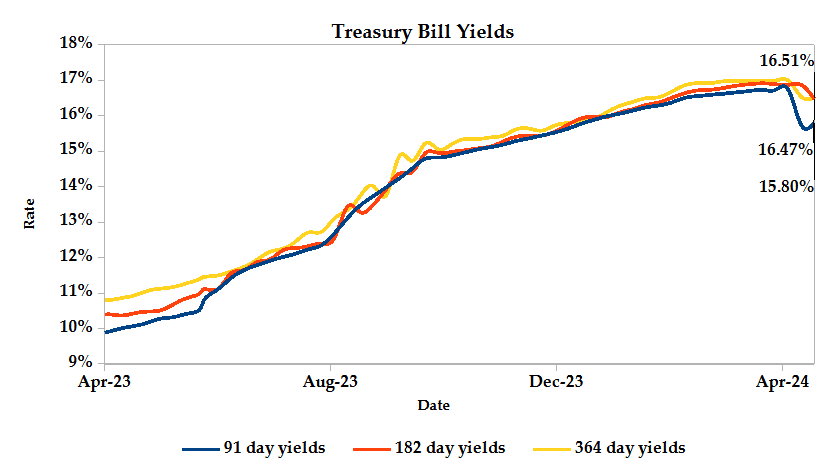

T-Bills remained over-subscribed during the week, with the overall subscription rate decreasing to 108.70%, down from 192.70% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 150.13% while the 182-day T-Bill and 364-day T-Bill had subscription rates of 78.15% and 122.67% respectively. The acceptance rate increased by 0.76% to close the week at 99.56%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 34.30%, from KES 16.61 billion in the previous week to KES 22.31 billion. Total bond deals increased by 43.30% from 455 in the previous week to 652.

In the primary bond market, CBK released auction results for the re-opened 2-year FXD1/2023/002 which sought to raise KES 40.0 billion. The issues received bids worth KES 47.19 billion, representing a subscription rate of 117.98%. Of these, KES 34.76 billion worth of bids were accepted at a weighted average rate of 16.99%.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.11% compared to the previous week, 0.46% month-to-date and decreased by 0.57% year-to-date. The yields on the 10-year Eurobonds for Angola and Zambia also decreased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -1.01% | 0.30% | 0.05% |

| 2018 30-Year Issue | -0.22% | 0.74% | 0.11% |

| 2019 7-Year Issue | -1.33% | 0.52% | 0.16% |

| 2019 12-Year Issue | -0.34% | 0.40% | 0.14% |

| 2021 13-Year Issue | 0.10% | 0.41% | 0.12% |

| 2024 6-Year Issue | -0.60% | 0.36% | 0.06% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 3.64%, 2.06%, 3.80% and 3.47% lower compared to the previous week, bringing the year-to-date performance to 15.91%, 11.96%, 18.17% and 20.89% respectively. Market capitalization also lost 3.64% from the previous week to close at KES 1.67 trillion, recording a year-to-date increase of 15.90%. The performance was driven by losses recorded by large-cap stocks such as Equity, KCB, Safaricom and ABSA of 9.36%, 6.99%, 5.60% and 5.54% respectively. This was however mitigated by gains recorded by EABL of 11.23%.

The Banking sector had shares worth KES 674.8M transacted which accounted for 42.12% of the week’s traded value, Manufacturing and Allied sector had shares worth KES 371.7M transacted which represented 23.20% and Safaricom, with shares worth KES 490.5M transacted, represented 30.62% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| TP Serena | 23.38% | 27.71% |

| New Gold | -4.89% | 11.24% |

| EA Breweries | 34.19% | 11.23% |

| Car General | 14.00% | 9.20% |

| Flame Tree | 5.26% | 8.11% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Sanlam | 0.00% | -12.79% |

| I&M Holdings | 9.17% | -12.21% |

| BOC Kenya | -18.29% | -11.84% |

| EA Cables | -5.10% | -9.71% |

| Equity | 23.10% | -9.36% |

Alternative Investments

| Losers | Week (previous) | Week (ending) | % Change |

|---|---|---|---|

| Derivatives Turnover (million) | 0.73 | 3.98 | 446.32% |

| Derivatives Contracts | 6.00 | 14.00 | 133.33% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 4.73% | -3.05% |

| Dow Jones Industrial Average (DJI) | 0.72% | 0.01% |

| FTSE 100 (FTSE) | 2.26% | -1.25% |

| STOXX Europe 600 | 4.34% | -1.18% |

| Shanghai Composite (SSEC) | 2.99% | 1.04% |

| MSCI Emerging Markets Index | -2.00% | -3.60% |

| MSCI World Index | 2.73% | -2.85% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -8.37% | -3.25% |

| JSE All Share | -2.92% | -2.74% |

| NSE All Share (NGSE) | 30.99% | -2.71% |

| DSEI (Tanzania) | 0.69% | -0.40% |

| ALSIUG (Uganda) | 19.38% | -1.26% |

The US stock market was volatile during the week, as investors grappled with rising Treasury yields and diminishing hopes for near-term interest rate cuts by the Federal Reserve.

The European market closed the week in the red zone, weighed down by rising geopolitical tensions in the Middle East after Israel’s response to Iran’s weekend airstrike.

Asian stock markets closed the week in the green zone, buoyed by positive economic signals and supportive policy measures from China. Low lending rates, as indicated by the central bank’s monthly fixing, coupled with robust GDP figures for Q1 2024, boosted investor sentiments. Additionally, news of government initiatives promoting overseas investment in the tech sector and encouraging domestic banks to support these activities further fueled market optimism.

Week’s Highlights

Get future reports

Please provide your details below to get future reports: