Performance Review

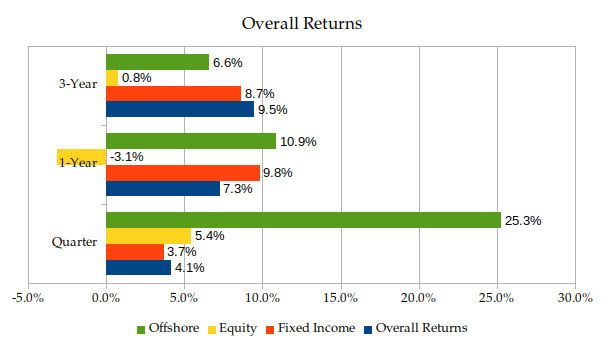

For the second quarter of 2020, the average return achieved by the 373 pension schemes with a total fund value of about Kshs. 716 Billion (excluding property) participating in the survey was 4.1% compared to 2.3% in the previous quarter.

The improved performance in this quarter was largely due to better returns in equity and offshore than in Q1 2020.

The highest-performing scheme over the quarter recorded a return of 7.9%.

Over the 3-year period, pension schemes recorded a return of 12.68% p.a. The 3-year performance is a better gauge of performance as the volatility of returns is smoothed.

It would be useful for trustees to engage in better strategies in order to maximize members’ returns.

Equity performance improved from -23.9% recorded in Q1 2020 to 5.4% this quarter.

The offshore returns significantly rose in this quarter with a weighted return of 25.3% compared to the -14.9% recorded in Q1 2020.

The fixed income returns in the quarter improved from 2.6% in Q1 2020 to 3.7% in this quarter.

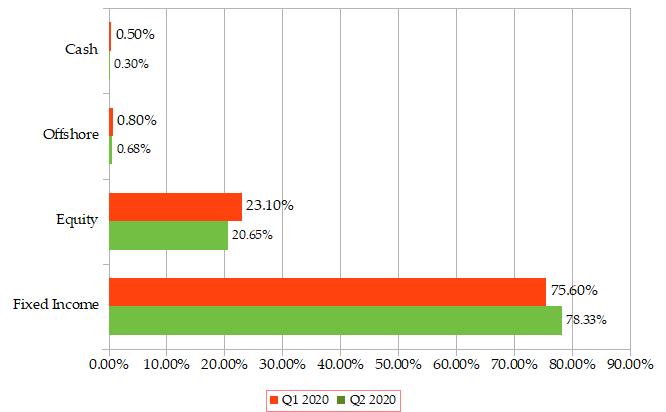

Asset Allocation

For the current quarter, it was noted that pension schemes invested most of their funds in fixed income, their allocation increased to 78.3% from 75.6% in Q1 2020.

Overall, ideal asset allocation is needed to ensure pension schemes can meet their targeted returns.

For a more detailed report on their performance, please share your details below.

Get future reports

Please provide your details below to get future reports: