Foreign Exchange Reserves

The usable foreign exchange reserves stood at USD 7,357 million (4.02 months of import cover). This meets CBK’s statutory requirement to endeavour to maintain at least 4.0 months of import cover but still falls short of EAC region’s convergence criteria of 4.5 months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar and Sterling Pound but appreciated against the Euro to exchange at KES 144.18, KES 184.00 and KES 157.14 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency, which has caused a market shortage.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | 16.82% | 0.42% |

| Sterling Pound | 23.72% | 0.41% |

| Euro | 19.35% | -0.74% |

Liquidity

Liquidity in the money markets tightened, with the average interbank rate increasing from 9.05% to 11.90%, as tax remittance more than offset government payments. Remittance inflows totaled $378.1 million in July 2023, an 8.21% increase from $345.86 million in June 2023 and an 18.4% rise from $319.4 million in July 2022. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 9.05% | 11.90% |

| Interbank volume (billion) | 24.50 | 21.93 |

| Commercial banks’ excess reserves (billion) | 14.60 | 3.40 |

Fixed Income

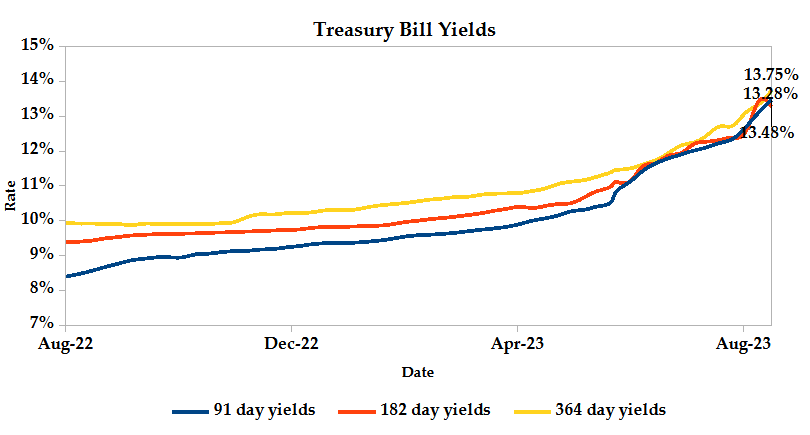

T-Bills

T-Bills were over-subscribed during the week, with the overall subscription rate recorded as 186.16%, down from 199.73% performance recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 955.74% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 38.57% and 25.92% respectively. The acceptance rate decreased by 2.21% to close the week at 97.54%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 5.25% from KES 14.63 billion in the previous week to KES 13.86 billion. Total bond deals decreased by 4.34% from 576 in the previous week to 551.

In the primary bond market, CBK released auction results for the newly issued FXD1/2023/2 and reopened FXD1/2023/5 which sought to raise KES 40.0 billion. The issues received bids worth KES 53.01 billion, representing a subscription rate of 132.52%. Of these, KES 19.12 billion worth of bids were accepted at a weighted average rate of 16.97% and 17.95% respectively.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average 0.69% compared to the previous week, 0.91% month to date and 1.04% year to date. The yields on the 10-Year Eurobonds for Zambia and Angola also increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 1.25% | 1.67% | 0.99% |

| 2018 10-Year Issue | 1.25% | 0.91% | 0.69% |

| 2018 30-Year Issue | 0.51% | 0.53% | 0.47% |

| 2019 7-Year Issue | 1.35% | 0.97% | 0.98% |

| 2019 12-Year Issue | 0.71% | 0.70% | 0.50% |

| 2021 13-Year Issue | 1.15% | 0.67% | 0.49% |

Equities

NASI, NSE 25 and NSE 20 settled 2.55%, 3.86% and 3.27% lower compared to the previous week bringing the year-to-date performance to -20.41%, -8.53% and -16.49% respectively. Market capitalization lost 2.56% from the previous week to close at KES 1.58 trillion recording a year-to-date decline of 20.47%. The performance was driven by losses recorded by large-cap stocks such as EABL, Standard Chartered and KCB of 9.24%, 8.80% and 4.84% respectively.

The Banking sector had shares worth KES 451M transacted which accounted for 26.72% of the week’s traded value, Manufacturing & Allied sector had shares worth KES 412M transacted which represented 24.42% and Safaricom, with shares worth KES 732.8M transacted represented 43.42% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Car & General | -18.37% | 17.99% |

| Kenya Orchards | 58.17% | 9.67% |

| E.A Portland Cement | 2.94% | 7.69% |

| Longhorn Publishers | -10.00% | 7.57% |

| Unga Group | -43.75% | 5.88% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Olympia Capital | 9.80% | -23.35% |

| Eveready | 73.61% | -13.79% |

| Jubilee | -14.47% | -10.17% |

| Williamson | 52.34% | -9.97% |

| Uchumi | -9.52% | -9.52% |

Alternative Investments

| Losers | Week (previous) | Week (ending) | % Change |

|---|---|---|---|

| Derivatives Turnover (million) | 1.13 | 1.21 | 7.02% |

| Derivatives Contracts | 19.00 | 37.00 | 94.74% |

| I-REIT Turnover (million) | 0.39 | 0.54 | 51.19% |

| I-REIT deals | 47 | 52 | 10.64% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 14.27% | -2.11% |

| Dow Jones Industrial Average (DJI) | 4.13% | -2.21% |

| FTSE 100 (FTSE) | -3.86% | -3.48% |

| STOXX Europe 600 | 3.28% | -2.34% |

| Shanghai Composite (SSEC) | 2.33% | 1.83% |

| MSCI Emerging Markets Index | 0.19% | -3.34% |

| MSCI World Index | 11.40% | -2.53% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -3.85% | 0.06% |

| JSE All Share | -1.08% | -5.34% |

| NSE All Share (NGSE) | 25.48% | -0.89% |

| DSEI (Tanzania) | -6.48% | -1.19% |

| ALSIUG (Uganda) | -19.24% | -2.85% |

US indices closed the week in the red, with tech-heavy Nasdaq posting the biggest weekly drop, weighted down by technology stock declines as investors were apprehensive about next week’s Federal Reserve meeting. Strong economic data within the region revived concerns about rates remaining high for a longer period, driving up yields on government bonds. Defensive sector stocks in consumer staples and utilities helped pare losses in the Dow Jones Index.

European indices sank to 6-week lows, steered by losses recorded in financials and healthcare stocks. Concerns about interest rates staying high spilled over, coupled with China’s dwindling growth prospects and the effect of rising bond yields on equity market valuations, took a toll on investor sentiment.

Asian stocks recorded weekly gains, supported by a stimulus package by China’s securities regulator aimed at reviving the stock market. The measures include speeding up the registration of index funds, widening access to derivative instruments, cutting trading costs and incorporating share buybacks. Investors are still calling for reforms in the property market to revive overall market sentiments and the economy. The People’s Bank of China helped provide some relief, cutting the one-year rate by 10 basis points in a bid to pump up liquidity conditions in the wake of slowing economic growth.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 2.33% and 2.32% lower at $81.25 and $84.80 respectively. Gold futures prices settled 1.55% lower at $1916.50.

Week’s Highlights

- The Energy and Petroleum Regulatory Authority (EPRA) published its monthly statement outlining the maximum retail prices of petroleum products, effective August 15th, 2023, to September 14th, 2023. During this period, prices of Super Petrol, Diesel and Kerosene remained unchanged at KES 182.04 per litre, KES 167.28 per litre, and KES 161.48 per litre respectively. Proceeds from the Petroleum Development Levy were applied to stabilize pump prices to cushion against the rising cost of crude oil.

- The National Treasury gazetted the actual revenues and expenditures for the first month of the 2023/24 financial year, ending 31st July 2023. Total revenue collected during the month amounted KES 156.94 billion, accounting for 6.10% of the original estimate of KES 2.57 trillion for the financial year. This figure falls short of the prorated amount of KES 214.26 billion expected for the first month of the year. Total expenditure amounted KES 279.64 billion, translating to 6.77% of the original estimates. The deficit was plugged by a total KES 127.52 billion in financing.

- Safaricom has received approval from the Central Bank of Kenya to increase the M-PESA account limit to KES 500,000. The convenience this shift will bring to customers, particularly small businesses, is anticipated to increase as the volume of cashless transactions. In addition to the higher account limit, Safaricom has also increased the daily transaction limit to KES 500,000. The current per-transaction limit of KES 150,000 will remain in place, but customers will be able to make as many transactions as they need to up to the daily limit of KES 500,000.

- The Eurozone economy grew by a modest 0.3% in the second quarter of 2023, following a flat first quarter. This is the slowest pace of growth since the 2020/2021 recession. The recovery in demand was likely boosted by a moderation in inflationary pressures, but higher interest rates and waning confidence continued to weigh on the economy. Among the largest economies in the bloc, France and Spain demonstrated sustained growth rates, while Germany’s economy stagnated and Italy unexpectedly experienced a 0.3% contraction.

- UK inflation fell to 6.8% in July 2023, the lowest level since February 2022. This is mainly due to a slump in fuel prices, which fell by 24.9% in the month. The core rate, which excludes volatile items such as energy and food, was at 6.9%, unchanged from June’s reading but remaining outside the Bank of England’s 2.0% target. Transport prices declined further to -2.1% from -1.8% in June, pressured by the drop in fuel prices. There were also notable downward effects from food and non-alcoholic beverages to 14.8% from 17.3%, furniture and household goods to 6.2% from 6.5%, recreation and culture from 6.5% to 6.7%, and miscellaneous goods and services from 6.0% to 6.5%. On a monthly basis, consumer prices fell by 0.4%, the first decline since January. The Bank of England is expected to continue raising interest rates in order to bring inflation back to target.

- Euro area inflation was confirmed at 5.3% in July 2023, the lowest since January 2022. This is mainly due to a further decline in energy prices, which fell by 6.1% in the month, while inflation for non-energy industrial goods slowed. However, service inflation accelerated to 5.6%, the highest level since March 2022. Core inflation, which excludes energy, food, alcohol, and tobacco, was unchanged at 5.5%. This is the first time that core inflation has been higher than the headline rate since 2021. Compared to June, the CPI in the Euro Area declined by 0.1%. The European Central Bank (ECB) targets inflation at 2%. The latest inflation figures suggest that the European Central Bank is still some way off achieving its target, but the decline in energy prices is a positive sign.

- The European Central Bank (ECB) raised interest rates for the ninth time in a row, by 25 basis points bringing the benchmark rate to 4.25%, the highest level since 2008. The bank expects inflation to remain elevated despite recent declines and will continue to raise rates until inflation returns to its 2% target. The ECB’s decision to raise rates is likely to have a dampening effect on economic growth, but the bank is committed to following a data-dependent approach while maintaining rates at sufficiently restrictive levels.

Get future reports

Please provide your details below to get future reports: