MONTH’S HIGHLIGHTS

- The Monetary Policy Committee (MPC) reversed its tightening stance, cutting the benchmark lending rate by 25 basis points to 12.75%. This marks the first rate cut in four years and aims to lower borrowing costs for consumers and businesses. The move comes after the CBK aggressively raised rates from 10.5% to 13.0% between December 2023 and February 2024 in response to inflationary pressures. The MPC noted that these measures have successfully reduced overall inflation to within the target range, stabilized the exchange rate and anchored inflationary expectations. Additionally, the Committee observed a moderation in non-food, non-fuel inflation, alongside a trend of easing interest rates by central banks in advanced economies in response to diminishing inflationary pressures.

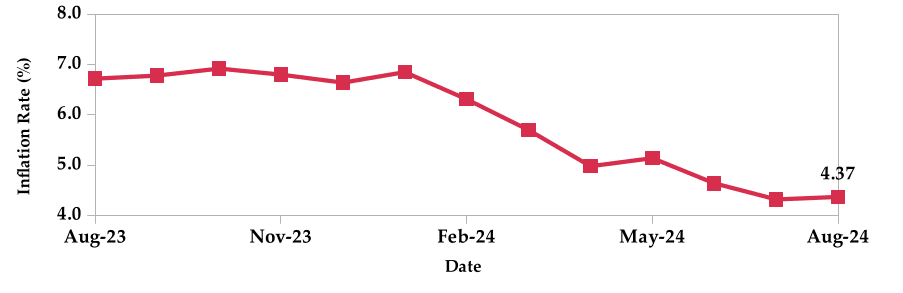

- Inflation increased to 4.37% in August 2024, from a near four-year low of 4.32% in July. This was primarily attributed to higher electricity prices. The food and non-alcoholic beverages index declined 0.7%, driven by lower food prices. The housing, water, electricity, gas and other fuels index rose by 0.3%, mainly due to increased electricity prices. Additionally, the transport index increased by 0.3%, mainly due to elevated country bus fares, despite stable fuel prices.

- The government allocated Kshs 44 billion from the Petroleum Development Levy Fund to stabilize fuel prices. This move follows the removal and subsequent reinstatement of fuel subsidies in 2022 and 2023. The Levy Fund is intended to support the development of the oil industry and to stabilize local fuel prices during periods of high landed costs. The principal secretary has defended the decision to import refined petroleum products through a government-to-government arrangement, which began in April 2023, offering extended credit terms of 180 days.

- The S&P Global Ratings downgraded Kenya’s credit rating to ‘B-‘ from ‘B’, citing the withdrawal of the Finance Bill 2024. This decision may interfere with the country’s fiscal consolidation efforts. The downgrade follows similar actions by Moody’s and Fitch, who also emphasized the bill’s withdrawal as a key factor. S&P projects that Kenya’s debt-servicing costs will exceed 30% of government revenue between 2024 and 2027, placing it among the world’s most highly indebted sovereigns. While immediate external liquidity risks have eased, Kenya’s structurally high external debt and significant financing needs remain a concern.

- Bamburi Cement received a second acquisition offer from Savannah Clinker Ltd., which proposes to purchase the company at Kshs 70 per share. Savannah Clinker, established in 2019, is offering a bid valued at Kshs 25.4 billion. This exceeds the previous offer from Tanzania’s Amsons Group, which valued Bamburi Cement at Kshs 23.59 billion. Amsons Group had proposed acquiring all shares at Kshs 65 each, representing a 44% premium over Bamburi’s closing share price on 10th July 2024.

- The Eurozone’s annual inflation rate decreased to 2.2% in August 2024 from 2.6% in July, matching market expectations. This marked the lowest consumer price increase since July 2021, suggesting progress towards the ECB’s 2% target. The decline was primarily due to a sharp decrease in energy costs, while inflation for non-energy industrial goods slowed. However, prices for services and food rose. Excluding energy and unprocessed food, price growth remained unchanged at 2.8%. The currency bloc’s Harmonized Index of Consumer Prices (HICP) increased by 0.2% from the previous month.

- The People’s Bank of China (PBOC) held its key lending rates steady at the August fixing, aligning with market expectations. Both the one-year and five-year Loan Prime Rates (LPRs) remained at record lows of 3.45% and 3.85% respectively. This decision aligns with the PBOC’s recent approach of avoiding “drastic” measures to stimulate the economy, as stated by Governor Pan Gongsheng. The PBOC plans to accelerate the implementation of existing policies, explore new measures and support proactive fiscal actions.

- The US real GDP grew at an annual rate of 3.0% in the second quarter of 2024, up from the initial estimate of 2.8%. Consumer spending, private inventory investment and non-residential fixed investment fueled this growth, despite increased imports. Notably, imports, non-residential fixed investment, exports and government spending were revised downwards.

ECONOMIC INDICATORS

Foreign Exchange Reserves

During the month, the usable foreign exchange reserves increased by 1.03% to settle at $7.35 billion (3.80 months of import cover). This was below the CBK’s statutory requirement to endeavor to maintain at least 4 months of import cover and EAC region’s convergence criteria of 4.5 months of import cover.

Currency

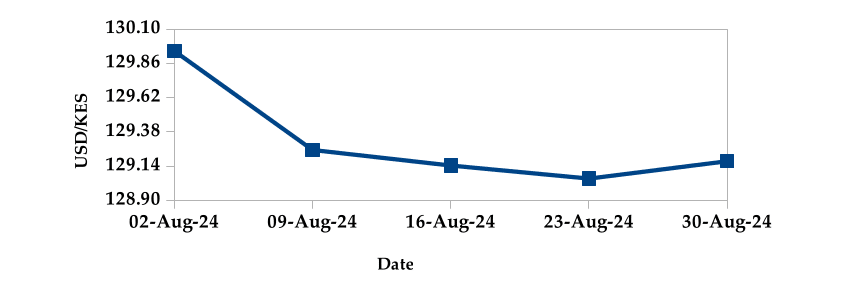

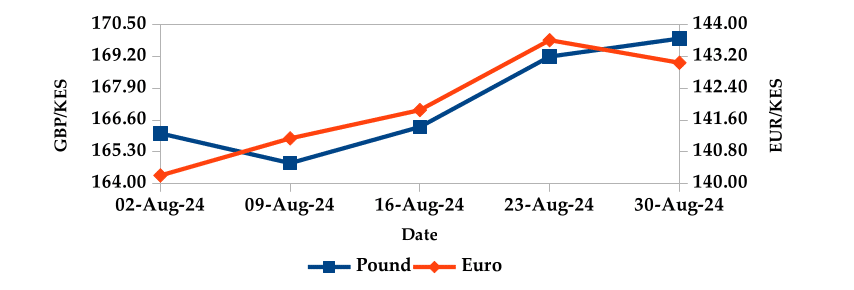

The Kenyan Shilling appreciated against the USD, but depreciated against the Sterling Pound and the Euro by 0.58%, 1.86% and 1.87%, exchanging at Kshs 129.17, Kshs 169.94 and Kshs 143.04 respectively at the end of the month, from Kshs 129.92, Kshs 166.84 and Kshs 140.42 in the previous month. The observed appreciation against the Dollar is attributed to increased foreign inflows.

USD Vs KSHS

STERLING POUND & EURO Vs KSHS

Inflation

The overall year-on-year inflation increased to 4.37% in August from 4.32% in July. This was primarily driven by higher electricity prices.

INFLATION EVOLUTION

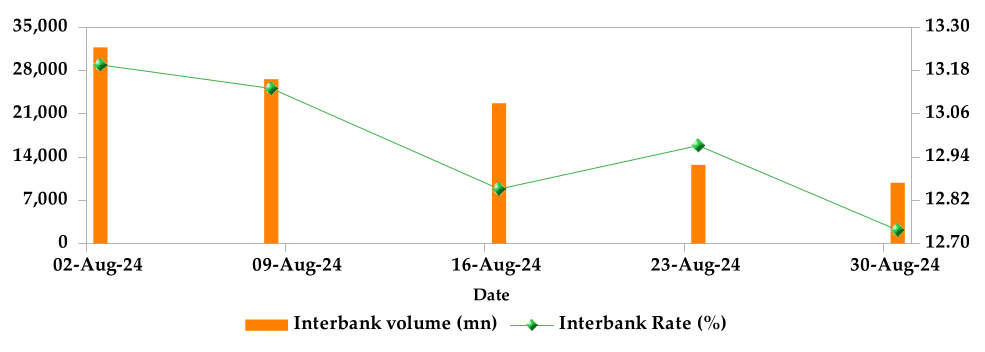

Liquidity

During the month, liquidity increased as a result of government payments which more than offset tax remittances. The average inter-bank rate decreased from 13.18% to 12.97%. The volume of inter-bank transactions decreased from Kshs 28.61 billion to Kshs 22.92 billion. Commercial banks excess reserves increased from Kshs 19.30 billion to Kshs 20.30 billion.

INTER-BANK RATE and VOLUME

FIXED INCOME

T-Bills

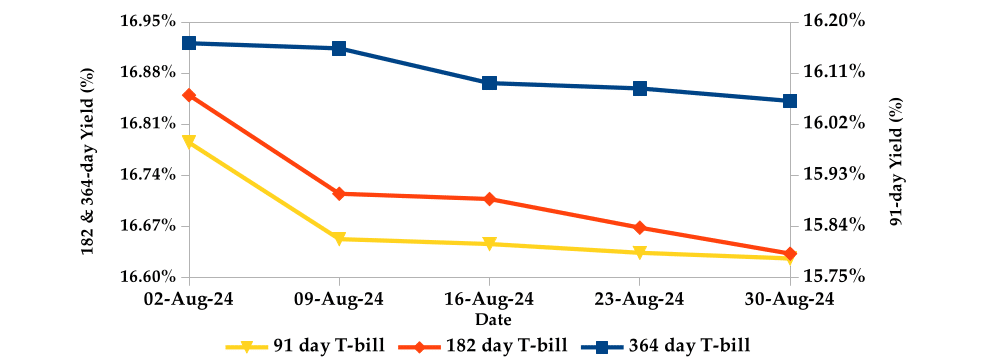

T-bills recorded an overall subscription rate of 112.93% during the month of August, compared to 116.53% recorded in the previous month. The performance of the 91-day, 182-day and 364-day papers stood at 302.96%, 101.41% and 48.43% respectively. On a monthly basis, yields on the 91-day, 182-day and 364-day papers decreased by 1.28%, 1.29% and 0.47% to 15.78%, 16.63% and 16.84% respectively.

T-BILLS

T-Bonds

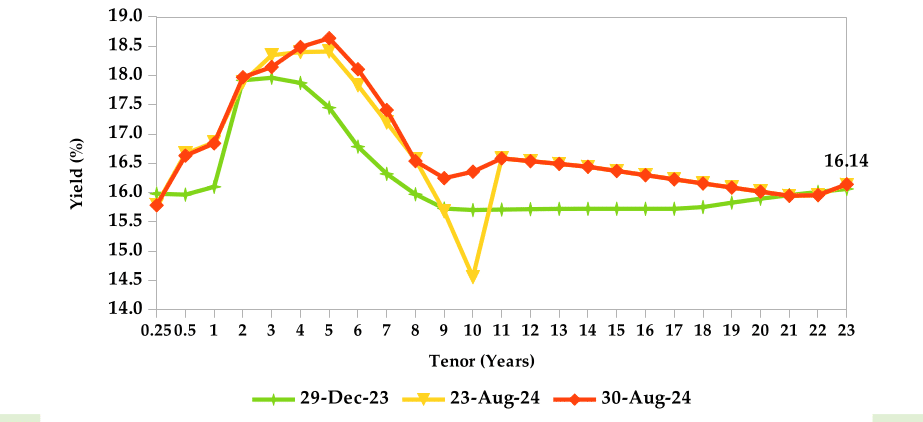

During the month, T-Bonds registered a total turnover of Kshs 88.35 billion from 2,642 bond deals. This represents a monthly decrease of 46.73% and 4.72% respectively. The yields on government securities in the secondary market increased during the month of August.

In the primary bond market, CBK released auction results for the reopened IFB1/2023/6.5 and IFB1/2023/017, which sought to raise Kshs 50.0 billion. The issues received bids worth Kshs 126.32 billion, representing a subscription rate of 252.64%. Of these, Kshs 88.70 billion worth of bids were accepted at weighted average rates of 18.30% and 17.73% respectively. Additionally, CBK released auction results for the re-issued IFB1/2023/017, which sought to raise Kshs 15.0 billion. The issue received bids worth Kshs 35.19 billion, representing a subscription rate of 234.57%. Of these, Kshs 32.02 billion worth of bids were accepted at weighted average rates of 17.73%.

In the international market, yields on Kenya’s Eurobonds decreased by an average of 51 basis points.

YIELD CURVE

EQUITIES

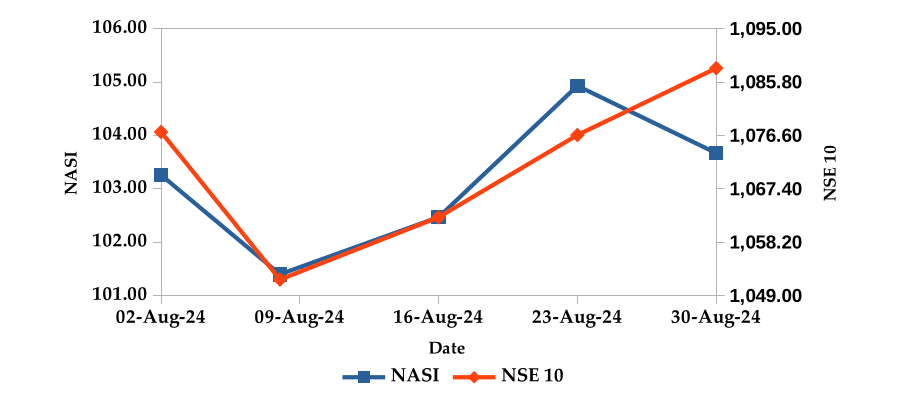

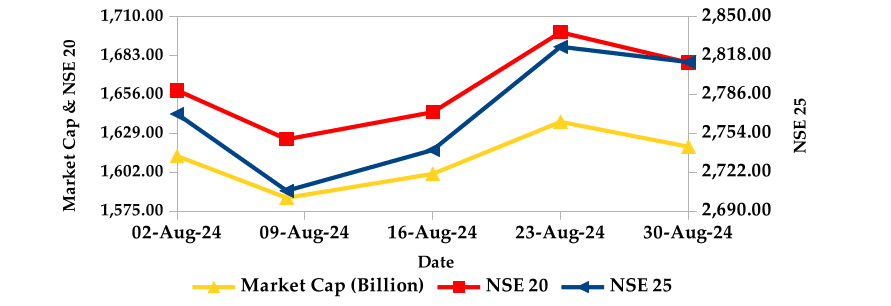

During the month, market capitalization lost 1.94% to settle at Kshs 1.62 trillion. Total shares traded increased by 33.22% to 392.13 million shares while equity turnover increased by 11.08% to close at Kshs 6.51 billion. On a monthly basis, NASI and NSE 10 settled 1.95% and 0.52% lower, while NSE 20 and NSE 25 settled 0.51% and 0.22% higher respectively. The performance was as a result of gains recorded by large cap stocks such as NCBA, Standard Chartered, Co-operative Bank and KCB of 7.62%, 7.44%, 6.69% and 4.10% respectively. This was however weighed down by the losses recorded by Safaricom and EABL of 8.81% and 3.96% respectively.

NASI and NSE 10

Market Capitalization, NSE 20 and NSE 25

ALTERNATIVE INVESTMENTS

GLOBAL AND REGIONAL MARKETS

| Global Markets | Monthly Change | YTD Change |

|---|---|---|

| S&P 500 | 3.70% | 19.09% |

| STOXX Europe 600 | 2.58% | 9.73% |

| Shanghai Composite (SSEC) | -3.08% | -4.05% |

| MSCI Emerging Market Index | 1.11% | 7.34% |

| MSCI World | 4.07% | 15.52% |

| Regional Markets | Monthly Change | YTD Change |

|---|---|---|

| FTSE ASEA Pan African Index | 3.16% | 382.63% |

| JSE All Share | 2.11% | 10.03% |

| NSE All Share (NGSE) | -0.80% | 27.09% |

| DSEI (Tanzania) | 1.12% | 19.18% |

| ALSIUG (Uganda) | 0.48% | 18.76% |

Get future reports

Please provide your details below to get future reports: