MONTH’S HIGHLIGHTS

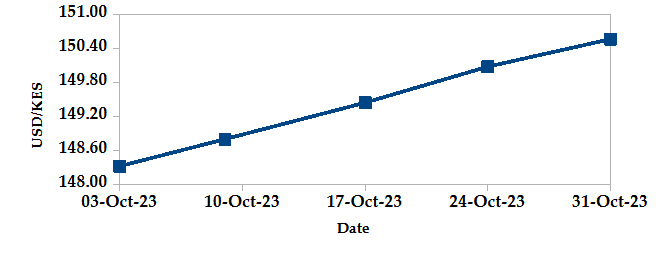

- Inflation rose to 6.92% in October from 6.78% in September, marking the second consecutive increase, but remained within the central bank’s target range of 2.5%-7.5%. This upsurge was driven by higher food, gas, electricity and fuel prices. All major indices edged higher during the month, with the food and non-alcoholic beverages index increasing by 1.3%, the housing, water, electricity, gas and other fuels index rising by 1.9% and the transport index increasing by 1.5%.

- The Kenya Revenue Authority (KRA) has achieved consistent growth in revenue collection, with a notable 20.90% increase in Q1 of the 2023/2024 financial year to Kshs 537.35 billion. However, this revenue falls short of the prorated amount of Kshs 642.79 billion expected in the first quarter of the financial year. The expenses surpassed revenue collections by Kshs 208.46 billion, signalling a fiscal deficit of 38.79% which was financed through external and internal borrowing by 27.79% and 72.21% respectively.

- Among the bills approved by the government into law include; the Universal Health Coverage (UHC) bill, which abolishes the National Health Insurance Fund (NHIF) and introduces three new funds: a Primary Health Care Fund, a Social Health Insurance Fund and a Chronic Illness and Emergency Fund. The bill aims to make healthcare more affordable and accessible. The Privatization Bill 2023, which replaces the 2005 Privatization Act, aims to accelerate the privatization of non-performing state-owned enterprises, a move that is expected to foster private sector participation in the economy, improved efficiency and enhance capital market development. The Public Finance Management (amendment) bill, which sets the borrowing threshold at 55% of GDP. This aligns with the constitutional provisions and includes principal, interest payments and all financial obligations as part of the public debt.

- According to the World Bank Africa’s Pulse report dated October 2023, Kenya’s growth is expected to accelerate slightly from 5% in 2023 to 5.2% and 5.3% in 2024 and 2025 respectively, supported by an increase in economic activity due to higher consumption expenditure and investment levels. Household consumption growth is expected to rise from 4.5% in 2023 to 5.3% on average in 2024–25. Gross fixed investment is expected to soar to 9.3% in 2024–25, up from 7.7% in 2023. Agriculture, industry and services growth are also anticipated to accelerate in 2024–25.

- Safaricom announced the completion of its acquisition of the entire issued share capital of M-Pesa Holding Company Limited from Vodafone International Holdings, concluding a process that began on 17 April 2023. M-Pesa Holdings will continue to serve as the corporate trustee responsible for M-Pesa customers’ funds under the M-Pesa trust, as required by the National Payment System Regulations 2014.

- Following approval from the Capital Markets Authority (CMA), ILAM Fahari I-REIT received redemption applications for 41,371,604 units from non-professional investors, representing a subscription rate of 113.08%, and top-up applications for 421,945 additional units from the redemption offer. The REIT’s manager, ICEA Lion Asset Management, is slated to call an extraordinary general meeting on November 24th to seek unit-holder approval to authorize the conversion and possible de-listing of the REIT from the NSE.

- The US economy expanded at its fastest pace in nearly two years in Q3 2023, rising at an annualized rate of 4.9%, exceeding market forecasts and significantly higher than the 2.1% growth in Q2. Consumer spending was the main driver of growth, with spending on housing and utilities, health care, financial services & insurance, food services & accommodations, nondurable goods particularly prescription drugs, recreational goods and vehicles accounting for the growth. Exports also rebounded in Q3 soaring 6.2%, after a 9.3% fall in Q2. Imports also increased but at a slower pace than exports.

- The European Central Bank (ECB) kept interest rates unchanged at 4.5% during its October meeting, signalling a more cautious stance among policymakers. This comes as price pressures gradually ease and concerns about an impending recession grow. Policymakers intend to keep rates at these multi-year highs until inflation returns to its 2% target over the medium term.

ECONOMIC INDICATORS

Foreign Exchange Reserves

During the month, the usable foreign reserves declined by 1.48% to settle at USD 6.84 billion (3.67 months of import cover). This falls short of CBK’s statutory requirement to endeavour to maintain at least 4 months of import cover as well as the EAC region’s convergence criteria of 4.5 months of import cover.

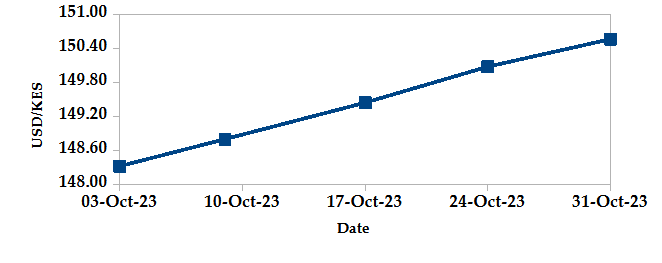

Currency

The Kenyan Shilling depreciated against the USD, the Sterling Pound and the Euro by 1.66%, 1.20% and 2.28%, exchanging at Kshs 150.56, Kshs 182.72 and Kshs 159.56 respectively at the end of the month, from Kshs 148.10, Kshs 180.56 and Kshs 156.00 in the previous month. The depreciation against the Dollar is attributed to rising demand from importers, which has caused a shortage in the market.

USD Vs KSHS

STERLING POUND & EURO Vs KSHS

Inflation

The overall year-on-year inflation increased to 6.92% in October from 6.78% in September. This was primarily driven by higher food, gas, electricity and fuel prices.

INFLATION EVOLUTION

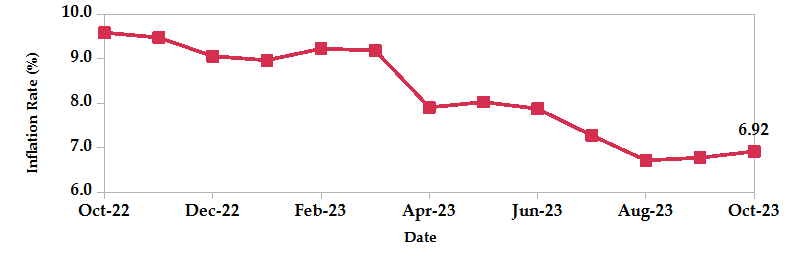

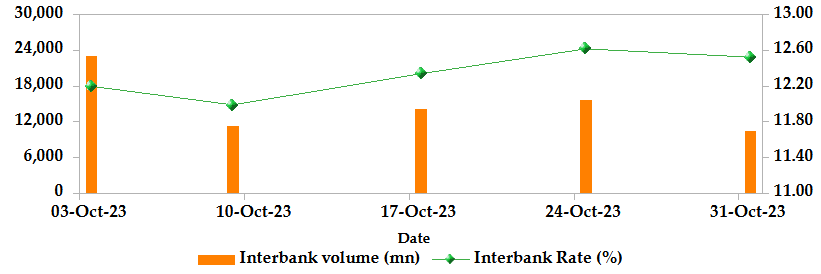

Liquidity

During the month, liquidity tightened as a result of tax remittances which more than offset government payments. The inter-bank rate increased from 12.44% to 12.52%. The volume of inter-bank transactions decreased from Kshs 20.0 billion to Kshs 10.38 billion. Commercial banks excess reserves increased from Kshs 19.30 billion to Kshs 19.80 billion.

INTER-BANK RATE and VOLUME

FIXED INCOME

T-Bills

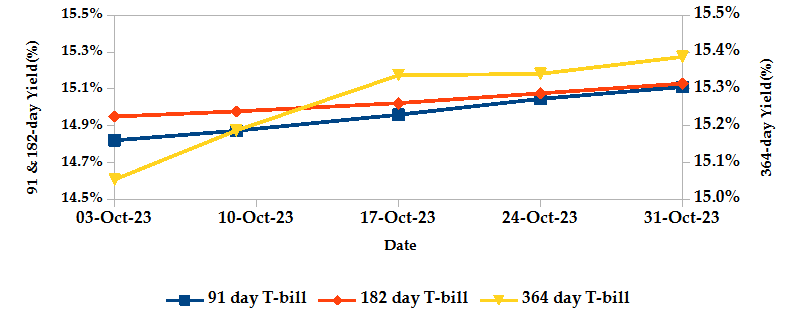

T-bills recorded an overall subscription rate of 129.32% during the month of October, compared to 98.73% recorded in the previous month. The performance of the 91-day, 182-day and 364-day papers stood at 626.70%, 34.10% and 25.58% respectively. On a monthly basis, yields on the 91-day, 182-day and 364-day papers increased by 1.96%, 1.20% and 2.21% to 15.11%, 15.13% and 15.39% respectively as investors aggressively bid to compensate for a weaker Shilling and inflationary pressures.

T-BILLS

T-Bonds

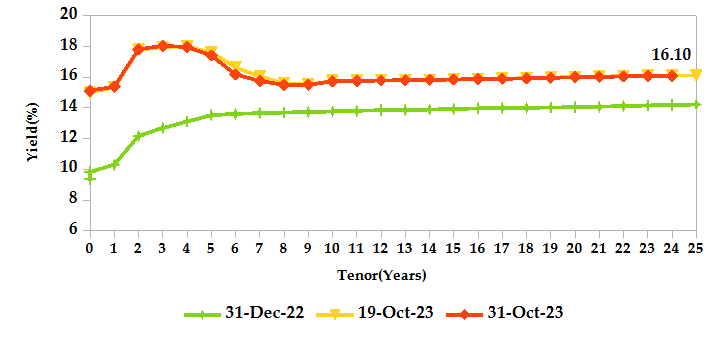

During the month, T-Bonds registered a total turnover of Kshs 34.59 billion from 1,536 bond deals. This represents a monthly decrease of 63.31% and 30.62% respectively. The yields on government securities in the secondary market increased during the month of October.

In the primary bond market, CBK reopened FXD1/2023/2 and FXD1/2023/5 treasury bonds, seeking to raise Kshs 35.0 billion from both papers. The bonds have effective tenors of 1.9 years and 4.8 years and coupon rates of 16.97% and 16.84% respectively. In addition, the Central Bank issued a new 6.5-year infrastructure bond IFB1/2023/6.5, targeting Kshs 50.0 billion with the period of sale running from 20/10/2023 to 08/11/2023 and a market-determined coupon rate.

In the international market, yields on Kenya’s Eurobonds decreased by an average of 715 basis points.

YIELD CURVE

EQUITIES

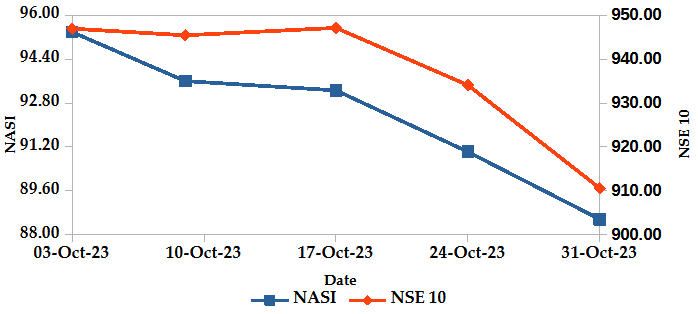

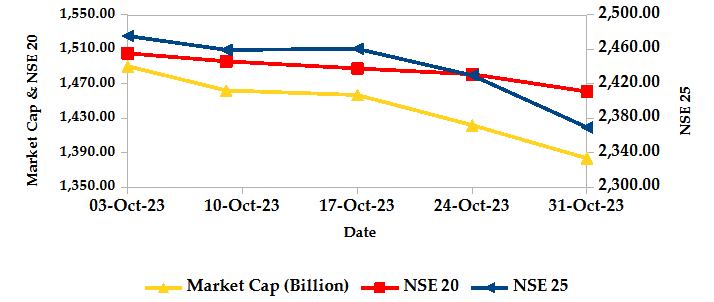

During the month, market capitalization lost 6.99% to settle at Kshs 1.38 trillion. Total shares traded increased by 13.85% to 269.03 million shares while equity turnover went down 4.91% to close at Kshs 3.88 billion. On a monthly basis, NASI, NSE 20, NSE 25 and NSE 10 settled 6.99%, 3.16%, 4.21% and 4.29% lower. The performance was a result of losses recorded by large-cap stocks such as KCB, Safaricom and Stanbic of 16.07%, 14.73% and 6.07%.

NASI and NSE 10

Market Capitalization, NSE 20 and NSE 25

ALTERNATIVE INVESTMENTS

- During the month, the derivatives market recorded 127 contracts with a turnover of Kshs 4.12 million, which was an increase from 117 contracts with a decrease in turnover of Kshs 6.99 million recorded in the previous month.

- During the month, the I-REIT market recorded a turnover of Kshs 600.26 million with 40 deals which was an increase from Kshs 1.98 million with 168 deals recorded in the previous month.

- During the month, the ETF market recorded a turnover of Kshs 10.23 million with 2 deal which was an increase from Kshs 4.11 million with 4 deal recorded in the previous month.

GLOBAL AND REGIONAL MARKETS

| Global Markets | Weekly Change | Monthly Change |

|---|---|---|

| S&P 500 | -2.20% | 9.67% |

| STOXX Europe 600 | -3.68% | -0.12% |

| Shanghai Composite (SSEC) | -2.95% | -3.14% |

| MSCI Emerging Market Index | -3.94% | -4.92% |

| MSCI World | -2.97% | 6.45% |

| Regional Markets | Weekly Change | Monthly Change |

|---|---|---|

| FTSE ASEA Pan African Index | 3.34% | -0.75% |

| JSE All Share | -3.95% | -6.56% |

| NSE All Share (NGSE) | 4.30% | 34.19% |

| DSEI (Tanzania) | -0.87% | -6.46% |

| ALSIUG (Uganda) | -1.43% | -23.81% |

- Global markets registered losses during the month. In the US, the S&P 500 lost 2.20% and the Dow Jones index lost 1.36%, marking the third consecutive month of losses amid rising yields, US Dollar appreciation and lower consumer confidence. In Europe, the STOXX Europe 600 and the UK’s FTSE 100 indices edged 3.68% and 3.76% lower, on concerns about prolonged high interest rates and uncertainties surrounding economic growth. In Asia Pacific, the Shanghai Composite (SSEC) index lost 2.95% on continued economic weakness in China, Asia’s biggest economy, as manufacturing activity contracted unexpectedly and business activity remained subdued.

- On a regional front, markets recorded mixed performance. The FTSE ASEA Pan African index, representing the overall African markets gained 3.34% from September. South Africa’s JSE All Share Index, Tanzania’s DSEI and Uganda’s All Share Index dropped by 3.95%, 0.87% and 1.43% respectively, while Nigeria’s All Share Index rose by 4.30%.

- On the global commodities markets, oil future indices edged lower, reflecting concerns about weaker-than-expected factory activity in China, a major oil importer and the prolonged high-interest rate environment. Crude Oil WTI futures and ICE Brent Crude Oil settled 10.76% and 8.29% lower to close at $81.02 and $87.41 respectively.

Get future reports

Please provide your details below to get future reports: