Foreign Exchange reserves

The CBK’s usable foreign exchange reserves soared from the previous week to stand at USD 9.30 bn (5.59 months of import cover). This meets CBK’s statutory requirement to endeavour to maintain at least 4.0 months of import cover, and the EAC region’s convergence criteria of 4.5 months of import cover.

Currency

The Kenyan Shilling declined against major currencies over the week, trading against the USD at Kshs 106.50 up from Kshs 106.09 recorded last week. It declined by 147 basis points against the Sterling Pound to trade at Kshs 134.92 and 162 basis points against the Euro to trade at Kshs 120.99.

Liquidity

Liquidity continued to improve from the previous weeks on account of government payments. The weekly mean of the daily weighted average inter-bank rate dipped to 2.55% from 3.12% in the previous week. The volume transacted declined by 75.13% to stand at Kshs 2.34 bn. Commercial banks’ excess reserves stood at Kshs 32.8 bn.

Fixed Income

T-Bills

T-bills remained oversubscribed at a rate of 290.51%, up from 209.07% in the preceding week. The over-subscription is owed to high liquidity in the money market and investors’ preference for short-term papers. The subscription rates for the 91-day, 182-day, and 364-day papers increased to 294.03%, 264.95%, and 314.66%, respectively. The yields on the 91-day, 182-day, and 364-day papers, decreased marginally by -0.90%, -1.73% and -1.47% to close at 7.26%, 8.06%, and 9.03%, respectively.

T-Bonds

The bonds market registered reduced activity from the previous week with the bonds turnover declining by 69.03% to Kshs 2.94 billion. The total bond deals decreased from 375 to 94. In the international market, yields on Kenya’s Eurobonds decreased by an average of 9.94 basis points. Similarly, the yields on the 10-year Eurobonds for Angola and Ghana declined.

Equities

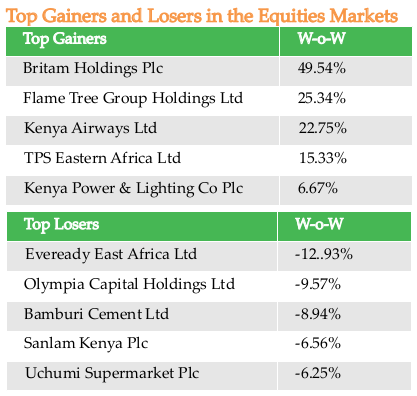

The Equity Market closed the week with 47.76m shares valued at Kshs 1.11 bn against 98.9m shares valued at Kshs 2.30 bn transacted in the previous week. The market capitalization grew marginally by 2.67% to Kshs 2.13 trillion.

NASI gained by 2.66%, NSE 20 3.72% and NSE 25 by 2.66% respectively. The performance of the NASI was driven by gains recorded by large-cap stocks, with Safaricom and Equity Group gaining by 3.22%, 5.13% respectively.

The Banking sector had shares worth Kshs 901m transacted which accounted for 26.93% of the week’s traded value, Insurance sector represented 5.17%, manufacturing & Allied sector 6.83% and Safaricom with shares worth Kshs 1.9bn transacted, contributed 57.83%.

Global stocks markets declined from the previous week as Covid-19 cases spiked in reopened states in the US and abroad. The MSCI World Index dropped by 8.23%, while the MSCI Emerging Markets fell by1.56%. DJI and S&P 500 declined at week end by 5.55% and 4.78% following the Monetary Policy forecast, interest rates would remain near zero through 2022. In Europe, STOXX Europe 600 depreciated by 5.66% and the FTSE 100 went down by 5.85%. China’s Shanghai Composite declined by 0.38% as Chinese inflation data for May missed expectations, the producer price index declined by 3.7%.

On the regional front, the FTSE ASEA Pan African index rose sharply by 18.62% to close the week at 2252.50. The JSE All Share declined 1.88%, Nigeria’s NSE All Share gained slightly by 0.67%. Within the EAC, Tanzania’s DSEI and Uganda’s ALSIUG increased marginally by 0.17% and 0.80%, respectively. On the global commodities market, the oil futures declined in prices with the Crude Oil WTI and ICE Brent Crude falling by 7.76% and 7.92%, respectively. Gold futures prices declined by 3.92% to settle at $1,683.00 at the end of the week.

Alternative Investments

The Derivatives Market closed the week with a total of 21 contracts valued at Kshs 581,350.00 KCB contract expiring on 18th June 2020 moved 8 contracts valued at Kshs 276, 000. Safaricom contract expiring on 18th June 2020 had 5 contracts transacted worth Kshs. 149,250.

The I-REIT market registered depressed activity with a turnover of Kshs 1.46m from only 29 unit deals against a turnover of Kshs 1.17m from 148 unit deals in the preceding week.

Week’s Highlights

- The proportion of defaulted bank loans rose from 12.5 percent to 13.1 percent to stand at Sh 366.8 billion in April , the highest since August 2007 when it stood at 14.41 percent. The increase is attributable to increased non performing loans in the real estate, trade and manufacturing sectors following the slowdown in economic activity in these sectors.

- Banks’ pre-tax earnings declined by 11 percent year-on-year during the quarter as a result of increased loan impairment losses. The percentage of non performing loans is expected to increase to 18 percent increasing the loan impairment losses by 60% . The Callstreet-10 banking index, a market cap that tracks 10 listed banking stocks, has declined by 18 percent year-to-date. It is forecasted that banks will have equity losses that might impact their dividend payouts in 2021

- Price of tea has dipped from Sh 192 last week to Sh 188, the prices have declined in the past two months from Sh 220 in April despite a reduction in volumes. The decline has been attributed to decline in market demand caused by slow purchases at the auction due to Covid-19. Exports to Kenya’s top three tea markets declined significantly in the first quarter.

- Kenya’ trade deficit narrowed by Sh 33.6 billion during the first quarter compared to a similar period in 2019. Data from the Central Bank of Kenya shows that imported goods declined by 3% while exports rose by 7%. The import bill declined due to lower fuel costs in the period following a steep decline in global crude prices as demand fell due to Covid-19 restrictions. On exports, higher prices especially on tea have helped moderate losses despite decline in volumes.

- The government’s budget totaling to Sh 3.2 trillion in the fiscal year starting July 1 was read. The budget is 20.8 percent higher than the previous year and is aimed at spurring the economy by countering the impacts of the pandemic. It focuses on creating more jobs and cash flow to business with significant allocations to infrastructure, water and sanitation as well as energy projects.

- The Treasury is planning on increasing its local borrowing by 20.98 percent from Sh 391.45 billion to Sh 473.6 billion for the current year. This threats access to loan by SMEs even as they remain the hardest hit by the economic disruptions caused by COVID-19. A survey by CBK indicated that 75 percent of SMEs would collapse if they failed to access funds by end month as banks are expected to increase their lending to government.

- In the budget, government has proposed amendments to the Capital Market Act, to provide for the regulation of private equity and venture capital companies that have access to public funds by the CMA.

- The proposed pension reform involves re-engineering and upgrading the pensions system by the National Treasury, in order to clear all pension payments backlog by the end of the calendar year 2020. This is expected to enhance to pave way for a modernized pension management system that will enable a smooth transition of retirees from a monthly salary cheque to a monthly pension payment.

- Tax relief for workers saving in mortgage firms for home purchase is set to be eliminated ending the 24 year practice which began on January 1, 1996. Also, income of retirees aged 65 and above is set to subjected to applicable taxes should the Treasury approve a proposal to remove exemptions on it.

- The proposed amendments also seek to introduce a penalty of Ksh 100,000 to Ksh 1,000 per day of continuing default by a scheme to submt an actuarial valuation report to the Retirement Benefits Authority (RBA).