Performance Review

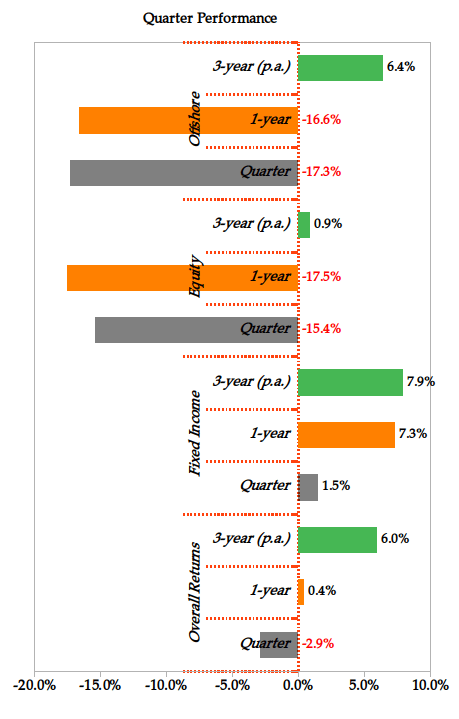

For the current quarter, the average return achieved by the 435 pension schemes with total fund value of about Kshs. 913Billion (excluding property) participating in the survey was -2.9% compared to -0.6% in the previous quarter. This lower return was largely due to the decline in equities from the Q1 2022 majorly as a result of rising inflation and reduced demand driven bythe Russia-Ukraine conflict.

The decline in fixed income was attributable to tighter liquidity in the money market and rising inflation.

The highest performing scheme over the quarter recorded a return of 5.9%.

Over the 3 year period, pension schemes have recorded a return of 6.0% p.a . The 3-year performance is a better gauge of performance as the volatility of returns is smoothened.

It would be useful for trustees to engage better strategies in order to maximize members’ returns.

Fixed income asset class decreased to1.5% from 3.3% in the same quarter last year. The decline in fixed income was attributable to tighter liquidity in the interbank market, tightened liquidity in the money market.

The equities also achieved a lower quarter return of -15.4% compared to -4.8% in the previous quarter. The negative returns were attributable to rising inflation and reduced demand driven by the Russia-Ukraine conflict.

Asset Allocation

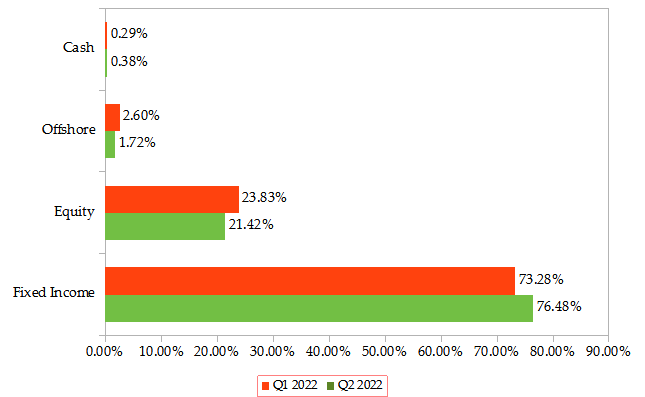

For the current quarter, it was noted that pension schemes invested most of their funds in fixed income, increasing their allocation to76.5% compared to 73.3% in the previous quarter.

The allocation to equities decreased to 21.4% in the current quarter compared to 23.8% in the previous quarter.

Overall, ideal asset allocation is needed to ensure pension schemes can meet their targeted returns.

For a more detailed report on their performance, download the report here.

Get future reports

Please provide your details below to get future reports: