Foreign Exchange Reserves

The CBK’s usable foreign exchange reserves remained adequate at USD 8,210 million (4.88 months of import cover). This meets CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Euro and the Sterling Pound to exchange at Ksh 117.05, Ksh 125.34 and 146.94 respectively. The observed overall depreciation against the Dollar is attributable to increased Dollar demand from energy and commodity importers.

| YTD Change | W-o-W Change | |

|---|---|---|

| Dollar | 3.45% | 0.19% |

| Euro | -2.15% | 0.30% |

| Sterling Pound | -3.54% | 0.02% |

Liquidity

Liquidity in the money markets tightened, partly reflecting government payments which offset tax remittances. Open market operations remained active.

| Week (previous) | Week (ending) | |

|---|---|---|

| Interbank rate | 4.75% | 4.83% |

| Interbank volume (billion) | 20.21 | 27.91 |

| Commercial banks’ excess reserves (billion) | 17.50 | 14.80 |

Fixed Income

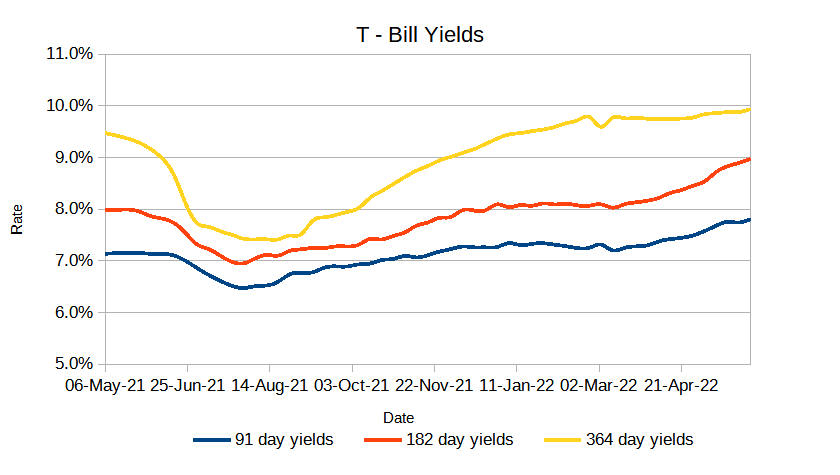

T-Bills

T-Bills remained under-subscribed during the week with a decrease in the overall subscription rate from 86.29% recorded in the previous week to 61.26%. The 91-day T-Bill got the highest subscription rate at 81.1% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 40.0% and 74.6% respectively. The decrease in subscription is attributed to concurrent sale of the infrastructure bond in the primary market. The acceptance rate increased by 42.23% to close the week at 95.40%.

T-Bonds

The bonds market had a higher demand for the week’s bond offers. Bonds turnover increased by 18.88% from 10.64B in the previous week to 12.65B. Total bond deals decreased by 8.38%.

In the primary market, the Central Bank released results for the auction of the 18 year infrastructure bond; IFB1/2022/018. The bonds received bids worth 76.37B against the targeted 75B translating to a 101.83% over-subscription rate as investors sough higher rates citing high exposure to inflation and currency risks. The bonds attracted an average coupon rate of 13.742%. CBK accepted Kshs 73.77B.

Eurobonds

In the international market, the yields on the 10-year Eurobonds for Angola rose and that for Ghana declined. Yields on Kenya’s Eurobonds generally increased by 1.79% compared to the previous week; 1.85% and 6.13% month to date and year to date respectively. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 9.06% | 2.64% | 2.54% |

| 2018 10-Year Issue | 6.38% | 1.90% | 1.87% |

| 2018 30-Year Issue | 3.93% | 1.13% | 1.07% |

| 2019 7-Year Issue | 7.65% | 2.64% | 2.59% |

| 2019 12-Year Issue | 5.29% | 1.57% | 1.50% |

| 2021 12-Year Issue | 4.47% | 1.24% | 1.14% |

Equities

NASI increased by 0.37% while NSE 20 and NSE 25 fell by 1.37% and 0.74% compared to last week bringing the year to date performance down to -22.27%, -12.42% and -18.98% respectively. The market capitalization increased by 0.37% to 2.023 trillion. The performance was driven by gains recorded by large-cap stocks. Top gains were recorded in ABSA, Safaricom and KCB which decreased by 9.52%, 1.91% and 0.78% respectively.

The Banking sector had shares worth Kshs 524M transacted which accounted for 31.99% of the week’s traded value, Manufacturing & Allied sector had shares worth 159M transacted which represented 9.69% and Safaricom, with shares worth Kshs 925M transacted represented 56.40% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Car and General | 35.49% | 17.95% |

| Olympia Capital | 21.05% | 14.43% |

| Sameer Africa | 2.81% | 12.69% |

| ABSA Bank | -2.13% | 9.52% |

| Longhorn Publishers | -12.34% | 8.41% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| Uchumi | -26.09% | -15.00% |

| NBV | -31.34% | -10.76% |

| NSE | -7.00% | -10.36% |

| Kapchorua | -18.59% | -10.00% |

| Express Kenya | -16.59% | -10.00% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 0.55 | 4.12 | 653.87% |

| Derivatives Contracts | 10 | 58 | 480.00% |

| I-REIT Turnover | 0.21 | 0.13 | -40.94% |

| I-REIT Deals | 27 | 38 | 40.74% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | -18.67% | -5.05% |

| Dow Jones Industrial Average (DJI) | -14.19% | -4.58% |

| FTSE 100 (FTSE) | -2.50% | -2.86% |

| STOXX Europe 600 | -13.73% | -3.95% |

| Shanghai Composite (SSEC) | -9.57% | 2.80% |

| MSCI Emerging Markets | -14.50% | -0.58% |

| MSCI World Index | -18.50% | -4.94% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -10.92% | -0.45% |

| JSE All Share | -8.47% | -4.62% |

| NSE All Share (NGSE) | 23.65% | 0.55% |

| DSEI (Tanzania) | -1.47% | -1.13% |

| ALSIUG (Uganda) | -12.28% | -1.62% |

U.S stocks closed the week low, as gains in the Technology, Consumer Services and Industrials sectors led shares lower. Investors’ sentiments dwindled as a steeper-than-expected rise in U.S. consumer prices in May fueled fears of more aggressive interest rate hikes by the Federal Reserve. Following the inflation report, two-year Treasury yields spiked to 3.057% and benchmark 10-year yields reached 3.178%. Recent stock selling has largely been tied to worries over inflation, rising interest rates and the likelihood of a recession.

European stocks closed the week low as investors digested the rate hike guidance from the European Central Bank ahead of the release of key U.S. inflation data. The possibility of a more aggressive hiking cycle later in the year is weighing on sentiment as the Eurozone economy struggles with slowing growth, exacerbated by the war in Ukraine, as well as rampant price increases.

Asia Pacific stocks closed the week low, as investors digested the European Central Bank’s signals on future interest rate hikes ahead of U.S. inflation data. Japan, South Korea, Australia and Hong Kong’ reported an decrease at the end of the week. However, the Chinese market remains on a positive position week on week.

On the global commodities markets, Crude Oil WTI closed the week higher by 1.51% and the ICE Brent Crude increased by 1.91%. Gold futures prices increased by 3.93% to settle at $1,875.50.

Week’s Highlights

- The National Treasury canceled plans to issue a Ksh. 115 Billion Eurobond citing high rates in international markets. The call comes after the shilling hit a record Ksh. 117 per dollar on Thursday. Nigeria also canceled the planned issuance of a $950 million for the same reasons. Treasury will raise funds through lending from commercial banks. Dollar shortages are on the rise as mentioned by Kenya Association of Manufacturers (KAM) with some companies forced to temporarily suspend services.

- The National Assembly raised the debt ceiling to Ksh. 10 trillion to allow the government to borrow Sh 846 million for financing the budget deficit in the next fiscal year.

- The world bank has projected Kenya’s real gross domestic product (GDP) will grow by 5.5 per cent in 2022 and 5.2 per cent on average in 2023–24.

- Ghana’s inflation rate jumped to 27.6% in May as food and transport costs surged. Ghana had earlier raised its benchmark lending rate by 200 basis points; an aggressive move that has been employed by most emerging markets to tame inflation. Additionally, the United States also registered an increase in inflation to 8.6% on the back of high commodity prices due to supply shortages. The annual inflation rate in Thailand surged to 7.1%.

- The African Development Bank (AfDB) is set to lend Ksh 17.5 billion towards the construction of the Nairobi-Nakuru highway among ten other lenders. AfDB also approved two grants of $9.25 million to implement the Africa Disaster Risk Financing Programme (ADRiFi) in Malawi.

- The Capital Markets Authority (CMA) granted approval to GenAfrica Asset Managers to register unit trust funds as the Asset Manager seeks to offer clients with a more diversified product range. Unit trusts currently hold more than Sh 134 billion in assets under management.

Get future reports

Please provide your details below to get future reports: