MONTH’S HIGHLIGHTS

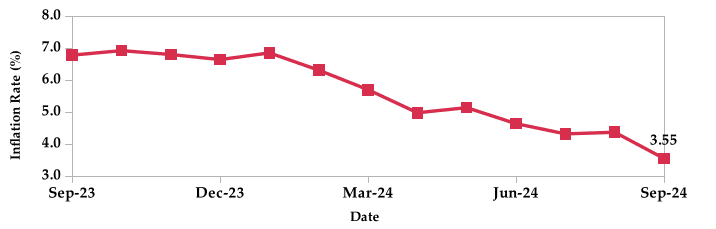

- Inflation eased to 3.55% in September 2024 from 4.37% in August, falling below the midpoint of the central bank’s target range. This was primarily driven by lower kerosene and electricity prices. The food and non- alcoholic beverages index increased by 0.4%, driven by higher food prices. The housing, water, electricity, gas and other fuels index decreased by 0.1%, mainly due to decreased kerosene and electricity prices. Additionally, the transport index increased by 0.1%, mainly due to elevated city bus fares, despite stable fuel prices.

- The National Assembly’s investments committee halted Kenya Airports Authority’s (KAA) dealings with Adani Group until a forensic audit is completed. The Public Investments Committee will meet in two weeks to review the Auditor General’s special audit report and ensure accountability for the project. The audit will focus on procurement, project estimates and the effectiveness of the proposed investment plan. The committee also seeks clarity on the future of KAA staff and the collaboration between Adani and other airport operators.

- The Nairobi Securities Exchange (NSE) implemented a new requirement for listed companies to disclose a forward-looking calendar of corporate events. This calendar will outline key events such as earnings releases and dividend payment dates. The Capital Markets Authority (CMA) and NSE stated that the move aims to enhance transparency, improve communication between issuers and investors and boost market efficiency and investor confidence.

- Kenya officially became a full member of the Asian Infrastructure Investment Bank (AIIB), a multilateral development institution with 109 members and USD 100 billion in capital. As a fully paid member, Kenya will now have access to concessional funding for infrastructure projects, climate change initiatives, connectivity programs, regional cooperation endeavors and technology-driven initiatives.

- The Federal Reserve made a significant move in September 2024, cutting the federal funds rate by 50 basis points to a range of 4.75% to 5%. This marked the first reduction in borrowing costs since the onset of the COVID-19 pandemic in March 2020. The Fed also revised its economic projections, indicating a slower decline in inflation and a more optimistic outlook for growth. This move signaled a shift towards a more accommodating monetary policy as the central bank sought to support economic growth and mitigate the risks of a recession.

- US GDP grew by 3% in the second quarter of 2024, unchanged from the previous estimate and surpassing the first quarter’s revised growth of 1.6%. While consumer spending slowed slightly, increases in inventories, government spending and imports boosted the economy. Conversely, business investment and exports contracted. The Bureau of Economic Analysis also released updated GDP figures for previous years, showing stronger growth in 2023 and 2022 than initially reported.

- The Caixin China General Manufacturing PMI fell to 49.3 in September 2024, from 50.4 in August and below the market expectations of 50.5. This marked the lowest level since July 2023. New orders, exports and employment all declined, while backlogs shrank. Rising competition led to falling input and output prices. The decline in business sentiment to its second-lowest level on record reflects deteriorating conditions.

- The Bank of England (BoE) held the Bank Rate steady at 5% during its September 2024 meeting, following a 25 basis point cut in August. This decision was in line with market expectations. Annual inflation in August stood at 2.2% and is projected to rise to around 2.5% by the end of the year as the impact of last year’s energy price declines fades from the annual comparison. The Committee expects headline GDP growth to return to its underlying pace of approximately 0.3% per quarter in the second half of the year. In addition, the Committee unanimously agreed to reduce its holdings of UK government bonds by £100 billion over the next 12 months, bringing the total to £558 billion.

ECONOMIC INDICATORS

Foreign Exchange Reserves

During the month, the usable foreign exchange reserves increased by 9.23% to settle at $8.03 billion (4.10 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4 months of import cover but below EAC region’s convergence criteria of 4.5 months of import cover.

Currency

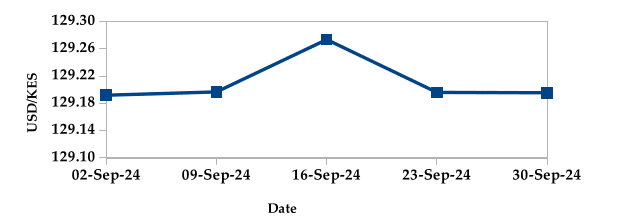

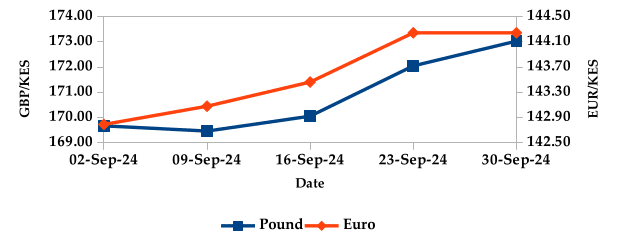

The Kenyan Shilling depreciated against the USD, the Sterling Pound and the Euro by 0.02%, 1.82% and 0.84%, exchanging at Kshs 129.20, Kshs 173.03 and Kshs 144.24 respectively at the end of the month, from Kshs 129.17, Kshs 169.94 and Kshs 143.04 in the previous month. The observed depreciation against the Dollar is attributed to high demand for the currency.

USD Vs KSHS

STERLING POUND & EURO Vs KSHS

Inflation

The overall year-on-year inflation decreased to 3.55% in September 2024 from 4.37% in August. This was primarily driven by lower kerosene and electricity prices.

INFLATION EVOLUTION

Liquidity

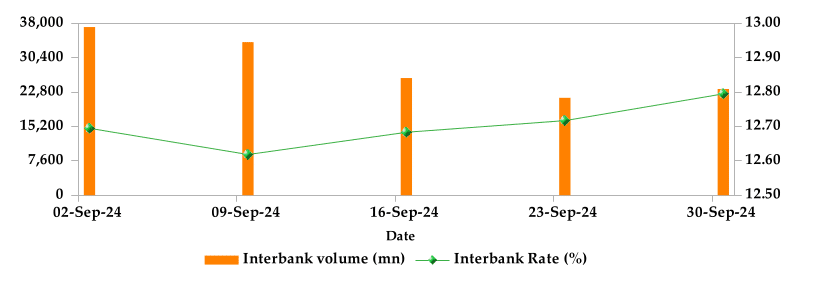

During the month, liquidity increased as a result of government payments which more than offset tax remittances. The average inter-bank rate decreased from 12.97% to 12.68%. The volume of inter-bank transactions increased from Kshs 22.92 billion to Kshs 26.53 billion. Commercial banks excess reserves decreased from Kshs 20.30 billion to Kshs 12.40 billion.

INTER-BANK RATE and VOLUME

FIXED INCOME

T-Bills

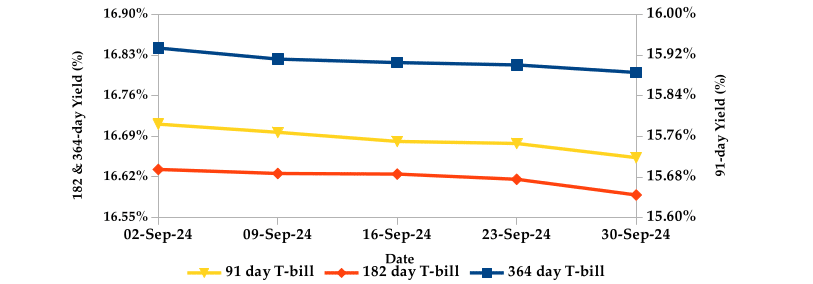

T-bills recorded an overall subscription rate of 116.24% during the month of September, compared to 112.93% recorded in the previous month. The performance of the 91-day, 182-day and 364-day papers stood at 347.93%, 68.21% and 71.60% respectively. On a monthly basis, yields on the 91-day, 182-day and 364-day papers decreased by 0.42%, 0.26% and 0.25% to 15.72%, 16.59% and 16.80% respectively.

T-BILLS

T-Bonds

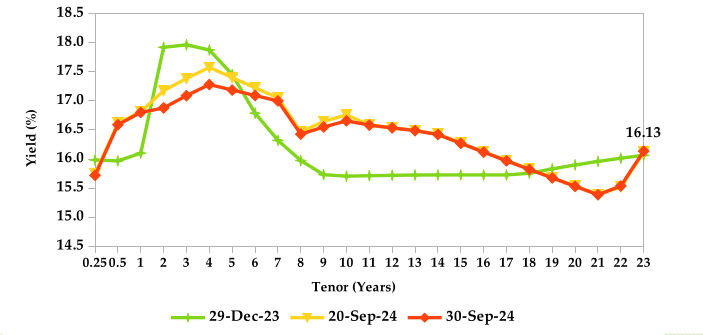

During the month, T-Bonds registered a total turnover of Kshs 133.18 billion from 2,589 bond deals. This represents a monthly increase of 50.75% and decrease of 2.01% respectively. The yields on government securities in the secondary market also decreased during the month of September.

In the primary bond market, CBK re-issued FXD1/2024/010 and FXD1/2016/020 bonds with coupon rates of 16.00% and 14.00% respectively, targeting to raise Kshs 30 billion. Additionally, CBK reopened the FXD1/2016/10 and FXD1/2022/10 treasury bonds in an effort to raise Kshs 50.0 billion. The respective coupon rates of the bonds are 15.04% and 13.49%. The sale runs from 25/09/2024 to 09/10/2024.

In the international market, yields on Kenya’s Eurobonds decreased by an average of 119 basis points.

YIELD CURVE

EQUITIES

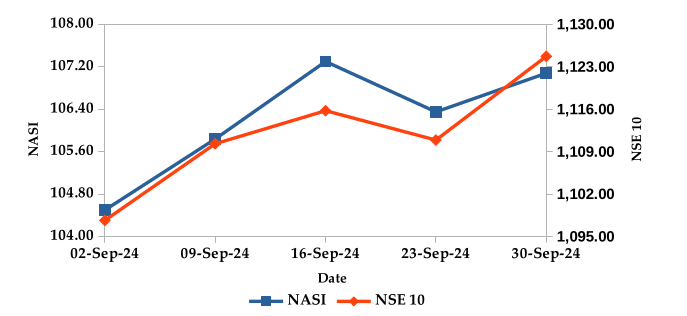

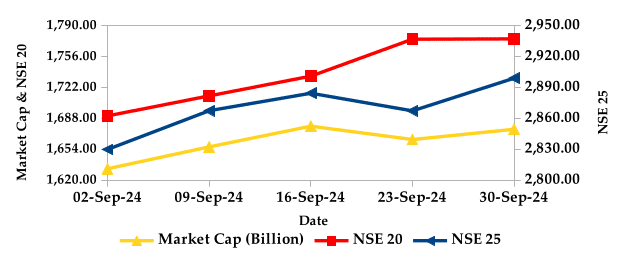

During the month, market capitalization gained 3.49% to settle at Kshs 1.68 trillion. Total shares traded decreased by 14.81% to 334.04 million shares and equity turnover decreased by 22.91% to close at Kshs 5.02 billion. On a monthly basis, NASI, NSE 20, NSE 25 and NSE 10 settled 3.29%, 5.81%, 3.07% and 3.36% higher respectively. The performance was as a result of gains recorded by large cap stocks such as KCB, Equity, Standard Chartered and Safaricom of 9.29%, 6.82%, 3.83% and 3.45% respectively. This was however weighed down by the losses recorded by Stanbic and ABSA of 2.09% and 1.75% respectively.

NASI and NSE 10

Market Capitalization, NSE 20 and NSE 25

ALTERNATIVE INVESTMENTS

GLOBAL AND REGIONAL MARKETS

| Global Markets | Monthly Change | YTD Change |

|---|---|---|

| S&P 500 | 2.02% | 21.50% |

| STOXX Europe 600 | -0.41% | 9.27% |

| Shanghai Composite (SSEC) | 17.39% | 12.63% |

| MSCI Emerging Market Index | 6.45% | 14.27% |

| MSCI World | 1.69% | 17.47% |

| Regional Markets | Monthly Change | YTD Change |

|---|---|---|

| FTSE ASEA Pan African Index | 1.81% | 2.58% |

| JSE All Share | 2.90% | 13.22% |

| NSE All Share (NGSE) | 2.05% | 29.70% |

| DSEI (Tanzania) | 0.57% | 19.85% |

| ALSIUG (Uganda) | 5.71% | 25.54% |

Get future reports

Please provide your details below to get future reports: