MONTH’S HIGHLIGHTS

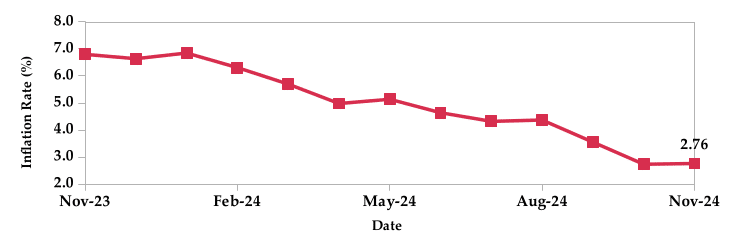

- Inflation edged 2.76% in November 2024 from 2.73% in October, marking the first increase since August. However, it remains below the central bank’s target range midpoint of 5%. The uptick was primarily driven by rising food prices, with the food and non-alcoholic beverages index increasing by 0.6%. The housing, water, electricity, gas and other fuels index decreased by 0.1%, mainly due to decreased LPG (gas) and electricity prices. Despite stable petrol and diesel prices, the transport index increased by 0.2%, due to higher international flight costs.

- The Central Bank of Kenya (CBK) announced changes to some denominations of the Kenyan currency banknotes. The changes affect the Kshs 50, Kshs 100, Kshs 200, Kshs 500 and Kshs 1,000 currency banknotes.

- Safaricom PLC launched Ziidi Money Market Fund, a new investment product accessible to M-PESA customers. Licensed by the Capital Markets Authority (CMA) as a Collective Investment Scheme, the fund offers a low-risk investment opportunity. This partnership between Safaricom, Standard Investment Bank, ALA Capital Limited and Sanlam Investments East Africa Limited aims to provide customers with a convenient and accessible way to invest in short-term debt securities.

- The Capital Markets Authority (CMA) granted a Real Estate Investment Trust (REIT) Manager License to Future Construkt Investment Managers Ltd, a subsidiary of Construkt Africa. This development enables the firm to mobilize capital for real estate projects, particularly green housing schemes and commercial property asset management. The license aligns with the government’s affordable housing agenda and Construkt Africa’s vision of creating sustainable cities. With Kenya’s improving economic environment, REITs offer an attractive investment opportunity for local and foreign investors.

- Kenya Electricity Generating Company PLC (KenGen) signed a Kshs 250 million contract with Eswatini Electricity Company (EEC) to conduct geothermal exploration in three regions of Eswatini. Announced during its 72nd Annual General Meeting (AGM), KenGen emphasised its commitment to expanding its renewable energy footprint across Africa, utilising its geothermal expertise to drive sustainable development. This project strengthens the company’s position as a leader in Africa’s renewable energy sector, following previous successes, including a Kshs 709 million geothermal drilling contract in Djibouti in 2021 and the completion of seven geothermal wells in Ethiopia in 2022.

- US GDP expanded at an annualized rate of 2.8% in the third quarter of 2024, matching the initial estimate and slowing from the 3% growth recorded in the second quarter. Personal consumption expenditure (PCE) increased at the fastest pace since the first quarter of 2023, driven by a surge in goods consumption and robust spending on services. However, the PCE growth was slightly revised downward from the initial estimate. Government consumption remained steady at 5%, while net trade contributed negatively to growth due to slower export and import growth. Fixed investment increased more than initially estimated, with investment in equipment surging. However, investment in structures and residential investment declined.

- The Eurozone economy grew by 0.4% in the third quarter of 2024, marking the strongest quarterly growth in two years. This was driven by improved performance in several major economies, including Germany, France and Spain. While Italy’s economy stalled and Latvia continued to contract, other countries like Portugal, Ireland and Lithuania experienced positive growth. The Eurozone’s annual GDP growth for 2024 is now projected to be 0.8%.

- Eurozone inflation increased to 2.3% in November 2024 from 2% in October. This was primarily driven by base effects as the sharp decline in energy prices from last year no longer impacted annual rates. While energy prices continued to decline, albeit at a slower pace, prices for non- energy industrial goods rose faster than in the previous month. Core inflation, which excludes volatile food, energy, alcohol and tobacco prices, remained steady at 2.7%, defying expectations of a further increase. On a monthly basis, consumer prices fell 0.3% in November, following a 0.3% rise in October.

ECONOMIC INDICATORS

Foreign Exchange Reserves

During the month, the usable foreign exchange reserves increased by 4.90% to settle at $9.0 billion (4.60 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4 months of import cover and EAC region’s convergence criteria of 4.5 months of import cover.

Currency

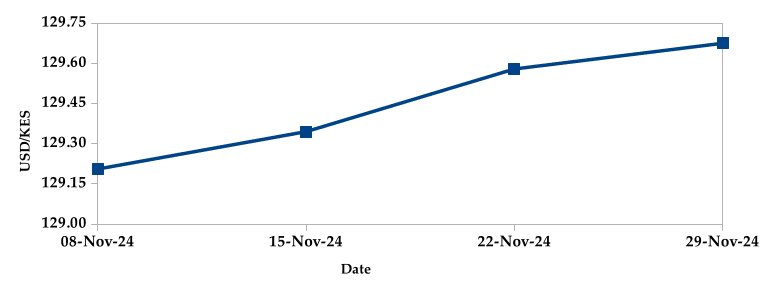

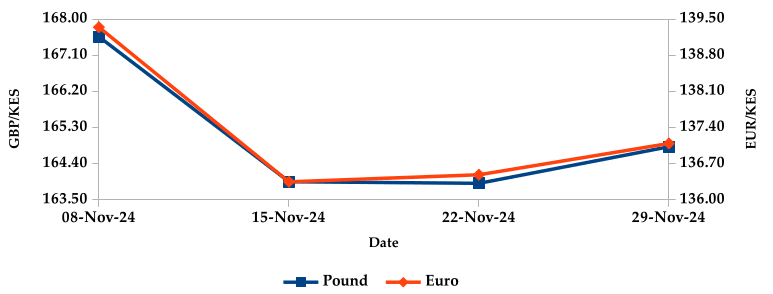

The Kenyan Shilling depreciated against the USD by 0.37%, but appreciated against the Sterling Pound and the Euro by 1.49% and 2.20%, exchanging at Kshs 129.68, Kshs 164.82 and Kshs 137.09 respectively at the end of the month, from Kshs 129.20, Kshs 167.32 and Kshs 140.18 in the previous month. The observed depreciation against the Dollar is attributed to high demand for the currency.

USD Vs KSHS

STERLING POUND & EURO Vs KSHS

Inflation

The overall year-on-year inflation marginally increased to 2.76% in November 2024 from 2.73% in October. This was primarily driven by higher food and international flight prices.

INFLATION EVOLUTION

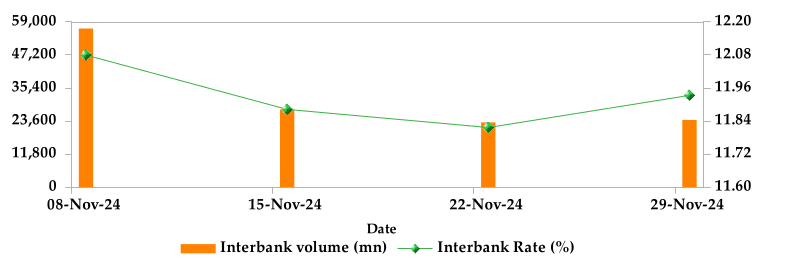

Liquidity

During the month, liquidity increased as a result of government payments which more than offset tax remittances. The average inter-bank rate decreased from 12.15% to 11.96%. The volume of inter-bank transactions decreased from Kshs 34.10 billion to Kshs 32.01 billion. Commercial banks excess reserves increased from Kshs 39.50 billion to Kshs 44.80 billion.

INTER-BANK RATE and VOLUME

FIXED INCOME

T-Bills

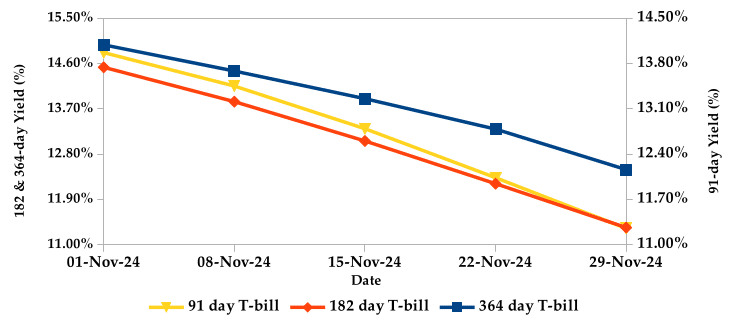

T-bills recorded an overall subscription rate of 335.21% during the month of November, compared to 296.55% recorded in the previous month. The performance of the 91-day, 182-day and 364-day papers stood at 634.90%, 256.67% and 293.88% respectively. On a monthly basis, yields on the 91-day, 182-day and 364-day papers decreased by 19.45%, 21.93% and 16.56% to 11.25%, 11.34% and 12.49% respectively.

T-BILLS

T-Bonds

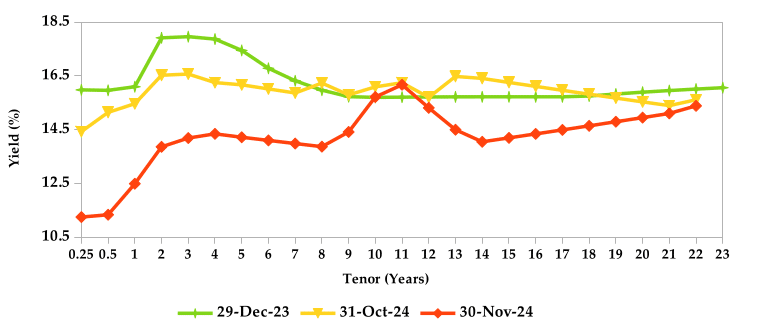

During the month, T-Bonds registered a total turnover of Kshs 109.36 billion from 2,519 bond deals. This represents a monthly decline of 9.47% and an increase of 1.49% respectively. The yields on government securities in the secondary market also decreased during the month of November.

In the primary bond market, CBK re-opened FXD1/2023/10 and FXD1/2018/20 treasury bonds in an effort to raise Kshs 25.0 billion. The coupon rates are 14.15% and 13.20% respectively. Additionally, CBK re-issued FXD1/2024/10 bond with a coupon rate of 16.00%, targeting to raise Kshs 20 billion.

In the international market, yields on Kenya’s Eurobonds decreased by an average of 15 basis points.

YIELD CURVE

EQUITIES

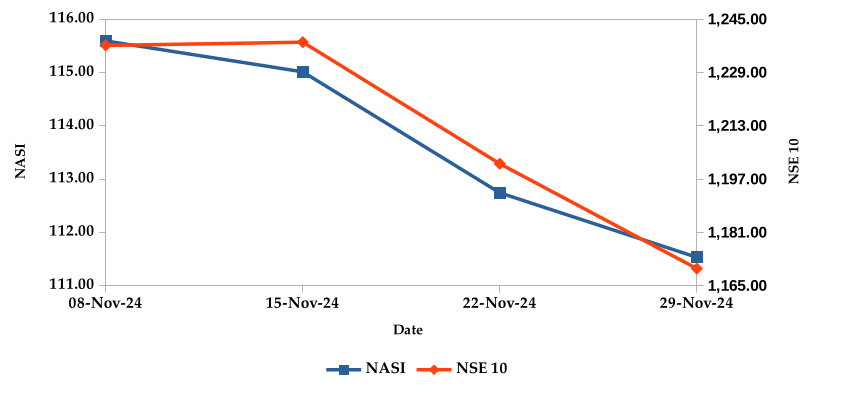

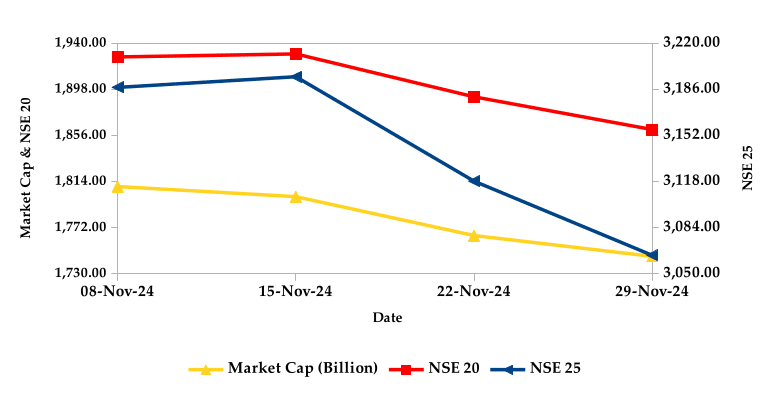

During the month, market capitalization lost 5.17% to settle at Kshs 1.75 trillion. Total shares traded increased by 23.23% to 470.95 million shares and equity turnover increased by 25.18% to close at Kshs 6.19 billion. On a monthly basis, NASI, NSE 20, NSE 25 and NSE 10 settled 5.17%, 2.32%, 3.99% and 5.54% lower respectively. The performance was as a result of losses recorded by large cap stocks such as Safaricom, EABL and Equity of 10.45%, 9.43% and 4.86% respectively. This was however mitigated by the gain recorded by Standard Chartered of 4.85%.

NASI and NSE 10

Market Capitalization, NSE 20 and NSE 25

ALTERNATIVE INVESTMENTS

GLOBAL AND REGIONAL MARKETS

| Global Markets | Monthly Change | YTD Change |

|---|---|---|

| S&P 500 | 4.95% | 27.19% |

| STOXX Europe 600 | 1.01% | 6.63% |

| Shanghai Composite (SSEC) | 1.42% | 12.29% |

| MSCI Emerging Market Index | -3.79% | 5.26% |

| MSCI World | 3.97% | 20.22% |

| Regional Markets | Monthly Change | YTD Change |

|---|---|---|

| FTSE ASEA Pan African Index | -0.99% | 2.48% |

| JSE All Share | -1.65% | 9.68% |

| NSE All Share (NGSE) | -0.12% | 28.31% |

| DSEI (Tanzania) | -2.06% | 22.83% |

| ALSIUG (Uganda) | -1.74% | 30.88% |

Get future reports

Please provide your details below to get future reports: