Foreign Exchange Reserves

The usable foreign exchange reserves decreased by 0.33% to USD 7,316 million (3.80 months of import cover). This was below the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover and EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar but depreciated against the Sterling Pound and the Euro to exchange at KES 129.14, KES 166.32 and KES 141.85 respectively. The observed appreciation against the Dollar is attributed to increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.74% | -0.08% |

| Sterling Pound | -16.78% | 0.90% |

| Euro | -18.31% | 0.51% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 13.14% to 12.87%, as government payments more than offset tax remittances. Remittance inflows totaled $414.30 million in July 2024, a 11.49% increase from $371.59 million in June 2024 and a 9.57% rise from $371.59 million in July 2023. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 13.14% | 12.87% |

| Interbank volume (billion) | 33.69 | 25.92 |

| Commercial banks’ excess reserves (billion) | 14.00 | 10.80 |

Fixed Income

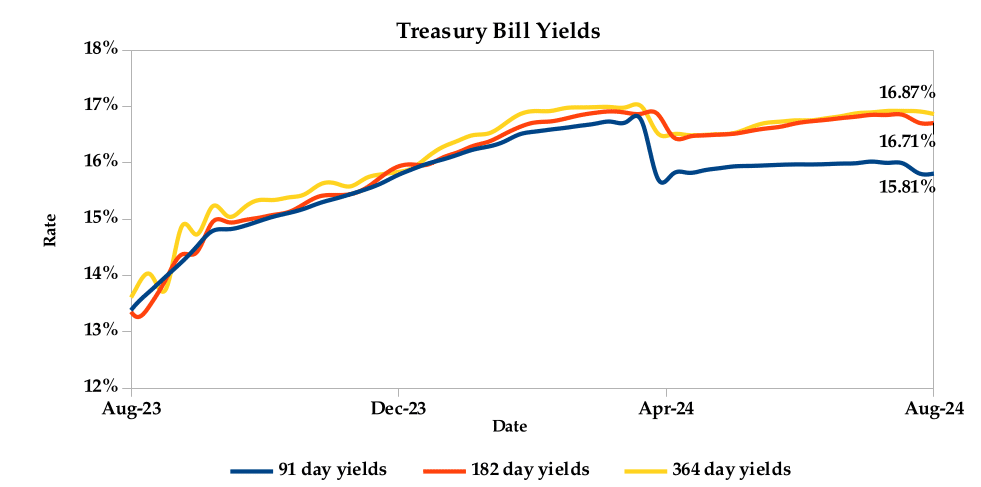

T-Bills

T-Bills remained over-subscribed during the week, with the overall subscription rate decreasing to 107.25%, down from 163.74% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 262.93%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 110.39% and 41.85% respectively. The acceptance rate increased by 13.94% to close the week at 99.53%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 34.11%, from KES 10.53 billion in the previous week to KES 6.93 billion. Total bond deals decreased by 27.75% from 436 in the previous week to 315.

In the primary bond market, CBK released auction results for the reopened IFB1/2023/6.5 and IFB1/2023/017 which sought to raise KES 50.0 billion. The issues received bids worth KES 126.32 billion, representing a subscription rate of 342.06%. Of these, KES 88.69 billion worth of bids were accepted at weighted average rates of 18.30% and 17.73% respectively.

Eurobonds

In the international market, yields on Kenya’s Eurobonds decreased by an average of 0.69% compared to the previous week, by 0.02% month-to-date and increased by 0.80% year-to-date.The yield on the 10- year Eurobond for Angola declined while for Zambia increased . Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | 0.80% | 0.13% | -0.69% |

| 2018 30-Year Issue | 0.78% | -0.04% | -0.53% |

| 2019 7-Year Issue | 0.26% | -0.01% | -0.81% |

| 2019 12-Year Issue | 0.94% | -0.08% | -0.68% |

| 2021 13-Year Issue | 1.17% | -0.12% | -0.74% |

| 2024 6-Year Issue | 0.85% | -0.02% | -0.68% |

Equities

NASI, NSE 20, and NSE 25 settled 0.40%, 0.62%, 0.21% higher while NSE 10 settled 0.01% lower compared to the previous week, bringing the year-to-date performance to 11.42%, 8.95%, 14.79% and 16.60% respectively. Market capitalization also gained 0.40% from the previous week to close at KES 1.60 trillion, recording a year-to-date increase of 11.41%. The performance was driven by gains recorded by large-cap stocks such as Co-operative Bank, Standard Chartered, ABSA and Safaricom of 1.19%, 0.53%, 0.36% and 0.34% respectively. This was however weighed down by the losses recorded by NCBA and EABL of 1.14% and 0.66% respectively.

The Banking sector had shares worth KES 283M transacted which accounted for 36.00% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 66M transacted which represented 8.00% and Safaricom, with shares worth KES 352M transacted, represented 45.00% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Liberty | 38.34% | 9.65% |

| Standard Group | -24.29% | 8.92% |

| Sanlam | 1.67% | 8.54% |

| Olympia | -13.46% | 8.43% |

| Jubilee | -11.35% | 7.54% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| TP Serena | -16.92% | -10.00% |

| NBV | -18.70% | -8.26% |

| Eaagads | 0.78% | -7.86% |

| EA Portland | -15.50% | -7.40% |

| Longhorn | -10.37% | -6.49% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 1.39 | 2.77 | 99.53% |

| Derivatives Contracts | 19.00 | 5.00 | -73.68% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 17.11% | 3.93% |

| Dow Jones Industrial Average (DJI) | 7.81% | 2.94% |

| FTSE 100 (FTSE) | 7.64% | 1.75% |

| STOXX Europe 600 | 6.88% | 2.46% |

| Shanghai Composite (SSEC) | -2.80% | 0.60% |

| MSCI Emerging Markets Index | 6.73% | 0.62% |

| MSCI World Index | 13.09% | 3.96% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 380.14% | 1.30% |

| JSE All Share | 9.18% | 2.68% |

| NSE All Share (NGSE) | 27.78% | -1.53% |

| DSEI (Tanzania) | 17.96% | 0.97% |

| ALSIUG (Uganda) | 17.16% | 1.16% |

Global and Continental Markets

The US stock market posted gains during the week, fueled by positive economic data including robust retail sales and easing inflation.

European stocks closed the week on an upward trajectory, as lower concerns of a US recession boosted demand for riskier assets. Additionally, positive UK economic data bolstered investor sentiment, with retail sales rising in line with market expectations.

Asian stock markets closed the week on a positive note, as investors weighed the mixed signals from the Chinese economy. While retail sales outperformed expectations, industrial production and fixed asset investment lagged. Unemployment increased and new home prices declined.

Week’s Highlights

- The National Treasury gazetted the actual revenues and net expenditures for the first month of the financial year 2024/25, ending 31st July 2024. Total revenue collected stood at KES 173.22 billion, representing 5.94% of the original KES 2.92 trillion estimate. This falls short of the projected KES 243.10 billion for the period. Total expenditure reached KES 181.51 billion, accounting for 4.20% of the original estimate. The resulting deficit was primarily financed by domestic borrowing of KES 13.15 billion. The National Assembly’s Departmental Committees and Budget & Appropriations Committee are currently reviewing Supplementary Estimates aimed at aligning with the Revised Fiscal Framework and implementing expenditure cuts.

- The Energy and Petroleum Regulatory Authority (EPRA) released its latest monthly statement on the maximum retail prices of petroleum products, effective 15th August 2024 to 14th September 2024. The pump prices of super petrol, diesel and kerosene remained unchanged at KES 188.84, KES 171.60 and KES 161.75 respectively. This marks the first time fuel prices have remained constant this year, despite the Kenyan Shilling strengthening against the US Dollar.

- The Co-operative Bank of Kenya has been promoted to the MSCI Frontier Markets Index. This significant achievement places the bank alongside other leading Kenyan companies on the global index. The upgrade, announced by Morgan Stanley Capital International (MSCI), will enhance the bank’s visibility to international investors. Additionally, four other Kenyan companies such as British American Tobacco, Diamond Trust Bank, KenGen and Kenya Reinsurance Company have been included in the MSCI Frontier Markets Small Cap Indexes. These changes will take effect from 30th August 2024.

- 5 US annual inflation continued its downward trend in July 2024, decelerating to 2.9%. This marks the lowest level since March 2021, representing a cooling of price pressures from the previous month’s 3% rate. Key factors contributing to this moderation include decrease in costs for shelter, transportation and apparel. Additionally, the ongoing decline in new and used vehicle prices helped to taper overall inflation. While food prices remained relatively stable, energy costs experienced a slight uptick. On a month-over-month basis, the Consumer Price Index (CPI) increased by 0.2%, primarily driven by a 0.4% rise in shelter costs. Core inflation, excluding volatile food and energy prices, also continued its downward trajectory, reaching 3.2% in July.

- UK’s annual inflation rate increased slightly to 2.2% in July 2024, from 2% in June. This is below market expectations of 2.3%. While overall inflation was subdued, certain components contributed to the uptick. Prices for housing, household services, clothing, footwear, communication and miscellaneous goods and services rose faster than in the previous month. However, the rate of increase for food, education, and some services, such as restaurants, hotels and transport, slowed down. The easing in energy price declines compared to the previous month also contributed to the overall inflation figure. Core inflation, which excludes volatile food and energy prices, eased to 3.3% from 3.5%, below forecasts. On a month-on- month basis, the Consumer Price Index (CPI) edged down by 0.2%

- The Euro Area economy maintained its growth trajectory in the second quarter of 2024, expanding by 0.3% compared to the previous quarter. This figure aligns with the preliminary estimate and marks a continuation of the growth pace observed in the first quarter. Several key economies including France, Italy and Spain contributed to the overall expansion. Other countries such as Ireland, Lithuania and Cyprus demonstrated robust growth rates. However, Germany, the Euro Area’s largest economy, unexpectedly contracted by 0.1% due to ongoing challenges in the industrial sector. On an annualized basis, the Euro Area economy expanded by 0.6%, marking the strongest growth in five quarters. The European Commission forecasts continued economic growth of 0.8% for the entire year, following a period of stagnation in 2023.

Get future reports

Please provide your details below to get future reports: