MONTH’S HIGHLIGHTS

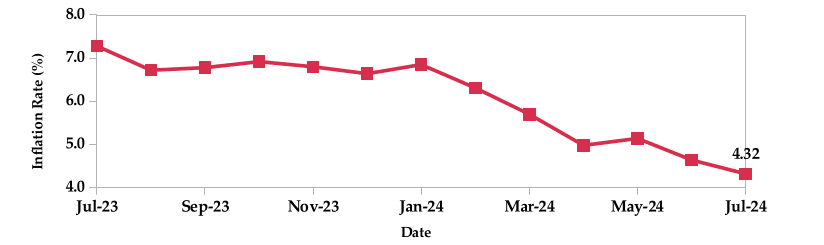

- Inflation decreased to 4.32% in July from 4.64% in June. This was primarily attributed to lower food, electricity and fuel prices. The food and non-alcoholic beverages index declined 0.5%, driven by decreased food prices. Despite an increase in gas prices, the housing, water, electricity, gas and other fuels index decreased by 0.4%, mainly due to lower electricity and kerosene prices. Additionally, the transport index dropped by 0.1%, driven by a decrease in petrol and diesel prices.

- Moody’s and Fitch Ratings downgraded Kenya’s creditworthiness from B3 to Caa1 and B to B- respectively. This downgrade was attributed to the government’s decision to withdraw the Finance Bill 2024, which aimed to increase taxes to address the country’s burgeoning debt. The rating agencies expressed concerns about Kenya’s weakened fiscal position, limited access to international funding and increased reliance on domestic borrowing as key factors influencing the downgrade.

- Kenya finalized an agreement with the UAE that grants preferential market access for Kenyan goods, further solidifying its trade momentum following a similar deal with the European Union. This comes after a remarkable first quarter of 2024, where Kenyan exports to Asia increased by 76.4% year-on-year. This growth was fueled by a surge in shipments of tea, goat meat and jet fuel to both Saudi Arabia and the UAE.

- The Japanese International Cooperation Agency (JICA) allocated a Kshs 1.85 billion grant to Kenya Power to expand electricity access nationwide. This funding will facilitate Phase V of the Last Mile Connectivity Project, benefiting over 9,000 households in Nakuru, Kilifi, Nyandarua and Kwale counties. Building on the momentum of Phase IV, which began two months ago with the signing of 26 contracts with partners including the European Investment Bank and the French Development Agency, the project aims to connect a total of 280,000 new customers to the grid by November 2025.

- The Federal Reserve held interest rates steady at 5.25%–5.50% for the eighth consecutive meeting in July, maintaining its hawkish stance. While acknowledging progress in curbing inflation, the central bank remains cautious, emphasizing the need for continued rate stability until price pressures are consistently under control. The Fed signaled a potential for future rate cuts but stressed that the timing and extent of such moves will depend on incoming economic data, particularly inflation trends.

- The Caixin China General Manufacturing PMI declined to 49.8 in July from 51.8 in June, indicating a contraction in factory activity for the first time since October 2023. This downturn was primarily driven by a sharp decrease in new orders as demand weakened both domestically and internationally. Purchasing activity also contracted, leading to inventory adjustments. While employment remained relatively stable, output growth slowed.

- Euro Area GDP growth remained steady in the second quarter of 2024, expanding by 0.30%. While this marks a continuation of the region’s economic recovery, it falls slightly below the long-term average of 0.37% since 1995. The Euro Area experienced significant volatility during the pandemic, reaching a peak of 11.70% growth in the third quarter of 2020 and a trough of -11.10% in the second quarter of the same year.

ECONOMIC INDICATORS

Foreign Exchange Reserves

During the month, the usable foreign exchange reserves decreased by 6.74% to settle at $7.27 billion (3.80 months of import cover). This was below the CBK’s statutory requirement to endeavor to maintain at least 4 months of import cover and EAC region’s convergence criteria of 4.5 months of import cover.

Currency

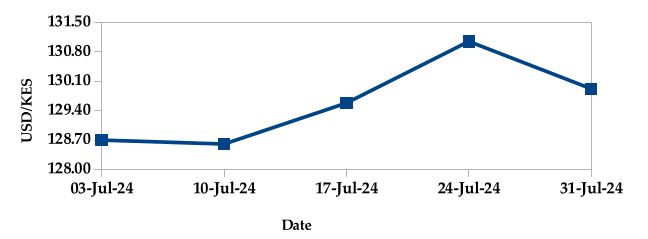

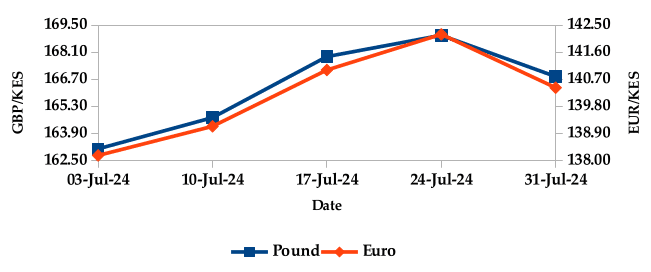

The Kenyan Shilling depreciated against the USD, the Sterling Pound and the Euro by 0.31%, 1.79% and 1.12%, exchanging at Kshs 129.92, Kshs 166.84 and Kshs 140.42 respectively at the end of the month, from Kshs 129.53, Kshs 163.90 and Kshs 138.87 in the previous month. The observed depreciation against the Dollar is attributed to a high demand for the currency.

USD Vs KSHS

STERLING POUND & EURO Vs KSHS

Inflation

The overall year-on-year inflation slightly decreased to 4.32% in July from 4.64% in June. This was primarily driven by lower food, electricity and fuel prices.

INFLATION EVOLUTION

Liquidity

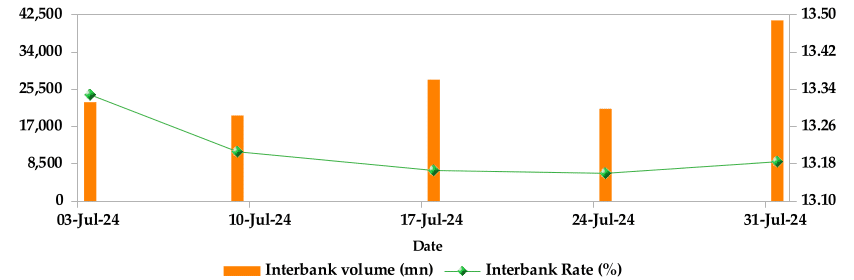

During the month, liquidity decreased as a result of tax remittances which more than offset government payments. The average inter-bank rate increased from 13.14% to 13.18%. The volume of inter-bank transactions increased from Kshs 24.10 billion to Kshs 28.61 billion. Commercial banks excess reserves increased from Kshs 12.80 billion to Kshs 19.30 billion.

INTER-BANK RATE and VOLUME

FIXED INCOME

T-Bills

T-bills recorded an overall subscription rate of 116.53% during the month of July, compared to 84.42% recorded in the previous month. The performance of the 91-day, 182-day and 364-day papers stood at 404.72%, 78.73% and 39.06% respectively. On a monthly basis, yields on the 91-day, 182-day and 364-day papers increased by 0.07%, 0.51% and 0.77% to 15.99%, 16.85% and 16.92% respectively.

T-BILLS

T-Bonds

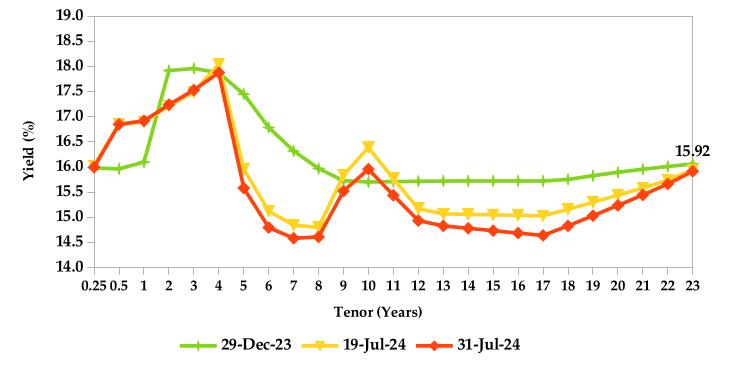

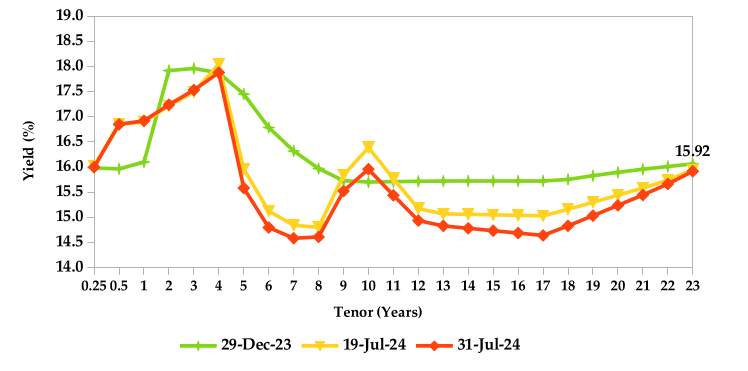

During the month, T-Bonds registered a total turnover of Kshs 165.85 billion from 2,773 bond deals. This represents a monthly increase of 70.48% and 9.95% respectively. The yields on government securities in the secondary market slightly decreased during the month of July.

In the primary bond market, CBK re-opened two infrastructure bonds IFB1/2023/6.5 and IFB1/2023/17, seeking to raise Kshs 50 billion. These bonds have coupon rates of 17.9% and 14.4%, and tenors of 5.8 years and 15.7 years respectively. The sale runs from 25/07/2024 to 14/08/2024.

In the international market, yields on Kenya’s Eurobonds decreased by an average of 3 basis points.

YIELD CURVE

EQUITIES

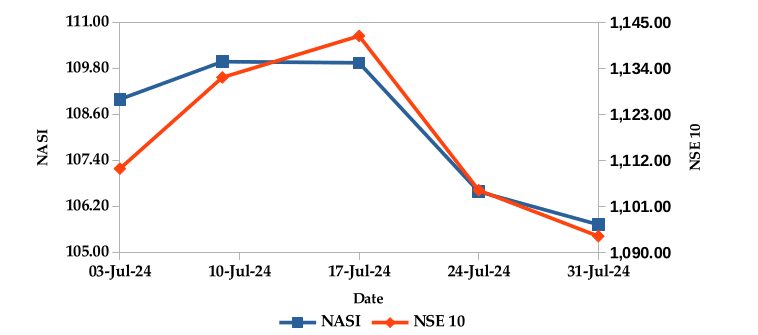

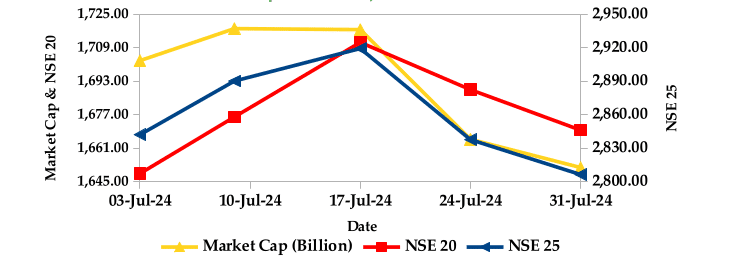

During the month, market capitalization lost 3.44% to settle at Kshs 1.65 trillion. Total shares traded decreased by 47.65% to 294.35 million shares while equity turnover increased by 16.85% to close at Kshs 5.86 billion. On a monthly basis, NASI, NSE 25 and NSE 10 settled 3.43%, 1.91% and 2.10% lower while NSE 20 settled 0.80% higher. The performance was as a result of losses recorded by large cap stocks such as Safaricom, Equity, Standard Chartered and NCBA of 8.09%, 4.14%, 2.96% and 2.68% respectively. This was however mitigated by the gain recorded by EABL of 7.67%.

NASI and NSE 10

Market Capitalization, NSE 20 and NSE 25

ALTERNATIVE INVESTMENTS

GLOBAL AND REGIONAL MARKETS

| Global Markets | Monthly Change | YTD Change |

|---|---|---|

| S&P 500 | -0.25% | 14.84% |

| STOXX Europe 600 | 0.08% | 6.96% |

| Shanghai Composite (SSEC) | -1.18% | -1.01% |

| MSCI Emerging Market Index | 0.14% | 6.16% |

| MSCI World | 0.18% | 11.00% |

| Regional Markets | Monthly Change | YTD Change |

|---|---|---|

| FTSE ASEA Pan African Index | 12.68% | 367.85% |

| JSE All Share | 2.37% | 7.75% |

| NSE All Share (NGSE) | -2.70% | 28.12% |

| DSEI (Tanzania) | 3.08% | 17.86% |

| ALSIUG (Uganda) | 0.07% | 18.18% |

Get future reports

Please provide your details below to get future reports: