Foreign Exchange Reserves

The usable foreign exchange reserves increased by 3.21% to USD 7,744 million (4.0 months of import cover). This was within the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover but below EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, but appreciated the Sterling Pound and the Euro to exchange at KES 129.20, KES 169.85 and KES 143.20 respectively. The observed depreciation against the Dollar is attributed to high demand for the currency.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.70% | 0.01% |

| Sterling Pound | -15.01% | -0.23% |

| Euro | -17.54% | -0.29% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing marginally from 12.640% to 12.637%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.640% | 12.637% |

| Interbank volume (billion) | 28.66 | 35.12 |

| Commercial banks’ excess reserves (billion) | 16.40 | 13.80 |

Fixed Income

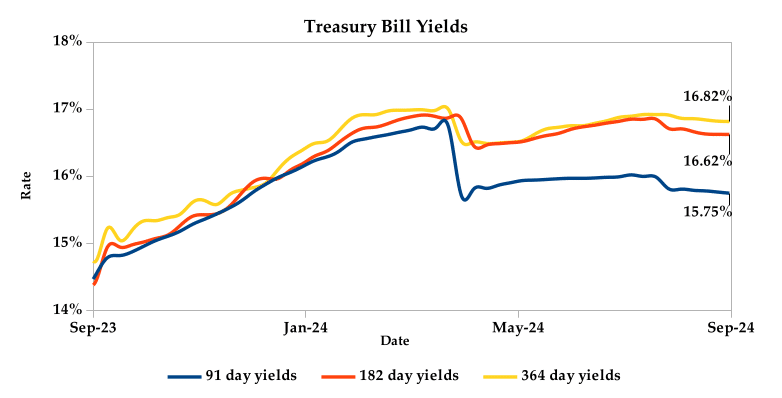

T-Bills

T-Bills were under-subscribed during the week, with the overall subscription rate decreasing to 89.10%, from 162.25% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 354.72%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 32.74% and 39.21% respectively. The acceptance rate decreased by 1.61% to close the week at 93.25%.

T-Bonds

In the secondary bond market, there was a higher demand for the week’s bond offers. Bond turnover increased by 4.05%, from KES 31.37 billion in the previous week to KES 32.64 billion. Total bond deals increased by 5.02% from 617 in the previous week to 648.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.24% compared to the previous week, by 0.35% month-to-date and declined by 0.62% year-to-date. The yields on the 10-year Eurobonds for Angola and Zambia also increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | 0.44% | 0.26% | 0.15% |

| 2018 30-Year Issue | 0.61% | 0.14% | 0.11% |

| 2019 7-Year Issue | 0.24% | 0.67% | 0.47% |

| 2019 12-Year Issue | 0.79% | 0.39% | 0.27% |

| 2021 13-Year Issue | 1.01% | 0.33% | 0.24% |

| 2024 6-Year Issue | 0.63% | 0.32% | 0.19% |

Equities

NASI and NSE 20 settled 0.69% and 0.41% higher, while NSE 25 and NSE 10 settled 0.18% and 0.19% lower compared to the previous week, bringing the year-to-date performance to 15.59%, 13.62%, 19.64% and 21.18% respectively. Market capitalization gained 0.69% from the previous week to close at KES 1.66 trillion, recording a year-to-date increase of 15.81%. The performance was driven by gains recorded by large-cap stocks such as Safaricom, ABSA, EABL and Standard Chartered of 3.38%, 0.71%, 0.50% and 0.48% respectively. This was however weighed down by the losses recorded by NCBA, KCB and Stanbic of 7.89%, 3.86% and 1.03% respectively.

The Banking sector had shares worth KES 714M transacted which accounted for 59.00% of the week’s traded value. Construction and Allied sector had shares worth KES 68M transacted which represented 5.00% and Safaricom, with shares worth KES 228M transacted, represented 19.00% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| E.A Portland | 52.50% | 30.62% |

| HF Group | 19.42% | 9.57% |

| Sanlam | 10.00% | 8.20% |

| Nation Media | -24.02% | 8.01% |

| Flame Tree | -3.51% | 7.84% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| NBV | -24.39% | -18.78% |

| Eveready | -10.17% | -10.17% |

| Carbacid | 44.33% | -9.98% |

| Car & General | -24.00% | -9.52% |

| Standard Group | 27.65% | -9.09% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 1.68 | 4.83 | 187.72% |

| Derivatives Contracts | 14.00 | 37.00 | 164.29% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 18.62% | 4.02% |

| Dow Jones Industrial Average (DJI) | 9.75% | 2.60% |

| FTSE 100 (FTSE) | 7.14% | 1.12% |

| STOXX Europe 600 | 7.82% | 1.85% |

| Shanghai Composite (SSEC) | -8.72% | -2.23% |

| MSCI Emerging Markets Index | 5.62% | 0.69% |

| MSCI World Index | 14.69% | 3.30% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 244.61% | 0.41% |

| JSE All Share | 7.25% | 0.67% |

| NSE All Share (NGSE) | 28.25% | 1.06% |

| DSEI (Tanzania) | 18.86% | -1.01% |

| ALSIUG (Uganda) | 22.07% | 0.48% |

Global and Continental Markets

US stock market closed the week in the green zone, buoyed by growing expectations of a larger interest rate cut at the upcoming Federal Reserve meeting. Mega-cap tech and semiconductor stocks led the charge, with notable gains by Super Micro Computer and ARM Holdings.

European stock markets closed the week on a positive note, boosted by strong performances in the Mining, Automobiles & Parts and Electronic & Electrical Equipment sectors. Additionally, increased clarity regarding the US Federal Reserve’s anticipated interest rate cut boosted investor sentiment.

Asian stock markets closed the week on a downward trajectory, primarily driven by weak Chinese economic data. Industrial output, retail sales and fixed investment all slowed more than expected.

Week’s Highlights

- The Energy and Petroleum Regulatory Authority (EPRA) released its latest monthly statement on the maximum retail prices of petroleum products, effective from 15th September 2024 to 14th October 2024. The pump prices of super petrol and diesel remained unchanged at KES 188.84 per litre and KES 171.60 per litre respectively, while the pump price of kerosene decreased by KES 3.43 to KES 158.32 per litre.

- The Nairobi Securities Exchange (NSE) has implemented a new requirement for listed companies to disclose a forward-looking calendar of corporate events. This calendar will outline key events such as earnings releases and dividend payment dates. The Capital Markets Authority (CMA) and NSE stated that the move aims to enhance transparency, improve communication between issuers and investors and boost market efficiency and investor confidence.

- The National Hospital Insurance Fund (NHIF) will officially transition to the Social Health Insurance Fund (SHIF) under the Social Health Authority (SHA) starting 1st October 2024. The last NHIF admission will be 30th September 2024. All payments made before 9th October 2024 will be credited to NHIF, while payments made after 9th October 2024 will be credited to the SHIF.

- Actuarial Services E.A. Limited 1113 Kayahwe Rd, Off Galana Rd, Kilimani, P. O. Box 10472 – 00100 NAIROBI, KENYA Tel. +254 202 710 028 / Cell: +254 111 037 100 / +254 708 710 028 / +254 785 710 028 Office Email: info@actserv-africa.com Website: www.actserv.co.ke 5 Nigerian global investments startup Rise has completed its second acquisition in less than a year, acquiring Kenyan stock trading platform Hisa. This strategic move allows Rise to expand its operations into the Kenyan market without the need for new regulatory approvals, given Hisa’s existing licenses. The acquisition aligns with Rise’s mission to increase investment opportunities for Africans and it’s expected to enhance Hisa’s reach and technological capabilities.

- China’s annual inflation rate increased to 0.6% in August from 0.5% in July but fell short of market expectations of 0.7%. This marked the highest level since February and the seventh consecutive month of consumer price increases. Food prices contributed to the rise, increasing for the first time since June 2023. Fresh vegetable prices rebounded sharply, leading to the fastest rate of increase in 19 months. Non-food prices however, rose at a slower pace, with softer increases in categories like clothing, housing, health and education. Transport costs declined due to lower oil prices, offsetting higher utility costs. Core consumer prices, excluding food and energy, rose at the slowest rate since March 2021. The CPI increased by 0.4% on a monthly basis, marking the second consecutive month of gains but below market forecasts.

- The European Central Bank (ECB) lowered its deposit facility rate by 25 basis points to 3.5% in September, easing its monetary policy stance. This decision reflected an updated inflation outlook and improved transmission of policy measures. The interest rates on the main refinancing operations and the marginal lending facility were also decreased by 3.65% and 3.90% respectively. Despite these adjustments, the ECB reiterated its commitment to achieving its 2% inflation target, emphasising a data-dependent approach and avoiding a predetermined rate path. Inflation projections for 2024, 2025 and 2026 remained consistent with previous forecasts at 2.5%, 2.2% and 1.9% respectively. However, the ECB anticipated a short-term uptick in inflation as the impact of lower energy prices diminishes from year-on- year comparisons.

- The US annual inflation rate decreased to 2.5% in August 2024 from 2.9% in July for the fifth consecutive month, reaching its lowest level since February 2021. Prices for energy, food and transportation fell, while shelter costs continued to rise. The Consumer Price Index (CPI) increased by 0.2% on a month-on-month basis, aligning with expectations, primarily attributed to shelter costs. Core inflation, excluding food and energy, remained steady at a three-year low but rose slightly on a monthly basis.

Get future reports

Please provide your details below to get future reports: