Foreign Exchange Reserves

The usable foreign exchange reserves increased by 1.38% to USD 8,299 million (4.3 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover but below EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling slightly depreciated against the Dollar, but appreciated against the Sterling Pound and the Euro to exchange at KES 129.20, KES 168.57 and KES 141.30 respectively. The observed depreciation against the Dollar is attributed to a high demand for the currency.

| Currency | YTD Change | W-o-W Change |

|---|---|---|

| Dollar | -17.70% | 0.01% |

| Sterling Pound | -15.65% | -0.64% |

| Euro | -18.63% | -0.83% |

Liquidity

Liquidity in the money markets increased, with the average inter-bank rate decreasing from 12.76% to 12.19%, as government payments more than offset tax remittances. Open market operations remained active.

| Liquidity | Week (previous) | Week (ending) |

|---|---|---|

| Interbank rate | 12.76% | 12.19% |

| Interbank volume (billion) | 17.94 | 34.12 |

| Commercial banks’ excess reserves (billion) | 21.00 | 33.00 |

Fixed Income

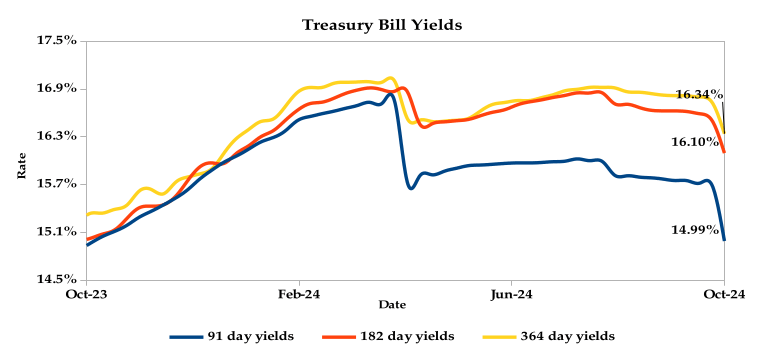

T-Bills

T-Bills remained over-subscribed during the week, with the overall subscription rate increasing to 304.32% from 224.83% recorded in the previous week. The 91-day T-Bill received the highest subscription rate at 462.70%, while the 182-day T-Bill and 364-day T-Bill had subscription rates of 287.89% and 257.40% respectively. The acceptance rate decreased by 21.27% to close the week at 42.66%.

T-Bonds

In the secondary bond market, there was a lower demand for the week’s bond offers. Bond turnover decreased by 46.87% from KES 28.88 billion in the previous week to KES 15.35 billion. Total bond deals decreased by 16.84% from 576 in the previous week to 479.

In the primary bond market, CBK released auction results for the re-opened FXD1/2016/010 and FXD1/2022/010 which sought to raise KES 30.0 billion. The issues received bids worth KES 50.96 billion, representing a subscription rate of 169.88%. Of these, KES 31.28 billion worth of bids were accepted at a weighted average rate of 16.98% and 16.95% respectively.

Eurobonds

In the international market, yields on Kenya’s Eurobonds increased by an average of 0.16% compared to the previous week, 0.50% month-to-date and decreased 0.37% year-to-date. The yield on the 10- year Eurobond for Angola declined marginally while that of Zambia increased. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2018 10-Year Issue | -0.85% | 0.60% | 0.19% |

| 2018 30-Year Issue | 0.02% | 0.36% | 0.13% |

| 2019 7-Year Issue | -1.49% | 0.56% | 0.11% |

| 2019 12-Year Issue | 0.03% | 0.51% | 0.20% |

| 2021 13-Year Issue | 0.29% | 0.50% | 0.23% |

| 2024 6-Year Issue | -0.22% | 0.46% | 0.09% |

Equities

NASI, NSE 20, NSE 25 and NSE 10 settled 1.68%, 1.89%, 1.81% and 1.79% higher compared to the previous week, bringing the year-to-date performance to 19.75%, 19.73%, 25.72% and 28.26% respectively. Market capitalization also gained 1.68% from the previous week to close at KES 1.72 trillion, recording a year-to-date increase of 19.98%. The performance was driven by gains recorded by large-cap stocks such as Equity, KCB and Safaricom of 6.29%, 4.12% and 2.00% respectively. This was however weighed down by the loss recorded by EABL of 2.44%.

The Banking sector had shares worth KES 287M transacted which accounted for 32.00% of the week’s traded value. Manufacturing and Allied sector had shares worth KES 52M transacted which represented 5.00% and Safaricom, with shares worth KES 466M transacted, represented 52.00% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Kenya Orchards | 125.90% | 32.88% |

| KPLC | 157.14% | 19.60% |

| Eveready | 0.85% | 14.42% |

| Liberty | 55.44% | 9.09% |

| E.A Cables | 8.16% | 7.07% |

| Losers | YTD Change | W-o-W |

|---|---|---|

| Express | -14.86% | -9.74% |

| Car & General | -24.00% | -9.52% |

| Standard Group | -28.94% | -8.94% |

| Sanlam | 0.33% | -8.23% |

| NSE | -5.17% | -7.09% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 2.79 | 6.17 | 121.00% |

| Derivatives Contracts | 14.00 | 16.00 | 14.29% |

| I-REIT Turnover (million) | 0.00 | 0.00 | 0.00% |

| I-REIT deals | 0.00 | 00.00 | 0.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | 22.61% | 1.11% |

| Dow Jones Industrial Average (DJI) | 12.57% | 0.24% |

| FTSE 100 (FTSE) | 6.89% | -0.33% |

| STOXX Europe 600 | 9.08% | 0.66% |

| Shanghai Composite (SSEC) | 8.62% | -3.56% |

| MSCI Emerging Markets Index | 13.16% | -1.68% |

| MSCI World Index | 17.75% | 0.91% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | 2.10% | -0.40% |

| JSE All Share | 12.90% | -1.54% |

| NSE All Share (NGSE) | 28.33% | -0.95% |

| DSEI (Tanzania) | 21.22% | 0.44% |

| ALSIUG (Uganda) | 26.62% | 0.69% |

Global and Continental Markets

The US stock market closed the week with a surge, boosted by strong performances in the financial, industrial and consumer services sectors. JPMorgan and Wells Fargo led the charge with better-than-expected earnings.

European stock markets were volatile over the week. While the automotive and parts sector, a long-time under-performer rallied on a positive forecast from a German supplier, investor sentiment was dampened by China’s lack of specific economic stimulus measures, weak British growth and losses in Sainsbury’s.

Asian stock markets declined during the week, as investors questioned the extent of Beijing’s ability to implement additional stimulus measures.

On the global commodities markets, Crude Oil WTI and ICE Brent Crude closed the week 4.99% and 3.94% higher at $75.56 and $78.88 respectively. Gold futures prices settled 0.32% higher at $2,676.30.

Week’s Highlights

- The Central Bank of Kenya’s Monetary Policy Committee (MPC) lowered its benchmark interest rate from 12.75% to 12% at its 8th October meeting. This decision was based on a decline in inflation, easing global interest rates and concerns about slowing economic growth. The MPC also noted the slowdown in credit to the private sector and economic growth in Q2 2024, suggesting a need for further monetary policy easing to support economic activity while maintaining exchange rate stability. The next Committee meeting is scheduled for December 2024.

- Kenya is finalising talks with the IMF to unlock more funding by the end of the year. According to the IMF, the disbursement will unlock about $976 million as the remaining amount of the 7th and 8th reviews of the program, which is expected to end in April 2025. The disbursement is expected to improve the country’s forex reserves.

- Savings and Credit Cooperatives (SACCOs) have seen a surge in loan disbursements, outpacing commercial banks in the first eight months of 2024. This trend is likely fueled by rising interest rates imposed by banks, prompting borrowers to seek more favorable terms from SACCOs. Data from the Central Bank of Kenya (CBK) reveals that SACCOs extended KES 46 billion more in loans than commercial banks during this period, bringing their total to KES 749 billion. Meanwhile, commercial bank loan disbursements declined by KES 154 billion to KES 4.045 trillion.

- 5 US inflation slowed for the sixth month in a row in September, reaching 2.4% in September 2024, the lowest since February 2021, from 2.5% in August. While energy prices fell sharply, food and transportation costs rose. Core inflation unexpectedly ticked up to 3.3%. The decline in inflation was primarily driven by falling energy prices, particularly gasoline and fuel oil. However, rising food and transportation costs offset some of this downward pressure. The monthly core inflation rate remained unchanged at 0.3%, indicating continued underlying inflationary pressures.

- The UK’s GDP grew by 0.2% month-on-month in August 2024, following two consecutive months of no growth. This was driven by increases in services, production and construction. Water supply, sewerage, waste management, and utilities also contributed positively to the economy. Construction output also grew, led by new work. However, mining and quarrying, particularly the extraction of crude petroleum and natural gas, contracted. Overall, the UK economy grew by 0.2% in the three months to August.

- China’s annual inflation rate dropped to 0.4% in September 2024 from 0.6% in August, underscoring growing deflationary pressures and signaling a need for more aggressive policy stimulus from Beijing. This marked the lowest inflation rate since June, despite being the eighth consecutive month of consumer price increases. Falling transportation costs due to cheaper crude oil and a government crackdown on the property market contributed to the decline in non-food prices. Additionally, costs for healthcare and education slowed. Core inflation, excluding food and energy, rose by only 0.1% year-over-year, the smallest increase since February 2021.

Get future reports

Please provide your details below to get future reports: