Foreign Exchange Reserves

The CBK’s usable foreign exchange reserves stand at USD 7.86 billion (4.75-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Currency

Increased dollar demand amid reduced foreign currency inflow caused the Shilling to

depreciate against the USD, exchanging at Kshs 107.24 as compared with the previous

week rate of Kshs 106.00.

Liquidity

Liquidity in the money market increased with the inter-bank rate decreasing to 5.33%

from 5.93% recorded the previous week. The increase was as a result of government

payments which partly offset receipts. Commercial banks’ excess reserves stood at Ksh

53.9 billion in relation to the 4.25% cash reserves requirement (CRR) while the volume of

inter-bank lending increased by 49% to Kshs 7.25 billion.

Fixed Income

T-Bills

T-bills remained undersubscribed at an overall subscription rate of 81.70%. This is attributable to the tap sale of infrastructure bond, IFB1/2020/9. The 91-day paper was oversubsribed at 219.65% while the 182-day and 364-day papers were undersubsribed at rates of 44.45% and 63.75% respectively. The yields increased marginally with the 91-day,182-day and 364-day papers registering yields of 7.21%, 8.12% and 9.11% respectively.

T-Bonds

The bonds turnover and total deals in the domestic secondary bond market increased by 37.90% and 50.53% respectively to Kshs 8.48 billion and 426 deals. A tap sale of IFB1/2020/9, infrastructure bond, had a performance of 168.51% after attracting bids worth Kshs:35.39 billion against amount offered of Kshs 21.00 billion. The bond’s average interest rate is 12.05%. In the international market, yields on Kenya’s Euro bonds increased by an

average of 103.0 basis points.

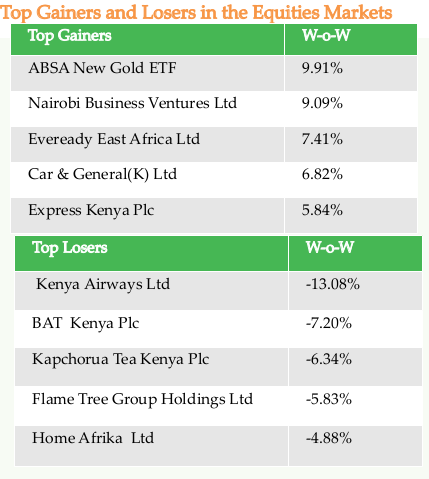

Equities

NASI and NSE 20 decreased by 0.11% and 0.30% respectively while the NSE 25 gained by 0.96%.The drop of the NASI index was driven by lossses in large-cap stocks such as Safaricom, BAT and Co-operative

Bank.

The market capitalization decreased by 0.11% to Kshs 2,075.20 billion. The total shares traded and equity turnover increased by 68.06% and 78.54% respectively to 134 million shares and Kshs 4.26 billion.

Global and Regional Markets Highlights

S&P 500 and the Dow Jones Industrial Average declined by 1.32% and 1.93% respectively, the indices had however recorded slight gains within the week due to rise in prices of large-cap stocks such as Microsoft.

MSCI World Index declined by 1.48% to reach 1987.65 down from 2017.51 and the MSCI Emerging Markets declined by 2.43%.

FTSE 100 and Shanghai Composite declined by 0.60% and 1.06% respectively. On the regional front, the FTSE ASEA Pan African index rose marginally by 0.73%.

The JSE All Share, DSEI (Tanzania) and ALSIUG (Uganda) increased by 0.80%, 0.27% and 1.76% successively. NGSE(Nigeria) index dropped by 1.41%.

Volatility in oil futures indices increased during the week with the Crude Oil WTI Future declining by 7.28% to -$37 and ICE Brent Crude declining by 23.65%.This reflects the collapse in global demand of oil.

The Gold Futures gained by 2.17% indicating investors

preference for secure investments during this uncertain

times.

Alternative Investments

The Derivative Market closed the week with a total of 6 contracts worth Kshs 179,500. The Safaricom contract expiring in 17th September 2020 had 3 contracts valued at Kshs 81,000 transacted.

The I-REIT market registered a turnover of Kshs 35,286.00 with a total of 8 deals.

The ETF market recorded an outstanding increase in activity after closing the week with a turnover of Kshs 45.33 million and 5 total deals.

Week’s Highlights

- The president assented the Tax Amendments Bill 2020, which will allow salaried persons to use part of their retirement savings to secure home loans. The amendment will remove the restriction which prohibits Week ending 10th April 2020 schemes from using their funds to offer direct or indirect loans to any person.

- The Central Bank of Kenya approved 51% acquisition of Mayfair Bank by Egypt’s leading private-sector bank, Commercial International Bank (CIB). As of September 2017, the bank’s total assets were valued at Kshs2.563 billion, with shareholder equity of Sh1.121 billion. CIB is expected to provide Mayfair Bank with skills, resources and infrastructure to scale up its business in an increasingly competitive banking environment.

- Twiga Foods signed a deal with Jumia to distribute fresh produce. The service dubbed ‘Jumia Freshi powered by Twiga’, will allow customers to shop on Jumia for their fruits and vegetables and also get same-day free delivery on the platform in Nairobi passing on to consumers the price benefit of sourcing directly from farmers and manufacturers.

- The Treasury’s outstanding overdraft at the Central of Bank of Kenya (CBK) hit a fresh high of Kshs64.44 billion, indicating depressed tax revenue streams amid rising demands for money to fight the Covid-19 pandemic. The emergency lending ought to be capped at a maximum of 5% of the most recently audited revenues and repaid by the end of the fiscal year.

- During the week, banks cut deposit rates to 4.02%, a 3-year low, reflecting the impact of removal of controls amid growing profits. The top eight lenders recorded 18% growth in customer deposits to Kshs3.029 trillion. However, interest paid on customer deposits rose by 5.9% to Kshs103.2 billion. However, interest paid on large deposits from cash-rich clients, who usually have room to negotiate, touched 7% for the first time since last June.

- Mayfair Insurance posted Ksh359.5 million net profit for the year ended December 2019, slightly up from Ksh361.8 million in the previous year. Total income grew by 18% to Ksh2.4 billion due to higher written premiums and commissions earned. However, expenses rose by 28% to Ksh1.95 billion due to rise in net claims paid and policyholders’ benefits.

- The Insurance Regulatory Authority announced that insurers will be required to give insurance policyholders, who are facing financial difficulties due to COVID-19, a 3-month grace period for payment and renewal of premiums. The grace period may be over and above any contractual premium holidays already in place for existing policies.

- Bank cash available for onward lending to businesses and households increased to Ksh50.3 billion amid tightening borrowing restrictions. This follows the downward revision of Cash Reserve Ratio to 4.25%.Kenya Bankers Association (KBA) noted that the reduction in the CRR does not necessarily mean increased uptake of credit as the operating environment is challenging.