MONTH’S HIGHLIGHTS

- The 2021/22 fiscal year budget was read and there is a plan to reduce the level of fiscal deficit from 8.7% of GDP in the current budget to 7.5% of GDP in the financial year 2021/22 and further to 3.6% of GDP in the financial year 2024/25. The economic growth is expected to rebound to 6.6% in 2021. This recovery reflects a lower base of 2020 when most services sectors were adversely affected by the closure of the economy recording negative growths.

- The IMF projected Kenya’s GDP growth at 7.6% for 2021.

- The IMF executive board completed the first reviews of the 38-month Extended Fund Facility (EFF) and Extended Credit Facility (ECF) arrangements with Kenya, allowing for an aggregate immediate disbursement of USD 407 million for budget support, addressing debt vulnerabilities, supporting Covid-19 response and enhancing governance. This brings Kenya’s total disbursement for budget support to about USD 714.5 million.

- Kenya kicked off its fourth Eurobond offer with a promise to review the size of the economy later in the year through a rebasing. This is to give an accurate reflection of the structure and size of the Kenyan economy. Higher GDP figures will help improve Kenya’s debt-to-GDP ratios and can, therefore, be applied by the country to justify the capacity to carry a larger debt load.

- The resurgence of Covid-19 and the re-imposition of restriction measures have heightened uncertainties. In order to mitigate adverse effects, Kenya’s Covid-19 Health Emergency Response Project received $130 million from the World Bank in additional financing to enable Kenyans access to affordable Covid-19 vaccines.

- TransUnion Kenya recently launched a newly enhanced consumer report called TrendedView Report which helps lenders understand a consumer’s credit behaviour and repayment patterns before and after the Covid-19 hit to identify credit risk and lending opportunities.

- The European Investment Bank (EIB) agreed to invest 95 million dollars in geothermal power projects in East Africa in an effort to reduce greenhouse gas emissions in East Africa through its investment in renewable energy.

- The Energy and Petroleum Regulatory Authority(EPRA) has revised upwards the prices of super petrol by Kshs 0.77 per litre, while the prices of diesel and kerosene remain unchanged for the period between 15th June and 14th July 2021. This is despite an increase in the price of imported Murban crude oil. In May, the average landing costs of super petrol increased by 1.52% to $449.37 while diesel increased by 5.98% to $ 461.95 per cubic meter Kerosene also increased by 4.41% to $ 449.37 per cubic meter.

- Kenya has appointed Citi and JP Morgan as underwriters for a dollar-denominated sovereign bond issue, and I&M Bank and NCBA Group as co-managers. The Ministry first announced plans for the $1 billion Eurobond in March 2021 and a separate 1-billion-euro bond, which will have a 12 to 15-year tenor.

- The National Assembly Finance and National Planning Committee rejected the tax imposition on bread, as well as the variation of excise duty on imported motorcycles, citing tough economic times.

ECONOMIC INDICATORS

Foreign Exchange Reserves

During the month, the CBK’s usable foreign reserves gained by 8.48% to stand at USD 8.11 billion (4.96 months of import cover). This meets the CBK’s statutory requirement to endeavour to maintain at least 4 months of import cover, and the EAC region’s convergence criteria of 4.5 months of import cover.

Currency

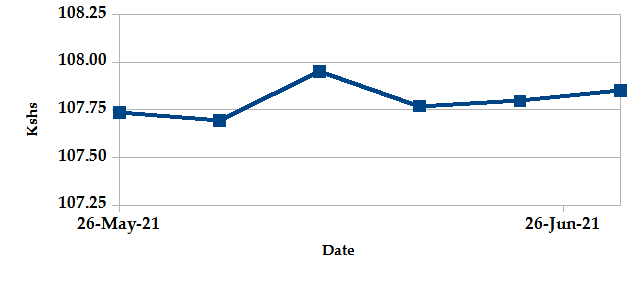

The Kenyan Shilling was relatively stable against the USD depreciating by 0.20% exchanging at Kshs 107.75 at the end of the month up from Kshs 107.54 in the previous month. The depreciation is due to low dollar demand by importers, lower current account deficit supported by steady inflows from diaspora remittances, relatively stable forex reserves at the end of the quarter and improved export receipts.

USD Vs KSHS

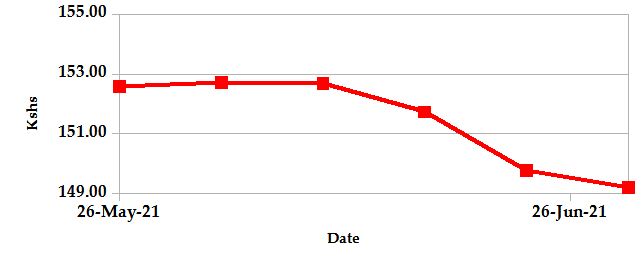

STERLING POUND Vs KSHS

Inflation

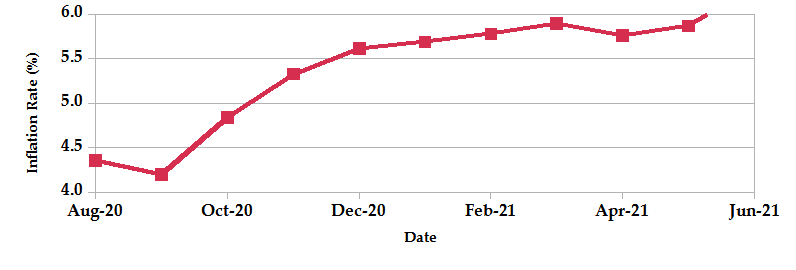

The overall year-on-year inflation increased to 6.32% in the month of June up from a revised figure of 5.87% in May. The increase is attributable to increased transport and food prices. The month-to-month prices of transport increased to 16.76% in June 2021 from 14.71% in May 2021. The food & non-alcoholic beverages index rose 8.46% in June 2021 from May.

Going forward, we expect inflation to be higher than 5.2% but remain within the government target range of 2.5% – 7.5%.

INFLATION EVOLUTION

Liquidity

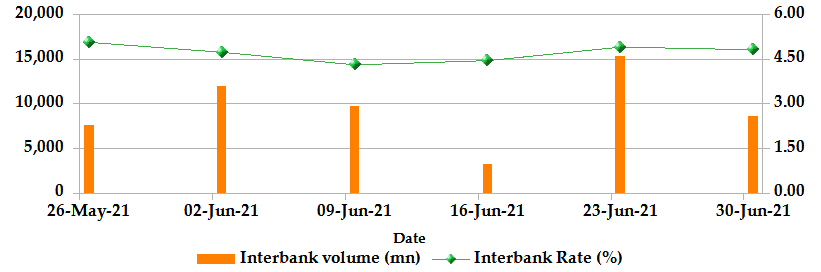

Liquidity declined during the month of June as a result of the treasury mopping up liquidity by opening a tap sale on the June bond. The interbank rate increased by 0.27%. The volume of inter-bank transactions decreased from Kshs 15.71 billion to Kshs 10.22 billion. Commercial banks’ excess reserves decreased to Kshs 10.3 billion.

INTER-BANK RATE and VOLUME

FIXED INCOME

T-Bills

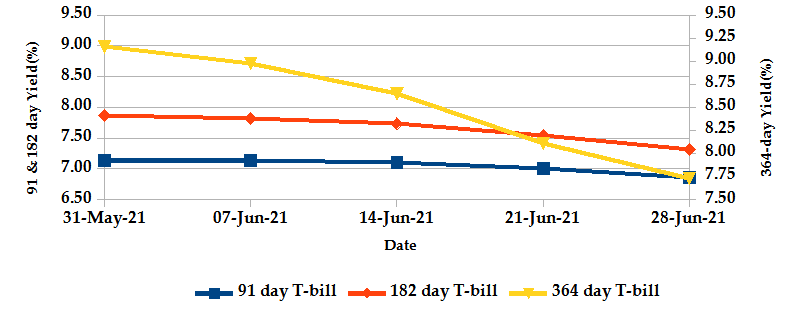

The T-bills recorded an overall subscription rate of 152.85% at the end of the month of June, compared to 95.97% recorded in the previous month. The increase in subscription is due to investor attraction to the 91-day treasury bills. The performance of the 91-day, 182-day and 364-day papers stand at 83.44%, 49.02% and 147.94% respectively. On a monthly basis, the yields on the 91-day, 182-day and 364-day papers decreased by 3.91%, 6.97% and 15.59% respectively to 6.86%, 7.32% and 7.73%.

T-BILLS

T-Bonds

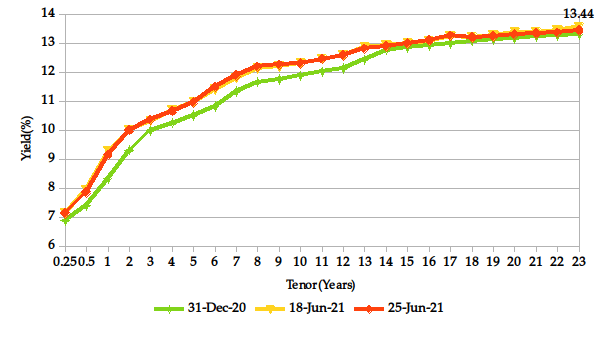

Over the month of June, the T-Bonds registered a total turnover of Kshs 81.23 billion from 1,467 bond deals. This represents a monthly increase of 1.12% and a decrease of 11.04% respectively. The yields on government securities in the secondary market remained relatively stable during the month of June.

In the international market, yields on Kenya’s Eurobonds declined by an average of 0.26 basis points.

YIELD CURVE

EQUITIES

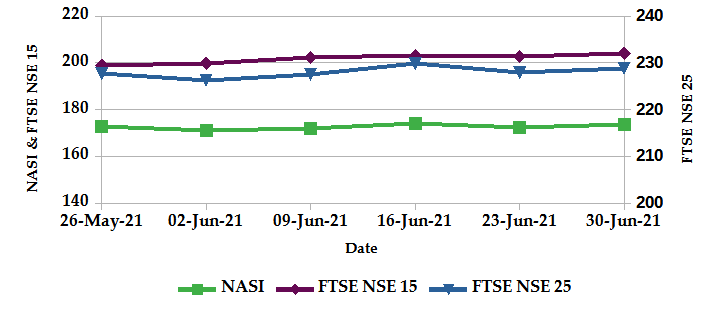

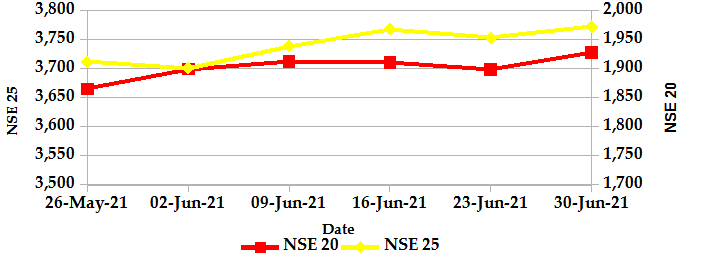

During the month of June, NASI decreased by 0.62% while NSE 20 and NSE 25 increased by 2.0% and 1.0% respectively on a monthly basis. On a weekly basis, the NASI and NSE 20 decreased by 0.4% and 0.1% while NSE 25 increased by 0.05%. The drop in NASI is a result of the depreciation of large-cap stocks such as BAT Kenya, Safaricom Plc and East Africa Breweries Ltd. At the close of the month, market capitalization decreased by 0.62% to Kshs 2.67 trillion. Also, total shares traded and equity turnover decreased by 40.36% and 26.46% respectively to 17 million shares and Kshs 607 million.

NASI, FTSE NSE 15 and FTSE NSE 25

NSE 20 and NSE 25

ALTERNATIVE INVESTMENTS

- The derivatives market over the month recorded 597 contracts having a turnover of Kshs 26.72 million which was a decrease from 433 contracts having a turnover of Kshs 28.32 million recorded over the last month.

- The I-REIT market over the month recorded 161 contracts having a turnover of Kshs 1.50 million which was an increase from 166 contracts having a turnover of Kshs 1.09 million recorded over the last month.

- The ETF market recorded a turnover of Kshs 189,000 from 1 deal.

GLOBAL AND REGIONAL MARKETS

| Global Markets | Weekly Change | Monthly Change |

|---|---|---|

| S&P 500 | 2.74% | 1.82% |

| STOXX Europe 600 | 1.23% | 1.93% |

| Shanghai Composite (SSEC) | 2.34% | 0.19% |

| MSCI Emerging Market Index | 1.35% | 1.38% |

| MSCI World Index | 2.39% | 1.53% |

| Regional Markets | Weekly Change | Monthly Change |

|---|---|---|

| FTSE ASEA Pan African Index | 0.79% | 1.51% |

| JSE All Share | 1.07% | -1.96% |

| NSE All Share (NGSE) | -2.56% | -1.58% |

| DSEI (Tanzania) | 0.99% | -0.18% |

| ALSIUG (Uganda) | 0.95% | 3.39% |

- During the month, major global markets rose hitting an all-time high on lift from a better-than-expected U.S. monthly jobs report that signalled a strong end to the second quarter in the world’s largest economy. Still, there were signs of caution in various corners of the market due to the continuing spread of the Covid-19 Delta variant and concerns over a potentially more hawkish Fed. In the USA, the S&P 500 gained 1.82% while the Dow Jones index declined by 0.28% from the previous month. In Europe, the continental index of STOXX Europe 600 and the UK’s FTSE 100 gained by 1.93% and 1.62% respectively.

- On a regional front, most markets had mixed returns. The FTSE ASEA Pan African index, representing the overall African markets, increased by 1.51% from the month of May. South Africa’s JSE All Share dropped by 1.96%, Uganda’s All Share Index gained by 3.39% and Tanzania’s DSEI decreased by 0.18%. Also, Nigeria’s All-share index declined by 1.58%. Uganda’s central bank cut its benchmark interest rate for the fourth time in the current monetary easing cycle, saying the economic recovery still requires monetary policy support and inflation will likely remain below the target in the near term with little space for fiscal policy to respond to “fragile economic growth.”

- On the global commodities markets, surging U.S. fuel demand amid stagnant domestic crude oil production is drawing down American crude inventories at the quickest pace in nearly 40 years. The record-fast decline in U.S. oil stockpiles has started to reflect in the crude oil futures market, where the American benchmark, WTI Crude, has surged by 50% so far this year. The U.S. oil price has also started to narrow the discount at which it trades relative to the international benchmark, Brent Crude.

Get future reports

Please provide your details below to get future reports: