Foreign Exchange Reserves

The CBK’s usable foreign exchange reserves stood at USD 7,075 million (3.96 months of import cover). This falls below CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover as well as EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Euro and the Sterling Pound to exchange at KES 122.99, KES 130.63 and KES 151.81 respectively. The observed depreciation against the Dollar is attributable to increased Dollar demand from energy and commodity importers.

| YTD Change | W-o-W Change | |

|---|---|---|

| Dollar | 8.71% | 0.16% |

| Euro | 1.98% | 1.18% |

| Sterling Pound | -0.34% | 1.41% |

Liquidity

Liquidity in the money markets increased with the average interbank rate down to 5.10% from 5.25%, as government payments offset tax remittances. Open market operations remained active.

| Week (previous) | Week (ending) | |

|---|---|---|

| Interbank rate | 5.25% | 5.10% |

| Interbank volume (billion) | 19.35 | 23.67 |

| Commercial banks’ excess reserves (billion) | 14.50 | 13.00 |

Fixed Income

T-Bills

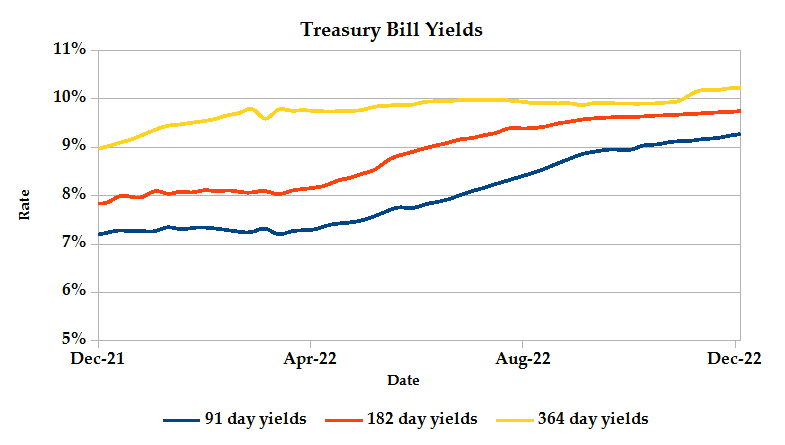

T-Bills were over-subscribed during the week, with the overall subscription rate picking up to 121.75% from 97.05% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 487.75% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 67.21% and 29.90% respectively. The acceptance rate declined by 27.20% to close the week at 59.59%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 24.94% from KES 12.13B in the previous week to KES 15.15B. Total bond deals rose by 9.07% from 562 in the previous week to 613.

In the primary bond market, CBK reopened three bonds seeking to raise KES 70.0 billion. These include a tap sale of the infrastructure switch bond IFB1/2022/006 which targets KES 20.0 billion at an average yield of 13.22% determined in the first auction. KES 50.0 billion is to be raised from FXD1/2020/005 and FXD1/2022/015 with effective tenors of 2.4 years and 14.3 years and coupon rates of 11.67% and 13.94% respectively.

Eurobonds

In the international market, yields on Kenya’s Eurobonds rose by an average 0.09% compared to the previous week, 0.22% month to date and 4.32% year to date. The yields on the 10-year Eurobond for Ghana and Angola declined. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 8.16% | 1.00% | 0.27% |

| 2018 10-Year Issue | 4.08% | 0.02% | 0.01% |

| 2018 30-Year Issue | 2.49% | -0.05% | -0.02% |

| 2019 7-Year Issue | 4.79% | 0.13% | 0.11% |

| 2019 12-Year Issue | 3.58% | 0.10% | 0.10% |

| 2021 12-Year Issue | 2.84% | 0.10% | 0.05% |

Equities

NASI, NSE 20 and NSE 25 gained 1.61%, 0.39% and 1.20% compared to the previous week bringing the year to date performance to -23.11%, -13.66% and -16.82% respectively. Market capitalization picked up 1.61% from the previous week to close at KES 2.00 trillion recording a year to date decline of 23.09%. The performance was driven by gains recorded by large-cap stocks such as Safaricom, ABSA and Equity of 2.67%, 1.25% and 1.11% respectively. These were weighed down by losses recorded by Standard Chartered, Co-operative and EABL of 4.79%, 0.83% and 0.60%.

The Banking sector had shares worth KES 342M transacted which accounted for 39.76% of the week’s traded value, Manufacturing & Allied sector had shares worth KES 228M transacted which represented 26.58% and Safaricom, with shares worth KES 250M transacted represented 29.05% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Liberty | -19.55% | 27.07% |

| Sanlam | -16.88% | 7.87% |

| Eveready | -29.52% | 7.25% |

| Trans-Century | -30.00% | 6.33% |

| Home Afrika | -12.50% | 6.06% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| TP Serena | -27.87% | -10.93% |

| Total | -6.53% | -8.76% |

| Fahari I-REIT | -5.30% | -8.43% |

| EA Portland | 4.62% | -7.86% |

| NBV | -43.31% | -6.94% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 1.32 | 6.48 | 390.38% |

| Derivatives Contracts | 29 | 12 | -58.62% |

| I-REIT Turnover | 0.41 | 2.02 | 393.95% |

| I-REIT Deals | 36 | 59 | 63.89% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | -19.68% | -2.08% |

| Dow Jones Industrial Average (DJI) | -10.02% | -1.66% |

| FTSE 100 (FTSE) | -2.31% | -1.93% |

| STOXX Europe 600 | -13.32% | -3.28% |

| Shanghai Composite (SSEC) | -12.79% | -1.22% |

| MSCI Emerging Markets | -22.39% | -2.14% |

| MSCI World Index | -19.60% | -2.13% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -21.61% | 1.32% |

| JSE All Share | -0.19% | -2.13% |

| NSE All Share (NGSE) | 14.62% | 0.89% |

| DSEI (Tanzania) | -1.77% | -0.25% |

| ALSIUG (Uganda) | -13.54% | 1.32% |

Major US indices pared losses as recession concerns continue to mount after Fed Chair confirmed more rate hikes in 2023. Almost all sectors receded (with the highest drop recorded by real estate stocks of 2.96%) with the exception of energy stocks which were supported by a rebound in oil prices. Utility stocks also lagged, following a slower than expected December Manufacturing PMI.

European stocks traded lower with investor sentiment hit by the hawkish comments by ECB President as she reported on the monetary policy decision during the week that signaled further tightening. Healthcare stocks weighed on both FTSE 100 and the STOXX 600, industrials slid 4.8% followed by rate-sensitive technology stocks which fell 2.5%. The export-heavy FTSE 100 was however supported by stronger commodity prices and a weaker Sterling Pound.

Asia Pacific indices recorded weekly declines led by technology stocks which suffered a setback from the US government’s directive to add more firms to the trade blacklist on semiconductors. Japan’s Nikkei 225 reflected industrial stocks’ under performance after PMI data indicated that the country’s manufacturing sector shrank more than expected in December.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 4.13% and 3.86% higher at $74.45 and $79.04 respectively. Gold futures prices settled 0.58% lower at $1,800.20.

Week’s Highlights

- Energy and Petroleum Regulatory Authority (EPRA) released the monthly statement on maximum retail prices of petroleum products which will be in force from 15th December 2022 to 14th January 2023. Pump prices remained unchanged at KES 177.30 per litre for Super Petrol, KES 162.00 per litre for Diesel and KES 145.94 per litre for Kerosene. Electricity prices, on the other hand have risen, with the price of buying an electricity token up 16.8% in December. Prices are expected to remain elevated owing to the end of the 15% cut put in place in January 2022. The subsidy on Kerosene has been maintained at KES 25.07 per litre while the price of Diesel has been cross-subsidized with that of Super Petrol.

- Fitch Ratings has downgraded Kenya’s Issuer Default Rating (IDR) to ‘B’ from ‘B+’, while maintaining a Stable Outlook, supported by IMF’s $2.3 billion 38-month programme aimed at reducing the country’s debt vulnerabilities. The downgrade was associated with the country’s relatively high debt and debt service obligations in the 2023/2024 financial year with the maturity of the $2 billion Eurobond in June 2024, challenges in financing externally due to high costs and constrained liquidity.

- Negotiations are on-going with the East African Community Secretariat for NSE to join Phase 2 of the World Bank’s $26.18 million flagship project, East Africa Capital Markets Infrastructure (CMI) project. The project comprises 6 components; integration of market infrastructure, development of regional bond market institutions, project management, financial inclusion and strengthening of market participants, harmonization of financial laws and regulations and mutual recognition of supervisory agencies. Uganda, Rwanda and Tanzania are already incorporated into CMI’s trading system that aims to connect the region’s stock markets electronically to operate in real time, reducing costs and trading time.

- Scope Markets Kenya has been admitted as a Trading Member of the NSE NEXT Derivatives Market, becoming the second non-dealing online foreign exchange-trading market participant, joining eight other active derivative brokers.

- US Consumer Price Index rose by 7.1% in November 2022, a slower pace compared to 7.7% in October, mainly on the back of falling energy prices with the index comprising gas prices, fuel and energy commodities declining by 1.6% over the month and a softer rise in food prices.

- The Federal Open Market Committee voted to raise primary credit rate by 50 basis points, lifting the targeted policy rate to the 4.25%-4.50% range, marking a pivot to the 75bps hikes. Fed Reserve Chair, however assured of more hikes throughout 2023, noting that rates are expected to rise to the 5.00%-5.25% range as long as inflation remains above the 2% target.

- Bank of England and European Central Bank (ECB) both followed the Fed’s lead in easing the pace of interest rate hikes and delivered a 50bps increase, stressing the need for significant tightening ahead.

- EU statistics office, Eurostat released November CPI report, indicating annual inflation of 10.1% for the euro area, down from 10.6% in October and 11.1% down from 11.5% in October for the European Union. The highest contribution to euro area inflation came from energy which recorded a 3.82% rise, followed by food, alcohol & tobacco of 2.84%, services at 1.76% and non-energy industrial goods which was steady at 1.63%.

Get future reports

Please provide your details below to get future reports: