Performance Review

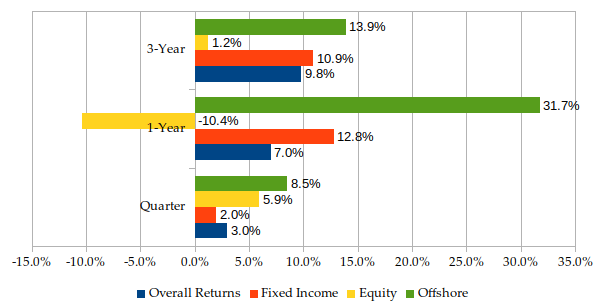

For the current quarter, the average return achieved by the 417 pension schemes with a total fund value of about Kshs. 841 Billion participating in the survey was 3.0% compared to 2.5% in the previous quarter. This is an improvement despite the negative impact of the Covid-19 pandemic on the performance of the schemes.

The positive return can mainly be attributed to investors’ optimism supported by signs of economic recovery and loose monetary policies by governments and central banks across the globe to spur economic development and repress the negative impact of COVID-19 on economies.

The highest-performing scheme over the quarter recorded a return of 5.5%.

Over the 3 year period, pension schemes have recorded a return of 9.9% p.a. The 3-year performance is a better gauge of performance as the volatility of returns is smoothed.

It would be useful for trustees to engage in better strategies in order to maximize members’ returns.

Overall Returns

Equities returns improved over the quarter at 5.9% from 5.1% last quarter while offshore returns declined to 8.5% compared to 11.3% achieved in the previous quarter. The positive equities and offshore returns were majorly a result of investors’ optimism supported by signs of economic recovery.

The fixed income also achieved a lower quarter return of 2.0% compared to 4.0% in the previous quarter.

Asset Allocation

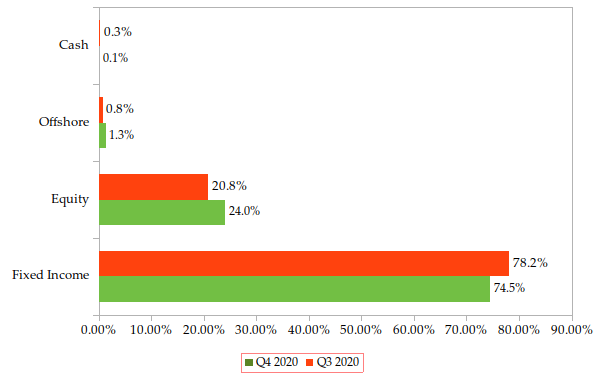

For the current quarter, it was noted that pension schemes invested most of their funds in fixed income, decreasing their allocation to 74.5% compared to 78.2% in the previous quarter.

The allocation to equities slightly increased to 24.0% in the current quarter compared to 20.8% in the previous quarter.

Overall, ideal asset allocation is needed to ensure pension schemes can meet their targeted returns.

For a more detailed report on their performance, download the report here.

For more detailed information click on the link below to download the report.

Get future reports

Please provide your details below to get future reports: