MONTH’S HIGHLIGHTS

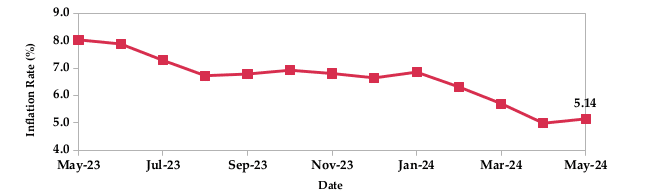

- Inflation edged up to 5.14% in May from 4.98% in April, reversing a consistent downward trend since January. This rise was primarily attributed to higher food and electricity prices. The food and non-alcoholic beverages index rose by 2.0%, driven by rising food costs. The housing, water, electricity, gas and other fuels index also surged by 1.2%, mainly due to an increase in electricity prices. Notably, despite a drop in fuels prices, the transport index also went up by 0.2% compared to the previous month.

- The World Bank approved a new $1.2 billion funding under the Kenya Fiscal Sustainability and Resilient Growth Development Policy Operation (DPO), the first in a series of three. This aims to improve the macroeconomic environment following government action to address previous economic challenges, including tight liquidity pressures, depressed investor confidence and limited capital inflows that led to a rapidly depreciating Shilling.

- The Kenya National Bureau of Statistics (KNBS) released the 2024 Economic Survey Report, outlining the following key economic developments:

- Real GDP growth increased to 5.6% in 2023 from a 4.9% growth in 2022, primarily attributed to the resilience of the service and agricultural sectors;

- The current account deficit narrowed significantly in FY’2023, down 13% to Kshs 603.7 billion from Kshs 694.2 billion in 2022, driven by slower import growth compared to exports and a significant rise foreign inflows;

- The balance of payments (BoP) improved in FY’2023, with the overall deficit decreasing by 46.4% to Kshs 134.8 billion compared to the previous year, supported by a narrower current account deficit and a slight increase in the capital account balance;

- External debt rose in 2023, reaching Kshs 6.1 trillion by December, a 30.3% increase from the previous year, attributed to a significant surge in multilateral debt and commercial bank loans.

ECONOMIC INDICATORS

Foreign Exchange Reserves

During the month, the usable foreign exchange reserves decreased by 3.55% to settle at $6.98 billion (3.60 months of import cover). This falls short of CBK’s statutory requirement to endeavor to maintain at least 4 months of import cover as well as EAC region’s convergence criteria of 4.5 months of import cover.

Currency

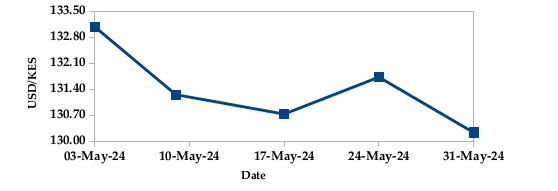

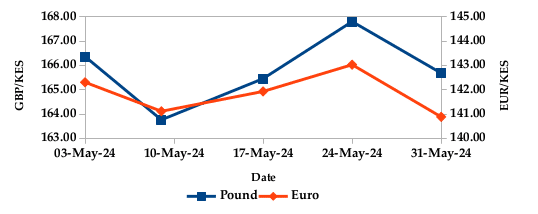

The Kenyan Shilling appreciated against the USD, the Sterling Pound and the Euro by 2.29%, 0.82% and 1.19%, exchanging at Kshs 130.23, Kshs 1165.68 and Kshs 140.89 respectively at the end of the month, from Kshs 133.28, Kshs 167.05 and Kshs 142.58 in the previous month. The observed appreciation against the Dollar is attributed to increased foreign inflows.

USD Vs KSHS

STERLING POUND & EURO Vs KSHS

Inflation

The overall year-on-year inflation slightly increased to 5.14% in May from 4.98% in April. This was primarily driven by higher food and electricity prices.

INFLATION EVOLUTION

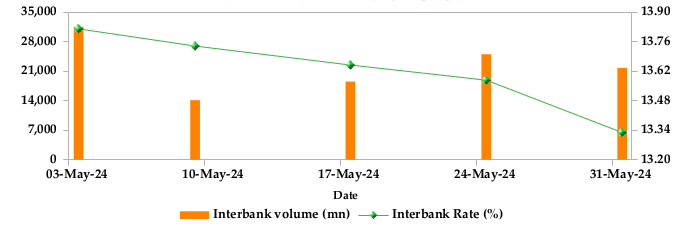

Liquidity

During the month, liquidity increased as a result of government payments which more than offset tax remittances. The average inter-bank rate decreased from 13.71% to 13.57%. The volume of inter-bank transactions decreased from Kshs 22.35 billion to Kshs 19.98 billion. Commercial banks excess reserves decreased from Kshs 22.60 billion to Kshs 15.70 billion.

INTER-BANK RATE and VOLUME

FIXED INCOME

T-Bills

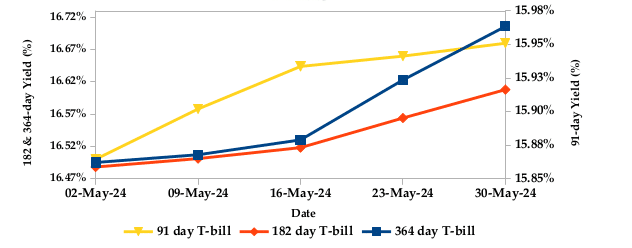

T-bills recorded an overall subscription rate of 153.26% during the month of May, compared to 129.58% recorded in the previous month. The performance of the 91-day, 182-day and 364-day papers stood at 326.69%, 134.07% and 103.08% respectively. On a monthly basis, yields on the 91-day, 182-day and 364-day papers increased by 0.83%, 0.90% and 1.30% to 15.96%, 16.61% and 16.71% respectively.

T-BILLS

T-Bonds

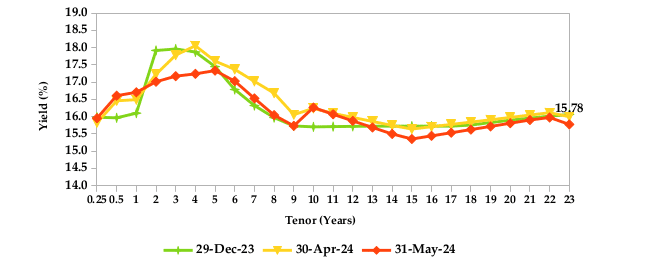

During the month, T-Bonds registered a total turnover of Kshs 119.53 billion from 2,973 bond deals. This represents a monthly increase of 11.18% and 27.91% respectively. The yields on government securities in the secondary market decreased during the month of May.

In the primary bond market, CBK reissued FXD1/2024/10 bond with a 16.00% coupon rate, seeking to raise Kshs 15.0 billion. Additionally, Central Bank reopened FXD1/2023/02 & FXD1/2024/03 bonds with effective tenors of 1.2 years and 2.6 years, and coupon rates of 16.97% and 18.39% respectively, seeking to raise Kshs

30.0 billion. The period of sale runs from 30/05/2024 to 05/06/2024. CBK also reopened FXD1/2023/05 & FXD1/2023/10 bonds, with effective tenors of 4.1 years and 8.7 years, and coupon rates of 16.84% and 14.15% respectively, seeking to raise Kshs 30.0 billion. The period of sale runs from 30/05/2024 to 12/06/2024.

YIELD CURVE

EQUITIES

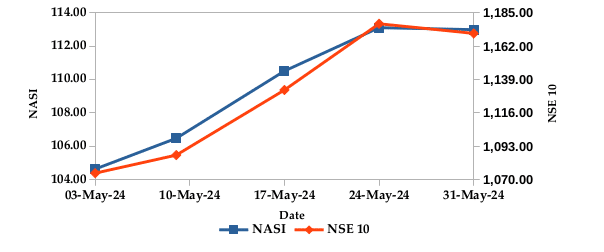

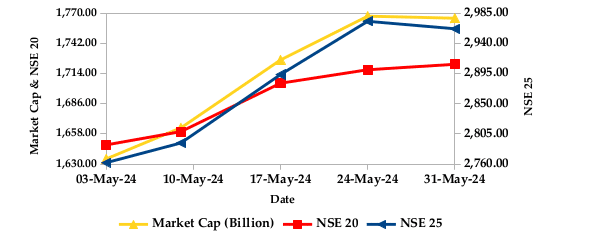

During the month, market capitalization gained 6.04% to settle at Kshs 1.77 trillion. Total shares traded increased by 69.12% to 509.65 million shares and equity turnover also increased by 118.72% to close at Kshs 16.04 billion. On a monthly basis, NASI, NSE 10, NSE 20 and NSE 25 settled 6.04%, 1.86%, 3.88% and 5.25% higher. The performance was as a result of gains recorded by large cap stocks such as KCB, Safaricom and Standard Chartered of 18.70%, 12.23% and 11.34% respectively. This was however weighed down by the loss recorded by Stanbic of 12.15%.

NASI and NSE 10

Market Capitalization, NSE 20 and NSE 25

ALTERNATIVE INVESTMENTS

GLOBAL AND REGIONAL MARKETS

| Global Markets | Monthly Change | YTD Change |

|---|---|---|

| S&P 500 | 4.80% | 11.27% |

| STOXX Europe 600 | 2.63% | 8.29% |

| Shanghai Composite (SSEC) | -0.58% | 4.20% |

| MSCI Emerging Market Index | 0.29% | 2.37% |

| MSCI World | 4.23% | 8.71% |

| Regional Markets | Monthly Change | YTD Change |

|---|---|---|

| FTSE ASEA Pan African Index | 4.47% | 259.49% |

| JSE All Share | 0.76% | 1.61% |

| NSE All Share (NGSE) | 1.09% | 30.67% |

| DSEI (Tanzania) | 15.77% | 17.13% |

| ALSIUG (Uganda) | 4.55% | 24.71% |

Get future reports

Please provide your details below to get future reports: