MONTH’S HIGHLIGHTS

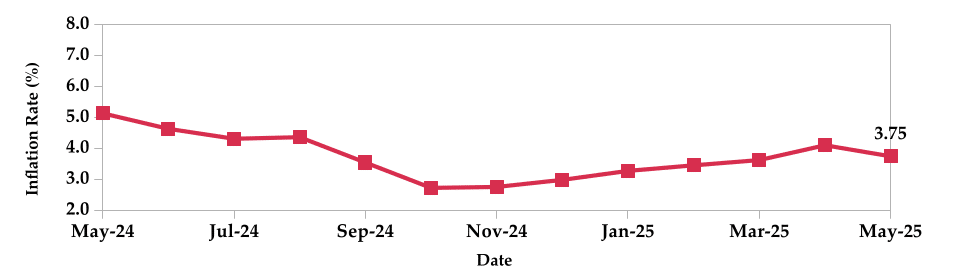

- Inflation decreased to 3.75% in May 2025 from 4.11% in April. This was primarily attributed to lower electricity and gas/LPG prices. The food and non-alcoholic beverages index increased by 1.2%, driven by higher food prices. The housing, water, electricity, gas and other fuels index remained stable, primary driven by decline in gas/LPG prices and electricity costs. Despite the stabilisation in diesel and petrol prices, the transport index increased by 0.2%, mainly attributed to an increase in international flight prices.

- Kenya’s GDP decelerated to 4.7% in 2024, a drop from the revised 5.7% in 2023. This slowdown was mainly attributed to contractions in the industrial sector, particularly construction and mining & quarrying. While most key sectors experienced slower growth, manufacturing, trade, public administration, education and health showed resilience. Agriculture’s growth also eased, with gains in sugarcane, tea and coffee offset by lower maize and potato output. Service sectors remained a key support, growing at 6.0%, driven by finance, transport, real estate, ICT and trade.

- The Capital Markets Authority (CMA) announced that Assets Under Management (AUM) in Collective Investment Schemes have surpassed Kshs 400 billion, marking a sevenfold growth over the past decade. AUM rose from Kshs 57 billion in 2016 to Kshs 389 billion in 2024. The CMA also licensed the Meridian Asset Management and Swala Capital Limited raising the total to 45 fund managers and approved Ndovu Wealth Limited to launch two multi-asset funds under the Taifa Unit Trust denominated in Kenyan Shillings and US Dollars.

- The Competition Authority of Kenya (CAK) approved US fintech firm Moniepoint Inc.’s acquisition of a 78% stake in Sumac Microfinance Bank Limited, marking Moniepoint’s strategic entry into Kenya’s financial sector. Sumac, a medium-sized microfinance institution with a 4.3% market share, awaits further approval from the Central Bank of Kenya (CBK), with CAK noting no threat to competition given Moniepoint’s lack of local presence and the market’s concentration among five dominant players. CAK also approved the acquisition of Mananasi Fibre Limited (MFL) by Del Monte Kenya Limited, allowing the pineapple processor to enter the waste management sector. MFL specializes in compost, biochar and pineapple fibre for textiles, and operates in a market alongside players such as TakaTaka Solutions, Eco Nasi, Cookswell Jikos, Biochar Life and Pine Kazi.

- Serena Hotels operator, TPS Eastern Africa PLC resumed dividend payouts after five years, declaring Kshs 0.35 per share for FY2024, matching its FY2018 distribution. This follows a strong financial turnaround, with profit surging 188% to Kshs 1.3 billion and revenue up 5% to Kshs 10.2 billion. Key drivers included a Kshs 830 million unrealized forex gain due to the strengthening Kenya Shilling, a 58% drop in finance costs to Kshs 671 million and positive EBITDA across all business units.

- The US economy contracted at an annualised rate of 0.2% in Q1 2025, marking its first quarterly GDP decline in three years. While this represents a slight improvement from the initial estimate of a 0.3% contraction, it still reflects growing pressures on the economy. The upward revision was primarily driven by stronger-than-expected fixed investment, which helped partially offset subdued consumer spending and a weaker-than-anticipated drag from trade. A key contributor to the trade imbalance was a 42.6% surge in imports, as businesses and consumers accelerated purchases ahead of anticipated price increases following new tariff announcements by the Trump administration.

- The S&P Global US Composite PMI increased to 52.1 in May from 51.3 in April, signaling a modest uptick in private sector activity. The improvement was overshadowed by rising concerns over tariffs, which firms cited as weighing on demand, disrupting supply chains and pushing up input costs. Selling prices for goods and services saw their sharpest increase since August 2022, driven primarily by these tariff-related pressures. In anticipation of further supply challenges, manufacturers boosted inventories at a record pace —reflecting a cautious outlook despite the pickup in output.

ECONOMIC INDICATORS

Foreign Exchange Reserves

During the month, the usable foreign exchange reserves increased by 7.36% to settle at $10.47 billion (4.70 months of import cover). This was above the CBK’s statutory requirement to endeavor to maintain at least 4 months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover.

Currency

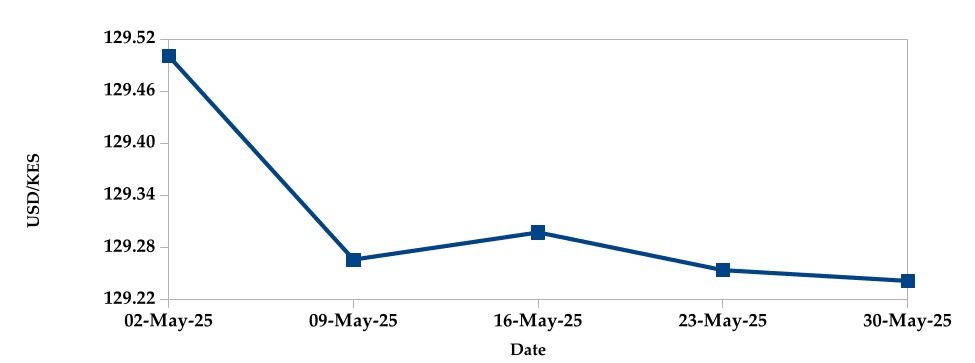

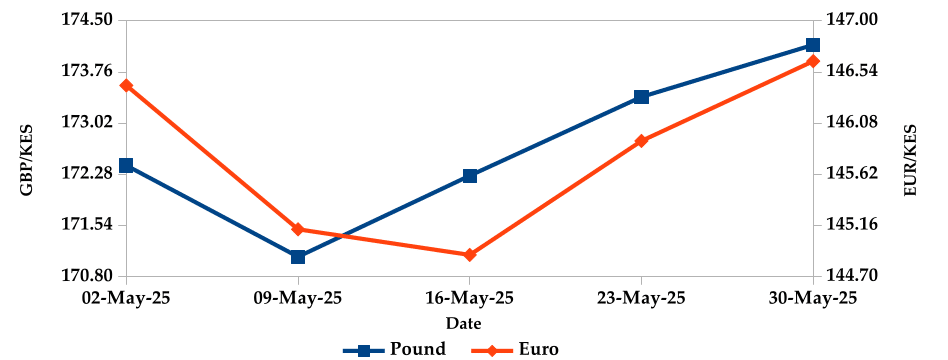

The Kenyan Shilling appreciated against the USD and the Euro, but depreciated against the Sterling Pound by 0.08%, 0.36% and 0.54%, exchanging at Kshs 129.24, Kshs 146.64 and Kshs 174.15 respectively at the end of the month, from Kshs 129.34, Kshs 147.16 and Kshs 173.21 in the previous month. The observed appreciation against the Dollar is attributed to an increase in foreign exchange reserves.

USD Vs KSHS

STERLING POUND & EURO Vs KSHS

Inflation

The overall year-on-year inflation decreased to 3.75% in May 2025 from 4.11% in April. This was primarily attributed to lower electricity and gas/LPG prices.

INFLATION EVOLUTION

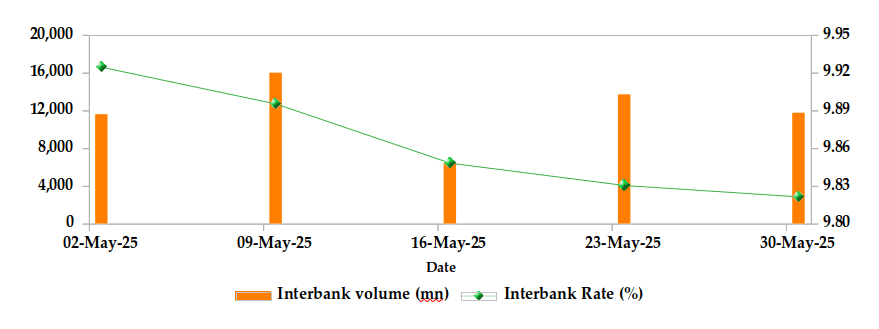

Liquidity

During the month, liquidity increased as a result of government payments which more than offset tax remittances. The average inter-bank rate decreased from 10.17% to 9.86%. The volume of inter-bank transactions decreased from Kshs 15.02 billion to Kshs 7.41 billion. Commercial banks excess reserves increased from Kshs 7.70 billion to Kshs 15.80 billion.

INTER-BANK RATE and VOLUME

FIXED INCOME

T-Bills

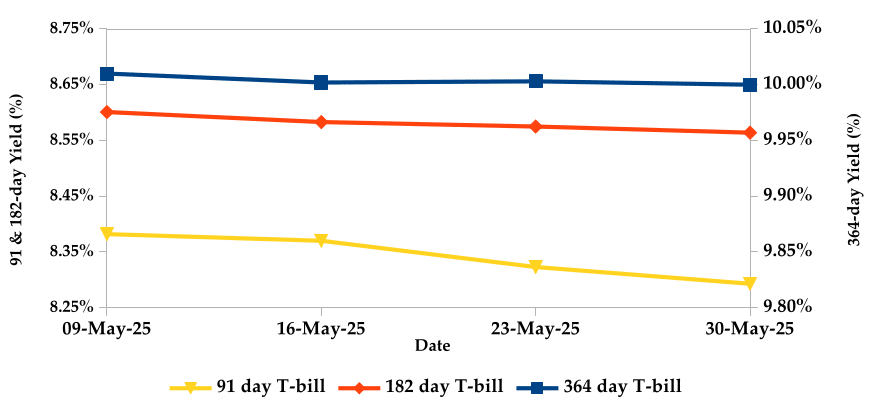

T-bills recorded an overall subscription rate of 192.80% during the month of May, compared to 161.74% recorded in the previous month. The performance of the 91-day, 182-day and 364-day papers stood at 263.46%, 118.37% and 238.97% respectively. On a monthly basis, yields on the 91-day, 182-day and 364-day papers decreased by 1.34%, 0.64% and 0.06% respectively.

T-BILLS

T-Bonds

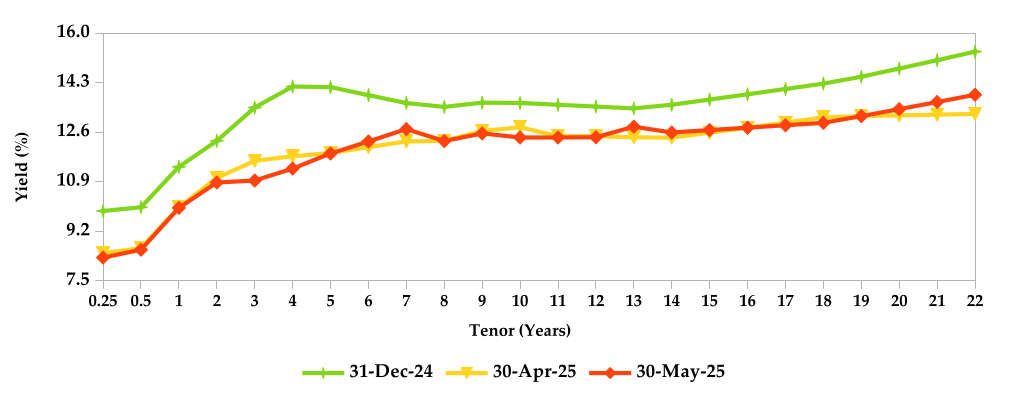

During the month, T-Bonds registered a total turnover of Kshs 189.42 billion from 3,899 bond deals. This represents a monthly decrease of 19.12% and an increase of 0.57% respectively. The yields on government securities in the secondary market increased during the month of May.

In the international market, yields on Kenya’s Eurobonds decreased by an average of 227 basis points.

YIELD CURVE

EQUITIES

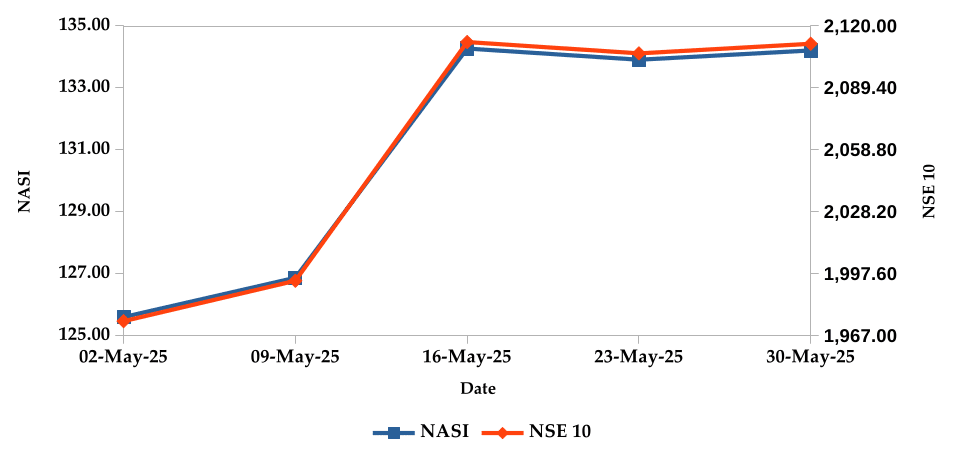

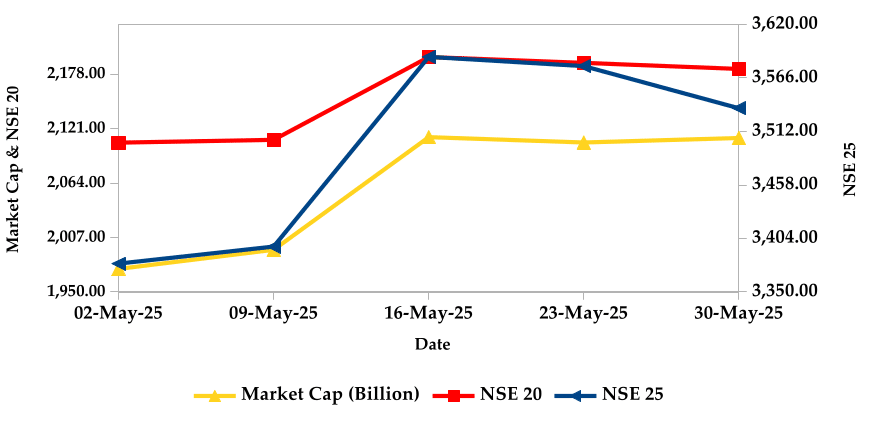

During the month, market capitalization gained 6.53% to settle at Kshs 2.11 trillion. Total shares

traded increased by 42.13% to 468.38 million shares and equity turnover increased by 18.96% to

close at Kshs 8.94 billion. On a monthly basis, NASI, NSE 20, NSE 25 and NSE 10 settled 6.45%,

2.25%, 3.60% and 4.94% higher respectively. The performance was as a result of gains recorded

by large cap stocks such as Safaricom, KCB and Co-operative Bank 17.38%, 9.49% and 7.64%

respectively. This was however weighed down by the losses recorded by Stanbic and Standard

Chartered of 12.46% and 10.50% respectively.

NASI and NSE 10

Market Capitalization, NSE 20 and NSE 25

ALTERNATIVE INVESTMENTS

GLOBAL AND REGIONAL MARKETS

| Global Markets | Monthly Change | YTD Change |

|---|---|---|

| S&P 500 | 6.15% | 0.74% |

| STOXX Europe 600 | 4.02% | 7.44% |

| Shanghai Composite (SSEC) | 2.09% | 2.60% |

| MSCI Emerging Market Index | 4.00% | 7.51% |

| MSCI World | 5.69% | 4.20% |

| Regional Markets | Monthly Change | YTD Change |

|---|---|---|

| FTSE ASEA Pan African Index | 3.81% | 14.63% |

| JSE All Share | 2.76% | 14.19% |

| NSE All Share (NGSE) | 5.62% | 8.30% |

Get future reports

Please provide your details below to get future reports: