Foreign Exchange Reserves

The CBK’s usable foreign exchange reserves remained adequate at USD 7,727 million (4.46 months of import cover). This meets CBK’s statutory requirement to endeavor to maintain at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Currency

The Kenyan Shilling depreciated against the Dollar, the Euro and the Sterling Pound to exchange at Ksh 118.57, Ksh 120.88 and Ksh 141.61 respectively. The observed overall depreciation against the Dollar is attributable to increased Dollar demand from energy and commodity importers.

| YTD Change | W-o-W Change | |

|---|---|---|

| Dollar | 4.80% | 0.25% |

| Euro | -5.63% | 1.90% |

| Sterling Pound | -7.04% | 0.93% |

Liquidity

Liquidity in the money markets eased, partly reflecting government payments which offset tax remittances. Open market operations remained active.

| Week (previous) | Week (ending) | |

|---|---|---|

| Interbank rate | 5.56% | 5.26% |

| Interbank volume (billion) | 29.20 | 29.5 |

| Commercial banks’ excess reserves (billion) | 27.70 | 25.5 |

Fixed Income

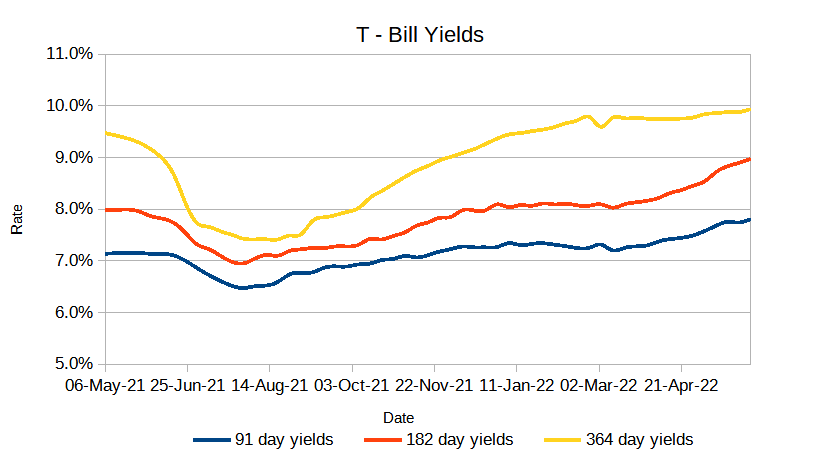

T-Bills

T-Bills were over-subscribed during the week with an increase in the overall subscription rate from 105.77% recorded in the previous week to 144.07%. The 91-day T-Bill got the highest subscription rate at 388.4% while the 182-day T-Bill and 364-day T-Bill had a subscription rate of 146.5% and 44% respectively. The acceptance rate decreased by 10.82% to close the week at 88.95%.

T-Bonds

The bonds market had a higher demand for the week’s bond offers. Bonds turnover increased by 109.49% from 7.14B in the previous week to 14.96B. Total bond deals decreased by 40.16%.

In the primary bond market, the Central Bank of Kenya released results for the auction of the two reopened 15-year bonds. Both bonds were undersubscribed with an overall subscription rate of 26.43% amounting to Ksh. 9.3B against the targeted Ksh. 40B. The bonds attracted a coupon rate of 12% and 12.75% and weighted average rates of 13.21% and 13.89% for FXD2/2013/15 & FXD2/2018/15 respectively.

Eurobonds

In the international market, the yields on the 10-year Eurobonds for Angola decreased, but increased for Ghana. Yields on Kenya’s Eurobonds generally decreased by 133.9 basis points compared to the previous week, 1.35% and 9.85% month to date and year to date respectively. Below is a summary analysis of performance for individual bonds.

| Bond | YTD Change | M-o-M Change | W-o-W Change |

|---|---|---|---|

| 2014 10-Year Issue | 14.88% | 2.35% | -2.35% |

| 2018 10-Year Issue | 9.75% | 0.92% | -1.06% |

| 2018 30-Year Issue | 6.18% | 0.52% | -1.72% |

| 2019 7-Year Issue | 12.30% | 1.76% | -1.58% |

| 2019 12-Year Issue | 7.87% | 0.77% | -0.71% |

| 2021 12-Year Issue | 8.14% | 1.75% | -0.61% |

Equities

NASI, NSE 20 and NSE 25 decreased by -4.05%, -0.36% and -1.95% compared to last week bringing the year to date performance to -18.27%, -12.42% and -16.10% respectively. The market capitalization decreased by 4.06% from the week to close at 2.128 trillion recording a year to date decline of -18.23%. The performance was driven by loses recorded by large-cap stocks. Top loses were recorded in Safaricom, KCB and ABSA which decreased by 7.79%, 4.82% and 3.69% respectively.

The Banking sector had shares worth Kshs 941M transacted which accounted for 51.42% of the week’s traded value, Manufacturing & Allied sector had shares worth 134M transacted which represented 7.34% and Safaricom, with shares worth Kshs 727M transacted represented 39.73% of the week’s traded value.

Top Gainers and Losers in the Equities Markets

| Top Gainers | YTD Change | W-o-W |

|---|---|---|

| Stanbic Holdings | 21.84% | 17.78% |

| Trans-Century | -0.83% | 11.21% |

| Standard group plc | -4.80% | 9.32% |

| Crown paints Kenya | 39.34% | 8.97% |

| TPS East Africa | -3.61% | 8.89% |

| Top Losers | YTD Change | W-o-W |

|---|---|---|

| Olympia Capital | 26.84% | -10.74% |

| Express Kenya | -20.98% | -10.00% |

| Safaricom | -23.98% | -7.79% |

| Bamburi Cement | -12.70% | -7.10% |

| Home Afrika | -10.00% | -5.26% |

Alternative Investments

| Week (previous) | Week (ending) | % Change | |

|---|---|---|---|

| Derivatives Turnover (million) | 1.1 | 0.86 | -22.28% |

| Derivatives Contracts | 32 | 24 | -25.00% |

| I-REIT Turnover | 0.23 | 0.42 | 79.80% |

| I-REIT Deals | 40 | 33 | -17.50% |

Global and Regional Markets

| Global Markets | YTD Change | W-o-W |

|---|---|---|

| S&P 500 | -17.41% | 2.55% |

| Dow Jones Industrial Average (DJI) | -12.81% | 1.96% |

| FTSE 100 (FTSE) | -3.05% | 1.64% |

| STOXX Europe 600 | -13.12% | 2.88% |

| Shanghai Composite (SSEC) | -9.98% | 1.30% |

| MSCI Emerging Markets | -19.71% | 2.97% |

| MSCI World Index | -18.22% | 3.20% |

| Continental Markets | YTD Change | W-o-W |

|---|---|---|

| FTSE ASEA Pan African Index | -20.24% | 0.86% |

| JSE All Share | -7.85% | 4.86% |

| NSE All Share (NGSE) | 20.81% | -0.45% |

| DSEI (Tanzania) | -1.38% | -0.20% |

| ALSIUG (Uganda) | -12.28% | -0.55% |

U.S stocks closed the week higher as gains in the Consumer goods, Healthcare and Basic materials sector led shares higher. Ninety one S&P 500 companies reported earnings and more than three-quarters of them beat expectations. This comes at a time when the Federal Reserve is expected to raise U.S interest rates by about 75 basis points at its policy meeting to combat inflation.

European stocks closed the week higher, as U.K. retail sales fell by 0.1% on the month in June, a less steep decline than had been expected. However, this comes despite the European Central Bank’s larger-than-expected interest rate by 50 basis points from zero percent on Thursday as well as disappointing survey growth data which suggested that growth is slowing in the region, even before the central bank has started to tighten monetary policy.

Asia Pacific stocks closed the week higher, as investors keep a hawkish eye on the economic outlook led by disappointing technology earnings. Japan, Australia, China and Hong Kong recorded gains while South Korea declined. Investors are closely monitoring rising US jobless claims, a dimming regional factory outlook, and a weaker leading economic indicator amid tightening monetary policy.

On the global commodities markets, Crude Oil WTI closed the week lower by 2.54% and the ICE Brent Crude increased by 2.45%. Gold futures prices increased by 1.10% to settle at $1,725.30.

Week’s Highlights

- Kenya is set to receive $ 235.6M for budgetary support after the Executive Board of the International Monetary Fund (IMF) completed the Third review under the 38-month arrangements under the Extended Credit Facility (ECF) and the Extended Fund Facility (EFF) arrangements. This brings total disbursement for budget support to $1.2082B.

- The state eased maize flour prices to sh 100 for four weeks. According to a statement by the ministry of Agriculture ,the government subsidized the price of maize flour to sh 100 for a two-kilogram packet down from sh 210.This comes as a relief to households that are grappling with the high cost of living.

- The International Monetary Fund (IMF) set a new loan condition requiring Kenya to drop the fuel subsidy. Should the government give in, this will expose Kenyans to a sharp rise in pump prices resulting in hiked fare price. According to the Energy and Petroleum Regulatory Authority (EPRA), petrol and diesel prices would skyrocket to sh 209.70 and sh 193.70 per liter respectively without the subsidy.

- The horticulture sector faced a decline in its exports after the Euro lost to the shilling for over the past six months to sh 120.67 down from sh 128.05 in February 2022.This comes at a time when Europe is experiencing a heat wave since a majority of people are spending more time outdoors that has resulted to a decrease in the demand for flowers. The weakening shilling also led to more money being spent on farm inputs such as fertilizer and chemicals.

- The Salaries and Remuneration Commission (SRC) turned down payrise pleas worth sh 18.83 billion from state agencies as the Treasury struggled to tame the public wage bill that now consumes over half the total revenue. As of the financial year to June 2021 ,the wage bill to total revenue ratio was 40.89% which is significantly above the 35% recommended in the Public Finance Management Act. The commission is set to abolish the currently 247 allowances in the civil service while it merges others. This review of the allowances will free up an estimated sh 100 billion from the wage bill annually, offering the country an opportunity to allocate more funds for development projects.

- South Africa’s Reserve Bank raised its benchmark policy rate by three-quarters to 5.5% in an effort to tame surging inflation. The Central Bank of Nigeria raised its rate to 14% as inflation hit a 5-year high of 18.6%. Inflation in the UK hit 9.4%, the highest in 40 years as food and energy prices soar, while Ghana’s inflation stood at 38% down from 33.3% recorded in May stocked by rising fuel, food and beverages and the weakening shilling.

Get future reports

Please provide your details below to get future reports: