Foreign Exchange Reserves

The usable foreign exchange reserves increased by 0.44% to USD 7,012 million (3.70 months of import cover). This falls short of CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover as well as EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling appreciated against the Dollar, the Sterling Pound and the Euro to exchange at KES 128.66, KES 164.11 and KES 138.50 respectively. The observed appreciation against the Dollar is attributed to the increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -18.05% | -1.06% |

| Sterling Pound | -17.88% | -1.23% |

| Euro | -20.24% | -2.09% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 13.18% to 13.04%, as government payments more than offset tax remittances. Remittance inflows totaled $404.4 million in May 2024, a 1.79% increase from $397.30 million in April 2024 and a 14.9% rise compared to $352.1 million in May 2023. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 13.18% | 13.04% |

| Interbank volume (billion) | 30.13 | 19.62 |

| Commercial banks’ excess reserves (billion) | 12.60 | 8.16 |

Fixed Income

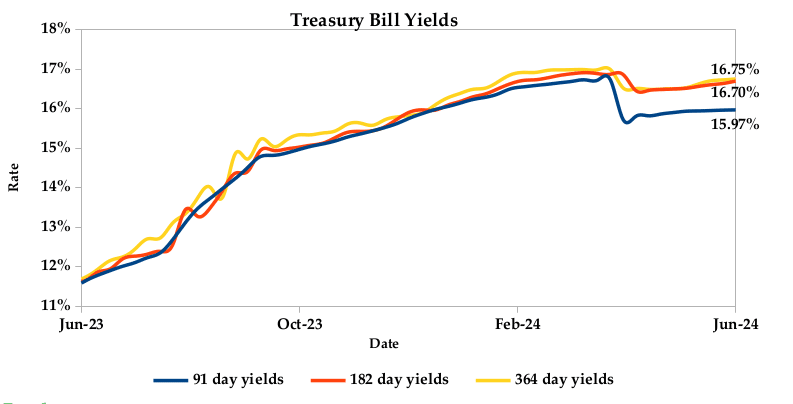

T-Bills

T-Bills were under-subscribed during the week, with the overall subscription rate decreasing to 94.66%, down from 150.98% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 257.15%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 99.31% and 25.02% respectively. The acceptance rate decreased marginally by 0.89% to close the week at 93.43%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 1.27%, from KES 20.60 billion in the previous week to KES 20.86 billion. Total bond deals decreased by 4.82% from 706 in the previous week to 672.

In the primary bond market, CBK released auction results for the re-opened 5-year FXD1/2023/005 and 10-year FXD1/2023/010 which sought to raise KES 30.0 billion. The issues received bids worth KES 41.56 billion, representing a subscription rate of 138.53%. Of these, KES 30.17 billion worth of bids were accepted at a weighted average rate of 18.16% and 16.39% respectively.

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.35% compared to the previous week, by 0.27% month-to-date and declined by 0.21% year-to-date. The yields on the 10-year Eurobonds for Angola and Zambia also increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -0.57% | 0.23% | 0.39% |

| 2018 30-Year Issue | 0.15% | 0.35% | 0.30% |

| 2019 7-Year Issue | -1.03% | 0.26% | 0.39% |

| 2019 12-Year Issue | 0.01% | 0.30% | 0.38% |

| 2021 13-Year Issue | 0.44% | 0.26% | 0.30% |

| 2024 6-Year Issue | -0.23% | 0.24% | 0.35% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 0.82%, 1.04%, 1.21% and 1.17% lower, compared to the previous week, bringing the year-to-date performance to 23.58%, 15.61%, 23.50% and 27.01% respectively. Market capitalization also lost 0.81% from the previous week to close at KES 1.78 trillion, recording a year-to-date increase of 23.59%. The performance was driven by losses recorded by large-cap stocks such as Co-operative Bank, KCB, EABL and NCBA of 2.90%, 2.74%, 2.74% and 2.63% respectively. This was however mitigated by the gain recorded by Standard Chartered of 4.63%.

The Banking sector had shares worth KES 515M transacted which accounted for 45.0% of the week’s traded value. Manufacturing & Allied had shares worth KES 29M transacted which represented 2.65% and Safaricom, with shares worth KES 462M transacted, represented 41.0% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Eveready | 21.19% | 22.22% |

| Kapchorua Tea | 17.91% | 9.74% |

| Trans-Century Plc | -5.77% | 8.89% |

| Kenya Re | 51.35% | 7.28% |

| Longhorn | 2.07% | 5.13% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| EA Portland | -19.50% | -15.71% |

| Olympia Capital | -17.43% | -15.36% |

| Unga Group | -22.26% | -11.49% |

| Eaagads | 0.39%- | 11.38% |

| Nation Media | -11.76% | -10.00% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 0.61 | 3.01 | 396.91% |

| Derivatives Contracts | 12.00 | 13.00 | 8.33% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 14.52% | 1.58% |

| Dow Jones Industrial Average (DJI) | 2.32% | -0.54% |

| FTSE 100 (FTSE) | 5.51% | -1.19% |

| STOXX Europe 600 | 6.80% | -2.39% |

| Shanghai Composite (SSEC) | 2.37% | -0.61% |

| MSCI Emerging Markets Index | 5.10% | 0.35% |

| MSCI World Index | 10.19% | 0.38% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 284.54% | 2.20% |

| JSE All Share | 1.70% | -0.02% |

| NSE All Share (NGSE) | 31.50% | 0.71% |

| DSEI (Tanzania) | 15.26% | -0.46% |

| ALSIUG (Uganda) | 21.71% | -0.96% |

Global and Continental Markets

The US stock market recorded a mixed performance during the week, as elevated interest rates piled pressure on the US retail sector. The Federal Reserve had reiterated that it needs to see more evidence of easing inflation before lowering borrowing costs. Investor sentiment remained elevated in anticipation of growth in retail sales data.

European stocks recorded losses as a hawkish Federal Reserve raised concerns about the additional easing of monetary policy going forward. The Fed believes that fewer rate cuts are needed this year and expect the benchmark rate to fall to 5.1%, below the current range of 5.2% to 5.5%.

Asian stocks plunged this week, following the new European Union tariffs against the country’s major electric vehicle makers. Fears of retaliatory measures from Beijing also dampened sentiment.

Week’s Highlights

- The Energy and Petroleum Regulatory Authority (EPRA) released its latest monthly statement on the maximum retail prices of petroleum products, effective 15th June 2024 to 14th July 2024. The pump prices of super petrol decreased by KES 3.00 to KES 189.84 per litre, diesel decreased by KES 6.08 to KES 173.10 per litre and kerosene decreased by KES 5.71 to KES 163.05 per litre.

- According to the Fiscal Year (FY) 2024/2025 budget tabled in parliament by the National Treasury, effective from 1st July 2024 to 30th June 2025:

- Ordinary revenue projections increased by 13.23% to KES 2.91 trillion from KES 2.57 trillion in the previous FY. Overall expenditure was estimated at KES 3.92 trillion, a 5.08% decrease from the original estimate of KES 4.13 trillion in the previous FY. This decrease is supported by under-performance of revenues in FY 2023/2024 and rationalization of expenditures to sustainable levels aligning with the fiscal consolidation strategy.

- Fiscal deficit is projected at KES 514.7 billion (2.9% of GDP), compared to an actual deficit of KES 800.4 billion in FY 2022/2023 and a revised (II) estimate of KES 908.6 billion in FY 2023/2024. This significant reduction in deficit aligns with the government’s fiscal consolidation plan designed towards addressing rising debt without compromising service delivery. This will be achieved through broadening the revenue base and containing non- priority expenditures while enhancing social safety nets. Additionally, the Present Value of debt to GDP ratio is projected to progressively reduce towards the debt anchor of 55%.

- 5 The National Treasury gazetted the actual revenues and expenditure for the 11 months of the financial year 2023/24 ending 31st May. Total revenue collected during the month amounted KES 2.02 trillion, a 10.70% increase from the previous month but falling short of the 11-month prorated target by 14.17%. Total expenditure, which amounted to KES 3.26 trillion, exceeded revenue collection resulting in a KES 1.23 trillion deficit which was financed through external and internal borrowing by 43% and 57% respectively.

- The cabinet approved sale of the government’s stake in six listed companies: East African Portland Cement, Nairobi Securities Exchange, HF Group, Stanbic Holdings, Liberty Kenya Holdings and Eveready East Africa.

- The Federal Reserve, as anticipated, maintained its target interest rate range at 5.25%-5.50% during its June meeting. This marks the seventh consecutive meeting with no change, reflecting the Fed’s prioritization of curbing inflation. Policymakers remain cautious, indicating rate cuts are contingent upon inflation demonstrating a sustained return to the 2% target.

- US inflation unexpectedly further deceleration in to a three-month low of 3.3% in May 2024 compared to 3.4% in April and forecasts of 3.4%. The slowdown was broad-based, with easing observed in key categories like food, shelter (excluding energy), transportation and apparel. Notably, prices for new and used vehicles continued their downward trend. However, energy costs, particularly gasoline, rose at a faster pace compared to the previous month. Notably, core inflation, excluding volatile food and energy prices, also dipped to 3.4%, the lowest since April 2021.

- The Bank of Japan (BoJ) opted to hold its key short-term interest rate at 0.00%-0.10% at its June meeting, as anticipated by markets. This follows the historic rate hike in March, ending a period of negative rates since 2007. However, the BoJ signaled a potential shift in policy by indicating it will consider how to begin scaling back its massive bond purchasing program at the July meeting.

Get future reports

Please provide your details below to get future reports: