Foreign Exchange Reserves

The usable foreign exchange reserves increased by 0.67% to USD 9,029 million (4.6 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5- months of import cover.

Currency

The Kenyan Shilling remained stable against the Dollar, appreciated against the Euro, but depreciated against the Sterling Pound to exchange at KES 129.30, KES 136.08 and KES 165.12 respectively. The observed stabilisation of the Kenyan Shilling against the Dollar is attributed to increased foreign inflows.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.64% | 0.00% |

| Sterling Pound | -17.38% | 0.23% |

| Euro | -21.63% | -0.33% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 11.80% to 11.45%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 11.80% | 11.45% |

| Interbank volume (billion) | 43.16 | 54.36 |

| Commercial banks’ excess reserves (billion) | 24.00 | 22.90 |

Fixed Income

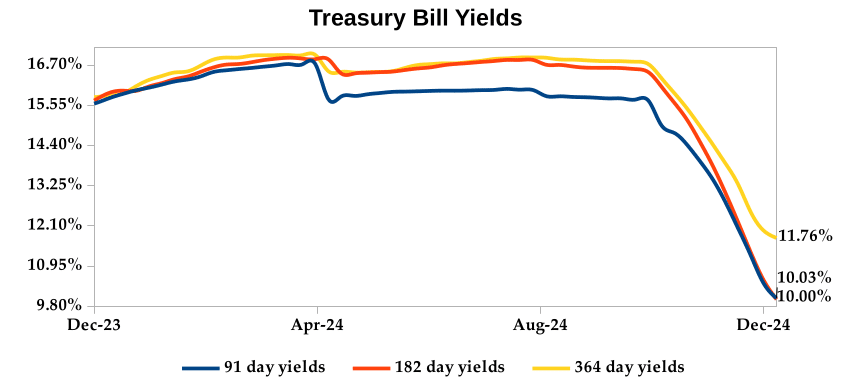

T-Bills

T-Bills were under-subscribed during the week, with the overall subscription rate decreasing to 69.17% from 176.31% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 146.21%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 30.85% and 76.69% respectively. The acceptance rate increased by 0.14% to close the week at 99.90%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 34.97% from KES 38.46 billion in the previous week to KES 25.01 billion. Total bond deals decreased by 34.13% from 668 in the previous week to 440.

In the primary bond market, CBK released auction results for the re-opened FXD1/2024/010 treasury bond which sought to raise KES 20.0 billion. The issue received bids worth KES 53.63 billion, representing a subscription rate of 268.14%. Of these, KES 43.45 billion worth of bids were accepted at a weighted average rate of 14.69%. Additionally, CBK re-issued FXD1/2018/015 and FXD1/2022/025 treasury bonds in an effort to raise KES 30.0 billion. The coupon rates are 12.65% and 14.19% respectively. The sale runs from 13/12/2024 to 15/01/2025.

Eurobonds

In the international market, yields on Kenya’s Eurobonds decreased by an average of 0.05% compared to the previous week, 0.29% month-to-date and 1.05% year-to-date. The yield on the 10- year Eurobond for Angola increased.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -1.64% | -0.26% | -0.04% |

| 2018 30-Year Issue | -0.43% | -0.22% | -0.06% |

| 2019 7-Year Issue | -2.64% | -0.27% | 0.01% |

| 2019 12-Year Issue | -0.57% | -0.33% | -0.08% |

| 2021 13-Year Issue | -0.23% | -0.28% | -0.07% |

| 2024 6-Year Issue | -0.81% | -0.37% | -0.09% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 3.36%, 2.69%, 3.37% and 3.93% higher compared to the previous week, bringing the year-to-date performance to 29.48%, 24.62%, 35.92% and 37.40% respectively. Market capitalization also gained 3.36% from the previous week to close at KES 1.86 trillion, recording a year-to-date increase of 29.73%. The performance was driven by gains recorded by large-cap stocks such as Equity, EABL and Safaricom of 5.73%, 4.65% and 4.62% respectively.

The Banking sector had shares worth KES 372M transacted which accounted for 18.00% of the week’s traded value. Manufacturing & Allied sector had shares worth KES 53M transacted which represented 2.70% and Safaricom, with shares worth KES 1B transacted, represented 72.00% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Kenya Power | 196.43% | 17.23% |

| BK Group | -3.52% | 13.22% |

| Eveready | -3.39% | 12.87% |

| Sanlam | -25.50% | 11.75% |

| Uchumi | 22.22% | 10.00% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Bamburi | 35.14% | -13.89% |

| NBV | -16.67% | -9.69% |

| Olympia | -5.20% | -8.82% |

| Liberty | 63.21% | -8.70% |

| Kapchurua Tea | 2.33% | -6.38% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 0.44 | 6.08 | 1,296.70% |

| Derivatives Contracts | 6.00 | 5.00 | -16.67% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 0.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 27.58% | -0.64% |

| Dow Jones Industrial Average (DJI) | 16.21% | -1.82% |

| FTSE 100 (FTSE) | 7.50% | -0.10% |

| STOXX Europe 600 | 7.93% | -0.77% |

| Shanghai Composite (SSEC) | 14.50% | 3.82% |

| MSCI Emerging Markets Index | 8.04% | 0.17% |

| MSCI World Index | 20.45% | 0.98% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 3.91% | -0.06% |

| JSE All Share | 13.19% | 0.15% |

| NSE All Share (NGSE) | 30.78% | 1.19% |

| DSEI (Tanzania) | 19.13% | -2.24% |

| ALSIUG (Uganda) | 32.00% | 1.51% |

Global and Continental Markets

The US stock market closed the week on a downword trajectory, as investors assesed the higher- than-expected inflation data. Notably, technology shares lead the decline.

European stock markets closed the week in the red zone, as investors digested the European Central Bank’s rate cut and revised economic forecasts. While the ECB lowered interest rates as expected, its cautious outlook and concerns about inflation weighed down the market sentiment.

Asian stock markets closed the week higher, buoyed by China’s announcement of a more accommodative monetary policy. The Politburo’s decision to adopt a “moderately loose” stance aims to stimulate economic growth and counter slowing momentum.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 6.09% and 4.74% higher at $71.29 and $74.49 respectively. Gold futures prices also settled 0.61% higher at $2,675.80.

Week’s Highlights

- The Energy and Petroleum Regulatory Authority (EPRA) released its latest monthly statement on the maximum retail prices of petroleum products, effective from 15th December 2024 to 14th January 2025. The pump price of super petrol decreased by KES 4.37 to KES 176.29 per litre, diesel decreased by KES 3.00 to KES 165.06 per litre and kerosene decreased by KES 3.00 to 148.39 per litre. This offers some relief to households during this festive season.

- The President has signed into law seven bills, including the Tax Laws (Amendment), Tax Procedures (Amendment), Business Laws (Amendment) and Kenya Revenue Authority (Amendment) Bills. Key changes include the introduction of a 6% Significant Economic Presence (SEP) tax on multinational firms, an increase in the mortgage interest deduction limit to KES 360,000 and excise duty exemptions for locally assembled electric vehicles. The Business Laws (Amendment) Bill raised banks’ core capital requirements to KES 10 billion and empowered the CBK to regulate non-deposit-taking lenders. Additionally, the Kenya Revenue Authority Act now allows the Commissioner-General to appoint Deputy Commissioners with board approval. These laws aim to streamline tax compliance, support local industries and strengthen financial regulation.

- The World Bank has revised its economic growth forecast for Kenya to 4.7% for 2024, from the initial estimate of 5%. This downward revision reflects the impact of severe floods, political unrest and tighter monetary policy. While the forecast remains above the Sub- Saharan Africa average, the World Bank has highlighted concerns about fiscal discipline, debt sustainability and the impact of high interest rates on private sector activity. To mitigate these risks and sustain economic growth, the government will need to prioritise revenue mobilisation, fiscal consolidation and prudent debt management.

- Actuarial Services E.A. Limited 1113 Kayahwe Rd, Off Galana Rd, Kilimani, P. O. Box 10472 – 00100 NAIROBI, KENYA Tel. +254 202 710 028 / Cell: +254 111 037 100 / +254 708 710 028 / +254 785 710 028 Office Email: info@actserv-africa.com Website: www.actserv.co.ke 5 Catalyst Fund, a Kenyan pre-seed accelerator, has secured over KES 33 million to join four other African venture capital firms in the 2025 phase of the Empowering Sustainable Entrepreneurship in Africa program, led by Village Capital and backed by the Norwegian Agency for Development Cooperation (NORAD). This program aims to support ecosystem builders who will, in turn, provide capital to 30 climate-focused startups across Sub-Saharan Africa. Village Capital, with a strong track record in the region, has supported over 120 startups and 78 Entrepreneur Support Organizations. By partnering with these ecosystem builders, Village Capital aims to address the funding gap in the climate-tech sector and empower entrepreneurs to develop scalable solutions to climate challenges.

- Sanlam Kenya has secured shareholder approval for a KES 3.25 billion rights issue to strengthen its balance sheet and reduce debt. The funds raised will be used to repay a loan from Stanbic Bank and provide additional working capital. Despite a challenging year, the company remains committed to its growth strategy and aims to improve profitability.

- The Eastern Africa Power Pool (EAPP) initiative has commenced trial operations for the 500- kilometer Tanzania-Kenya interconnection line, marking a significant step towards regional energy integration. This project facilitates electricity exchange between the two countries, bolstering energy security and accelerating the adoption of renewable energy sources. The EAPP aims to create a centralised market for energy producers, ensuring a stable and affordable power supply for the region.

- China’s annual inflation rate eased to 0.2% in November 2024, marking a significant decline from 0.3% the previous month and falling below market expectations of 0.5%. This was primarily driven by lower food prices, particularly for fresh vegetables and pork. While non- food prices remained stable, core inflation, excluding food and energy, edged up slightly. Monthly, consumer prices fell 0.6%, indicating a sharper decline than anticipated. Despite recent stimulus measures and accommodative monetary policy, China continues to grapple with weak domestic demand and global economic uncertainties.

- US inflation increased to 2.7% in November 2024 from 2.6% in October, marking a second consecutive monthly increase. While energy costs continued to decline, pace of decline slowed and food prices accelerated. Shelter costs remained elevated, contributing significantly to overall inflation. Core inflation, which excludes volatile food and energy prices, held steady at 3.3%.

- The European Central Bank (ECB) lowered its key interest rate by 25 basis points, marking the fourth rate cut this year. This move reflects a more optimistic outlook on inflation and improved monetary policy transmission. While inflation is expected to gradually decline, the ECB remains committed to its 2% inflation target. Economic recovery is projected to be slower than initially anticipated, with growth forecasts revised downwards. Despite the rate cuts, borrowing costs remain high due to prior tightening measures. The ECB will continue to monitor economic developments and adjust its policy stance accordingly.

Get future reports

Please provide your details below to get future reports: