Foreign Exchange Reserves

The CBK’s usable foreign exchange reserves remained adequate at USD 7,372 million (4.20 months of import cover). This meets CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover. However, it does not meet EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar and the Euro but gained against the Sterling Pound to exchange at Ksh 120.41, Ksh 120.33 and Ksh 136.69 respectively. The observed overall depreciation against the Dollar is attributable to increased Dollar demand from energy and commodity importers.

| YTD Change | W-o-W Change | |

|---|---|---|

| Dollar | 6.43% | 0.08% |

| Euro | -6.06% | 0.19% |

| Sterling Pound | -10.27% | -1.49% |

Liquidity

Liquidity in the money markets decreased, partly reflecting tax remittances which offset government payments. Remittances inflows in August declined by 0.8% from August 2021 to USD 310.5 million, bringing the cumulative inflows for the twelve months to August to USD 3,992 million. Open market operations remained active.

| Week (previous) | Week (ending) | |

|---|---|---|

| Interbank rate | 4.3% | 4.0% |

| Interbank volume (billion) | 13.5 | 27.3 |

| Commercial banks’ excess reserves (billion) | 42.8 | 20 |

Fixed Income

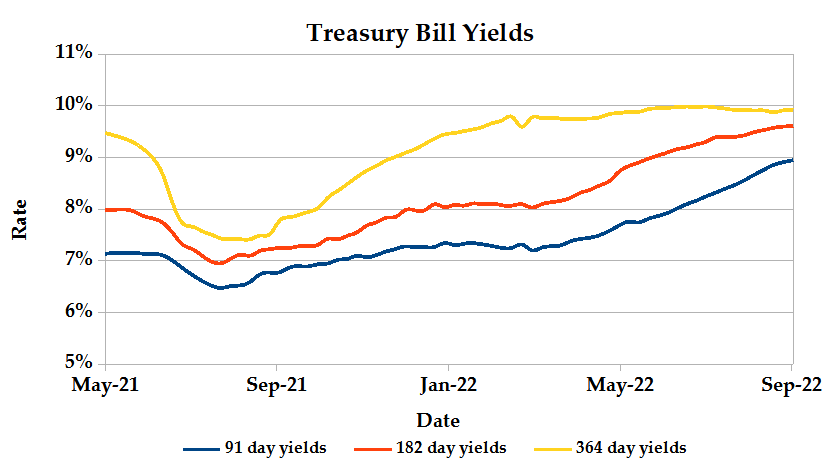

T-Bills

T-Bills were under-subscribed during the week with a decrease in the overall subscription rate from 152.99% recorded in the previous week to 97.02%. The 91-day T-Bill got the highest subscription rate at 248.4% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 113.9% and 19.6% respectively. The acceptance rate decreased by 1.54% to close the week at 74.59%.

T-Bonds

The bonds market had a lower demand for the week’s bond offers. Bonds turnover decreased by 66.52% from 22.5B in the previous week to 7.5B. Total bond deals decreased by 33.75% from 537 in the previous week to 345.

Eurobonds

In the international market, the yields on the 10-year Eurobonds for Angola and Ghana decreased. Yields on Kenya’s Eurobonds generally decreased by 0.37% compared to the previous week, -1.37% and 5.81% month to date and year to date respectively. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 7.54% | -3.28% | -1.23% |

| 2018 10-Year Issue | 6.43% | -0.98% | -0.24% |

| 2018 30-Year Issue | 3.75% | -0.66% | 0.04% |

| 2019 7-Year Issue | 7.16% | -1.78% | -0.57% |

| 2019 12-Year Issue | 5.68% | -0.81% | -0.11% |

| 2021 12-Year Issue | 4.28% | -0.71% | -0.10% |

Equities

NASI, NSE 20 and NSE 25 decreased by 6.57%, 2.22% and 5.49% compared to last week bringing the year to date performance to -20.8%, -8.70% and -16.03% respectively. The market capitalization decreased by 6.58% from the previous week to close at 2.062 trillion recording a year to date decline of -20.77%. The performance was driven by losses recorded by large-cap stocks. Top losses were recorded in Safaricom plc, KCB group, East Africa Breweries and Equity Group Holdings which declined by 11.20%, 8.65%, 7.79% and 3.38% respectively.

The Banking sector had shares worth Ksh 943M transacted which accounted for 33.90% of the week’s traded value, Manufacturing & Allied sector had shares worth Ksh 142M transacted which represented 5.09% and Safaricom, with shares worth Kshs 1.39B transacted represented 49.93% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Kenya Power | 13.22% | 23.13% |

| Car & General | 19.27% | 12.21% |

| NBV | -38.91% | 8.10% |

| Longhorn | -7.47% | 8.05% |

| Kakuzi | 1.30% | 5.98% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| Standard Group | -11.44% | -16.08% |

| Limuru Tea | 37.81% | -13.53% |

| EA portland | 4.31% | -11.26% |

| Safaricom Plc | -30.41% | -9.23% |

| BOC Kenya | 11.43% | -8.24% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 2.83 | 6.34 | 123.87% |

| Derivatives Contracts | 34 | 38 | 11.76% |

| I-REIT Turnover | 0.14 | 0.49 | 257.05% |

| I-REIT Deals | 38 | 48 | 26.32% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | -19.25% | -4.77% |

| Dow Jones Industrial Average (DJI) | -15.75% | -4.14% |

| FTSE 100 (FTSE) | -3.58% | -1.56% |

| STOXX Europe 600 | -16.68% | -2.89% |

| Shanghai Composite (SSEC) | -13.93% | -4.16% |

| MSCI Emerging Markets | -23.46% | -2.70% |

| MSCI World Index | -20.74% | -1.38% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -24.89% | -2.54% |

| JSE All Share | -10.46% | -3.40% |

| NSE All Share (NGSE) | 14.99% | -0.44% |

| DSEI (Tanzania) | -1.28% | -2.41% |

| ALSIUG (Uganda) | -10.40% | -1.96% |

US stocks closed the week lower, as investors brace for next week’s Federal Reserve decision on interest rates. FedEx Corporation shared dropped by 22% after reporting a weak outlook, thus increasing the fears of an economic slowdown. The central bank is also expected to raise its benchmark rate by 0.75%, amid optimism among consumers according to the Michigan consumer sentiment index which increased to 59.5 from 58.2.

European stocks closed the week lower as well, on renewed fears that aggressive monetary tightening will result in global recession. Warnings of an impending global recession by the World Bank and IMF may lead to stagflation, a period of low growth and high inflation. Additionally, Eurozone’s CPI data for August is expected to rise by 0.5% on the month.

Asia Pacific stocks closed the week lower, amid growing expectations of hawkish moves by the Federal Reserve and fears of global recession. Losses in real estate stocks also led the indices lower, after data showed Chinese house prices fell at their worst in seven years. The stocks are expected to lose further, amid growing concerns over economic growth in the country.

On the global commodities markets, Crude Oil WTI closed the week lower by 0.94% and the ICE Brent Crude decreased by 0.91%. Gold futures prices decreased by 2.61% to settle at $1,683.50.

Week’s Highlights

- The Energy and Petroleum Regulatory Authority (EPRA) revised upwards the prices of super petrol, diesel and kerosene which will retail at Ksh 179.30, Ksh 165 and Ksh 147.94 per litre. Respectively. The prices include the 8% Value Added Tax in line with the Finance Act.This is after the removal of fuel subsidies that have been cushioning consumers from the high cost of fuel, amid pressure from the IMF. The scrapping off of the subsidy has saved an estimated Kshs9.49 billion.

- Kenya’s current account deficit narrowed to 5.1% attributable to lower oil imports and improved inflows from tourism and diaspora remittances. Data from the Central Bank of Kenya showed diaspora remittances were up by 13% compared to 2021 boosting the current account. Global shipping prices and the cost of goods has also gone up adding to the total cost of bringing imports into the country.

- The Treasury missed its target in the domestic market monthly bond sale falling Ksh 11 billion short as the Central Bank continued to spurn expensive bids from investors. The two 10 and 15-year papers sold earlier this year sought to raise Ksh 50 billion but only raised sh 39 billion. This under-performance means the government remains below target in its borrowing program for the current fiscal year, a time when securing money from the international market remains a struggle due to high rate demands by external lenders.

- The World Bank is calling on governments to help boost supply to ease the constraints behind rising prices as it warns of a global recession amidst simultaneous rate hikes urging policy makers to shift their focus from reducing consumption to boosting production. Inflation has been on the rise due to supply constraints amid high demand as countries emerged from the pandemic worsening this year as a result of the Russian- Ukraine war and Covid-19 lockdowns in China.

- According to the Insurance Regulatory Authority (IRA), paid insurance claims rose by 5.8% to stand a 1.8 million in Q’2 2022 compared to 1.7 million claims paid in Q’2 2021.

- US inflation fell to 8.3% in August down from 8.5% in July marking a second month of decline. However, the cost of food, housing and medical care continued to surge standing at 13.5%, 6.2% and 5.6% respectively. Policy makers at the Federal Reserve have been raising interest rates to tackle inflation.

Get future reports

Please provide your details below to get future reports: