MONTH’S HIGHLIGHTS

- Kenya’s economy posted a 4.7% growth in Q3 2022, a slowdown from 5.2% recorded in Q2 and 9.3% in Q3 2021. Notable improvements were realized in the agriculture sector which contracted by 0.6% compared to 1.4% in Q2, although performance remained subdued occasioned by unfavourable weather conditions during the period. A strong performance was recorded in the services category, led by accommodation & restaurant (22.9%) and wholesale & retail trade (9.1%). Increased activity in the railway, evidenced by a rise in passengers plying the Standard Gauge Railway (SGR), road and water segments boosted the transport sector’s 4.8% expansion.

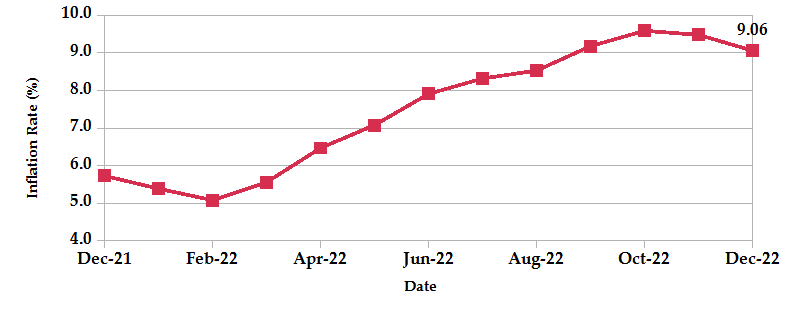

- Inflation declined further to 9.1% in December from 9.5% in November largely due to eased food prices as food and non-alcoholic beverages inflation dropped from 15.4% to 13.8% owing to rainfall experienced in various parts of the country and a drop in international prices of edible oils. While prices of diesel and petrol remained unchanged in December, the 2.3% rise in the transport index was attributed to an increase in prices of country bus fares for the holidays. The housing, water, electricity, gas and other fuels category rose by 0.7% mainly due to an increase in the prices of electricity units.

- IMF completed the fourth review of the 38-month Extended Credit Facility (ECF) and Extended Fund Facility (EFF) arrangements with Kenya, paving the way for the immediate release of a Kshs 55.1 billion ($433 million) loan for budgetary support. The decision brings the country’s cumulative disbursements under the EFF/ECF arrangements to $1,655.59 million. The country has been lauded for its commitment to fiscal consolidation, while areas of concern remain financial weaknesses in state-owned corporations and a review of the fuel pricing mechanism.

- Fitch Ratings downgraded Kenya’s Long-Term Foreign-Currency Issuer Default Rating (IDR) from ‘B+’ to ‘B’ and maintained a Stable Outlook, supported by progress with fiscal consolidation and the IMF’s $2.3 billion 38-month programme aimed at reducing the country’s debt vulnerabilities. The downgrade reflects the country’s elevated external debt service obligations in the 2023/2024 financial year with the upcoming maturity of the $2 billion Eurobond in June 2024, challenges in financing externally due to high costs and constrained liquidity.

- CBK reinstated charges on bank-to-mobile transactions effective 1st January 2023 that were waived in March 2020 as an incentive to increase the use of mobile money in the wake of the pandemic. However, the fees have been slashed by an average of 45% to 61% for the various transfers. The move positions banks to capitalize on the growth, in terms of volume and value of both peer-to-peer transactions and payment service providers, and plough back into the digital technology investments employed to contend with the transactions.

- Ghana’s Central Bank proposed a debt restructuring plan that entailed exchanging the country’s local bonds worth an estimated 137.3 billion cedis ($10.5 billion) maturing between 2023 and 2029 for new ones maturing in 2027, 2029, 2032 and 2037 with annual coupon rates set at 0% in 2023, 5% in 2024 and 10% from 2025 to maturity. A $1.2 billion stability fund was also set up to cushion the financial sector from the impact of restructuring. Nigeria’s government is also seeking its legislators’ approval to restructure 22.7 trillion naira debt owed to the central bank by converting it to 40-year bonds at 9% interest, in addition to a three-year moratorium on interest payments of existing debt.

- The Federal Open Market Committee, Bank of England and European Central Bank all voted to raise the primary credit rate by 50 basis points, easing the pace of interest rate hikes. However, they stressed the need for significant tightening throughout 2023 as long as inflation remained above the 2% target.

ECONOMIC INDICATORS

Foreign Exchange Reserves

During the month, the usable foreign reserves increased by 5.22% to settle at USD 7.44 billion (4.17 months of import cover). This meets the CBK’s statutory requirement to endeavour to maintain at least 4 months of import cover. However, it lies below the EAC region’s convergence criteria of 4.5 months of import cover.

Currency

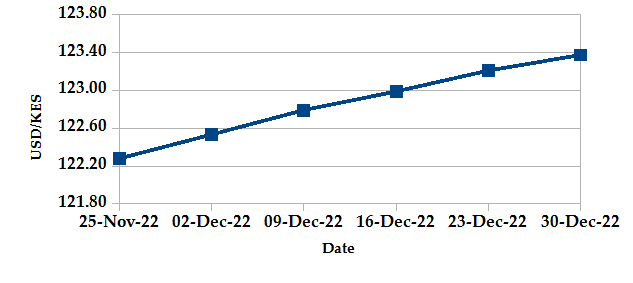

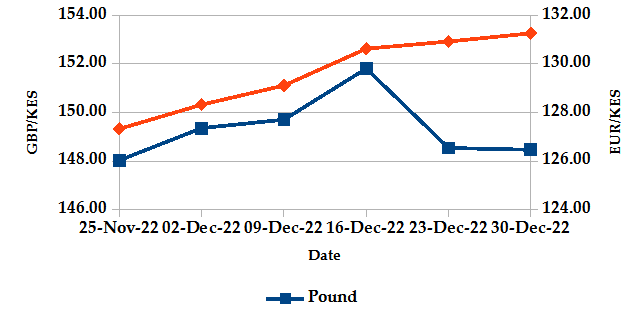

The Kenyan Shilling depreciated against the USD by 0.76%, exchanging at Kshs 123.37 at the end of the month up from Kshs 122.45 in the previous month. The depreciation is due to increased Dollar demand in the energy, oil and manufacturing sectors. The Shilling also depreciated against the Sterling Pound by 0.86% and the Euro by 3.26%, exchanging at Kshs 148.47 and Kshs 131.27 at the end of the month up from Kshs 147.21 and Kshs 127.13 respectively in the previous month.

USD Vs KSHS

STERLING POUND Vs KSHS

Inflation

The overall year-on-year inflation slowed to 9.06% in the month of December from a revised figure of 9.48% in November. This is mainly attributed to lower food prices as agricultural performance rebounds from favourable rain patterns.

INFLATION EVOLUTION

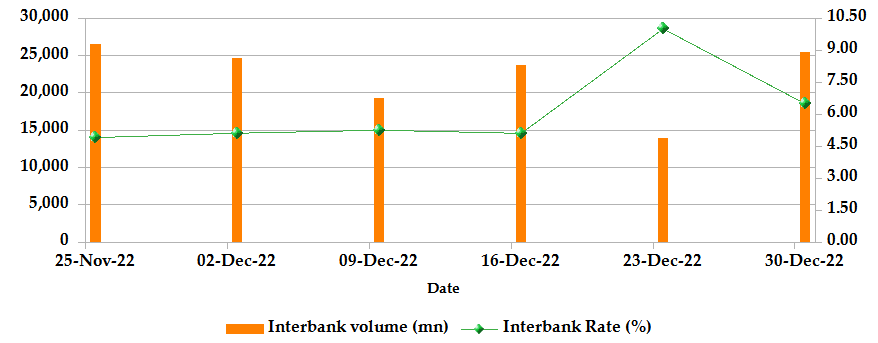

Liquidity

During the month, liquidity tightened as a result of tax remittances which offset government payments. The interbank rate rose to 6.49% from 5.14%. The volume of inter-bank transactions rose from Kshs 15.27 billion to Kshs 25.49 billion. Commercial banks’ excess reserves declined from Kshs 13.00 billion to Kshs 10.60 billion.

INTER-BANK RATE and VOLUME

FIXED INCOME

T-Bills

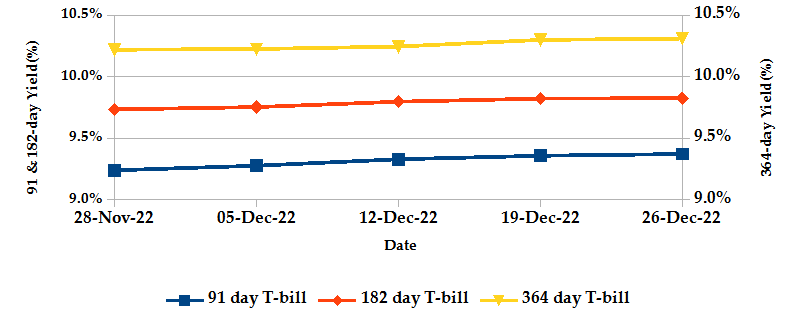

T-bills recorded an overall subscription rate of 77.81% at the end of December, compared to 167.66% recorded in the previous month. The decline in subscriptions was driven by tightened market liquidity. The performance of the 91-day, 182-day and 364-day papers stood at 327.44%, 32.98% and 22.79% respectively. On a monthly basis, yields on the 91-day, 182-day and 364-day papers increased by 1.43%, 1.04% and 0.87% to 9.37%, 9.83% and 10.31% respectively as investors pushed for higher returns to compensate for a weaker Shilling and inflationary pressures.

T-BILLS

T-Bonds

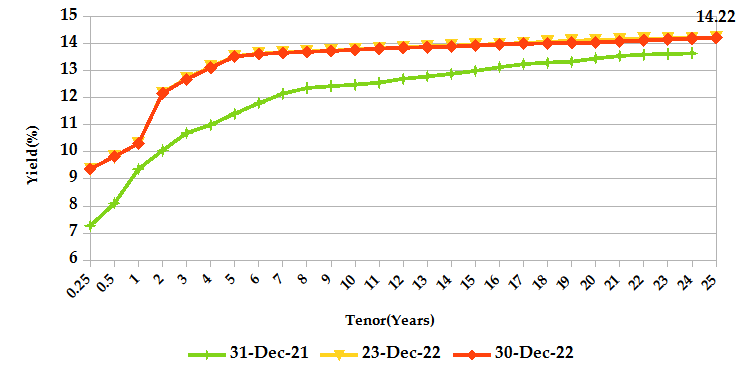

During the month, T-Bonds registered a total turnover of Kshs 41.23 billion from 1,935 bond deals. This represents a monthly decline of 25.01% and 23.15% respectively. The yields on government securities in the secondary market slightly increased during the month of December.

In the primary market, CBK reopened three bonds seeking to raise Kshs 70.00 billion. These included a tap sale of the infrastructure switch bond IFB1/2022/006 which targets Kshs 20.00 billion, FXD1/2020/005 and FXD1/2022/015 with effective tenors of 2.4 years and 14.3 years which targets the resulting Kshs 50.00 billion.

In the international market, yields on Kenya’s Eurobonds rose by an average of 65 basis points.

YIELD CURVE

EQUITIES

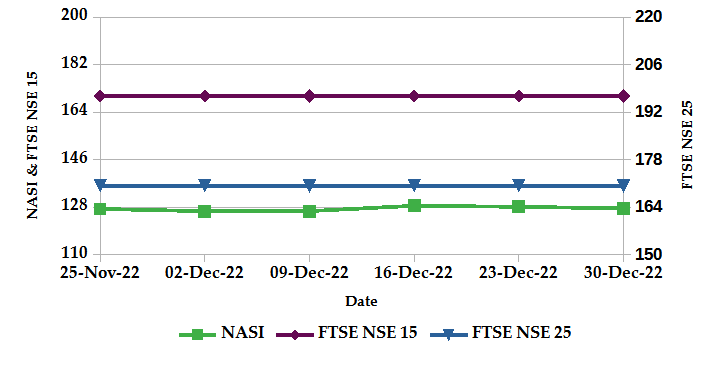

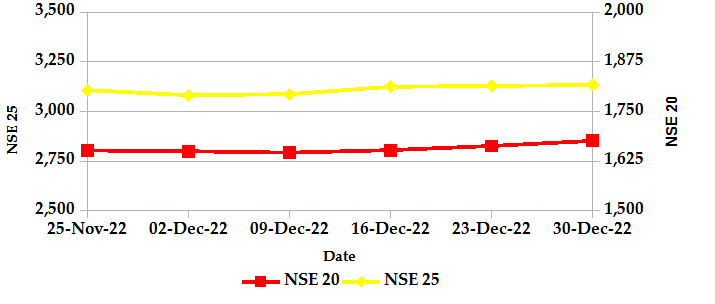

During the month of December, market capitalization gained 0.78% to settle at Kshs 1.99 trillion. Total shares traded dropped 24.02% to 30.05 million shares while equity turnover was down 34.04% to close at Kshs 0.84 billion. On a monthly basis, NASI, NSE 20 and NSE 25 were up 0.78%, 2.35% and 1.45% respectively. The performance was a result of gains recorded by large-cap stocks such as NCBA, ABSA and Co-operative of 18.52%, 5.58% and 2.50%, which were weighed down by losses posted by Equity and Standard Chartered of 2.52% and 1.04% respectively.

NASI, FTSE NSE 15 and FTSE NSE 25

NSE 20 and NSE 25

ALTERNATIVE INVESTMENTS

- The derivatives market, over the month, recorded 61 contracts with a turnover of Kshs 8.90 million which was an increase from 82 contracts with a turnover of Kshs 4.60 million recorded in the previous month.

- I-REIT market, over the month, recorded a turnover of Kshs 5.79 million with 188 deals which was an increase from Kshs 0.99 million with 165 deals recorded in the previous month.

- The ETF market, over the month, recorded a turnover of Kshs 251.14 million with 1 deal which was a decline from Kshs 289.77 million with 6 deals recorded in the previous month.

GLOBAL AND REGIONAL MARKETS

| Global Markets | Weekly Change | Monthly Change |

|---|---|---|

| S&P 500 | -0.14% | -5.90% |

| STOXX Europe 600 | -0.60% | -3.44% |

| Shanghai Composite (SSEC) | 1.42% | -1.97% |

| MSCI Emerging Market Index | 0.17% | -1.64% |

| MSCI World Index | -0.10% | -4.34% |

| Regional Markets | Weekly Change | Monthly Change |

|---|---|---|

| FTSE ASEA Pan African Index | 0.11% | 5.12% |

| JSE All Share | -0.55% | -2.35% |

| NSE All Share (NGSE) | 3.11% | 7.53% |

| DSEI (Tanzania) | 0.43% | 0.30% |

| ALSIUG (Uganda) | 1.09% | -1.26% |

- During the month, global markets edged lower as recession concerns mounted following assurances of further significant tightening in 2023 and a surge in COVID cases in China. In the USA, the S&P 500 and Dow Jones indices lost 5.90% and 4.16% respectively from the previous month. In Europe, the continental index of STOXX Europe 600 and the UK’s FTSE 100 also declined by 3.44% and 1.60%, weighed down by rate-sensitive technology stocks but buoyed by stronger commodity prices and a weaker Sterling Pound.

- On a regional front, markets recorded mixed performance. The FTSE ASEA Pan African index, representing the overall African markets rose 5.12% from November. South Africa’s JSE All Share declined by 2.35%, Nigeria’s All Share Index gained 7.53%, Tanzania’s DSEI picked up 0.30% while Uganda’s All Share index declined by 1.26%.

- On the global commodities markets, oil futures indices were volatile, reflecting slowing global demand as well as Moscow’s plans to cut crude output following the imposed price cap and sanctions. Crude Oil WTI futures and ICE Brent Crude Oil settled 0.11% and 1.22% lower to close at $80.47 and $85.91 respectively.

Get future reports

Please provide your details below to get future reports: