Foreign Exchange Reserves

The usable foreign exchange reserves decreased by 0.50% to USD 9,276 million (4.8 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, but appreciated against the Sterling Pound and the Euro to exchange at KES 129.35, KES 163.95 and KES 136.35 respectively. The observed depreciation against the Dollar is attributed to a surge in demand for USD.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.61% | 0.11% |

| Sterling Pound | -17.96% | -2.15% |

| Euro | -21.48% | -2.15% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 12.08% to 12.00%, as government payments more than offset tax remittances. Remittance inflows totaled $437.18 million in October 2024, a 4.46% increase from $418.50 million in September 2024 and a 22.93% rise from $355.62 million in October 2023. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.08% | 12.00% |

| Interbank volume (billion) | 55.18 | 21.74 |

| Commercial banks’ excess reserves (billion) | 41.10 | 44.90 |

Fixed Income

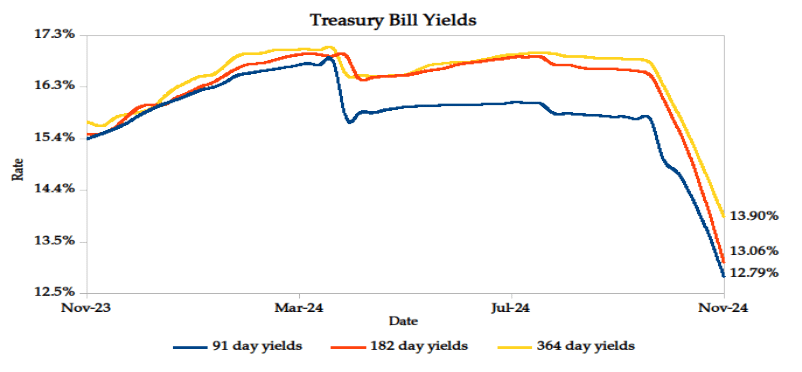

T-Bills

T-Bills remained over-subscribed during the week, with the overall subscription rate decreasing to 398.08% from 409.89% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 759.70%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 323.33% and 328.18% respectively. The acceptance rate decreased by 17.61% to close the week at 45.01%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 99.67% from KES 26.17 billion in the previous week to KES 90 million. Total bond deals increased by 6.10% from 525 in the previous week to 557.

In the primary bond market, CBK released auction results for the re-opened FXD1/2024/10 which sought to raise KES 20.0 billion. The issue received bids worth KES 55.58 billion, representing a subscription rate of 277.88%. Of these, KES 30.52 billion worth of bids were accepted at a weighted average rate of 15.86%.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.06% compared to the previous week, 0.03% month-to-date and declined by 0.52% year-to-date. The yield on the 10- year Eurobond for Angola increased while that of Zambia remained stable. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -0.99% | -0.03% | 0.05% |

| 2018 30-Year Issue | -0.05% | 0.02% | 0.05% |

| 2019 7-Year Issue | -2.02% | -0.06% | 0.01% |

| 2019 12-Year Issue | -0.05% | 0.01% | 0.06% |

| 2021 13-Year Issue | 0.21% | 0.04% | 0.08% |

| 2024 6-Year Issue | -0.21% | 0.18% | 0.13% |

Equities

NASI settled 0.50% lower, while NSE 20, NSE 25 and NSE 10 settled 0.14%, 0.25% and 0.08% higher compared to the previous week, bringing the year-to-date performance to 25.05%, 27.93%, 33.85% and 35.87% respectively. Market capitalization lost 0.51% from the previous week to close at KES 1.80 trillion, recording a year-to-date increase of 25.29%. The performance was driven by losses recorded by large-cap stocks such as EABL and Safaricom of 4.02% and 3.19% respectively. This was however mitigated by gains recorded by Equity, ABSA and Standard Chartered of 3.85%, 2.66% and 2.38%.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| E.A Portland | 434.38% | 21.45% |

| B.O.C | 8.54% | 9.88% |

| Express | -6.76% | 9.52% |

| NBV | -6.50% | 6.98% |

| BK | 0.00% | 6.77% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| WPP | 1.83% | -15.59% |

| Kapchorua Tea | 4.07% | -9.87% |

| Standard Group | -30.23% | -9.40% |

| Kakuzi | 3.12% | -8.53% |

| Williamson Tea | -7.57% | -7.77% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 3.41 | 2.73 | -19.91% |

| Derivatives Contracts | 9.00 | 10.00 | 11.11% |

| I-REIT Turnover (million) | 600.00 | 0.00 | -100.00% |

| I-REIT deals | 1.00 | 0.00 | -100.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 23.78% | -2.08% |

| Dow Jones Industrial Average (DJI) | 15.19% | -1.24% |

| FTSE 100 (FTSE) | 4.43% | -0.11% |

| STOXX Europe 600 | 5.14% | -0.69% |

| Shanghai Composite (SSEC) | 12.44% | -3.52% |

| MSCI Emerging Markets Index | 5.89% | -4.46% |

| MSCI World Index | 17.08% | -2.13% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 3.90% | -0.35% |

| JSE All Share | 9.28% | -1.55% |

| NSE All Share (NGSE) | 28.6% | 0.50% |

| DSEI (Tanzania) | 24.81% | -0.87% |

| ALSIUG (Uganda) | 36.90% | 1.78% |

Global and Continental Markets

The US stock market closed the week in the red, as investors reduced their expectations for an interest rate cut by the Federal Reserve in December. The decline came after US retail sales rose by 0.4% in October, showing that consumer spending remains strong despite high interest rates. Additionally, import and export prices unexpectedly increased in October, reinforcing Fed Chair Jerome Powell’s recent comments suggesting the central bank was not in a hurry to lower rates.

European stock markets posted losses over the week, following disappointing data showing the UK economy contracted unexpectedly in September. Overall, the UK economy grew 0.1% in the third quarter, below forecasts, weighed down by a decline in manufacturing output.

Asian stock markets posted losses, as investors exercised increased caution over U.S. interest rate cuts, while investors digested mixed economic readings from Japan and China.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 4.77% and 3.83% lower at $67.02 and $71.04 respectively. Gold futures prices settled 4.63% lower at $2,570.10.

Week’s Highlights

- The Energy and Petroleum Regulatory Authority (EPRA) released its latest monthly statement on the maximum retail prices of petroleum products, effective 15th November 2024 to 14th December 2024. The pump prices of super petrol, diesel and kerosene remained unchanged at KES 180.66, KES 168.06 and KES 151.39 respectively.

- The National Treasury released Kenya’s 2024 Budget Review and Outlook Paper, highlighting the fiscal performance for FY 2023/2024 and the projections for FY2025/2026. The budget recorded a 12% increase to KES 3.6 trillion from KES 3.2 trillion. Total revenues collected increased by 14.3% to KES 2.9 trillion, due to an increased tax base. This however fell short of the target by KES 0.2 trillion. Government expenditure stood at KES 3.6 trillion against a target of KES 3.9 trillion. Recurrent expenditure amounted to KES 2.7 trillion, falling short of the target by KES 98.2 billion, development expenditure fell below the target of KES 669.3 billion to KES 546.4 billion and County Transfer & Contigency also fell below the target by KES 44.7 billion to KES 380.4 billion. Total net government borrowing increased by 6.2% to KES 818.3 billion, with 72.8% being net domestic borrowing.

- Assets under management in collective investment schemes (CIS) such as money market funds and fixed income funds hit an all time high of KES 316.4 billion in the period ending September 2024, according to a report by the Capital Markets Authority. This was a 25.4% increase from KES 254.06 billion in June 2024. Money market funds accounted for 62% of all assets under management in the period under review, while other funds took up the rest. During this period, four new unit trust schemes were approved, bringing the total to 54 approved collective investment schemes. They include: Mansa x Special CIS (initially Mansa x), Stanbic Unit Trust Scheme, Avorcap Unit Trust and Taifa Unit Trust.

- Actuarial Services E.A. Limited 1113 Kayahwe Rd, Off Galana Rd, Kilimani, P. O. Box 10472 – 00100 NAIROBI, KENYA Tel. +254 202 710 028 / Cell: +254 111 037 100 / +254 708 710 028 / +254 785 710 028 Office Email: info@actserv-africa.com Website: www.actserv.co.ke Co-operative Bank posted KES 19.2 billion profit after tax in the three months to September. This is a 4.4% increase compared to KES 18.4 billion in Q3 2023. The performance was mainly as a result of a 12.3% surge in net interest income to KES 36.9 billion and 10.8% increase in total operating income. Gross non performing loans (NPLS) also increased by 13.1% to KES 70 billion, weighing down the company’s profits.

- Foreign Direct Investments (FDI) into China declined 29.8% year-on-year to CNY 693.2 billion in the ten months to October 2024, with 11.6% of the total going into high-tech manufacturing industries. This is a softer decline than the 30.4% plunge recorded in the first nine months of the year, according to data from the Ministry of Commerce. Foreign investment in medical equipment & instrument manufacturing and computer & office equipment manufacturing soared by 61.7% and 48.8% respectively. Additionally, foreign investment in the technical services industry rose by 19.5%. The primary sources of FDI were Germany (7.5%), Australia (6%) and Singapore (4.4%).

- UK 10-year gilt yields increased to 4.5% after disappointing GDP data. UK’s economy expanded by 0.1% in the third quarter, falling short of forecasts, with a surprise contraction in September driven by lower manufacturing output and reduced activity in the information and communication sector. Growth in services and construction helped offset some of the decline in production. Earlier, data showed UK inflation easing and wage growth in the third quarter was at its slowest in two years, reinforcing the Bank of England’s (BoE) belief that inflation pressures are diminishing. The BoE recently cut interest rates for the second time since 2020, citing that the Labour government’s budget would boost both inflation and growth. However, persistent inflation has forced the BoE to act more cautiously compared to the US or Eurozone central banks.

- The European Commission’s Autumn 2024 forecast anticipates a 0.8% growth in the Euro Area for this year, the same as in the previous Spring forecast. For 2025, growth forecasts were revised lower to 1.3% from 1.4% and for 2026, the Eurozone economy is seen rising 1.6%. The German economy is now forecasted to shrink by 0.1% this year, a reversal from the 0.1% growth projected in the spring. Looking ahead, the German economy is expected to expand by 0.7% in 2025 and 1.3% in 2026. On the inflation front, notwithstanding a slight pick-up in October, largely driven by energy prices, headline inflation in the Euro Area is set to more than halve to 2.4% in 2024, from 5.4% in 2023, before easing more gradually to 2.1% in 2025 and 1.9% in 2026.

- Business inventories in the US increased 0.1% month-over-month in September 2024, slowing from a 0.3% rise in August and below forecasts of 0.2%. This marked a sixth consecutive increase in inventories, led by retailers (0.9% compared to 0.8% in August). On the other hand, inventories fell for manufacturers (-0.2% vs 0.1%) and merchant wholesalers (-0.2% vs 0.2%). Year-on-year, business inventories were up 2.2%.

- Manufacturing output in the US fell by 0.5% in October 2024, following a 0.3% decrease in September, matching expectations. Durable goods production dropped 1.2%, with notable declines across several sectors. However, production of non-durable goods slightly increased, attributable to gains in chemicals, paper and petroleum products, which outweighed declines in textiles, apparel, printing and plastics. Capacity utilization in manufacturing fell to 76.2%, 5 2.1 points below its long-term average. Compared to a year ago, manufacturing output declined by 0.3%.

Get future reports

Please provide your details below to get future reports: