Foreign Exchange Reserves

The CBK’s usable foreign exchange reserves remained adequate at USD 7,608 million (4.39 months of import cover). This meets CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar but gained against the Euro and the Sterling Pound to exchange at Ksh 119.91, Ksh 119.59 and Ksh 141.71 respectively. The observed overall depreciation against the Dollar is attributable to increased Dollar demand from energy and commodity importers.

| YTD Change | W-o-W Change | |

|---|---|---|

| Dollar | 5.99% | 0.28% |

| Euro | -6.64% | -1.64% |

| Sterling Pound | -6.98% | -1.69% |

Liquidity

Liquidity in the money markets decreased, partly reflecting government payments which offset tax remittances. Open market operations remained active.

| Week (previous) | Week (ending) | |

|---|---|---|

| Interbank rate | 5.53% | 5.04% |

| Interbank volume (billion) | 21.4 | 20.9 |

| Commercial banks’ excess reserves (billion) | 30.3 | 40.1 |

Fixed Income

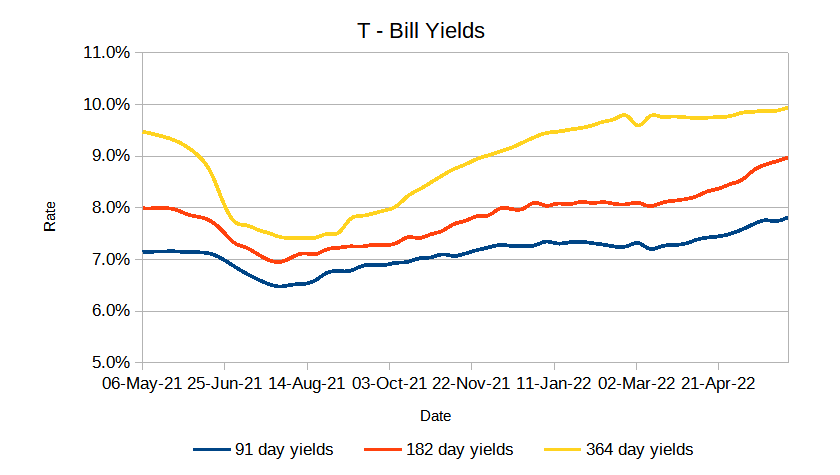

T-Bills

T-Bills were over-subscribed during the week with a decrease in the overall subscription rate from 197.15% recorded in the previous week to 194.15%. The 91-day T-Bill got the highest subscription rate at 270.40% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 41.6% and 106.6% respectively. The acceptance rate decreased by 13.46% to close the week at 86.48%.

T-Bonds

The bonds market had a lower demand for the week’s bond offers. Bonds turnover decreased by 1.70% from 2.62B in the previous week to 2.582B. Total bond deals increased by 98.28% from 58 in the previous week to 115.

Eurobonds

In the international market, the yields on the 10-year Eurobonds for Angola and Ghana decreased. Yields on Kenya’s Eurobonds generally increased by 0.11% compared to the previous week, -1.36% and 6.712% month to date and year to date respectively. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 10.20% | -0.15% | 0.10% |

| 2018 10-Year Issue | 7.09% | -1.75% | 0.13% |

| 2018 30-Year Issue | 3.94% | -1.38% | 0.17% |

| 2019 7-Year Issue | 8.64% | -1.83% | 0.14% |

| 2019 12-Year Issue | 5.98% | -1.22% | 0.12% |

| 2021 12-Year Issue | 4.42% | -1.83% | 0.23% |

Equities

NASI, NSE 20 and NSE 25 decreased by 5.75%, 1.69% and 3.43% compared to last week bringing the year to date performance to -17.47%, -8.63% and 13.03% respectively. The market capitalization decreased by 5.77% from the previous week to close at 2.149 trillion recording a year to date decline of -17.43%. The performance was driven by losses recorded by large-cap stocks. Top losses were recorded in Equity Group Holdings, East Africa Breweries, Standard Chartered Bank and Co-operative Bank which decreased by 2.50% 0.49%, 1.63% and 4.37% respectively.

The Banking sector had shares worth Ksh 218M transacted which accounted for 28.72% of the week’s traded value, Manufacturing & Allied sector had shares worth Ksh 46.7M transacted which represented 6.15% and Safaricom, with shares worth Kshs 454M transacted represented 59.81% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Olympia capital | 36.84% | 23.81% |

| BOC Kenya | 21.07% | 18.95% |

| NCBA | 12.18% | 10.66% |

| BK Group | 10.86% | 9.74% |

| UNGA Group | 15.01% | 9.6% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| Uchumi | 4.35% | -11.11% |

| Safaricom | -26.47% | -10.24% |

| Eaagads | -7.41% | -9.42% |

| Car & General | 16.35% | -8.14% |

| Bamburi | -7.98% | -7.98% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 0.13 | 0 | -100% |

| Derivatives Contracts | 5 | 10 | -86.84% |

| I-REIT Turnover | 0.016 | 0.00142 | -90.95% |

| I-REIT Deals | 8 | 2 | -75.00% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | -15.40% | -4.04% |

| Dow Jones Industrial Average (DJI) | -11.76% | -4.22% |

| FTSE 100 (FTSE) | -1.04% | -1.63% |

| STOXX Europe 600 | -13.04% | -2.58% |

| Shanghai Composite (SSEC) | -10.91% | -0.67% |

| MSCI Emerging Markets | -18.40% | -0.31% |

| MSCI World Index | -16.87% | -4.66% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -22.14% | -0.95% |

| JSE All Share | -5.25% | 0.85% |

| NSE All Share (NGSE) | 15.47% | 0.63% |

| DSEI (Tanzania) | -0.14% | -1.60% |

| ALSIUG (Uganda) | -8.54% | -3.06% |

US stocks closed the week lower as losses in the Technology, Consumer goods and services and industrial sectors led shares lower. However, short term U.S treasury yields rose after Federal Reserve chairman said the economy will need tight monetary policy before inflation is under control and that taming it would take a sustained effort that could lead to pain for households and businesses. Interest rate futures tied to expectations about Fed policy fell moments after the chairman’s speech reflecting increased chances of a third straight 75 point rate hike.

European stocks closed the week higher with gains in the Energy sector ahead of Federal Reserve Chairman widely anticipated speech that is set to offer clues on the U.S central bank’s monetary tightening plans. This comes at a time the continent struggles to cope with an energy crisis as gas prices soar in the wake of Russia’s invasion of Ukraine. Eralier, German economy minister said he would reassess the country’s levy on consumers to help fund aid for suppliers as gas prices surge amid an outcry over corporate profits in the sector.

Asia Pacific stocks closed the week higher as gains in the Energy, Resources and Materials sectors led shares higher. Japan stocks were higher as gains in the Power, Steel and Insurance led shares higher. Hong Kong’s technology stocks surged following a report of a deal that could potentially take some U.S regulatory pressure off their overseas listings by allowing American auditors travel to Hong Kong and review accounts of firms with dual listing, allowing for more transparency in their reporting potentially helping them avoid being delisted from the New York Stock Exchange.

On the global commodities markets, Crude Oil WTI closed the week higher by 2.52% and the ICE Brent Crude increased by 4.41%. Gold futures prices decreased by 0.01% to settle at $1,749.8.

Week’s Highlights

- Consumption data from the Energy and Petroleum Regulatory Authority (EPRA) showed Kenya spent Ksh 71.17 billion to subsidise diesel, super and Kerosene in the six months to June with an average of Ksh 11.86 billion monthly to keep the fuel prices low. This comes at a time the International Monetary Fund(IMF) set fresh loan conditions requiring Kenya to drop the fuel subsidy with the World bank saying the monthly expenditure continues to hurt budget and planning signalling its intention to push for the scrapping of the subsidy.

- Tea volumes declined to 27% from 34% as the price increased to Ksh 264 down from Ksh 263 in the previous sale with the low prices recorded earlier being attributed to low demand for the commodity following the invasion of Ukraine by Russia which disrupted the market.

- China’s Central Bank cut its benchmark loan rates with the one-year Prime Rate (LPR) which serves as a benchmark for corporate loans was reduced from 3.7% to 3.65% and the five-year Prime Rate used to price mortgages was cut from 4.45% to 4.3%. China seeks to boost its economy that has been battered by the governments strict zero-covid policy.

- Kenyan importers will now pay more to bring in cereal and textile from outside the East African Community following the implementation of 35% duty on most products including meat, dairy produce, coffee, cocoa among others. While the tariff is expected to boost the economies of East African Community member countries by increasing revenue and boosting intra-regional trade and investment, it is also poised to affect the purchasing power of citizens negatively.

- Bank loan defaults crossed the half trillion mark setting up thousands of borrowers for property seizures in an economy hit with reduced cash flows squeezing household budgets. Data from the Central Bank of Kenya showed that default loans rose by Ksh 30.6 billion in June to Ksh 514.4 billion with non-performing loans rising to 14.7% in june compared to 14.55% in March 2021.

- Zambia’s inflation rate decreased to 9.8% as prices of food fell with annual food-price growth slowing to 11.3% in August compared to 12% in July with the central bank retaining its benchmark interest rate unchanged at 9% to promote economic growth. South Africa’s consumer inflation jumped to 7.8% in July from 7.4% in June after the Reserve Bank raised its benchmark rate to 5.5%.

Get future reports

Please provide your details below to get future reports: